Sheriff’s Office Arrests Felony Warrant Suspect at Kimtu, Allegedly in Possession of a Great Deal of Fentanyl

LoCO Staff / Wednesday, Aug. 30, 2023 @ 2:56 p.m. / Crime

Press release from the Humboldt County Sheriff’s Office:

On Aug. 29, 2023, at about 11:49 a.m., Humboldt County Sheriff’s deputies on patrol at the Kimtu river bar access conducted an investigation into a parked vehicle, occupied by a known felony warrant suspect and two others.

Deputies contacted the suspect, 32-year-old Charles Joseph Henry-James, who initially provided deputies with a false name. During this contact, deputies observed drug paraphernalia in plain view. Henry-James and the two other occupants of the vehicle were detained without incident. During a search of the vehicle, deputies located over 40 grams of suspected fentanyl, drug paraphernalia and items consistent with the sale of controlled substances.

Henry-James was arrested and booked into the Humboldt County Correctional Facility on charges of false identification to a peace officer (PC 148.9(a)), possession of a controlled substance for sales (HS 11351) and possession of drug paraphernalia (HS 11364(a)), in addition to warrant charges of inflicting corporal injury on a spouse (PC 273.5(a)), battery against a spouse (PC 243(e)(1)), escape from a peace officer while under arrest (PC 836.6(b)) and resisting a peace officer (PC 148(a)(1)).

The other two occupants were released at the scene.

Anyone with information about this case or related criminal activity is encouraged to call the Humboldt County Sheriff’s Office at (707) 445-7251 or the Sheriff’s Office Crime Tip line at (707) 268-2539.

BOOKED

Yesterday: 4 felonies, 7 misdemeanors, 0 infractions

JUDGED

Humboldt County Superior Court Calendar: Yesterday

CHP REPORTS

No current incidents

ELSEWHERE

RHBB: ‘We Will Not Accept the Response’: Students Remain Overnight in Cal Poly Humboldt’s Nelson Hall

RHBB: Humboldt County Road Construction Notice: Central Avenue

RHBB: Electrify Home Appliances and Improve Efficiency, Says Arcata

Governor’s Office: Governor Newsom releases 2025 judicial appointment data

MOON NEWS! Tonight’s Full Moon Will be a Blue Moon and a Supermoon and Will Probably Look Really Cool

Stephanie McGeary / Wednesday, Aug. 30, 2023 @ 2:15 p.m. / Science

The Moon might look something like this tonight. | Image from Wikimedia Commons. Creative commons license.

###

You’ve probably noticed that the sky has been looking pretty smoky, as wildfires continue to burn around us. Not great. However, if there is one silver lining to the smoky skies, it’s that it makes the Moon look cool in the creepiest way.

And tonight the Moon will look extra cool and creepy because, not only will the Moon be completely full, but it is also a perigean moon (more commonly known as a supermoon), meaning that the Moon will be in its closest proximity to Earth during its orbit, meaning it will appear especially big and bright in the sky.

“When the Moon is closest to Earth (a “supermoon”), it looks about 14 percent bigger than when it’s farthest from Earth,” NASA says on its website. “This is similar to the size difference between a quarter and a nickel. Because the Moon will be close to us in its orbit, it will appear a bit brighter than usual.”

Here’s a quick video from NASA, explaining what makes a supermoon:

For those of you who are excited to gaze at the Moon tonight, NASA has some other tips about what to look for in the night sky. The moon begins to rise at 7:38 8:09 p.m. and evening twilight will end at about 8:42 p.m. Saturn will also be visible near the moon and should also look particularly big and bright, as it is near to its closest position to Earth for the year.

“The planet Saturn, just a few days from its closest and brightest for the year, will appear near the Moon,” NASA writes. “As evening twilight ends (at 8:42 p.m.) Saturn will be 5 degrees to the upper right of the Moon, and will appear to swing clockwise around the Moon as the evening progresses.”

There you have it. Happy moon-gazing, everyone!

Following Owner’s DUI Arrest, Former Singing Trees Employees Report Unethical Behavior to the State

Ryan Burns / Wednesday, Aug. 30, 2023 @ 2:12 p.m. / Community Services , News

Singing Trees Recovery Center, located just north of Richardson Grove State Park. Photo provided by counselor Marilynne Walpole.

