OBITUARY: Arnold ‘Arny’ Roen Bolkcom, 1961-2024

LoCO Staff / Thursday, July 25, 2024 @ 6:56 a.m. / Obits

Arnold “Arny” Roen Bolkcom passed away at the age of 63 on Tuesday, July 16, 2024, at home in Fortuna with his wife by his side, after a yearlong battle with epithelioid angiosarcoma metastasized cancer.

Arny was born the fifth child of Richard and Ruth (Roen) Bolkcom, Sr., in Happy Camp, California. He grew up moving wherever his father transferred, to Arcata in 1964, Oakdale in 1972, and Fort Bragg in 1975, where he graduated from Fort Bragg High School in 1979. Following high school he enrolled in College of the Redwoods Diesel Program; his first job after attaining his Diesel certification was in central California as a diesel mechanic for Van Dykes Rice Dryer, Inc. This is where he earned his class A driver license and later Jim Stitt, where he received his certificate of Completion for Apprenticeship from the California Apprenticeship Council, and his Journeyman classification with the Machinists and Mechanics Union in 1987.

He met his future wife, Tammy Ashby, in 1982, and married her in 1985. Arny was hired by the California Department of Transportation in 1992, and in 1994 began his career with California Department of Forestry and Fire Protection. In 1995 Arny became the Fleet Equipment Manager for Humboldt and Del Norte counties. He relocated his family to Humboldt County, settling in Fortuna, where he worked until his retirement in September 2014. He spent his retirement years enjoying time with his family and friends, camping, fishing, metal detecting, wood working, building projects for friends and family and home improvement. He especially enjoyed the time he spent with his four grandsons.

Arny was preceded in death by his father Richard H. Bolkcom, Sr. (1998), mother Ruth E. Roen (2013), brother Richard H. Bolkcom, Jr. (2012), sister Ann Gill (2023); father-in-law Walter Frank Ashby (2007).

Arny is survived by his wife of thirty-nine years, Tammy Bolkcom; daughters Amanda, (Anthony); Elizabeth (Cliff) Freitas; grandsons: Adam, Carter, Logan and Cameron: mother in law Mary Myers; brother David (Connie) Bolkcom; sister Nancy (Mike) Shaw; brother in law Curt Gill; cousin Michael Thomas; nieces and nephews: Rick Bolkcom, Aaron Peterson, John Shaw, Wendy Hunter, Mark Bolkcom, Travis Gill, Kristen Gill. Many great nieces and great nephews, and three great-great nephews. Arny had many friends, coworkers and neighbors that were like family to him. He made friends with everyone and could get to know a stranger like he knew them for years.

In lieu of flowers the family requests donations be made to the Humboldt County Hospice, the American Cancer Society, or a humane shelter in your community. A Celebration of Life is being planned for the future, but no date is yet scheduled.

###

The obituary above was submitted on behalf of Arny Bolkcom’s loved ones. The Lost Coast Outpost runs obituaries of Humboldt County residents at no charge. See guidelines here.

BOOKED

Today: 6 felonies, 7 misdemeanors, 0 infractions

JUDGED

Humboldt County Superior Court Calendar: Today

CHP REPORTS

No current incidents

ELSEWHERE

Governor’s Office: Governor Newsom announces appointments 1.13.2026

County of Humboldt Meetings: Humboldt County Behavioral Health Board Meeting - Jan. 22, 2025

Arcata Fire Snuffs Small Mystery Blaze in the Manila Dunes This Afternoon

LoCO Staff / Wednesday, July 24, 2024 @ 4:58 p.m. / Fire

Press release from the Arcata Fire District:

Today at 2:40 P.M. all three of Arcata Fire’s engines responded to a wildland fire in the Manila Dunes.

The first AFD engine arrived on scene to find approximately a 20’x20’ section of hilly, forested area on fire with an active column of smoke.

All three AFD engines were on scene and attempting to locate the fire on foot when an engine from Samoa Fire District and an engine from Westhaven Fire arrived.

