OBITUARY: Glynafay (Davis) Teasley, 1939-2025

LoCO Staff / Wednesday, Feb. 26, 2025 @ 7:02 a.m. / Obits

Glynafay

(Davis) Teasley of Fortuna passed away Saturday, February 22, 2025,

at Redwood Memorial Hospital at 10:33 pm at the age of 85 years old.

She was born on April 4, 1939 in Elsie’s McDonalds Home in

Okanogan, Washington to Frank and Pauline Davis. She is one of twelve

children.

Her older siblings who went before her were John, Charles, Mary Frances, Ruthie, and Marylee. Her living siblings are Melvin, William, Shirley, Ronald “Ronnie”, Thelma, and Fenton.

Glynafay grew up in the state of Washington.

She went to school clear up to 9th grade.

During the summer, Glynafay spent time picking apples and she also spent time painting store front windows.

She got married at fifteen to Gordan Leroy Weight. They had four children: Martin “Marty,” Glynamarie “Glyna,” Connan Leann and Deborah “Debbie.” They were married for six years before they got a divorce.

She got married to Hubert Harold Teasley on 24 Jun 1961 in Reno, Nevada. They had five children: Brenda Gail, Rocky Harold, Parnellie, Rodney Wayne, and Holly Ann. They were married for 38 years until Hubert’s death.

Two years later Glynafay got married to Justo Maldonado. They were married for six years when he passed away from Alzheimers.

She then married Robert “Bob” until his death from Alzheimer.

Glynafay worked for Saint Luke Manor for 20 years until she had a heart attack at the age of 60.

She loved roses and as a kid I remember the back yard being surrounded with roses. She had a collection of angels, cookie jars, salt and pepper shakers, and Disney character dolls.

She had an old red King James Bible that she read all of the time of where it was literally falling apart from her reading it and marking passages of verses.

She could draw a picture of anything and taught us kids how, but only a few of us had the talent to draw.

She taught all of us girls how to cook, bake, clean, sew, embroidery, etc.

She did not believe in saying you could not do something. She pushed us to accomplish our goals. Whenever I told her I did not want to something, she would tell me suck it up buttercup and do it. I was pushed along with others to do what we felt was impossible. One funny story was when my mom decided to have a sit-down strike from cleaning and cooking to let the family know how much she needed our help. We were asking our dad what was wrong with mom, because she never sat down. She leaves behind her children & their spouses: Martin & Elanore Weight, Redding; Glynamarie of Reno, Nevada; Connan & Bob of Fortuna; Deborah & Gerry Valdovinos of Galt, California; Brenda & Ronald Mason of Elk Grove, California; Rocky & Sherry Teasley of Maine; Parnellie & Manuel Meras of Fortuna; Holly & Christian of Fortuna; and numerous grandchildren, great- and great-great-grandchildren.

The funeral service will take place at Goble’s Fortuna Mortuary in Fortuna, California on Saturday, March 1, at 3 p.m. Reception to follow. All friends and family are invited. Arrangements are under the direction of Goble’s Fortuna Mortuary, Fortuna.

###

The obituary above was submitted on behalf of Glynafay Teasley’s loved ones. The Lost Coast Outpost runs obituaries of Humboldt County residents at no charge. See guidelines here. Email news@lostcoastoutpost.com.

BOOKED

Today: 8 felonies, 17 misdemeanors, 0 infractions

JUDGED

Humboldt County Superior Court Calendar: Friday, Feb. 6

CHP REPORTS

Us101 N / Newton B Drury Scenic Pkwy Ofr (HM office): Traffic Hazard

4593 Mm299 E Tri 45.90 (RD office): Report of Fire

ELSEWHERE

100% Humboldt, with Scott Hammond: #107. Jan Friedrichsen: Veteran Rescuer Explains How Search Dogs Track, Find, And Bring People Home

RHBB: Crash Blocks Lane on Northbound U.S. 101 at Humboldt Hill Onramp

RHBB: Crash off 101 into Trees North of Willits

Study Finds: When Moths Freeze: How LED Streetlights Are Silencing the Night

OBITUARY: Michael Allen Walkner, 1946-2025

LoCO Staff / Wednesday, Feb. 26, 2025 @ 6:51 a.m. / Obits

Michael

Allen Walkner passed away peacefully, surrounded by family, at Mad

River Hospital on Wednesday, Feb.

12, 2025.

He was 78 years old. He had been suffering from Lewy Body dementia

for the past several years and had recently been diagnosed with

prostate cancer.

He was born in Milwaukee, Wisconsin on June 26, 1946, the second of three sons born to Engelbert Walkner Jr. and Buelah Walkner (nee: Seyler). When he was eight years old, his life changed forever. His father drowned tragically when a boat he was in capsized during a storm while on a family fishing trip.

After his father’s death, Mike moved to Neenah, Wisconsin with his mother and brother, Tom, to be close to his mother’s brother and his family. Mike graduated from Neenah High School, where he played football and baseball, in 1964. He graduated from the University of Wisconsin – Stevens Point in 1968 with a B.S. degree in biology.

After graduation from college, Mike enlisted in the U.S. Army and served on active duty from 1968 to 1971. After basic and advanced training as a combat engineer, he entered Officers Candidate School, was commissioned a Second Lieutenant in 1970 and was deployed to South Korea, where he served as commanding officer of a unit until his discharge in 1971. He obtained the rank of first lieutenant while he served in Korea.

