Schneider Offers Emotional Apology as Planning Commission Approves Tear-Down of His Permit-Violating, Half-Built Family Dream Home

Ryan Burns / Friday, July 7, 2023 @ 2:46 p.m. / Local Government

Local developer and owner of civil engineering firm Pacific Affiliates addresses the Planning Commission. | Screenshot.

###

Travis Schneider’s massive, half-built dream home will be demolished.

That’s the big takeaway from last night’s meeting of the Humboldt County Planning Commission — well, that and the fact that Schneider appeared in person to offer an emotional apology to those impacted by the numerous permit violations he accumulated while attempting to build a mega-mansion in the Walker Point subdivision, atop a hill overlooking the Fay Slough Wildlife Area.

The six members present (with Commissioner Thomas Mulder absent) unanimously approved modifications to a Coastal Development Permit and special permits, which will allow the local developer and business owner to remove the foundation and framing of a structure that dramatically exceeded its permitted size while violating numerous other conditions of the permit.

Senior Planner Cliff Johnson recapped some of those violations while introducing the agenda item. As originally approved in 2018, the permit called for an 8,000-square-foot single-family residence with attached cellar and garage. The structure Schneider framed up was nearly 21,000 square feet.

Schneider also built an un-permitted access road within a wetland setback area; built a portion of the house within a 100-foot wetland setback; started construction without a building permit; failed to get a required septic permit; and removed vegetation, including native California blackberries, from the wetland area, which is home to a designated archeological site from a historical Wiyot village.

The un-permitted access road. | Screenshot from Thursday’s meeting.

###

After learning about some of these violations, the county issued a stop work order on December 27, 2021, and three Wiyot-area tribes — the Blue Lake Rancheria, the Bear River Band of the Rohnerville Rancheria and the Wiyot Tribe — were called in for consultation. [DISCLOSURE: The Blue Lake Rancheria is a minority owner in the Outpost’s parent company, Lost Coast Communications, Inc.]

The project has been mired in controversy ever since, and while Schneider initially expressed optimism that he could resolve the permit violations, his quagmire of permit violations proved impossible to escape. By building inside the 100-foot wetland setback, the project automatically came under the jurisdiction of the California Coastal Commission, whose staff cautioned the county that it wouldn’t take the violations lightly.

“After further review and consultation with the California Coastal Commission, we’ve determined that there is no way for this residence to be permitted … ,” Johnson said at last night’s meeting.

Facing daily fines of $40,000, Schneider agreed in April to tear down the home and remediate the property to its pre-construction condition. As part of last night’s deliberations, the commission considered a lot-line adjustment between the two parcels on which the project was being built.

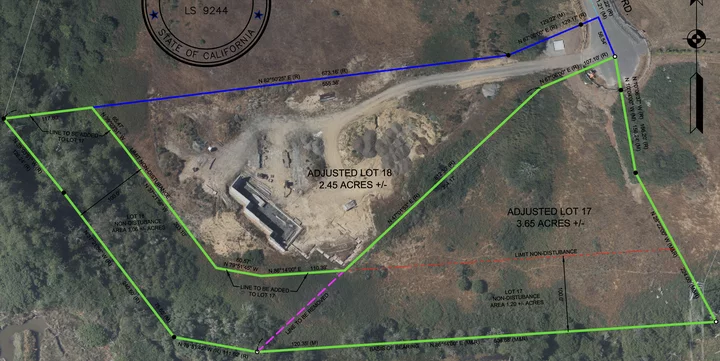

According to a staff report, Schneider intends to convey one of the two redrawn parcels (the larger of the two, at 3.65 acres, delineated in green below) to a land-holding agency for the benefit of the three Wiyot-area tribes.

Map of the proposed new lot lines. | Image via County of Humboldt.

###

Commissioner Peggy O’Neill asked whether the property owner could build a new home on the other parcel in the future. Johnson said yes, though the owner would have to reapply for a new permit.