PREVIOUSLY:

- After Closing Its Doors Late Last Year, Singing Trees Recovery Center Will Reopen Next Week Under New Ownership

- New Owner of Singing Trees Recovery Center Arrested for DUI and Child Endangerment, and in Odd Interview She Denies That the State Revoked Her Therapy License. (It Did.)

- Singing Trees Recovery Center Staff Apologizes for Owners’ ‘Unhealthy Choice’ Following Recent DUI and Child Endangerment Arrest

###

When Amber Bedell was arrested on the Fourth of July on charges of driving under the influence and child endangerment — her third DUI arrest and second for child endangerment since 2016 — her employees at the recently reopened Singing Trees Recovery Center sought to do some damage control, issuing an apology to the community while saying they “remain steadfast and committed to all past, present, and future residents” of the drug and alcohol residential detox facility, located south of Garberville.

But in the weeks since then, nearly all of those employees have quit, and at least two of them have reported Bedell to the Children and Family Services Division of the California Department of Social Services. They allege, among other things, that Bedell has misappropriated government funds acquired through a nonprofit she founded last year, called Pure Solution Family Services, Inc.

Pure Solution offers post-adoption support services as part of California’s WRAP Program, which finances individualized wraparound services to adopted kids by teams of professionals.

Christopher Jorgensen, who worked as a wraparound facilitator and therapist at Pure Solution, says he resigned from the nonprofit on June 28 because Bedell was “operating illegally, unethically and performing fraudulent activity.”

Specifically, he alleges that after acquiring the Singing Trees facilities via a lease-to-own agreement, Bedell used wraparound monies allocated for at-risk youth to pay for renovations and other unqualified expenses.

“Wraparound money was used to remodel, hire staff, licensing/credentialing, and a hefty $10,000 monthly payment,” Jorgensen said in an email to the Outpost. He says he reported Bedell to the state on July 13, and he forwarded some follow-up email communication he’s had with staff at the California Department of Social Services.

The Outpost acquired a partially redacted copy of another complaint submitted to the state on July 12 by a former substance abuse use disorder (SUD) counselor who was employed by Pure Solution while working at Singing Trees. In communications with the Outpost, this former employee asked to remain anonymous to protect her business and the people she serves.

Her complaint, like Jorgensen’s, accuses Bedell of funneling government money intended to help at-risk children into the renovation and reopening of Singing Trees.

“I have witnessed firsthand and heard secondhand from 2 other employees that have recently quit due to the unethical practices of the founder/director [Bedell], that Pure Solutions Family Services is accepting funds from Butte, Mendocino and Siskiyou Counties for WRAP services but those families are not being served,” the complaint says.

Theresa Mier, a spokesperson for the California Department of Social Services, said the department “is looking into the issue” and cannot comment further at this time.

Bedell, whose marriage and family therapist license was revoked by the state in 2018, denies the allegations, though she was very reluctant to speak on the record.

“I think the comment that I have at this time is that while we are navigating some challenging times, we appreciate the respect of privacy from the community,” she said in a phone conversation on Tuesday. “When we’re able to share more information, we will,” she added.

When asked why so many of her employees have quit recently, Bedell replied, “Disagreements about the operations of Singing Trees.”

What aspect of operations were these disagreements about?

“That’s really all I can say,” Bedell replied.

We tried to ask her about Pure Solution’s board of directors — Jorgensen said she once told him her board consisted of personal friends who don’t ask questions about the finances — but she cut us off.

“I’m gonna end this conversation,” she said. “I don’t think that my lawyers — I can’t have this conversation with you. As I said in the beginning, my statement is: We are dealing with some challenging times, and we appreciate the respect of privacy while we navigate these.”

After a beat she added, “Singing Trees is open and accepting new residents. Please give us a call.”

Meanwhile, more former employees of Singing Trees have been speaking out. Last week, for example, a former Singing Trees counselor named Marilyn Walpole posted a public statement on Facebook, saying she felt compelled to speak up in the best interests of future residents and staff.

“Neither the ‘owner’ nor the director of operations have any addiction studies qualifications or schooling,” Walpole’s statement says. “[T]his put my credentials at risk. Currently there are no staff members at the facility. I am sharing my experience in hopes that people will not put themselves or their loved ones at risk in that environment. It breaks my heart because Singing Trees is so loved & needed by the community.”