Crews from AFD and Samoa were able to stretch a hose line from an AFD engine to the area of the fire and extinguished it completely within 30 minutes. Crews then completed the clean-up process within another 30 minutes and exited the fire area. The cause of the fire is unknown and under investigation.

Arcata Fire would like to thank Samoa Fire District and Westhaven Fire for their prompt responses to this incident.

Photo: Arcata Fire District.

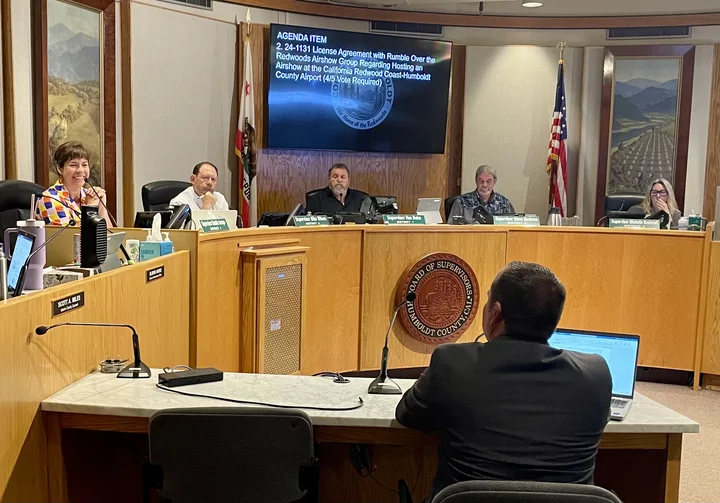

County Supes Have Differing Views on the Merits of Civilian Oversight of Sheriff’s Office But Postpone Decision on Grand Jury Recommendations

Ryan Burns / Wednesday, July 24, 2024 @ 3:35 p.m. / Local Government

The Humboldt County Board of Supervisors (from left): Fourth District Supervisor Natalie Arroyo, Third District Supervisor Mike Wilson, First District Supervisor/Board Chair Rex Bohn, Fifth District Supervisor Steve Madrone and Second District Supervisor Michelle Bushnell. | Photo by Ryan Burns..

###

###

With Humboldt County Sheriff William Honsal out on vacation and Undersheriff Justin Braud busy responding to yesterday’s fatal plane crash in Kneeland, the Humboldt County Board of Supervisors decided to postpone a decision on whether to create a new level of oversight for the Sheriff’s Office.

But the discussion during Tuesday’s Board of Supervisors meeting illuminated the starkly differing viewpoints among the five supervisors regarding the need for such oversight and the degree of deference owed to an independently elected law enforcement officer.

First District Supervisor and Board Chair Rex Bohn, in particular, defended to Sheriff Honsal, declaring that Humboldt County has “great law enforcement” while pointing to Honsal’s overwhelming wins at the ballot box (where, it should be noted, he has run entirely unopposed since being hand-picked as the de-facto successor of former Sheriff Mike Downey in 2013 and then elevated by the Board of Supervisors to the role of interim sheriff in 2017).

Second District Supervisor Michelle Bushnell also showed deference to Honsal, suggesting that the board postpone any decision until he and Braud could be present to discuss the matter.

Meanwhile, fellow supervisors Natalie Arroyo, Steve Madrone and Mike Wilson – generally considered the progressive majority on the five-member board – voiced support for following the recommendations of the Humboldt County Civil Grand Jury by establishing either a civilian oversight board or an inspector general with subpoena power. They argued that this additional layer of accountability could increase public trust and transparency while improving communication between law enforcement and the community.

The board was responding to an April report from the Civil Grand Jury, which found that Humboldt County lacks an independent means of oversight and review of critical incidents and allegations of misconduct involving the sheriff’s office, and that this lack of oversight can lead to public misunderstanding and mistrust.

The Grand Jury pointed out that California government code delegates to the board “a statutory duty to supervise the conduct of all county officers,” including elected officials such as the sheriff. A code section that went into effect just three years ago grants the board discretion to create an oversight board and inspector general for such supervision, and the Grand Jury recommended they do just that.