Prior to deliberations from the commission, Schneider spoke from the lectern, his voice trembling as he apologized and spoke about his intention to “be a positive member” of this community by providing housing to others.

The video below is queued up to the start of his apology:

Earlier in his comments, Schneider noted that the permit modifications, as written, would require him to perform all remediation work, including removal of the structure and regrading the property, by October 20, which he said would be “very challenging.” He asked for six months after receiving all necessary approvals — or a minimum of five months in the dry season — to complete that work.

Planning and Building Director John Ford said it would make sense for the site to be stabilized during the wet-weather winter months and for Schneider to be given time next year to remove the un-permitted fill material that was brought onto the property.

“I think that’s agreeable,” O’Neill said. “You don’t want to do more damage by working in the wet season.”

The commission agreed to modify the proposed motion, giving Schneider until July 31 of next year to fully remediate the property and requiring him to stabilize the site through the winter. A sentence was later added saying Ford could extend the deadline if there are delays due to “natural circumstances.”

Commissioners Iver Skavdal and Noah Levy both acknowledged Schneider’s apology with appreciation. O’Neill made a motion to adopt the resolution. Skavdal seconded, and the motion passed unanimously.

###

PREVIOUSLY:

- Heated Meeting Sparks Accusations of Dishonesty and Discrimination, Opening Rift Between Tribes and Humboldt County Planning Commission

- Despite Silence From Tribes, Mega-Home Builder Optimistic Ahead of Tonight’s Continued Planning Commission Hearing to Address Permit Violation Fallout

- After Rebukes and Apologies for Bongio’s ‘Disrespectful’ Comments, Planning Commission Defers Decision on Mega-Home Permits

- County Supes to Consider Censure of Planning Commission Chair Alan Bongio for Inappropriate Conduct

- Bohn Makes the Motion, Supes Unanimously Censure Bongio for Racist Remarks, Move to Remove Him as Chair of Planning Commission

- A Tour Through the Half-Built Dream Mansion of Travis Schneider, Who Remains Hopeful Amid Mounting Permit Problems

- Alan Bongio, Embattled Humboldt County Planning Commissioner, Resigns

- Planning Commission Set to Rescind Permit for Controversial Schneider Home as Developer Prepares to Tear it Down, Remediate Damage to Property

BOOKED

Today: 5 felonies, 11 misdemeanors, 1 infractions

JUDGED

Humboldt County Superior Court Calendar: Today

CHP REPORTS

Shelter Cove Rd / Toth Rd (HM office): Car Fire

ELSEWHERE

Governor’s Office: Governor Newsom issues proclamation declaring 2026 statewide primary election date

Governor’s Office: Governor Newsom issues statement on Trump administration’s vaccine schedule endangering the lives of infants and children

Governor’s Office: One year after Los Angeles firestorms, California continues all-of-government community recovery efforts

RHBB: Road Conditions Update from Humboldt County Public Works

California Employers Have No Duty to Protect Workers’ Families From COVID, Court Rules

Nigel Duara / Friday, July 7, 2023 @ 7:10 a.m. / Sacramento

A kitchen staffer works behind the counter of a restaurant in Los Angeles on June 8, 2021. Photo by Pablo Unzueta from CalMatters

A Bay Area woodworking employee caught COVID on the job and brought it home during the height of the pandemic. His wife contracted the illness and her symptoms were severe – at one point, she needed a respirator to breathe.

But she cannot claim workers’ compensation injuries from the infection, the California Supreme Court ruled yesterday in answer to questions from a federal appellate court, because while doing so would be a moral good, that good is outweighed by the potential flood of litigation that would force businesses to close, tie up courts and send commercial insurance rates skyrocketing.

“Recognizing a duty of care to nonemployees in this context would impose an intolerable burden on employers and society in contravention of public policy,” associate justice Carol Corrigan wrote in the ruling. “These and other policy considerations lead us to conclude that employers do not owe a tort-based duty to nonemployees to prevent the spread of COVID-19.”

