“We’ve got this amazing deal going,” my old boss confided in me. “Seems there’s a wealthy prince or something who’s being persecuted, now he’s trying to get out of the country with a lot of money, and our church is acting as the go-between. We all stand to make a mint!” “Wow! Where’s he from?” I asked. “Somewhere in Africa – Nigeria, I think.”

Don’t laugh. I didn’t. But this was 1980, pre-internet, pre-spam, pre-scams galore (see my previous post). At the time, a persecuted African prince, looking for some kindly agents in the U.S. who would be generously rewarded for helping him out—didn’t seem so outlandish. I remember feeling piqued that I wasn’t invited into the secret cabal. Church members only, sorry.

(Turns out the “Nigerian Scam” has its roots even earlier, to at least the 1920s, when some rich-but-imprisoned Spanish dude would handsomely compensate anyone who could help pay his ransom.)

How times have changed. No one gets taken by that sort of out-and-out scam anymore. (“All you have to do is wire $2,000 to cover our bank transfer costs, and the full million dollars will be in your account by the weekend!”) Today, we’re all knowledgeable and skeptical, right?

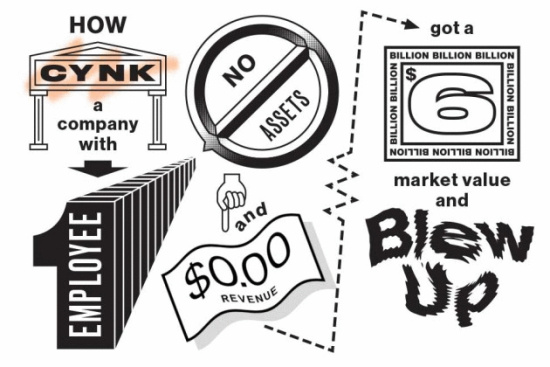

Well, no. Stock symbol CYNK mean anything to you? (The symbol should have been a giveaway, but I think investors were thinking “sync,” not “sink.”) CYNK – Cynk Technology—was a classic “pump and dump” exercise. The company – which consisted of one employee, no assets, no website, based in a non-existent office in Belize — was an Over The Counter penny stock, almost worthless. Until it wasn’t. In less than a month last year, CYNK’s stock market valuation went from virtually zero to six billion dollars.

When shares of a thinly-traded stock like CYNK start to move, “momentum traders” take note – these are traders who buy, not because they have any knowledge of the worth of a company, but simply because the price is going up. (Why would it start to move? Could it be because someone placed a bunch of “buy” orders, disguising the fact they’re all initiated by one individual?) More trades result in more traders result in more trades. At some point, whoever actually owns the shares – in this case the one employee – bails, sells his stocks, and dances all the way to the bank.

Which works only if the shareholder(s) can show there was no actual intention to pump and dump (in CYNK’s case, the SEC thought otherwise). So it’s perfectly legal, for instance, for 11-employee, zero-revenue Instagram to sell itself for $1 billion – the value was in its multi-million use base. Same for companies like Snapchat (which turned down a $3 billion offer) and $19 billion WhatsApp. Cynk Technology had no such base; it claimed to be selling access to celebrities – or their agents – or someone.

So yeah, scams are alive and well. Secret Shopper come ons? Make $$$ Working at Home? You’ve Won the Irish Sweepstakes? Your Good Pal Fred has been robbed in Panama (wire cash now!)? Bogus Cashier’s Checks? They’re all out there, just waiting for one of us to bite.

Not me though. I’m far too smart. Just ask my wife. Um, please don’t mention the words “junk silver” or “options” though. Especially in the same sentence.

###

Barry Evans gave the best years of his life to civil engineering, and what thanks did he get? In his dotage, he travels, kayaks, meditates and writes for the Journal and the Humboldt Historian. He sucks at 8 Ball. Buy his Field Notes anthologies at any local bookstore. Please.

CLICK TO MANAGE