County staff agreed with the Grand Jury’s findings and presented the board with options to either:

- create one or both of those oversight entities (a civilian review board or an Office of Inspector General) right away or

- declare that while those ideas are reasonable and deserve further analysis, there’s just not enough money to implement them at the moment given the county’s current $15 million budget deficit. Instead, establish a working group to research models for independent oversight as well as costs and funding opportunities.

“Any measures taken should take into account the need for oversight and recognition of the challenging work done by the sheriff and Humboldt County’s law enforcement professionals,” the staff report said.

In the board’s discussion, Arroyo brought up her experiences during her time on the Eureka City Council, noting that former Eureka Police Chief Andy Mills created an advisory board that was initially just that – advisory – but gradually got transformed into more of an oversight body.

She noted that the department’s inflammatory 2021 texting scandal resulted in a loss of public trust. Arroyo said that while many many see civilian oversight primarily as a means of serving a “watchdog” function over the sheriff’s office, “this other really important piece of it is about communication and understanding and getting people interested in law enforcement.”

Madrone brought up Sheriff’s Honsal’s recent push to place himself and his deputies in front of the reality TV cameras of “On Patrol: Live,” a cable series that follows on-duty law enforcement officers in real-time.

“So I know that the sheriff is very interested in building that trust and transparency in the community,” Madrone said.

He argued that the county needs critical incident oversight of the Sheriff’s Office given its recent history, including an officer-involved shooting, the response to protests on Humboldt Redwood Company land and, most recently, the raid on demonstrators up at Cal Poly Humboldt, where officers were accused of overreacting and violating press freedoms.

“The justification for that was written up as there was a high probability of violence that would occur, and I would completely disagree with that assessment,” Madrone said, noting that protests at other college campuses were resolved peacefully through de-escalation.

As for the cost, Madrone said civilian oversight might actually save the county money by avoiding costly lawsuits.

“Don’t get this wrong; I support law enforcement,” Madrone said, noting that he voted to approve raises for deputies “to boost retention and morale.”

But Madrone also brought up the corruption scandal that fell into Honsal’s lap shortly after he became sheriff: namely, the practice in his office’s Public Administrator division of selling property from the estates of the recently deceased to deputies and other county employees in violation of state law.

“And we were promised at that time when that [internal] investigation was done, that the community would know the outcome, yet when it all got done, it was, ‘Well, we can’t divulge any of this because of the union stuff or other stuff that occurred,’” Madrone said. Ultimately, people never really knew what the results of that oversight were. I had an issue with that.”

Madrone voiced support for civilian oversight, saying, “I don’t think we can afford not to do this.”

Bushnell sought to pump the brakes, saying, “I would like to work with the sheriff to develop a plan and have him present for that discussion.”

Bohn agreed and then argued that there’s already plenty of oversight on the Sheriff’s Office, including a critical response team from the California Department of Justice, the Civil Grand Jury and the Human Rights Commission.

“I think ironic,” Bohn said. “The sheriff’s rating is about 25 percent better than the Board of Supervisors, but we’re talking about putting an oversight committee on him.”

This was another reference to Honsal’s performance in elections, compared to those of the five supervisors. Unlike other publicly elected positions, though, the state of California restricts the pool of candidates for county sheriff to only people who have law enforcement certification and/or experience. This often leads to incumbents running unopposed.

“That’s an issue especially in smaller counties,” the Fresno Bee reported back in 2022. “Sonoma County, for example, once went 25 years without a contested election.”

The Humboldt County Sheriff hasn’t faced a ballot box challenge since 2010, when former Sheriff Mike Downey defeated Deputy District Attorney Investigator Michael Hislop by a more than two-to-one margin.

Bohn said his preference would be to “have the decision made with the party it affects,” meaning the board should wait until Honsal can be there.

He made a motion to go with option two from the staff report, with the board appointing a working group sometime next month. That group would then be required to give its recommendations to the board before October 30, the deadline for responding the the Civil Grand Jury’s report.