It was the second major loss for California employees seeking compensation for COVID infections passed to family members. Last year, a longtime employee of See’s Candies lost a workers’ comp claim after she contracted COVID and passed it to her husband, who died.

Workers’ comp is inherently a bargain, Corrigan wrote in a unanimous opinion: Employees get some guarantee that they’ll be paid in the event of an injury suffered on the job, no matter whether they were at fault, and employers get to limit the amount and extent of that compensation.

The question, then, is whether an employer’s duty to protect its employees from injury extends to their families. The court ruled that it doesn’t. But the court left the door open to more lawsuits, ruling that workers’ spouses who contract COVID can still file negligence claims against employers.

The facts of the case are a reflection of the push-and-pull concerning COVID regulations and essential businesses during the first year of the pandemic.

There’s little doubt that Nevada-based Victory Woodworks ignored San Francisco County health ordinances that demanded that employers quarantine potentially infected employees, the court found. Robert Kuciemba was employed at a Victory Woodworks jobsite for about two months when the company transferred a group of potentially infected workers to his San Francisco job site in the summer of 2020. He worked in close proximity to them and was infected.

His wife, Corby, caught COVID from him. She was older than 65, and her condition worsened until she was put on a ventilator. The couple sued, arguing that Victory Woodworks’ negligence led to her illness.

Though the Kuciembas sued in state court, Victory Woodworks had the case moved to federal court, where it was dismissed, a win for the woodworking shop and the U.S. Chamber of Commerce, which filed briefs in support of its defense.

Victory Woodworks argued that a win for the Kuciembas would have consequences far beyond workplace compensation.

“There is simply no limit to how wide the net will be cast: the wife who claims her husband caught COVID-19 from the supermarket checker, the husband who claims his wife caught it while visiting an elder care home,” the company argued in a federal court brief.

On appeal, the 9th Circuit Court of Appeals sent two questions to the California Supreme Court. First, whether the California Workers’ Compensation Act bars an employee’s household member’s claim against an employer, and second, whether the employer’s duty to protect its employees from COVID infections extends to the home.

During oral arguments in May, justices on the state Supreme Court voiced concerns that a workers’ comp ruling in Kuciemba’s favor would open the door to an “avalanche of litigation” against businesses.

###

CalMatters.org is a nonprofit, nonpartisan media venture explaining California policies and politics.

OBITUARY: Loran Gilbert Wright, 1930-2023

LoCO Staff / Friday, July 7, 2023 @ 6:56 a.m. / Obits

Loran Gilbert Wright

was born on September 25, 1930 in Ukiah and passed away on June 29,

2023 in McKinleyville.

Loran grew up in Arcata. He told stories about his youth, including summers that he spent with his brothers weeding gardens at Tyee City in the Arcata Bottoms. They slept in an old shed and swam in the Mad River at night. The boys used the money that they earned to purchase school clothes and shoes for the next school year. Loran was not especially fond of school, so he quit attending in the 7th grade and started working on a pig farm in the Arcata Bottoms. In 1948, he decided to enlist in the Navy. He was only 17 years old at the time, so he had to fib about his birthdate in order to enlist. He served for four years, 1948-1952, and was stationed in Hawaii during peace times. When the Korean War started, he was stationed in the Philippines on the USS Philippine Sea. About a year before his enlistment ended, he was home on leave when he ran into Patricia Brown. Loran and Patricia knew one another because Patricia was a good friend of Loran’s sister, Oleva. This chance encounter in Arcata was the beginning of a long and loving relationship that would span the rest of their lives.

Loran and Pat were married a year later, after Loran’s enlistment ended and Pat graduated high school. They married in Santa Rosa and honeymooned at Clearlake. On a subsequent trip to Clearlake, Loran learned to water ski. He and Pat bought a boat, and their family spent many memorable times boating and skiing on Big Lagoon and Trinity Lake. He built three different summer cabins at Trinity Center, where the family gathered and enjoyed boating on the lake.