In 1971 Mike married Judy (nee: Bily) in Hawaii. Their daughter, Jessie, was born in 1974 and their son, Casey, was born in 1976. During their marriage both Mike and Judy were employed in the medical industry, Judy as a licensed physical therapist and Mike as a licensed clinical laboratory scientist. Their employment took them to medical facilities in both Montana and Wisconsin. While married, Mike obtained a Master’s degree in Hospital Administration from the University of Wisconsin – Eau Claire.

While living in Minocqua, Wisconsin, Mike and Judy divorced in 1993. During this transition time, Mike commuted to a school in Minnesota, where he became licensed as a massage therapist. Jessie went with him and took classes at the University of Minnesota. Together they shared an apartment for Jessie, while Mike traveled weekly to Minocqua to maintain his employment status. After this year in Minnesota, Judy, Jessie and Casey moved to Northern California. Mike stayed in Minocqua until 1996, employed as the head of the laboratory at the Howard Young Medical Center in Minocqua.

At the end of 1996 Mike moved to Humboldt County to be close to his son and daughter. Mike was hired as a clinical laboratory scientist at the Northern California Blood Bank in Eureka, where he worked until he retired in 2017.

In 1997, Mike met and began dating Carolyn Ames and they were married on Jan. 5, 2001 in Eureka. Mike and Carolyn were both employed in the medical field. Mike as a clinical laboratory scientist, and Carolyn as a RN. They both were also massage practitioners, which is how they met. They spent many years juggling a life between family, full time employment, dedication to service, and building projects. Next January, they would have celebrated their 25th wedding anniversary. Mike and Carolyn loved the outdoors, taking trips to our national parks, as well as travel abroad. One of the highlights of their travels was a trip to Europe, in which Mike was able to spend time with distant relatives on his father’s side.

Mike was intelligent, loyal, funny and hard-working. He was a great husband, father, brother and a friend to many.

He was an avid reader, enjoyed swimming, woodworking, walking his dog, Gracie, camping, watching his grandchildren grow and was an avid Green Bay Packer fan. He enjoyed researching his family through genealogy. He was known for planting apple trees wherever he lived. Mike was not especially fond of Trivia games, but everyone wanted him on their team, because he knew minor details about everything. Mike’s love for family will truly be missed by all.

He was preceded in death by his mother and father, his brother Donald Walkner, sister-in-law Jane Walkner, his grandson Riley. His brother-in-law, Guy Ames, brother-in-law, Brad Ames, father-in-law, Bob Ames, & mother-in-law, Mary Jean Ames.

He is survived by his wife of 24 years, Carolyn; his brother Thomas (Kathleen), his son Casey Walkner (Laura), daughter, Jessie Burns, son, Guy Walkner (Ashley), daughter, Cicely (Jaimal ); grandchildren Adam (Tessa), Owen, Scarlett, Wylie, Coyle, Tatum, Baylee, Callie, great-grandson Alex, sister-in-law Kathy Sherwin (Ray), nieces Polly Lipinski (Luis), Amy Walkner, Rachel Armstrong (Brad), nephews Craig Walkner, and Clint Walkner (Courtney) and Adrian Sherwin (Kate).

His graveside service will be held on March 8, 2025, at 2:30 p.m. at Greenwood Cemetery in Arcata. A celebration of life will be held, following this service at the Arcata Veteran’s Hall.

Donations can be made to the Eureka Food Bank, in Mike’s name. Flowers can be delivered to the Greenwood Cemetery.

###

The obituary above was submitted on behalf of Mike Walkner’s loved ones. The Lost Coast Outpost runs obituaries of Humboldt County residents at no charge. See guidelines here. Email news@lostcoastoutpost.com.

TODAY in SUPES: Weed and Airplanes, the Ways Humboldt Gets High

Hank Sims / Tuesday, Feb. 25, 2025 @ 3:59 p.m. / Local Government

Another brutally long Board of Supervisors meeting today, with a wide variety of topics discussed and another couple punted down the road for later consideration. Supervisor Natalie Arroyo was out on assignment in Los Angeles with the U.S. Coast Guard’s Pacific Strike Team, which is helping our neighbors to the south with wildfire recovery.

The meeting is still going as of this writing, with several items left to go after a long closed session dealing with lawsuits and labor negotiations wraps up. But let’s get in the chips.

Bridgeville Cannabis Operation Gets Reprieve

The county’s Planning and Building Department came out swinging for Mana Farms, LLC – a 10,000-square-foot licensed cannabis operation in the Bridgeville area. The department had already suspended the operation’s cannabis license in October of last year; it came to the board with a long argument – seven pages, with tons of attachments — for why the board should revoke that license entirely.

In short: Staff argued that the operation had been found to be in violation of its cannabis cultivation permit on numerous occasions and in a number of different ways. It was using generators to power operations, rather than solar power. Required tests of the property’s well were not performed. Junk was piled around the premises, some of which led to a hazard to wildlife. Most importantly, it was discovered, through a search warrant obtained California Department of Fish and Wildlife and served on the site on Oct. 24, 2024, that it was the operation was illegally taking water from Little Larabee Creek.

“Taking water from an illegal source that has the potential to damage the environment is egregious enough to warrant suspension and revocation,” Planning Director John Ford told the board at the opening of proceedings.

But Kathy Hall, Mana Farms’ owner, and Vanessa Valare, her consultant, had a different story to tell. Valare went first. Hall had acquired the property and the operation relatively recently, she said. A lot of the junk found around the property, which included discarded monofilament netting, was actually from a neighbor, and it had been decided that the neighbor was supposed to clean it up. That hadn’t happened. As for the illegal water diversion: Her client had been confused about her legal rights to the water in the creek, as often happens, or whether she could use that water to supplement the well that was supposed to be the sole source of water for the farm, according to the terms of the permit.