Bushnell seconded the motion.

During the public comment period, Larry Giventer, one member of this latest Civil Grand Jury, said he and his fellow jurors spent several months on the report, and he pointed out that among its first words are these: “oversight is constructive, not punitive.”

Richard Bergstresser, another Civil Grand Jury member and a retired police officer, addressed the board on his own behalf. He argued that, contrary to Bohn’s suggestion, the Civil Grand Jury is “not the appropriate oversight body” for the Sheriff’s Office since it deals with systemic review rather that specific cases. Similarly, a law enforcement liaison group that the county established in 2010 didn’t fit the bill because it “had no teeth.”

Bergstresser said that the cost of oversight efforts could likely be covered by grants. He referenced the increased public scrutiny of law enforcement nationwide in recent years, saying, “a lot of people are more concerned and involved and want transparency than ever before, and they deserve to have it.”

“This is not about oversight of the sheriff,” he added. “This is about oversight of the largest, most high-profile law enforcement agency in this county.”

Bohn said the board should wait to see what the working group they establish comes up with and then defer to Honsal.

“I just think we’ll see what they put together and see what the sheriff thinks is a reasonable approach,” he said. “At the end of the day, and maybe I’m all wrong here, the difference is [that] he’s elected to run the sheriff’s department. … He’s the key element to what we can do here. … Because he’s elected, he’s earned that respect and that right to make that decision. I’m sorry, but that’s the way I feel.”

Arroyo pushed back. “This isn’t a commentary on the sheriff,” she said. “I’m just putting that out there again.”

“He’s elected by the people with numbers we’d all love to have, so it seems like there’s not as much opposition and his department … ,” Bohn replied. “We’re trying to make it sound like there is a huge amount of problems, and I don’t get that many phone calls about that. To have somebody overseeing his department or micromanaging it is what could very well happen.

Arroyo again weighed in. “I would just like to reiterate that the role of oversight isn’t inherently punitive or solely about the individual at the head … ,” she said. “There are a number of reasons why it behooves us to think about [civilian oversight] during a time where we’re not under extreme pressure and duress when an incident has take place.”

Ultimately, the board voted unanimously to bring the matter back at a later date, when Honsal will presumably be in attendance.

Out With the Noodles, In With the Sticky Rice: Obento to Take Over Former Japhy’s Location in Northtown Arcata

Gillen Tener Martin / Wednesday, July 24, 2024 @ 2:28 p.m. / Business

Later this summer, Humboldt’s fast-casual Japanese food company Obento will open in the former G Street Arcata home of Japhy’s Soup and Noodles.

And, for all those concerned, the beloved abundance-of-veggies mural adorning the space’s south wall will stay.

“We’re so excited for this new step, and can’t wait to bring our food to the community in such a beautiful location!” Obento wrote in a July 2 Instagram post announcing the move.

The opening, planned for August or early September, will be the first time Obento offers in-person dining in its own storefront, marking a big moment in the story of a business that has faced its fair share of obstacles, as co-owner Maya Matsumoto told the Outpost in a phone interview.

Obento’s beginnings can be traced back to its owners’ childhoods. Both Matsumoto and her partner Shin Tamura grew up cooking and eating Japanese food.

“I’ve been making sushi since I was probably like 12,” said Matsumoto, adding that she originally learned the art from her grandma in Japan. After apprenticing in a Sonoma County sushi spot in high school, Matsumoto journeyed north to attend Humboldt State and continued working in restaurants locally, including Hana (a Japanese fusion Eureka restaurant that closed permanently in 2020) and the Diver Bar & Grill.

As for Tamura, “Shin likes to say he was born in a restaurant in Japan, moved to California and continued growing up in a Japanese restaurant,” Obento’s website states.

Like Matsumoto, Tamura also came north for Humboldt State, and, after they met, the partners realized they shared a fantasy of owning a Japanese restaurant.

“It had always been kind of a conversation, in the back of our heads,” Matsumoto recalled. “But then one day, we were like, ‘Hey, what if we actually, really tried to do this?’ Like, ‘What would our name be? What would our menu be like?’”