Loran was an accomplished businessman. He started Sequoia Auto Supply in McKinleyville, Arcata and Eureka with partners, Don Cooper and Jerry Peterson. He and Don Cooper also partnered in starting the McKinleyville Stove Shop and the Eureka Stove Shop. Loran also independently opened the Laundromat on E Street in Eureka and Western Auto Supply in Weaverville.

After their children were grown, Loran built a summer home in Willow Creek. He had a big garden and planted 80 peach trees.

Loran was blessed to “retire” at age 55. He built his dream home at Trinity Center, where he and Pat lived until early 2000. He built two homes in Weaverville for his son, Mitch, and another home in McKinleyville for his son, Marc. He and Pat bought a Honda Goldwing Motorcycle and traveled 85,000 miles on it through the Western United States and Canada. Next, they purchased a fifth-wheel trailer and continued their travels through the Western and Midwestern United States, Canada, Alaska and Mexico.

In 2000, Pat and Loran moved to Weaverville to be closer to their son, Mitchell. They lived in Weaverville for 17 years. They moved back to McKinleyville in 2019 to be closer to their son, Marc. Loran loved hanging out with Marc in his shop, and “supervised” Marc’s crazy building projects. Loran also loved doing yard work, and he became a great gopher hunter. He was in the midst of a gopher hunting contest with his friend Bob Buck, which he was determined to win. The last count was 87 gophers! Just two weeks before his death, he asked his daughter-in-law, Teresa, for more Gopher Hawks.

Loran loved God. His family attended Arcata First Baptist Church. Most recently, he attended the Wesleyan Church of the Redwoods in McKinleyville. He enjoyed walking and meeting his neighbors. He had many friends.

Loran was preceded in death by his son Mitchell Wright in 2011, and by his siblings Jack Wright, Joseph Wright, Harold Wright, and Oleva Mellow (Wright).

Loran is survived by his loving and devoted wife of 70 years, Patricia Wright. He is also survived by his son, Marc Wright, Marc’s wife Teresa, and their children Tyla (Jasper) Brodie and Morgan (Katelyn) Wright. He is also survived by his foster daughter Lois Erhgood (Stockoff), Lois’ husband Jim, and Lois’ children, Russell Brenner and Alisha (Dennis) Wilson. He is also survived by his grandson (Mitchell’s son) Zachary (Tiffany) Wright. Loran had 6 great-grandchildren, Brooklyn and Rowan Brodie, Michael and Anthony Brenner, and Dennis Jr. and Delilah Wilson.

A memorial service to honor Loran will be held on July 16, 2023 at 2 p.m. at the Wesleyan Church of the Redwoods, 1645 Fischer Avenue, McKinleyville. There will be a celebration of life at the church’s social hall following the service.

###

The obituary above was submitted on behalf of Loran Wright’s loved ones. The Lost Coast Outpost runs obituaries of Humboldt County residents at no charge. See guidelines here. Email news@lostcoastoutpost.com.

OBITUARY: Mark Robert Maillie, 1964-2023

LoCO Staff / Friday, July 7, 2023 @ 6:56 a.m. / Obits

Mark Robert Maillie was born on April 5, 1964 to Robert Maillie and Jessie Desadier

in Roseburg, Oregon. His family later moved to Eureka, where Mark would grow up

and meet the love of his life, Shirley. They were married on September 28, 1985.

Mark and Shirley would go on to welcome three children, Max, Rex, and Lindsey. Anyone who knew Mark knew that cancer was present in his life from 2006 on. During this first diagnosis of large B cell Lymphoma, he was told that the survival rate was low. He underwent treatment despite this statistic. In late 2006 the oncologist said he would do one more treatment so he would get one more Christmas with his family. Little did everyone know this treatment was a miracle and put him in remission. From then on he lived with a new sense of gratefulness.