In any case, Valare said, her client was working diligently to comply with the terms of the permit. After receiving her shutdown notice from county staff, she had stopped waiting for the neighbor to fulfill his obligations and cleaned up all the junk from the property herself. She had every intention of operating within the terms of her permit, given the chance.

“With farms going out of business left and right, I see this as an opportunity to offer a carrot, not only a stick, to our farmers that are left in this county,” Valare said.

“So yeah, I know this all looks bad,” Hall began, when it was her turn. “We have worked hard — we’ve worked really hard — to come into compliance with stuff, especially the last few months.”

Hall.

Hall acknowledged that the biggest issue was over the illegal diversion from the creek. She noted that a previous landowner did have a state permit to use some of the Little Larabee Creek water for domestic purposes, and assumed – even though there is no home at the location now, and even though the county’s cannabis permit was conditioned on using the well for water – that she could continue to pump from the creek. She said she only pulled water out of the creek to balance out the pH levels from the well, which were testing high, which was not good for her cannabis plants.

When it came back to the board for discussion, it became immediately clear that Supervisor Steve Madrone was in a forgiving mood.

“One of the things that does impress me is the efforts that Ms. Hall has made since buying the property only a year, year and a half ago, to clean up,” Madrone said. “I mean, I’ve heard nothing here today about, no, I don’t want to do this. I’m not going to do that.”

Madrone.

“Is it your intention to continue to work as quickly as you can to meet all these other conditions that have now been made clear to you?” Madrone asked.

“Yes, and I mean, if I have the opportunity,” Hall responded. “And now moving forward, just understanding a little more like how each agency works — that was a huge misunderstanding on my part.”

With that, the sentiment of the room shifted, and it became clear that Planning’s push to revoke the cannabis cultivation license was going to fail. Supervisor Mike Wilson used to occasion to beef up the conditions placed on the operation. It should be reaffirmed that no water can be taken from the creek to fuel cannabis operations; there should be an increased inspection regime, including no-notice inspections, at Mana Farms’ expense; and that issues with solar power generation being used to power the farms should be resolved.

Hall said that this was all OK with her. Board Chair Michelle Bushnell, in whose district the farm is located, had a final thing to say before the vote.

“My message to the applicant would be that if you have another violation you’re going to be revocated by this board,” Bushnell said. “And amendments that are going to put be put forth on your permit — you need to adhere to them. And that you are going to get unannounced inspections, probably a lot of them. And so please comply with your permit.”

With that, the board voted unanimously to bring the issue back before the board on March 25, at which point it would presumably renew the operation under these new, more stringent conditions.

ACV is … Booming?

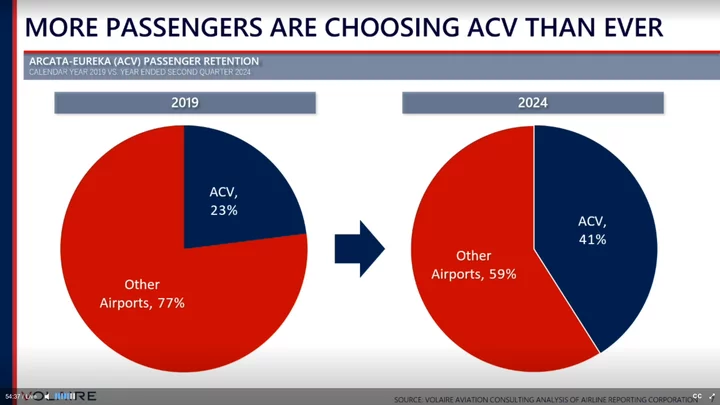

Forty-one

percent of Humboldt County people who are going to fly somewhere fly

out of our own airport, according to a new study performed for the

county by Volare Volaire Aviation, Inc., a consulting firm.

Doesn’t sound very good, does it? Almost 60 percent of our people who plan to take an airplane drive three to five hours — to San Francisco or Oakland or Santa Rosa or Sacramento or Medford — to do so, perhaps driving straight past McKinleyville’s California Redwood Coast-Humboldt County Airport (ACV) on the way.

And yet the message Volaire’s Jack Penning had for the board today was a very upbeat one. Why? Because 41 percent is a great deal larger than a truly miserable 23 percent, which was the rate we were flying ACV just a few years ago, in the pre-pandemic year of 2019.

A bigger piece of our own pie.

“My main point is this airport is doing the best that it has done in its history, in terms of passenger service and performance,” Penning said. “It’s serving this county the best it ever has. There is room to grow, and that’s very encouraging.”

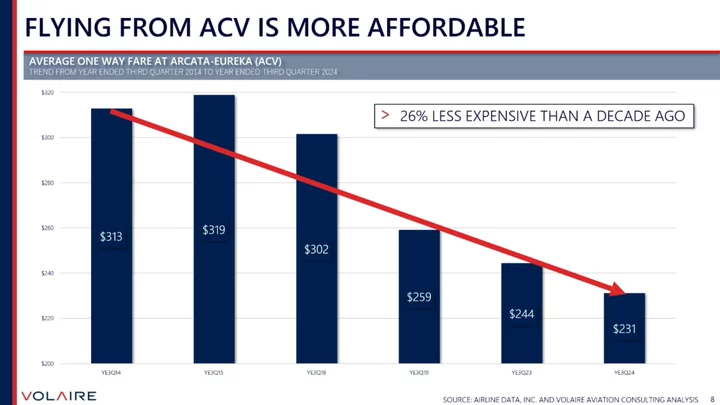

So, the good news: A larger percentage of our people are using our airport. That is due in part, no doubt, to the fact that average one-way ticket prices out of ACV have gone way down – from $313 in 2014 to $231 in 2024. (Penning didn’t mention this, but a lot of that seems due to the entry of budget carrier Avelo, with its cheap flights to Burbank and – once upon a time – Las Vegas.)