So, in 2019, Obento got its start in the City of Arcata’s Foodworks culinary facility, a site that’s spawned many iconic local businesses – from Humboldt Hot Sauce to Desserts On Us (creator of Lacey’s Cookies).

Initially, the company catered lunches solely to offices – a business model made difficult by the onset of the COVID-19 pandemic, which shuttered most workplaces the following year.

Photo: Obento via Instagram.

After a period of closure and regroup, Obento re-opened in fall 2020 as a “ghost kitchen,” with customers placing orders over the phone, through their website or via DoorDash. The following year, the business moved into the Depot on Cal Poly Humboldt’s campus.

“It’s cool to be connected to the campus and the students,” Matsumoto said of the return to their alma mater.

Matsumoto said that the university’s early closure this spring in response to student protests led to an unexpected loss of sales and product for Obento, giving her and Tamura an added push to find an off-campus location (a plan already semi-in the works).

After Japhy’s, an Arcata mainstay for 25 years, announced their closure on Instagram – spurring a flood of comments such as “I CAN’T LIVE WITHOUT YOUR CHICKEN CURRY” – Matsumoto said that the esteemed noodle spot’s former owners Josh and Miwa reached out to Obento about the open space.

“They wanted it to pass on to a business they had confidence in,” she said. “We did tell the former owners that we would keep the mural, but we’ll probably do a little bit of painting on the other side and add more decor and lighting to make it our own.”

Along with lunch and dinner seating, the G Street location will continue to offer Obento’s signature grab-and-go, bento box-style dining, inspired by Japanese Family Mart-type stores and the “authentic and affordable” motto that has always been core to the business.

“A big reason we started Obento was to showcase that Japanese food doesn’t need to be so expensive. There’s a kind of thought process around going out to eat sushi that it’s kind of a fancy thing…And it really doesn’t need to be like that,” Matsumoto said. “Japanese people eat Japanese food all the time, every day, and there are a lot of dishes besides sushi that are delicious and inexpensive and that can be a little bit more casual.”

“We have a lot of really great sushi places in town that have a sit-down feel and a lot of very fancy things on the menu,” she continued. “I think that side has been covered in Arcata.”

Obento’s Northtown location will create about ten new staff positions, according to Matsumoto, and the business will continue to serve at the Depot this school year.

“Good luck Maya and Shin,” Japhy’s wrote on Instagram, “We can’t wait to eat there.”

Credit: Obento/Maya Matsumoto.

What’s Going on With the Samoa Cookhouse? Danco Owner Dan Johnson Says Reopening is Still a Couple Years Away

Jacquelyn Opalach / Wednesday, July 24, 2024 @ 1:39 p.m. / Business

The Samoa Cookhouse. Photos: Andrew Goff

Back in May 2023, the Samoa Cookhouse and Danco Group announced that the old and beloved restaurant was to temporarily close, and unveiled renovation plans for “Camp Samoa,” an overnight tourist destination. While preserving the 133-year-old establishment’s “distinctive character,” Danco promised a spiffed-up restaurant with a hostel upstairs, cabins and campsites outside, and a picnic area and dog park nearby.

The plans came with no specific timeline, and more than a year after the Cookhouse closed its doors, there is no indication that the sweeping renovations mapped out by Danco are underway.

A banner posted on the building says that an “updated dining experience” is coming in 2024, and the Samoa Cookhouse Yelp page says the business is scheduled to reopen on May 10, 2025. Fans of the restaurant have taken to commenting on old Samoa Cookhouse Facebook posts to ask when it’ll reopen, without luck.

In a recent phone call, Danco owner Dan Johnson told the Outpost that it’s looking more like 2026, and that construction is yet to begin.

Why the wait?

Architects continued tweaking the designs for months after the restaurant closed, and Danco didn’t submit a permit proposal to the Humboldt County Planning and Building Department until a few months ago, Johnson said. The proposal was initially denied because it didn’t meet the California Coastal Commission’s conditions of approval, and Danco is now revising it. Johnson guessed it will be approved in two or three months.