We also spoke with Courtney Bell, who was the program manager at Singing Trees before her recent resignation. She agreed that the facility is sorely needed here in Humboldt County. Before its temporary closure late last year, Singing Trees had been offering its detox and rehabilitation services in Southern Humboldt for more than three decades.

“I was born and raised down here, and it has affected so many people’s lives,” Bell said in a recent phone interview. While most rehab facilities have a “hospital-like” feel that can be intimidating, Singing Trees was always different, Bell said. “That’s a special thing about it. It’s more like a summer camp vibe, almost. It doesn’t feel depressing and scary as a lot of rehabs do.”

Bell said she and her husband did much of the work to get Singing Trees back up and running, but when she learned that allegedly misappropriated government money was being used to finance the facility and its services, she quit.

“All the money that’s supposed to be going to those kids and their WRAP program are being filtered into Singing Trees at this point,” Bell said. “That’s the most annoying part. … She makes a lot of money off of those kids and gives them very little services.”

Bell, Jorgensen and others said the California Department of Social Services typically supplies $15,000 per child per month in Adoption Assistance Program (AAP) funds.

Like Bell, Jorgensen said he’s concerned about any current and future clients at Singing Trees.

“To this date, the agency offers no mandatory training to any of its employees, with most staff still not having [an] understanding [of] what the fundamentals of wraparound are, nor what role they even play as a wraparound provider,” Jorgensen said in an email.

Bell agreed. “Rehab is [a matter of] life and death for people, and I don’t feel [Bedell] takes that seriously enough … ,” she said. “She shouldn’t be the one counseling or doing anything [related]. It’s not in her lane at all.”

Pure Solution Family Services currently has job listings on Craigslist and iHire.com seeking a substance abuse counselor, a chef/cook and an overnight specialist for Singing Trees Recovery Center.

FIRE UPDATE: ‘Unhealthy’ Air Quality Conditions Reported Along the Coast as Numerous Fires Burning Across Northern California, Southern Oregon Push Smoke South

Isabella Vanderheiden / Wednesday, Aug. 30, 2023 @ 1:25 p.m. / Fire

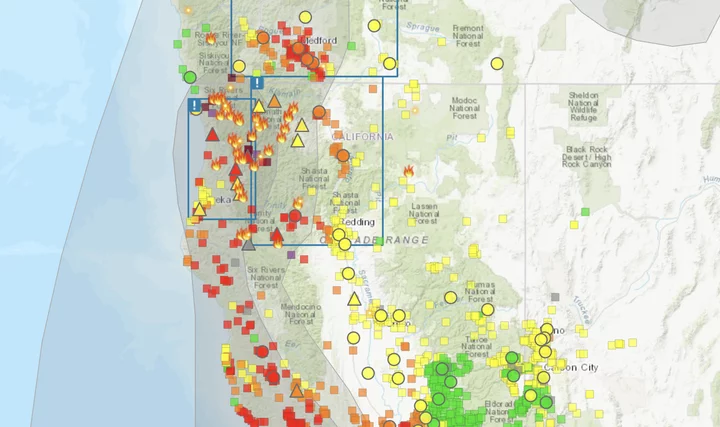

Screenshot of smoke map via AirNow.gov.

###

State agencies are reporting “unhealthy” air quality conditions for coastal communities all along the West Coast, the result of multiple fires burning across Northern California and Southern Oregon.

Coastal dwellers are experiencing “unhealthy” air quality conditions, with an AQI range of 150 to 180, due to smoke from the Smith River Complex being pushed south, according to the North Coast Unified Air Quality Management District.

“The increased smoke and southerly transport should result in most of the smoke being pushed to the [south and southeast],” according to an afternoon air quality update. “Unhealthy to Hazardous conditions are possible at times near Crescent City and Orleans, and generally Unhealthy conditions for communities … along the Klamath and Trinity River Valleys, and slightly better in Willow Creek. Along the coast, communities south of Crescent City should average Moderate as onshore flow begins to strengthen.”

Sensitive groups – including people with heart or lung disease, older adults, children, and pregnant people – should stay indoors in a place with clean indoor air and keep activity levels light.

Clean air shelters can be found at the following locations:

- Willow Creek Library (39 Mayfair Street, Willow Creek): Friday and Saturday, noon - 4 p.m. Wednesday and Thursday, noon - 5 p.m.

- Willow Creek Community Health Center - Open Door (38883 Hwy 299): Monday thru Friday 8 a.m. - 5 p.m.