The other good news, in Volaire’s view, is the same as the bad news: Only 41 percent of Humboldt County fliers use our airport. What if prices continue to fall? What if we can add some new routes? If we can capture more of the 60 percent who get in their cars before they fly, here’s a lot of room to grow. The study shows that if every local who buys plane tickets buys them to fly out of ACV, there’s enough demand to support 11 departures per day.

So what’s the plan? The county’s first priority, Penning said, is to get a regular route to Seattle. We currently fly south (San Francisco, Los Angeles, Burbank) and east (Denver). We lack a route north. But over the next 10 or 15 years, Volaire envisions new routes to a multitude of locations – Salt Lake City, Phoenix, Portland, Las Vegas.

There are a lot of challenges, and most of them are at the macroeconomic level. Aircraft production has slowed down a lot over recent years, with engineering problems at both Boeing and Airbus. There’s a shortage of pilots. And in the face of this scarcity, we’re competing with airports all across the nation, many of which are offering airlines big incentives to establish new services.

Penning had a concrete example of the pressure these industry-wide factors place on our local services. Avelo’s flights between ACV and Las Vegas – see here and here — were profitable, he said. This route was canceled, he said, only because the airline could make more money on a specific route on the East Coast.

On the other side of the coin, another macroeconomic trend: The rise of remote work. More and more people living where they want to live, unconstrained by their jobs, is a big opportunity for Humboldt air travel, Penning said.

“Guess where people want to live?” Penning said. “They want to live in great places. This is a great place to live. We are seeing a huge influx, especially from the L.A. area … Those people are mobile and they get on flights. So this is going to support more service for us as we move forward.”

Find a slideshow on the Volaire study here; those who would like to crunch numbers more deeply may check out this other link.

Odds and Ends

• Remember this big weed bust in the Table Bluff area last year? Well, apart from all his other problems, the person who owns the cannabis license for Humboldt Emerald Triangle, LLC – Uonan (John) Uonan – owes the county about $150,000 in back Measure S taxes, according to a staff report. Also, Planning Director John Ford told the board that Uonan has been, uh, hard to get hold of lately.

So the board revoked his weed license.

There was kind of an interesting wrinkle in the brief discussion around this item. A new person has bought the Table Bluff farm, and that person is going to pursue a new cannabis license for the property. Since the Measure S taxes follow the license and not the land, the county is likely out that $150,000 forever. It can’t place a lien on the land – at least in cases where the licenseholder and the landowner are different people.

Supervisor Madrone wondered: Given the cost of pursuing a new cannabis license, why doesn’t this new person just assume that $150,000 Measure S debt and take over Uonan’s license? But Ford said that the new person hasn’t had any more luck getting in contact with Uonan than the county has, and the county is “very, very strict” about requiring both parties to sign off on the transfer of a license, above and beyond the transfer of a deed to the property.

These complications, and others like them, are scheduled to come back before the board on March 25, as part of a more general discussion around holding cannabis license holders accountable for their Measure S obligations.

###

• A pair of items associated with some new Williamson Act agricultural preserves – one in the Ferndale bottoms and another near the intersection of Myrtle Avenue and Freshwater Road – were postponed. Director Ford said that there was some sort of problem with the staff report on one of the items was mistaken, and so he requested the delay. He didn’t say what the problem was, but we do note that the staff report associated with the Freshwater parcel was posted to the county’s system in conjunction with both items.

###

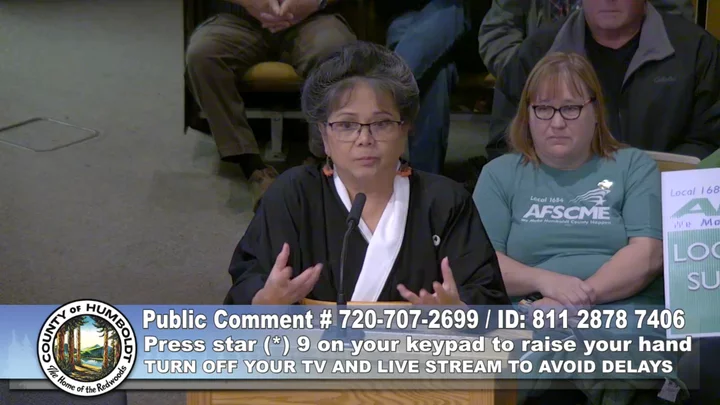

• Early in the meeting, many people spoke movingly in tribute to Dr. Ruby Bayan, a psychiatrist and co-founder of Waterfront Recovery, on the occasion of her retirement. Founded in 2017, Waterfront is Humboldt County’s only residential, medicine-based center for treating people with mental health and substance abuse issues. (Our Ryan Burns wrote about it when it opened.)

“Dr. Bayan, I’m not going to say a lot but what I want to say is thank you for all the lives that you saved here in Humboldt County,” said Supervisor Madrone. “Because truly that’s what you’ve done. You and your staff have been there at these crucial times for people, and you have really saved lives.”

The board passed a resolution commending Bayan for her work.

