When Carlo/Charles Ponzi ran the scam that gave us the generic name of his pyramid-scheme fraud in the 1920s, he was following in the footsteps of other imaginative swindles. The South-Sea Bubble, the Dutch Tulip racket, William (“520%”) Miller’s “Franklin Syndicate,” all had their moments in the sun. More recently, Bernie Madoff and Allen Stanford managed to bilk naive investors out of huge sums. If you’re following the whole George Santos debacle, you’ll know he’s no stranger to the Ponzi world, either, through Harbor City Capital, the Florida-based investment firm where he worked.

Today, one third of the population of the US believe that cryptocurrencies are Ponzi schemes. At the same time, around 46 million Americans (22%) own Bitcoin, the most popular cryptocurrency — none of whom, presumably, think of their investment as a Ponzi scheme. Worldwide, over a billion folks used cryptocurrencies in 2022. So which is it? Ponzi or investment?

A Ponzi scheme is pretty simple: Early investors receive regular high-interest payouts which are sustained just as long as new investors come in. Eventually the whole edifice collapses, at which point the mastermind is either arrested or disappears. The latter happened with a pseudo-crypto Ponzi scheme, OneCoin, a huge scam based in Bulgaria that collapsed in 2017. The founder, Ruja Ignatova, disappeared off the map with a huge chunk — billions! — of stolen money. (She is now on the FBI’s Ten Most Wanted Fugitives list.) I say “pseudo” because the con artists simulated transactions on the blockchain, rather than actually registering them, which would have made them permanent and immutable.

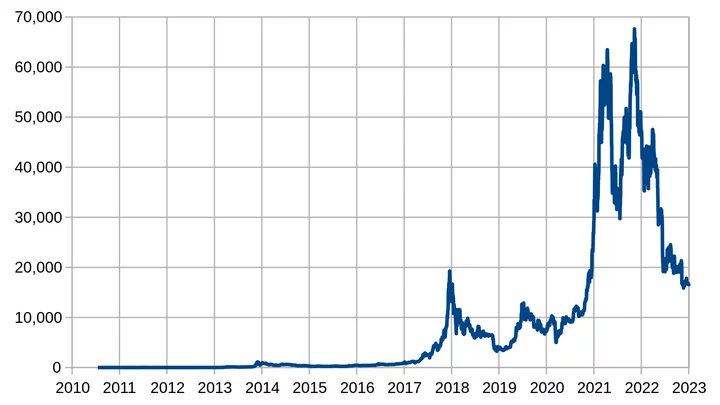

Cryptocurrencies like Bitcoin don’t qualify as Ponzi schemes. For one thing, Bitcoin certainly doesn’t promise high rates of return! Its value goes up and down like a yo-yo, and anyone who buys Bitcoin surely knows it’s a gamble just by looking at a historic price chart. For another, there’s no “mastermind” behind Bitcoin manipulating it — the whole point of cryptocurrencies, from Bitcoin on down, is to avoid centralized control. Also, transactions are transparent (anyone can access the blockchain, in which every transaction over the past 14 years is recorded), they are final (no one can go back and fiddle the books) and transactions are essentially instantaneous (< 10 minutes), while the source code is public.

The boom and bust cycle of Bitcoin in US dollars. FrankAndProust, Creative Commons license.

Bitcoin was created in response to the 2008 financial crisis resulting from the failure of centralized government to avoid unchecked speculation (in worthless mortgages), perhaps as a precursor to digitize the entire $600 trillion world of financial assets. When most of us think about money, what we want are two qualities: wealth preservation and monetary sovereignty, neither of which are guaranteed by our present fiat system (where a piece of green paper is worth $20 only because the government says so). $700 in 1970 is now worth $100, so rather than preserving wealth, the system has undercut saving. Meanwhile, monetary sovereignty — the ability for each of us to make free choices in how to save, invest or spend our wealth, free of censorship or confiscation — is hardly a given. For instance, Canadian PM Justin Trudeau used emergency powers to temporarily freeze the bank accounts of about 200 anti-vaxxer truckers who brought Ottawa to a standstill last year, while today, a tiny group of Trumpist Republicans are threatening to cause the US Treasury to default on its debt obligations in a few months, which could have repercussions for all of us.

I’m no economist, but I think it’s pretty obvious that what has worked (just barely) in the past isn’t going to work in the future, as global problems threaten to swamp the ability of our current capitalist system to deal with them. Cryptocurrencies may not be the final answer, but some trustless system of decentralized money, out of the hands of politicians and bankers, guaranteed by a secure blockchain, with a finite number of “coins” (to avoid inflation), may be the only way out of the mess we’ve gotten ourselves into.

Bottom line: Just because it’s risky doesn’t mean it’s a scam!

CLICK TO MANAGE