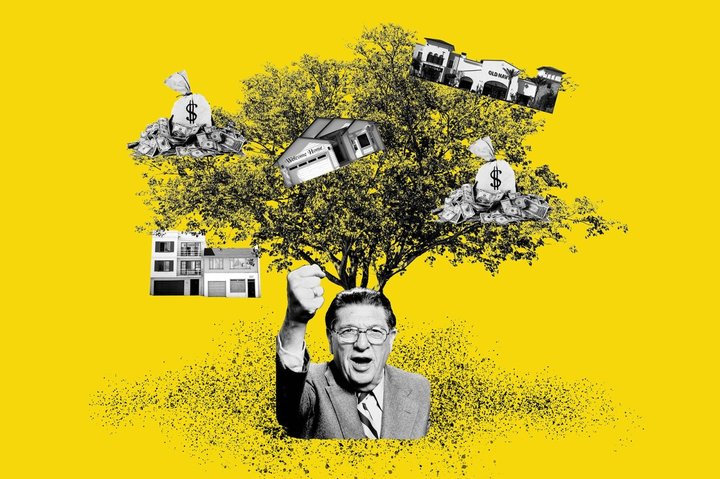

Illustration by Anne Wernikoff for CalMatters; istock, Howard Jarvis Taxpayers Association

###

The tax revolt started in California in 1978, but it never really ended.

Four decades ago mad-as-hell voters banded together to pass Proposition 13, capping property taxes, slapping a constitutional muzzle on state government and wringing local budgets like a washcloth. The electorate’s anti-tax fever may have broken in the years since, but the legacy of Prop. 13 is still very much with us.

Need proof? Check your ballot.

This year, Californians are being asked to weigh in on two more changes to the tax-slashing constitutional amendment that has done more than any other California ballot measure to reshape the state’s fiscal landscape and the politics of taxation.

Proposition 19 would pop open one new property tax loophole for older or disabled homeowners, while sewing shut another for people who inherit their parents’ and grandparents’ homes. And Proposition 15 would raise property taxes on many businesses — the largest change to California’s property tax structure since Prop. 13 campaign leader Howard Jarvis was railing against high taxes and “marinated bureaucrats.”

If it seems like California voters are perpetually being asked to redefine, clarify, overhaul or rewrite the terms of the 1978 tax revolt, it’s because we are. Since Prop. 13, the state has voted 33 times on potential amendments to it. These offshoots of Prop. 13 have sprouted their own offshoots, adding additions to revisions to edits of the original text. Forty-two years later, the tree first planted in 1978 has gotten mighty tangled.

“It’s an evergreen story,” said Jason Cohn, whose Jarvis documentary The First Angry Man, premiered last week. Cohn and his wife, Camille Servan-Schreiber, began working on the film in 2010 when voters were considering Proposition 26 — a successful Prop. 13 patch that made it even harder for state and local governments to raise revenue through fees.

“It’s never not relevant,” said Cohn.

There are few areas of California economic or political life that Prop. 13 hasn’t touched. To recap, it:

- Capped property taxes at 1% of a property’s assessed value

- Fixed a property’s assessed value to its original purchase price (rather than how much it can be currently sold for)

- Allowed that assessed value to inch up with inflation, but by no more than 2% each year

- Allowed a property to be reassessed whenever it is sold or if the owner makes a significant improvement or addition

- Required local and state governments — and in some cases voters — to get two-thirds of the vote to introduce new taxes

In the short term, the measure gave homeowners a lasting tax cut and, amid skyrocketing real estate prices, made it much easier for homeowners to stay in their homes. In exchange, property tax payments plummeted 60% in a year, cutting $7 billion from city and school district budgets.

Longer term, Prop. 13 had a number of unintended consequences. State government assumed a much bigger role in school financing. Local governments suddenly had a bigger incentive to approve commercial real estate over residential development. Governments across California turned to other sources of revenue — including income taxes, use taxes and fees — to make up the difference.