“I would like to thank the community of Humboldt for allowing me to fulfill my life’s mission as a doctor,” she said, in accepting that resolution. “Before I became a doctor, I had an agreement that should I become a doctor, I will take care of the most broken children. And it was shown to me that it was not pediatrics. No one can be more broken than those people who have substance abuse and mental health”

Waterfront Recovery has a whole page of tributes to “Dr. B” on their site. She will be succeeded as medical director by Dr. Landon Whittington, who you can meet here.

‘Dr. B”

(VIDEO) TOUCH GRASS, HUMBOLDT! Local Nature Enthusiast and Rapper B1G $uAV Invites You to Revel in His ‘Nature Rizz’ in Latest Music Video

Andrew Goff / Tuesday, Feb. 25, 2025 @ 1:55 p.m. / On the Air

B1G $uAV live in the KHUM studios in Old Town

It’s been an unusually sun-filled February here in Humboldt, right? Not bad, not bad. Truly, it’s a great time to work on your mental and/or physical health by reconnecting with nature in the outdoor wonderland we call home. Get out, friends!

B1G $uAV really hopes you will. In fact, he even went so far as to make you a soundtrack for your next forest jaunt.

Yes, the local hip hop artist and Cal Poly Humboldt wildlife management and conservation graduate — real name José Juan Rodriguez Gutierrez — is out promoting the release of his locally produced music video for the “eco trap” song “Nature Rizz.” Feast your eyes and ears on that below.

Why are you still inside, people?! On his Instagram account, B1G $uAV boasts that “if Steve Irwin and Tupac had a baby that spoke Spanish, it’d be me.” He expanded on his influences and why he chooses to fuse hip hop and his love of nature during an interview on KHUM Radio this week with DJ Lizzerd Kween .

“This whole project came about because I grew up in a big city my whole life and so when I say moving to Humboldt changed my life, I mean that desde el fondo mi corazón — from the bottom of my heart,” $uAV said on KHUM. “I just want to be able to reconnect people [with nature] and let them know, hey, if you’re getting a little stressed out today, go touch some grass! Go look at the clouds, go lay down and enjoy the ocean views we have in Trinidad or that we have down in SoHum.”

Hear B1G $uAV’s full KHUM interview at the top of this post. Other topics include:

- His favorite Humboldt nature spots

- How his wildlife studies at Cal Poly Humboldt influenced his art

- His plans for future single releases

- His favorite animals to sing to

# # #

Lizzerd Kween and B1G $uAV in the KHUM studio

PREVIOUS LIZZERD KWEEN:

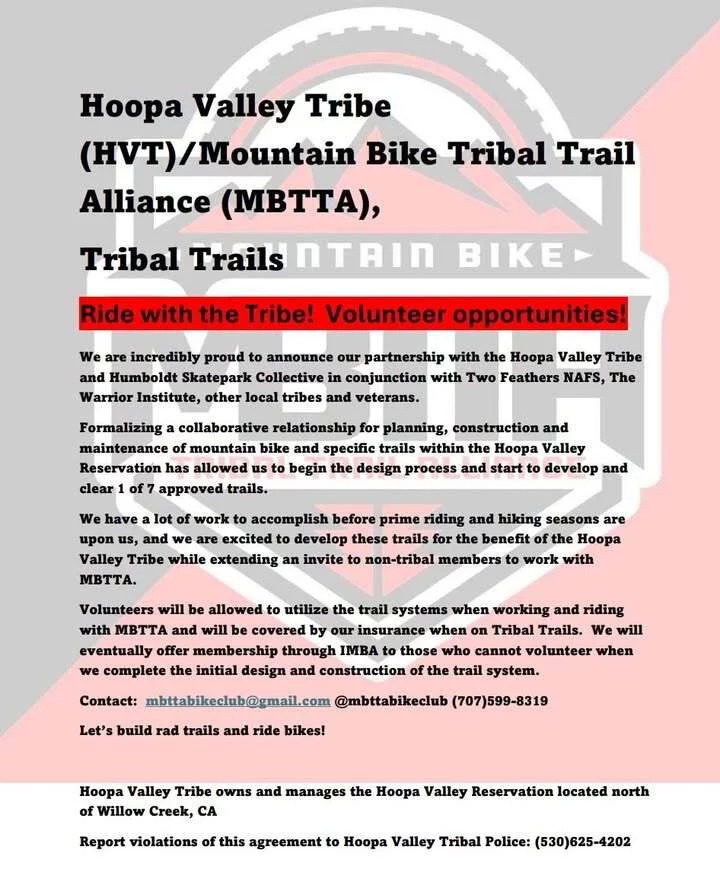

The New Mountain Biking Trails in Hoopa Will be Insane

Dezmond Remington / Tuesday, Feb. 25, 2025 @ 12:03 p.m. / LoCO Sports!

A rider blasts down the new trail on the Hoopa Valley Reservation. Photo courtesy of Shaun Fyfe.

Speed-demon riders will soon be able to bomb what may be some of the steepest routes in Humboldt County when the new mountain biking trails on the Hoopa Valley Reservation are finished.

Part of a year-long partnership between the Mountain Bike Tribal Trail Alliance (MBTTA) and the Hoopa Valley Tribe, seven trails will be built on the reservation, totaling about eight miles in length.

One has been completed. The trails in the McKinleyville Community Forest tend to drop about 200 feet in a mile — this one plummets 1,300 feet in a mile down the side of Big Hill. The other six will be about as steep or even steeper.