- Dream Quest Willow Creek (100 Country Club Drive): Monday thru Friday, 11 a.m. - 7 p.m.

- Hoopa Neighborhood Facility (11860 Highway 96): Monday thru Frida, 8 a.m. - 5 p.m.

- Elders - Hoopa Health Assoc. Senior Nutrition Center, Loop Road, Hoopa: Monday thru Friday, 8 a.m. - 5 p.m.

###

As of this writing, the Smith River Complex, burning near Gasquet in Del Norte County, has consumed 75,775 acres and is seven percent contained, according to the Six Rivers National Forest.

Level 3 “Go Now” evacuations are in effect for Patrick Creek, Little Jones Creek, Copper Creek Drainage, Coon Creek/16n19 17n07, Washington Flat, Pioneer Road, Panther Flat Campground Area, all communities between Slant Bridge Road north to the Oregon Border along Highway 199, French Hill Road. A full list of evacuation advisories and additional fire information can be found at this link.

The 2023 SRF Lightning Complex and Redwood Lightning Complex have burned an estimated 14,783 acres in Humboldt and Trinity Counties and are 20 percent contained. The town of Orleans and surrounding communities are still under an evacuation warning due to the Pearch Fire, one of 20 fires burning in the complex. The fire has burned 3,466 acres. Containment is unknown. (A map of the complexes can be found here.)

The South Fork Complex, burning north of Dinsmore, has burned 3,516 acres and is 31 percent contained. The Humboldt County Office of Emergency Services issued an evacuation warning for residents in the area of Henry Ridge, north and east of the Mad River.

More information on fire activity can be found at inciweb.nwcg.gov.

LoCo Fish Co. Owner Jayme Knight Apologizes for ‘Hurtful’ Language, Says He’s Stepping Away for Rehab

LoCO Staff / Wednesday, Aug. 30, 2023 @ 12:05 p.m. / News

###

The following message was posted to LoCo Fish Co.’s Instagram account on Tuesday evening:

I deeply regret my actions at the chili cook off last week. I am sorry for using language that was hurtful. It was an accident running over the box of marrow bones and not intentional. I am truly sorry. It pains me that I let my community down. My actions were inappropriate due to alcohol. They do not represent how my employees feel or how I feel in my heart. I’m stepping away from the company for rehab and to take this as opportunity to learn and grow. I’m committed to doing the work and strive to be a better person. I have let people down and I am sorry.

Sincerely,

Jayme Knight

Owner LoCo Fish Co

Cannabis Mega-Firm StateHouse to Take Over and Expand Willow Creek Cultivation Facility

Ryan Burns / Wednesday, Aug. 30, 2023 @ 10:46 a.m. / Cannabis

A cannabis farm formerly owned by Emerald Family Farms was auctioned off by the Pelorus Capital Group in April. | File photo.

PREVIOUSLY:

- Local Weed Growers With Emerald Family Farms are Embracing Legitimacy and Taxation

- Once Poster Boys for Legal Weed in Humboldt, Emerald Family Farms is Being Sold for Parts

###

Beware, all you moms and pops in the hills. The big money is coming to town.

In a press release issued this morning, the financial firm Pelorus Capital Group, which offers loans to folks the cannabis industry, announced that it has entered into a Managed Service Agreement with the publicly traded, vertically integrated StateHouse Holdings Inc. — owners of brands such as Smokies, urbn leaf and Kingpin and operators of Harborside dispensaries, among others — to operate cultivation facilities here in Humboldt County.

According to a story published last week on the financial website Benzinga, the facilities include “a 150,000 square foot greenhouse production facility with an additional acre of field production, in addition to nursery licenses that are split between two facilities, including a 1,500 square foot tissue culture laboratory.”

Today’s press release offers slightly different figures, saying StateHouse will complete “an expansive 118,000 square foot greenhouse production facility and plant tissue culture lab” before “commercializing and scaling production” through its own “full range of services including human resources, legal and compliance, post-harvest production and processing, contract manufacturing, distribution and safety management.”

That’s a lot.

We can’t be certain, but it would stand to reason that these are the same facilities that once belonged to Emerald Family Farms, a group of local boys who fell on hard times and defaulted on an $18 million loan from Pelorus, having put virtually all of their assets up as collateral. Those assets were auctioned off at the county courthouse in April.