Although cancer is a part of his story, it’s not his whole story. Mark had worked at Pacific Clears 19 years before getting cancer. It was a job he was always fond of. After he got the clearance to work again he got a job at the McKinleyville Services District doing maintenance around town. He loved his job and the ability to be outside doing something different everyday.

When sickness inhibited his ability to work a normal job, he focused on his hobbies. He was an avid fisherman. You could often find him climbing the rocks at the North Jetty to fish, or crabbing in the bay with Shirley. He also enjoyed woodworking. He was known for his redwood planter boxes that he would sell locally. He would even make a birdhouse from time to time, but usually only upon special request. He loved spending hours in his backyard crafting different boxes.

If you really knew Mark you would know that his other love was music, specifically heavy metal. He spent hours finding new bands to support online, even going to see a few of them in concert when they came to the states. He was definitely a real metal head. In his later years he also began collecting antique bottles. Mark and Shirley loved spending a weekend at a bottle show or scouring antique shops for bottles. They were happily welcomed into a wonderful group of northern California bottle collectors. Their collection is proudly displayed in their home.

Our family would like to make a special thank you to his entire team at UCSF medical center, especially Doctor Gansler. They provided many years of support and kindness when the hospital became a second home. Doctor Gansler was much like a second mother to Mark and he trusted her with his whole heart. It’s not often you are blessed to have the same team of people surrounding you for almost 20 years. Our biggest hope is that the research they were able to do on his case would help to save someone else in the future. Our family would also like to thank Dr. Cobb and his team. They have been like family to us and we don’t know where we would be without him. A special thanks also needs to be given to Providence in Home Healthcare. The team there provided Mark with such wonderful care to make him comfortable at home.Especially Sophia, Terrance, and Gina who went the extra mile every time Mark needed anything.

Mark is survived by his mother Jessie Desadier, brother Rodney Summers, wife Shirley, his children Max (Catrina), Rex, and Lindsey (Grady) and his grandsons Jaxson and Tristan; and his mother and father-in-law Judy and John Wolff. He is preceded in death by his father Robert Maillie, his brother-in-law John W. Wolff, his grandmother Percilla Madison, and many aunts and uncles.

Services for Mark will be held August 26 at 12 p.m. at Azalea Hall in McKinleyville.

###

The obituary above was submitted on behalf of Mark Maillie’s loved ones. The Lost Coast Outpost runs obituaries of Humboldt County residents at no charge. See guidelines here. Email news@lostcoastoutpost.com.

New Owner of Singing Trees Recovery Center Arrested for DUI and Child Endangerment, and in Odd Interview She Denies That the State Revoked Her Therapy License. (It Did.)

Ryan Burns / Thursday, July 6, 2023 @ 5:41 p.m. / Community Services , Crime

Singing Trees Recovery Center, located just north of Richardson Grove State Park. | File photo.

###

###

Less than a month after reopening Singing Trees Recovery Center, new owner Amber Rose Bedell, age 45, was arrested on the Fourth of July and booked into the Humboldt County jail on charges of driving under the influence of alcohol and child endangerment.

This was Bedell’s third DUI arrest since 2016 and her second for child endangerment, according to state and county records.

Bedell is the founder of Pure Solution Family Services, Inc., a 501(c)(3) nonprofit organization founded last year. It’s through that organization that Bedell is operating Singing Trees Recovery Center, a drug detox and rehab facility located in Southern Humboldt.

Formerly a marriage and family therapist, Bedell had her MFT license revoked in 2018 when the state’s Board of Behavioral Sciences found that she had failed to report a criminal conviction stemming from an incident in September of 2016. Read the revocation order here.

According to that order, Bedell was arrested and later convicted for driving 88 miles per hour with a blood alcohol level of 0.29 percent, more than three and a half times the legal limit.

Bedell has had several more run-ins with the law since then. In a somewhat convoluted incident from June 2018, deputies responded to a pair of stolen vehicle reports connected to a McKinleyville residence and to Bedell, who was already under investigation for child endangerment, according to a press release from the Humboldt County Sheriff’s Office. While searching the residence, deputies allegedly found a loaded firearm, heroin, syringes, marijuana and drug paraphernalia, all in an area accessible to children.