The MBTTA and the Hoopa Valley Tribe are looking for volunteers, both Native and not, to help clear the trails. It’s not incredibly difficult work; Shaun Fyfe, leader of the MBTTA’s partnership with the tribe, said he and one other person managed to clear the first trail in a day.

Fyfe and the Hoopa Valley Tribe hope that building these trails provide some much-needed recreational opportunities for the youth on the reservation. Trail work is rewarding, Fyfe said, and riding the trails is even more fun.

“We want to have the trails close to home for that local community,” Fyfe said. “Having the local Native youth have trails that they’re building, that they’ll have ownership of, that they’ll be able to ride and share with other [youth from surrounding areas]…We can share our trails we’ve developed together…It’s really rewarding for the trail builders, because the work is easy to see, and the reward is immediate.”

Even in Wet Years, Wells Are Still Dry. Why Replenishing California’s Groundwater Is Painfully Slow

Alastair Bland / Tuesday, Feb. 25, 2025 @ 7:39 a.m. / Sacramento

Don Cameron of Terranova Ranch near Fresno has built canals, pumps and headgates to capture more water from the Kings River during floods. Photo by Larry Valenzuela, CalMatters/CatchLight Local

After abundant rain and moderate snowfall this year in the northern half of the state, California’s largest reservoirs are holding more than 120% of their historical average. But underground, the state’s supply of water for drinking and irrigating crops remains depleted.

Even after multiple wet winters, and despite a state law that’s supposed to protect and restore the state’s precious groundwater, thousands of wells — mostly in rural, low-income communities in the San Joaquin Valley — have gone dry because of over-pumping by growers.

So why hasn’t the recent bounty of rain and snow replenished the state’s underground supplies?

The Newsom administration has been pushing for more groundwater storage and investing hundreds of millions of dollars in solutions, but most stormwater flows into the ocean. Some of this is intentional — the water has to be routed quickly away from communities to prevent flooding, while some supports aquatic ecosystems, including endangered salmon.

But millions of acre feet escape every year because there is no statewide system of pumps, pipelines and ponds to capture it and let it sink into the ground.

Replenishing aquifers isn’t easy. It can require building new canals or pipelines to divert flood waters into permeable basins that are miles from major rivers. In some cases, growers would have to build berms to contain water as it soaks into the Earth.

All these features cost money and take time to build so progress has been slow. Recharge itself can be a painfully slow process — often just inches per day. As a result, even exceptionally wet years like 2017 and 2023 only briefly paused depletion of drinking water wells.

“Long-term groundwater storage remains in a deficit from years of pumping more than what has been replenished,” according to the state’s 2024 semi-annual update on groundwater conditions.

Gov. Gavin Newsom has long vowed to enhance groundwater replenishment. In his 2020 Water Resilience Portfolio, the governor said he would “explore ways to further streamline groundwater recharge.” Then, in his 2022 Water Supply Strategy, he promised to increase average recharge by half a million acre-feet a year. (An acre-foot of water is enough to submerge one acre of land a foot deep.)

The effort has had some success. In 2023, San Joaquin Valley farmers sank 7.6 million acre-feet of water into the ground, compared to 6.5 million in 2017, another wet year, according to the Public Policy Institute of California.

However, “it’s safe to say that very little, if any, recharge happened in 2020 to 2022 as these were some of the driest years on record in many parts of the state,” said Caitlin Peterson, a research fellow at the institute.

The Los Angeles region’s water table is dropping, with only sluggish recovery after 2023’s heavy rains, according to a Stanford University study published early this month. “Only about 25% of the groundwater lost since 2006 was restored,” the study says. “Wet winters do not compensate for the substantial depletion during dry years.”

Even the extraordinary wet year of 2023 had missed opportunities.

That year, the state issued permits to landowners allowing more than 600,000 acre-feet of water to be diverted from the Sacramento and San Joaquin river basins for recharging groundwater during floods. But because some landowners received their permits too late in the rainy season and they were required to install costly fish screens to protect salmon, the program only resulted in about 20,000 acre-feet of recharge, according to the Department of Water Resources.

“We haven’t reached our full potential in California for groundwater recharge,” said Helen Dahlke, a UC Davis professor of integrated hydrologic sciences. “We’re still tinkering around with small numbers.”

Farmers taking action to capture groundwater

Since he began farming more than 40 years ago, Don Cameron has watched the groundwater beneath his ranch near Fresno drop a half-foot to a foot every year. In total, the water table has dropped at least 30 feet.

So he decided to take action to replenish his aquifer. He has been flooding his fields and orchards since 2011 to let that water trickle underground.

Cameron has installed several miles of canals, along with headgates and pump systems, to bring more water to his Terranova Ranch from the Kings River during floods. He used earth excavated from the canals to enclose several active farmfields, forming 350 acres of recharge basins.

Though he was assisted with a $5 million state grant, he spent about $13 million total, he said. He finished in 2020, in the midst of the last drought.

“Then we waited for a flood,” he said.

It came in 2023, and that wet winter his recharge system helped draw the water table up 15 feet.

Canals and other systems at Terranova Ranch near Fresno collect water during floods to recharge the aquifer. Photo by Larry Valenzuela, CalMatters/CatchLight Local

He would like to see managed recharge projects like his own replicated statewide.

“We know that groundwater recharge works and increases aquifer resilience,” he said. “If we had better infrastructure to do it, we could really put a lot more water underground.”

But not all landowners will invest in these projects. That’s because the water that sinks below one person’s farm becomes available for others to pump. Without a detailed accounting and crediting system, farmers don’t necessarily get back what they invest.

