Markets

can remain irrational longer than you can remain solvent.

— John Maynard Keynes

###

The best way to make money is to die. That’s because, as financial advisor Adam Fayed puts it, “The dead aren’t watching CNBC and worried about the latest thing which can rock markets…They don’t panic if markets crash, or try to predict the next crash. And they don’t allow bias to affect investing.” If you want to succeed financially, die, Or, failing that, leave your investments alone. Whether you’re tempted to get in or out of the market, or change your strategy, or cash out and move to Panama, or hire an investment manager whose expertise must surely outmatch yours…don’t.

Usually in life, knowledge is power. When we fail, we probably didn’t do our homework first, or we based our decisions on emotions, not data. That is, we were coming at a problem with a lack of knowledge. The world of investing is different. Knowledge (assuming it’s not illegal insider knowledge) works against success. As an investor, the more knowledge you have, the worse off you’ll be…on average, in the long run.

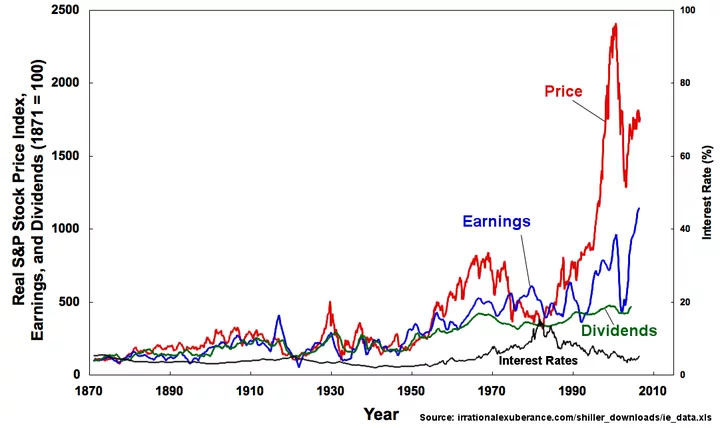

Consider the results of a 2019 study from Morningstar, the independent research company. Comparing the results of active managers (financial gurus who use their knowledge to beat the market) with index funds (which passively follow the ups and downs of hundreds of companies), just 23% of the active managers were able to outperform their passive peers. That is, you’re paying your investment advisor to lose your hard-earned money while your non-managed index fund nets you nearly 7% interest every year. That’s the average stock market return over the past 200 years after taking inflation, which averages around 2% annually, into account.

Plot of S&P Composite Real Price Index, Earnings, Dividends, and Interest Rates using data from Irrational Exuberance. Frothy, CC BY-SA 4.0, via Wikimedia Commons

Of course, if you invested with one of the 23%, you’re ahead of the game. This year. Statistically, the odds of your professional staying in the winning pack two years in a row are 5%. That’s based on past results, which is all you’ve got to go on when trying to predict the future. Of course, there are the Warren Buffett’s of this world, who consistently beat the odds—in Buffett’s case, by correctly picking what turned out to be undervalued stocks. But he’s the exception to the rule. Again, on balance and in the long run, managed money loses out to passive money.

The above is my attempt to explain the efficient-market hypothesis, or EMH, which says that share prices reflect all information about that stock, that is, the best available estimate of the value of the services or income flows it will generate. As my new BFF, ChatGPT, explains, “The EMH suggests that it’s difficult to consistently outsmart the stock market by finding ‘hidden gems’ or undervalued stocks, as the market is already efficient and all publicly available information is quickly reflected in stock prices.”

I’ve written about Bitcoin (BTC) previously (most recently here), and you may be wondering, What “services or income flows” can possibly be generated from cryptocurrency? The answer, as many naysayers have reminded me, is, None whatsover. Bitcoins don’t generate any earnings and their intrinsic worth is zero. Yet, for a worthless “currency,” Bitcoin has shown remarkable staying power over the last 13 years. Instead of popping like a traditional financial bubble (the 18th century South Sea Bubble being the archetype), it’s gone up, come down, gone up, come down (most recently, from nearly $70,000 to below $15,000)…and shows no signs of going away. What gives? Is Bitcoin “the final refutation of the efficient-market hypothesis,” as one commentator put it? Or will it pop, like all the rest? (If so, when?)

Perhaps the EMH has something to teach fans of cryptocurrency. Some years ago, while Bitcoin was dropping precipitously, a BTC investor and regular blogger advised his followers to HODL. That was late at night, after a couple of drinks. He meant, HOLD, of course. Typo or not, HODL entered the lexicon, and today you’ve got active cryptocurrency investors, just like with traditional stocks, trying to time and beat the market. And you’ve got HODL ones, who take the long view of the market, passively hanging on to whatever Bitcoins they might own. They watch as the value of Bitcoin goes through its wild swings—losing 20% in one day, for instance—all the while sticking to their HODL strategy. (Currently, Bitcoins that haven’t been moved from wallets in at least six months account for nearly four-fifths of all Bitcoins minted.)

Stock market and cryptocurrency investors alike could do worse than follow this strategy: When in doubt, do nothing!

CLICK TO MANAGE