At the time, Bedell was director of another public benefit nonprofit called Evolve Youth Services. She has not been affiliated with that organization for four or five years now, according to its current treasurer, Paul Rodrigues.

In January of 2020, Bedell was arrested again for driving under the influence of alcohol resulting in injury.

Reached by phone this afternoon, Bedell was hesitant to discuss the matter, saying she would release a statement after speaking with her attorney and East Coast PR team.

“You understand the implications and what this looks like, the seriousness of what this looks like on paper … ,” she said, adding that false things have been printed about her in the past. “I want to work with you, and I want you to work with me, too. I don’t want that facility to be in any danger. I don’t want people who need help to not benefit from the quality and amazing program we have. I know you don’t want that either.”

She added, “As you know, an arrest does not mean a conviction.”

When told that we planned to publish a story today, Bedell requested an hour to feed her kids and make some phone calls. Reached again an hour later, she said she couldn’t comment on the July Fourth incident except to say that it will have no effect on the operation of Singing Trees.

“It’s open and we have a resident moving in,” she said.

She went on to deny that the state had revoked her marriage and family therapy license, saying she relinquished it voluntarily because she no longer needed it, “but I didn’t follow the proper channels.”

We asked her to explain further.

“When you have a license for anything … and you want to not have it anymore, you have to do a process,” she said. “You can’t just not do it. So I paid my fee to renew my license and then I made the decision upon consultation [with a colleague] not to go through the process of continuing with that. And I didn’t turn in the correct paperwork for that because I wasn’t aware [I needed to].”

Asked if she had any proof that she’d voluntarily relinquished her license, anything she could send to us, she replied, “What would that even look like?”

We asked her why the California Board of Behavioral Sciences maintains a published ruling saying her license was, in fact, revoked, and Bedell again insisted that she had already relinquished her license by that time.

“It’s really what happened!” she said. “I thought, ‘Okay, I don’t need this license anymore and I don’t want it because this isn’t what I do anymore.’ I don’t do traditional therapy, I don’t bill insurance. I had moved on from that. I knew that there was gonna be a lot of hoops to jump through, but that [state ruling] hadn’t happened yet when I made that choice.”

Asked about the underlying criminal charges — driving 88 with a 0.29 percent blood alcohol content — Bedell acknowledged that it happened but again said she had already voluntarily relinquished her license by that point.

We then asked her about the 2018 arrest for child endangerment. “I’m not sure if I’m ready to talk about all of that,” Bedell said, adding that “incorrect information” about the incident had been printed at kymkemp.com. However, it seems she was referring to publication of a press release issued by the Humboldt County Sheriff’s Office and published by Kemp as well as the Outpost and the Times-Standard.

What was incorrect in that press release? Bedell said the charges mentioned were later dropped and that she, personally, had not reported the cars stolen, though the press release doesn’t say she had.

Asked if there was anything else she wanted to say, Bedell took some time to think through and recite a statement. Speaking slowly and deliberately she said, “We are very excited to have Singing Trees open and to provide quality substance abuse treatment services to our community from a holistic approach.”

She then wrestled with what to say about her latest arrest, at one point requesting this reporter’s help. Finally, she ventured forth on her own: “The event on July Fourth of 2023 is still under investigation. There are not official charges from the District Attorney — .”

She cut herself off there, mid-sentence: “No no no. I can’t talk about this.”

Before the conversation ended, Bedell returned to the matter of Singing Trees.

“We are still open,” she said. “We have residents moving in now and we are accepting new patients and there is no impact on the operations of the facility in any manner whatsoever.”

California and Manufacturers Strike Deal Over Zero-Emission Trucks

Rachel Becker / Thursday, July 6, 2023 @ 2:45 p.m. / Sacramento

A fleet of new Tesla big rigs was on display at PepsiCo’s Sacramento facility on April 11, 2023. Photo by Miguel Gutierrez Jr., CalMatters.

