Click to enlarge

Let’s assume you hate the results of the upcoming Presidential election. Yes, I know there’s a possibility we may not know the outcome Tuesday night. But go with me on this…

The winner of the Electoral College is not the one you voted for. Your blood pressure skyrockets. Your bags are packed to move to a remote island in the middle of the ocean. You’re ready to abandon every investment you’ve ever owned and sit in cash ‘til kingdom come.

Before you feel all those things, I want you to hear three key points from me today.

#1 Compound interest is magical, but it only holds its power if it’s allowed to compound.

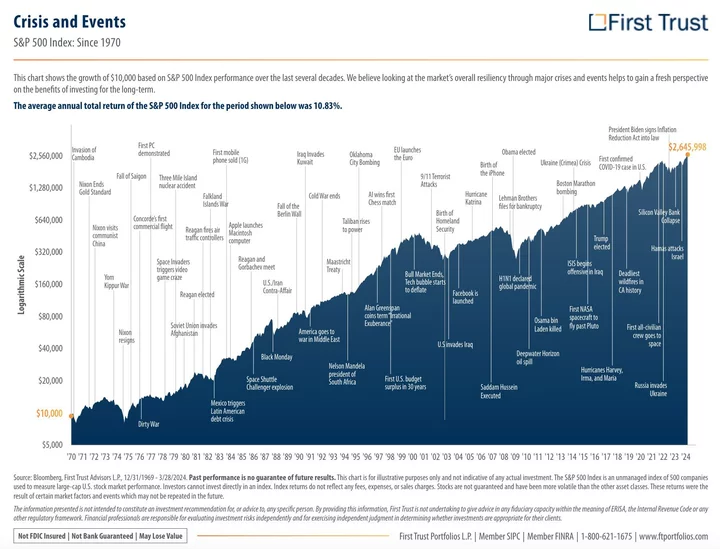

Take a look at the chart above.¹ Some of those events are elected Presidents that you may have an allergic reaction to. Some of those crises were objectively bad and caused economic and human suffering.

Still, here’s the bottom line: investing $10,000 in 1970 in the S&P 500—the stock market index of the largest companies in America—grew to $2,645,998 by 2024.

If you tried to time the dips over that time frame, selling on the ugliness of each particular crisis or the elections you didn’t like, how would you have known when to get back in and buy?

#2 Timing the market is super hard.

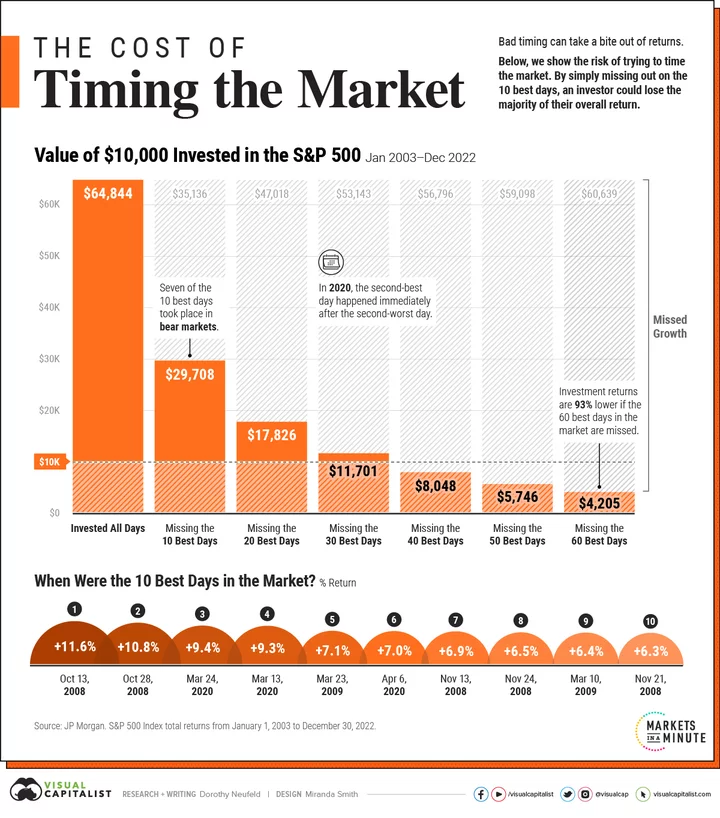

If you miss out on the best days of the market, you’ll likely face much lower investment returns.²

Visual Capitalist shows that if you had invested $10,000 in 2003 and missed the best 60 days of the market in that 20-year time frame, you would only have $4,205 instead of $64,844.

Bummer, right?

Lest you think you won’t miss the best days of the market because you’ll only be in when they’re at their best, you need to understand something—most of the market’s best days over the last few decades have been during bad bear markets. Here’s the chart:

Click to enlarge

This supports the wise words of Warren Buffett’s late right-hand man Charlie Munger, “The first rule of compounding is to never interrupt it unnecessarily.”³

#3 Be cautious about where you get your investment advice from and how you make investment decisions.

You probably shouldn’t take investment advice from people who don’t know your financial situation or people who say they know investing but may not face any consequences for what they say.

This means you may need to reconsider making investment decisions based on financial television, your social media feed, your favorite YouTube channel, or the political friend you’re texting on Election Night.

Here’s the kicker: Even the things I say here are general investment principles, not personal investment advice. There may be reasons why you should take various actions in your investment portfolio, but who is in the White House should not be the exclusive one. After all, investment portfolios and financial plans aren’t just about stocks anyway.

“This time is different,” you might say. Maybe. But that phrase is one of the most dangerous sentences that can come out of an investors mouth. It can be used to justify a decision that feels great in the present but looks foolish in hindsight. As one trader put it, “It can be very expensive to try to convince the markets you are right.” Or in the piercing words of comedian Rick Gervais on The View: “Just ‘cause you’re offended doesn’t mean you’re right.”

This is not a forecast that the stock market will perform a certain way based on the election outcome. It’s simply a reminder to be careful letting America’s decision about the 2024 Presidential election be the decisive moment of your financial planning future.

# # #

Sources:

- 1 First Trust. First Quarter 2024 Research Kit. Accessed online: https://www.ftportfolios.com/Commentary/Insights/2024/4/1/markets-in-perspective-client-resource-kit—-first-quarter-2024

- 2 “Timing the Market: Why It’s So Hard, in One Chart” by Dorothy Neufeld and Miranda Smith. Accessed online: https://www.visualcapitalist.com/chart-timing-the-market/

- 3 Quoted by financial author Morgan Housel on October 8, 2018. Accessed online: https://x.com/morganhousel/status/1049392552175124481?lang=en

Brandon Stockman has been a Wealth Advisor licensed with the Series 7 and 66 since the Great Financial Crisis of 2008. He has the privilege of helping manage accounts throughout the United States and works in the Fortuna office of Johnson Wealth Management. You can sign up for his weekly newsletter on investing and financial education or subscribe to his YouTube channel. Securities and advisory services offered through Prospera Financial Services, Inc. | Member FINRA, SIPC. This should not be considered tax, legal, or investment advice. Past performance is no guarantee of future results.

CLICK TO MANAGE