The Prop. 13 campaign reverberated across the country. Jarvis, the garrulous, pipe-smoking political gadfly who had been tilting at California’s tax code, Don Quixote-like, for decades, became a magazine cover-gracing populist hero overnight. Tax-capping measures sprouted up elsewhere, augering the landslide election of Ronald Reagan. In its wake, Jerry Brown, the state’s governor at the time, came to rebrand himself a “born-again tax cutter” — one of many Democrats who would see “taxation” and “government spending” as four letter words for decades to come.

“The era of the tax revolt, I think, has largely ended in California,” said Cohn. “But Prop. 13 has its own status outside that liberal-conservative spectrum.”

Of the 33 changes put before the voters, 24 have passed. They come in three varieties:

1. Perk Protectors

Under Prop. 13, a home’s value is reassessed whenever there’s a change of ownership or the property owner makes an addition or improvement. Property owners can find themselves slapped with a much higher tax bill if they opt to fix up their current place or move to a new one. As soon as Prop. 13 passed, people began scrambling for exemptions.

If someone is forced to move after a natural disaster, don’t they deserve a tax break? What if someone inherits a home from a parent — is California going to impose an orphan’s tax? And what about the responsible homeowner who installs a sprinkler system? A solar panel? A rain barrel?

Since 1978, the vast majority of the Prop. 13-related initiatives have carved out highly specific exemptions for niche investments and transactions, expanding the tax break’s protections one ballot measure at a time.

2. Rulemakers

Another key feature of Prop. 13: Legislators hoping to raise taxes need to convince two-thirds of their colleagues to agree. For local taxes, two-thirds of voters are needed to approve “special taxes.”

But what if the taxes were used to pay off debt? If a regulator imposes a fee or a fine, is that a “tax” too? And what’s a “special tax” anyway?

Eight more measures have gone before the California voter to answer such questions.

3. Tax hikers

Proposition 13 makes it really hard for governments to raise revenue. That was the point. So when interest groups are particularly strapped, sometimes they go to the voters directly asking for a loophole.

Despite everything, Prop. 13 still retains its basic structure, said Jon Coupal, president of the Howard Jarvis Taxpayers Association, one of the state’s most influential anti-tax groups. Property taxes are still capped at 1% of a property’s value, they can increase by only 2% each year and reassessment still occurs only with an ownership change or upgrade. “Those are the three legs of the stool and those have not changed,” said Coupal.

What makes Prop. 13 such a moving target, constantly in need of more modest revisions and clarifications, he said, is its brevity. The 1978 effort took place before California proposition campaigns became the half-a-billion-dollar, professionalized business they are today.

Overly-strict in some places and ambiguous in others, Prop. 13 “was particularly poorly drafted.”

— Darien Shanske, law professor at UC Davis

Jarvis and his co-drafters “were not insiders and they wanted a quick immediate fix that was really needed at the time,” said Coupal. “It was sparse…so there were a lot of unanswered questions. You can criticize Prop. 13 for that but remember, the United States Bill of Rights is very sparse too.”

Darien Shanske, a law professor at UC Davis, agrees that Prop. 13’s repeat presence on the ballot is a product of the way that it was written. But he doesn’t liken its lack of specificity to the genius of the Founding Fathers.

Overly-strict in some places and ambiguous in others, the measure “was particularly poorly drafted,” he said, which has led to continual efforts to prune or graft modifications onto it. That’s to say nothing of the frequent court battles over its precise meaning.

Critics of ballot box budgeting contend that the Legislature is better equipped than voters to make complex taxation and spending decisions, and believe Prop. 13 has resulted in an infuriating catch-22. By making it more difficult for lawmakers to raise taxes, Prop. 13 makes it more likely that increases will require yet another ballot measure. And because constitutional amendments can only be changed through the popular vote, any direct changes to Prop. 13 have to go before the voters.

Tax policy and refined spending decisions shouldn’t be done within the Constitution, Shanske said — “but once we’ve started down this road, we’re stuck with it because now we can’t fix it except through the Constitution.”

###

Via the Post It, CalMatters political reporter Ben Christopher shares frequent updates from the (socially distanced) 2020 campaign trail. CALmatters.org is a nonprofit, nonpartisan media venture explaining California policies and politics.

CLICK TO MANAGE