Truck manufacturers won’t file legal challenges over California’s controversial mandate, and in return, the state air board will relax some smog-fighting requirements.

California and major truck manufacturers announced a deal today that would avoid a legal battle over the state’s landmark mandate phasing out diesel big rigs and other trucks.

In return, the Air Resources Board will relax some near-term requirements for trucks to reduce emissions of a key ingredient of smog to more closely align with new federal standards.

“It’s great to have them not suing and not helping others in lawsuits,” said Steven Cliff, the air board’s executive director. “But more important is we ensure that we’re getting the actual reduction benefits associated with the rules.”

The powerful Truck and Engine Manufacturers Association as well as 10 manufacturers, including Cummins, Inc., Daimler Truck North America, Volvo Group North America and Navistar, Inc. signed on to the deal.

“Both (the California Air Resources Board) and we realized that, through these discussions, there was an opportunity for CARB to realign with the (U.S. Environmental Protection Agency) starting in 2027. And that’s really what led to our sitting down and coming to this agreement,” said Jed Mandel, president of the Truck and Engine Manufacturers Association.

Starting in 2036, no new fossil-fueled medium-duty and heavy-duty trucks will be sold in California under a regulation approved by the air board in April. All new models will have to instead be zero-emissions. Large trucking companies also must convert existing fleets to zero-emission electric or hydrogen models by 2042.

“It’s great to have them not suing and not helping others in lawsuits. But more important is we ensure that we’re getting the actual reduction benefits associated with the rules.”

— Steven Cliff, executive director of the California Air Resources Board

While manufacturers are now supporting California’s rules, trucking companies have vigorously opposed them, saying zero-emission big rigs can cost more than twice the cost of a diesel truck, take hours to charge, can’t travel the range that many companies need to transport cargo and lack a sufficient statewide network of charging stations. A top executive of the trucking industry had predicted economic chaos and dysfunction and said the mandate is likely to “fail pretty spectacularly.”

Vehicle pollution battles are high stakes in California: Under the federal Clean Air Act, the state has the unique authority to set vehicle emissions regulations that are stricter than the federal government’s. More than a dozen other states usually choose to follow California’s lead.

Engine manufacturers fought against an earlier state truck rule, enacted in 2020, that cut smog-forming pollutants from medium and heavy duty trucks, warning that the rule was not cost-effective and would harm California’s economy.

When the federal Environmental Protection Agency adopted its own rules to cut smog-forming pollutants from trucks in December 2022, manufacturers were faced with the possibility of a split market, with California enacting different rules.

Under the new agreement, California will bring its 2027 standards for smog-forming nitrogen oxides more in line with the federal version.

Truck and engine manufacturers also will be allowed to sell a higher percentage of older diesel technology that isn’t as clean burning between 2024 and 2027, provided they offset the emissions, such as by also offering up a comparable number of zero-emission engines. The air board also agreed to give manufacturers four-years warning before implementing new clean trucks rules.

In return, the truck manufacturers agreed not to sue over California’s suite of clean trucks rules or weigh in on lawsuits brought by other parties, and said that they would follow the rules regardless of how any other lawsuits resulted. If trucking companies sue the state, for instance, they won’t have the support of truck engine manufacturers, a powerful group.

The agreement calls for changes to the state’s current rules that will still require a formal rulemaking process and a vote of the board. Cliff said the staff has a strong case to make to the board about the changes.

Danny Cullenward, an energy economist and research fellow with American University, said the agreement is an unusual strategy, but given the legal uncertainty of a lawsuit in the current federal court system, he understands the rationale.

“It’s kind of like regulating through contract, which is a little weird,” said Danny Cullenward, an energy economist and research fellow with American University. “Deals get made all the time. This one is just written down in advance.”