“When someone recharges, they’re mainly benefitting their neighbors,” said Graham Fogg, a UC Davis professor emeritus of hydrogeology. “The recharge is local, but the benefits are regional.”

Cameron, for all his investments, knows this.

“The water I put in the ground does not have my name on it,” he said.

“We know that groundwater recharge works and increases aquifer resilience. If we had better infrastructure to do it, we could really put a lot more water underground.”

— Don Cameron, San Joaquin Valley grower

To address this problem, some irrigation agencies have developed accounting systems that credit farmers who help sink water into a region’s basin.

On the Central Coast, for example, the Pajaro Valley Water Management Agency uses “recharge net metering” that provides rebates to landowners based on how much water passes through their metered percolation system.

In the Tulare Irrigation District, groundwater managers similarly credit farmers who use their land for recharge, so that they are entitled to most of that water later.

California invests millions in replenishing groundwater

As a pattern of wetter wet periods and drier droughts develops in the West, California water managers, anticipating a 10% decline in water supply by the 2040s, are increasingly concerned with capturing water when it’s available.

The governor waived environmental restrictions in 2023 with a series of executive orders aimed at facilitating groundwater recharge. Early that summer, the governor and Legislature codified some of these regulatory easements into a new law.

Since 2018, the Department of Water Resources has directed more than $121 million to at least 69 recharge projects.

First: An aerial view of Lake Shasta, the state’s largest reservoir, on May 9, 2024, when its storage was 96% of capacity. Photo by Sara Nevis, state Department of Water Resources. Last: Low water levels at Shasta Lake on April 25, 2022, during a drought year. Photo by Miguel Gutierrez Jr., CalMatters

Paul Gosselin, the department’s director of sustainable water management, said the efforts are working. Newsom’s 2023 orders allowed farmers to divert more than 400,000 acre-feet of water for recharge that otherwise would have flowed directly to the ocean, he said.

Between 2023 and 2024, Westlands Water District recharged almost 400,000 acre-feet. The Tulare Irrigation District recharged about 200,000 acre-feet — “a record-breaking year for us,” said General Manager Aaron Fukuda.

Sarah Woolf, a San Joaquin Valley farmer and president of the agricultural consulting firm Water Wise, said the governor’s order in 2023 to capture more water underground was a sign that “we’ve done nothing to support recharge” since the state’s groundwater law passed in 2014. Woolf said there has been “still no real resolution from the state board on this recharge issue.”

A more recent order issued by Newsom in January directed state officials to remove or minimize barriers “that would hinder efforts to maximize diversions to storage of excess flows.”

While Newsom’s executive orders appeased farmers, they reduced Delta river flows, potentially harming endangered salmon, sturgeon and smelt.

“This outflow of freshwater might seem like excess water to some but it’s not excess to the environment, and it’s absolutely critical to this ecosystem that is on the brink of collapse,” said Ashley Overhouse, water policy advisor with Defenders of Wildlife.

Thousands of dried-up wells

Recent groundwater gains have not undone the decades of unregulated groundwater pumping, especially in disadvantaged communities in the San Joaquin Valley.

So much groundwater there has been pumped to irrigate orchards that the Earth has collapsed, subsiding almost 30 feet near Mendota last century, for example, as the water table has dropped. In the past two decades, subsidence has accelerated, with much of the valley floor plunging at a geologic freefall pace of a foot per year.

Even in 2023, groundwater managers in the San Joaquin Valley reported drawing 5.4 million acre-feet from the ground, mostly offsetting the total amount that was recharged.

Consequently, thousands of residents reliant on groundwater have reported drinking water wells drying out, especially in 2014-2015 and 2021-2022, all years of extreme drought.

State officials received about 700 reports of dry wells over the past two years, and a state database shows that more than 200 wells — many in the San Joaquin Valley — stand at all-time low levels. Eight dry household wells were reported in the San Joaquin Valley in the last 30 days alone.

During wetter periods, the number of dry wells reported tends to slow down. However, activists in the region say there has been little to no recovery of dewatered wells, forcing communities to find solutions.

“A lot of people have been relying on bottled and hauled water, and they’ve also committed a lot of money to digging deeper wells,” said Tien Tran, policy manager with the Community Water Center, an advocacy group that works in the San Joaquin Valley and Central Coast, another region with depleted groundwater.

In downtown San Jose, groundwater overdraft has led to 13 feet of permanent subsidence, according to Cindy Kao, the Santa Clara Valley Water District’s imported water manager.

o“Our county’s demands began outstripping our local groundwater supplies more than 100 years ago,” Kao said at a state water board hearing on Feb. 18.

Like other water supply advocates who spoke that day, Kao supported Newsom’s proposed $20 billion Delta tunnel as a means for boosting deliveries of Delta water that is deposited into the local aquifer.

Wade Crowfoot, secretary of the California Natural Resources Agency, said water from the tunnel would “recharge groundwater basins in the Central Valley, which is critically important for water supply and implementation of the Sustainable Groundwater Management Act.”

“Our county’s demands began outstripping our local groundwater supplies more than 100 years ago.”

— Cindy Kao, Santa Clara Valley Water District

In the Sonoma Valley, a region heavily pumped by wells to irrigate vineyards, groundwater supplies have trended downward.

Marcus Trotta, principal hydrologist with the Sonoma County Water Agency, said ample rainfall in the last two years muted this effect. “But there’s still been a long-term decline, mostly in the deeper aquifer system,” he said.