Danco will probably break ground in early 2025. Johnson said the work will take 18 months, pushing the opening date to around spring 2026. The building requires “quite a bit of an upgrade,” he said, not to mention the construction of 40 new cabins.

“It’s been a bit of a challenge to get to this point,” Johnson said.

The cookhouse property – along with the rest of the town of Samoa – is owned by the Samoa Pacific Group, of which Johnson is a principal owner. But the Samoa Pacific Group didn’t own the Samoa Cookhouse (the business, that is) until a couple of years ago. It used to belong to Redwood Restaurants – a company that owns Fresh Freeze, a ‘50s diner in Eureka, and Café Marina, over on Woodley Island – which sold the business to Danco a couple of years ago, a Redwood Restaurants representative told the Outpost.

But Johnson said it wasn’t so clean: the former owners didn’t renew their lease, he said, and “basically by default gave up the restaurant.”

The Samoa Pacific Group is “not really excited about being in the restaurant business,” Johnson said. The new owners opted to close the Samoa Cookhouse for renovations after running it for six months or so.

Cookhouse staff told the Outpost at the time that they were blindsided by the temporary closure. Employees learned they were out of a job the same day Danco announced the news to the public, and the restaurant closed immediately.

“All the employees were well taken care of in ensuring that they had good severance packages,” Johnson said, adding that Danco will likely consider rehiring former employees (if they’re still interested three years later, that is). He also said selling the business might be on the table, if a good opportunity pops up after the grand reopening.

Although Danco announced detailed plans for Camp Samoa just last year, intentions to glam up the cookhouse property have been sitting on the company’s back-burner for more than a decade. The renovations are a part of the Samoa Town Master Plan, Danco’s blueprint – first drafted up in 2002 – to build up Samoa’s commercial offerings, update its housing stock and expand its public spaces and facilities. In 2010, the California Coastal Commission required Danco to add low-cost visitor serving units to the plan, identifying the Samoa Cookhouse as a site for that development from the outset.

Camp Samoa will include 75 accommodations: 40 cabins, 15 campsites and 20 hostel rooms, which will lean into the second floor’s former brothel look, Johnson said.

As for changes to the restaurant? A liquor license, Johnson said, and more options on the menu.

Mill workers ate every weekday meal at the Samoa Cookhouse back when it opened in 1890. For the most part, the restaurant honored that dining experience throughout its ongoing service in the century-plus since – offering family-style meals with just one option for breakfast, lunch and dinner every day. Before it closed for renovations, the Samoa Cookhouse was – or is? – the only lumberjack cookhouse left in the United States.

When the Samoa Cookhouse announced its impending renovations on Facebook, commenters begged the restaurant not to change too much. Johnson said the goal is to hold onto the cookhouse’s famous family-style experience. “It’ll generally be the same,” he said.

At any rate, it’ll be a couple of years before dedicated Samoa Cookhouse customers can make that judgment for themselves.

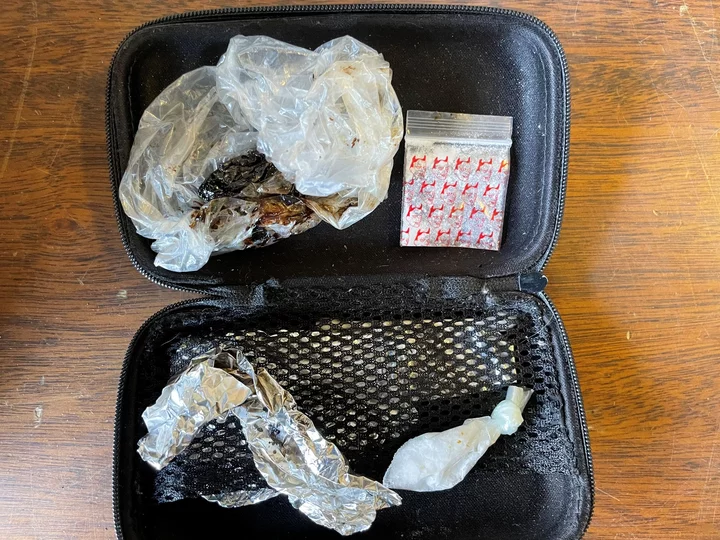

Search of Convicted Felon’s Eureka Home Finds Lots of Illegal Guns and Drugs, Says Humboldt County Drug Task Force

LoCO Staff / Wednesday, July 24, 2024 @ 11:45 a.m. / Crime

Images via HCDTF.