California has struck similar deals before, when the state crossed swords with the Trump administration over its power to set greenhouse gas limits for tailpipe pollution.

Cullenward said the move makes it less likely that California’s clean truck efforts will become mired in lawsuits that eventually end up in front of the Supreme Court.

“The Supreme Court has gone from conservative to reactionary and aggressive, and I mean, lawless,” Cullenward said. “There’s more to be said, practically, from avoiding that drama.”

###

CalMatters.org is a nonprofit, nonpartisan media venture explaining California policies and politics.

Tonka, the 11-Year-Old Camel Who Lived at Miranda’s Rescue and Was Best Friends With a Miniature Donkey, Died Last Week

Stephanie McGeary / Thursday, July 6, 2023 @ 11:41 a.m. / Animals

Miranda and Tonka at Miranda’s Rescue | Images provided by Shannon Miranda

###

Tonka – the beloved camel who lived at Miranda’s Rescue in Fortuna for the last decade – died last week after a long struggle with a bacterial infection.

“With a very heavy heart, we regret to say that we have lost Tonka, our amazing sanctuary animal, the camel,” Miranda’s Rescue posted on its Facebook page last week. “Unfortunately, he had some sort of bacterial infection that took him fast and there was nothing we could do to save him. He was an icon to the ranch and loved by so many.”

Reached by the Outpost on Wednesday afternoon, the rescue shelter’s founder Shannon Miranda said that he doesn’t know the name of the bacteria that ultimately killed Tonka, but that the camel had been born with the issue and there wasn’t a cure.

Though he usually seemed healthy, Tonka would occasionally have flare-ups from the infection, which would cause him to have terrible diarrhea. Miranda had to regularly give Tonka an oral medication, which would clear up the issue and everything would be fine again. But this time, Miranda said, the flare up just got so bad, Tonka was beyond the point of treatment and had to be euthanized. The vet had warned Miranda that Tonka’s infection would eventually get worse, so he knew this moment would come. But Miranda said he was still not expecting to lose the animal so soon.

Tonka had come to Miranda’s rescue when he was just one year old and had lived on the ranch until the day he passed at age 11. Originally a petting zoo animal, Tonka was brought to the shelter when his previous owner, Jenna Kilby, was no longer able to care for him. Though Kilby couldn’t keep Tonka with her, she maintained a close relationship with the camel, coming to visit him at the shelter all the time, Miranda said.

Miranda also had a very special bond with Tonka, he said, and was really the only one at the shelter who was able to handle him. Though camels are great animals, Miranda said, they can also be a bit ornery and usually require a lot of training to be able to be handled by humans. Miranda tried to train Tonka, but said that with all the other animals at the shelter, it was difficult to provide Tonka with the amount of training he needed.

Though Tonka was not a fully trained camel and wouldn’t let just anyone into his enclosure, he was very friendly with people who just wanted to visit him from outside of the fence. He was very popular with visitors at the ranch, Miranda said, and was happy to get pets and treats, especially bread, carrots and apples.

Aside from Miranda and Kilby, Tonka had also developed a special relationship with his best friend, a miniature donkey named Blossom. Tonka and Blossom would run around together and whenever Miranda had to groom Tonka or give him medical care, Blossom had to be there to help Tonka stay calm.

“Every time [Blossom] was out of his sight, he would get really upset,” Miranda said.

Despite his medical issue and his occasional “grumpiness,” Miranda said, Tonka lived an overall healthy and happy life and will be missed deeply by everyone at the ranch and many members of the community. Eventually Miranda hopes to find another camel to live at the ranch. But for now he is still getting over the death of his beloved Tonka. Though losing animals is a part of the territory when running a shelter, Miranda said that Tonka was very special to him and this was a particularly difficult loss.

“It’s so sad because he was a fixture out there,” Miranda said. “When he passed, I just sat out there with him and I just cried like a baby. I was so overcome with sadness…I want to thank everybody who loved Tonka that came out to see him. I know he’ll be really missed.”