Inphographics provided by the City of Arcata.

Tonight the Arcata City Council will likely vote to use the city library and bus station as collateral for a bank loan to refinance $17 million in unfunded benefits owed to the California Public Employees’ Retirement System.

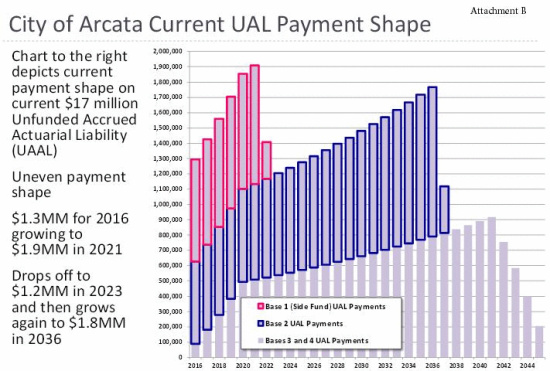

Contractual obligations between CalPERS and Arcata guarantee retirement benefits for all full-time employees and obligate the city to cover any unfunded liabilities. Due to CalPERS investment losses during the great recession, the city will face spikes in benefits costs for the next 20 years.

Arcata’s Finance Director Janet Luzzi told the Outpost that if the city did not refinance, it would have to make many budget cuts.

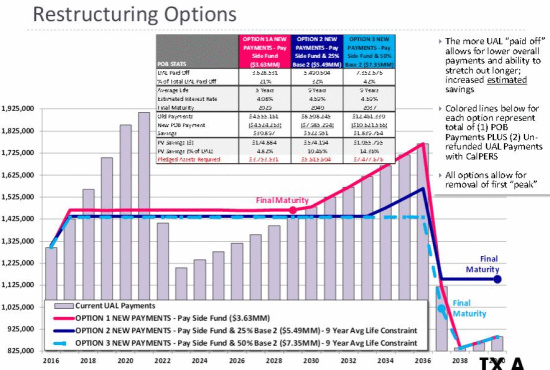

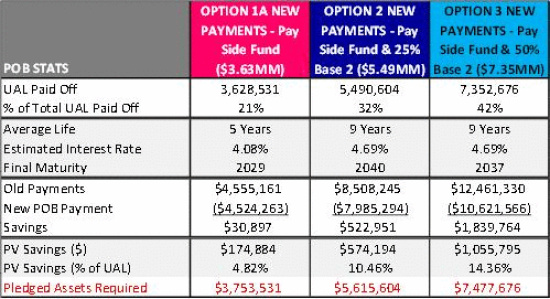

“What we’re trying to do is smooth the payment schedule to be more stable, predictable and manageable,” Luzzi said.

Several banks have bid to refinance the city. Umpqua Bank made the most aggressive bid, offering a 3.86 percent interest rate, 0.22 percent lower than the previously assumed rate.

The city and Umpqua originally had difficulty agreeing upon which assets to use as the city’s most valuable building (City Hall) is already encumbered as collateral for another loan. Umpqua has agreed to loan the city money against the the library and transit center, which are collectively valued at $3.2 million.

The city anticipates the deal will generate $1.15 million in cash flow savings during the next six years.

CLICK TO MANAGE