###

Press release from the Humboldt County Drug Task Force:

On July 24th, 2024, Agents with the Humboldt County Drug Task Force served a search warrant on Dustin Cody Pool (age 42), and his residence located in 3200 block of Ingley Street in Eureka. During the month of July, the HCDTF received information that Pool was selling large quantities of narcotics and he was in possession of several firearms. Pool is a convicted felon for narcotics- and firearm-related offenses.

Upon HCDTF’s arrival at Pool’s residence, Agents learned that he was not on scene. Agents searched Pool’s residence and located three handguns, a non-serialized P80 pistol with a fully automatic switch, a non-serialized AR-15, two non-serialized AR-15 short barreled rifles (SBR), one sawed off shotgun, a .22 caliber rifle, a fully automatic AK-47, multiple high capacity magazines for pistol, AR-15 and AK-47 style firearms, thousands of rounds of miscellaneous ammunition, approximately five grams of heroin, and approximately five grams of cocaine.

The HCDTF will be submitting a case to the Humboldt County District Attorney’s Office and requesting an arrest warrant for the following charges on Pool:

- 1370.1(A) PC: Possession of a controlled substance while armed with a loaded firearm

- 29800(a)(1) PC: Felon in possession of a firearm

- 30305(a)(1) PC: Felon in possession of ammunition

- 33215 PC: Possession of sawed-off shotgun/short-barreled rifle

- 30605 PC: Possession of an assault weapon

- 24610 PC: Possession of an undetectable firearm

- 32525(a) PC: Possession of a machine gun

- 32625 PC: Unlawful conversion of a firearm to a machine gun

Anyone with information related to this investigation, including Pool’s whereabouts, or other narcotics related crimes are encouraged to call the Humboldt County Drug Task Force at 707-267-9976.

Two Killed in Kneeland Plane Crash, Sheriff’s Office Confirmed; Additional Details Released

LoCO Staff / Wednesday, July 24, 2024 @ 10:34 a.m. / Crime

Photo: Andrew Goff

PREVIOUSLY:

Press release from the Humboldt County Sheriff’s Office:

On July 23 at approximately 11:15 AM, Humboldt County Sheriff’s Office (HCSO) Deputies, Fire Services, and Emergence Medical Services (EMS) were dispatched to the Kneeland Airport for the report of a fire and possible aircraft crash.

CAL FIRE personnel arrived on scene first and reported a fire and wreckage area in a steep ravine north of the airstrip. Deputies arrived on scene to assist and secure the scene. Sadly, two confirmed fatalities were located within the wreckage. The bodies were recovered and subsequently transported to the HCSO Coroner Station, where an autopsy will be performed in the coming days.

The HCSO would like to thank their Search and Rescue (SAR) Volunteers, CAL FIRE, the California Highway Patrol (CHP), the Humboldt County Aviation Department, Humboldt Bay Fire (HBF), the Arcata Fire Department (AFD), the Blue Lake Volunteer Fire Department (BLVFD), the Kneeland Fire Protection District (KFPD), Reach Air Medical Services, and City Ambulance for their assistance and collaborative response.

The HCSO would also like to send their sincere condolences to the families of those lost in this tragic incident. Identification of the victims is pending notification of next of kin.

The HCSO has turned the crash site over to the National Transportation Safety Board (NTSB) and the Federal Aviation Administration (FAA) to investigate this incident. All further inquiries regarding the crash should be directed to them. The NTSB can be contacted at 1(202)314-6000.