The valley’s deeper aquifers are separated from the surface by mostly impermeable clay deposits, Trotta said. This can make recharge of depleted basins almost hopelessly slow.

Room to recharge

As for space to store more water, there is plenty. An estimated 140 million acre-feet of groundwater storage space lies vacant beneath the Sacramento and San Joaquin valleys — three times the volume of all the state’s surface reservoirs combined.

Fogg, who helped produce that figure, said it was calculated by subtracting the current groundwater in storage from the estimated volume before California’s modern development.

One of the biggest bottlenecks to making use of this space is the capacity of conveyance systems.

“We have plenty of farmland for recharge, but the infrastructure to get the water to these places is still evolving,” Fogg said.

Agricultural production in California has steadily grown for many decades, now routinely exceeding $50 billion in gross annual sales. Thirsty nut crops have been so widely planted that prices have crashed from oversupply, and the Central Valley is carpeted with irrigated farms.

Ultimately, ensuring there is adequate groundwater for farms and communities means growers will have to permanently fallow large areas of cropland. Otherwise, Gosselin said groundwater recharge will never keep pace with agricultural demand.

“Farmers are not going to be able to recharge their way out of groundwater depletion,” he said.

###

CalMatters.org is a nonprofit, nonpartisan media venture explaining California policies and politics.

OBITUARY: Thomas Aaron Mosier Jr., 1976-2025

LoCO Staff / Tuesday, Feb. 25, 2025 @ 6:56 a.m. / Obits

Thomas Aaron Mosier Jr. was born June 26, 1976 to the late Tom Mosier and JoAnn Marshall. Thomas made his journey to his forever home on February 17, 2025.

From an early age, Thomas loved being outside, from hunting, cutting wood, fishing, to any activity that involved the open sky. Thomas grew up playing baseball and football. He was also in the Boy Scouts and created many friendships along the way, eventually becoming an Eagle Scout. He was the starring varsity football QB and captain all four years of high school. Thomas graduated high school in 1995.

After graduating, Thomas continued his love for working outside by being the first one from Hoopa, commuting to Arcata, beginning his career at Davey Tree, which later transitioned to Wright Tree Service. Thomas worked in the line clearance tree trimming industry for 23 years. He enjoyed his work; more like lived for it. He worked hard every day and sometimes nights when needed. He gained great respect in the tree climbing industry. He passed on his expertise to his son and nephew, who followed in his footsteps. After his line clearance career, Thomas was the founder and CEO of the ‘Chop Shop’ — he cut kindling and chopped wood like no other.

Thomas was a proud Hupa Tribal member and Standing Rock Sioux descent, a Chevy man — “Bow Tie Till I Die” he would say. Thomas was also an avid 49ers fan.

Thomas will be missed immensely, he took care of all of us. To the world he was just a man, but to us; his family, he was our world.

Thomas raised his two children, Thomas Charles Joseph Mosier III & Mercidez Rosalee Mosier with all the love he had to give. His children were his world.

Thomas is survived by his Mom JoAnn Marshall, Son Thomas Mosier III (Josa), his Grandchildren Aleena Mosier and Weston Mosier. His sister Jessica Mosier. His Nephews Dakota Mosier Sr.(Future), Dakota Mosier Jr., Zane Grant III (Makaya) and Wayne Mosier and his Nieces Nevaeh Mosier and Hunter Mosier. Aunts Dorcas Brazil, Dorene and George Kautsky, Lori and Tyke Billings. Uncle Emil and Darla Marshall. Man’s Best Friend, his doggy Sage Mosier.

Thomas is preceded in death by his Loving daughter Mercidez Mosier, his heart was forever shattered upon her passing. His Father Tom Mosier Sr., Grandparents Joseph and Eunice Marshall, Ernie and Henrietta Mosier, uncles Joseph Marshall Jr., Clarence Marshall and Jonathan Marshall Wirth, his best friend Arlen Williams, cousins Rebecca Brazil and Heather Brazil.

The wake will be held at the Neighborhood Facility starting at 8 p.m. February 26, 2025.

Services will be held at 11 a.m. on February 27, 2025 at the Neighborhood Facility with Pastors Harold Jones and Dee Dee McKinnon officiating. Burial will take place immediately following at the Hoopa Tribal Cemetery (Thomas will be laid to rest by his loving grandparents whom he missed dearly).

Please come share a story and a meal following at the Hoopa Fire Hall.

Pall Bearers:

Thomas Charles Joseph Mosier III, Dakota Mosier Sr, Zane Grant III, Josh McKnight, Rocky Erickson, Magnum Williams

Honorary Pall Bearers:

Mitch Burchard, Tyrell Burchard, Adrian Estrada, Mark, Ryan & Caden McManus, James Lewis, Kellum Kirk, Bunky Maloney, Hootie Lewis, Mike Obie, Romeo McCovey, Sa-Gep Blake, Jessie Mosier Sr, Skyler Mosier, Rob Roy Latham, Jeremy McKnight, Johnny McKnight, Chance Carpenter, John Knox Marshall, Joseph LeMeiux, Emil Marshall, Joe and Jude Marshall, Kathie and Leah Brazil, Jason and Jake Marshall, Troy Wirth, Gary Colegrove Jr., Shawn Korb, William Scott Peugh.

Sorry if we missed anyone, this has been a tragic time for our family. Just know he loved you all.

###

The obituary above was submitted on behalf of Thomas Mosier Jr.’s loved ones. The Lost Coast Outpost runs obituaries of Humboldt County residents at no charge. See guidelines here. Email news@lostcoastoutpost.com.