Here’s the press release from Pelorus:

Pelorus Capital Group (“Pelorus” or “the Company”), the leading provider of commercial real estate loans for the cannabis sector, announced today that it has entered into a Managed Service Agreement (the “Agreement”) with StateHouse Holdings Inc. (“StateHouse”) (CSE: STHZ) (OTCQX: STHZF), a California-focused, vertically integrated cannabis enterprise to construct and manage the operations at the Company’s cannabis cultivation asset located in Humboldt County, (collectively, the “Humboldt Facilities”).

The first phase of construction at the Humboldt Facilities will include the completion of an expansive 118,000 square foot greenhouse production facility and plant tissue culture lab. Under the terms of the Agreement, StateHouse will assist in finalizing construction of the Humboldt Facilities in addition to commercializing and scaling production through the implementation of its full range of services including human resources, legal and compliance, post-harvest production and processing, contract manufacturing, distribution and safety management.

“Commercializing and scaling up these operations is the first step in stabilizing this previously inactive site and driving strong yields for our investors,” said Travis Goad, Pelorus Capital Group. “Statehouse is one of the largest vertically integrated platforms in California and they are uniquely positioned with the cultivation expertise, operational knowledge, and distribution capabilities to help us generate maximum value from this site. We are excited to partner with a seasoned operator and existing Pelorus borrower to turn around a distressed asset, build a new source of sustainable revenue, and future real estate value.”

About Pelorus Capital Group

Pelorus Capital Group (“Pelorus”), the leading provider of commercial real estate loans for the cannabis sector, and its Pelorus Fund, a private mortgage real estate investment trust (“mREIT”), are changing the commercial real estate lending landscape in the cannabis sector. Pelorus Fund offers a range of innovative transactional solutions to address the diverse needs of real estate investors and portfolio managers, and its flexible acquisition and bridge lending programs are the direct result of the firm’s involvement in more than 5,000 transactions of varying size and complexity. Since 1991, Pelorus’ principals quickly understand an opportunity, structure a logical solution, execute a timely close and have participated in more than $5B of real estate investment transactions using both debt and equity solutions. To date, Pelorus has completed 70+ commercial real-estate loan transactions and deployed more than $500+ million to cannabis businesses and real estate owners, comprising nearly 4,200,000 sq. ft. in eight states across the U.S. With the ability to fund approved construction draws for reimbursement with a single agreement covering the financing of the entire project, the Pelorus Fund helps to stabilize cash flow for its clients, so they are able to remain focused on their core business goals and objectives. For more information, visit https://pelorusequitygroup.com/.

Old Town’s Soon-to-Open Rooftop Restaurant Will House Local Chef Joe Tan’s Latest Sushi and Sake Bar

Isabella Vanderheiden / Wednesday, Aug. 30, 2023 @ 10:22 a.m. / Eureka Rising , Food

The new multi-use building at Second and E Streets in Eureka will feature Humboldt County’s first rooftop restaurant and bar. Photo by Isabella Vanderheiden.

###

A little over a year ago, the Outpost posed a question to our readers: Who has proven that they are worthy of running Eureka’s first rooftop restaurant and bar space? Well, folks, we finally have an answer.

Local restaurateur and sushi chef Joe Tan plans to open a sushi and sake bar in the brand new space at Second and E Streets in Old Town Eureka by the end of this year.

“It’s really exciting,” Tan told this Outpost during a recent phone interview. “It’s going to be a rooftop restaurant – the first one in Humboldt – and the view up there is awesome. It’ll be nice being back in Old Town and along the waterfront. I’ve missed it.”

For years, Tan managed the kitchen and helmed the sushi bar at Bayfront Restaurant in Eureka before partnering with the restaurant’s co-owner, Jack Wu, to open Nori in Arcata. Just last year, Tan opened his second restaurant, Curry Leaf, a Malaysian-Chinese restaurant at the north end of Eureka.

The soon-to-be rooftop restaurant, which has yet to be named, will have a similar vibe to Nori, Tan said. The menu will feature “all different kinds of sushi,” including nigiri, sashimi, specialty rolls, ramen and a wide selection of sakes.

“We have a lot of competition here,” Tan said, referring to Bayfront and Sushi Spot, which opened its Eureka location a little over a year ago. “But people love sushi! I think people are really going to enjoy it – especially with the view.”

Tan hopes to open the new restaurant in the coming months, hopefully by the end of November.

###

PREVIOUSLY: