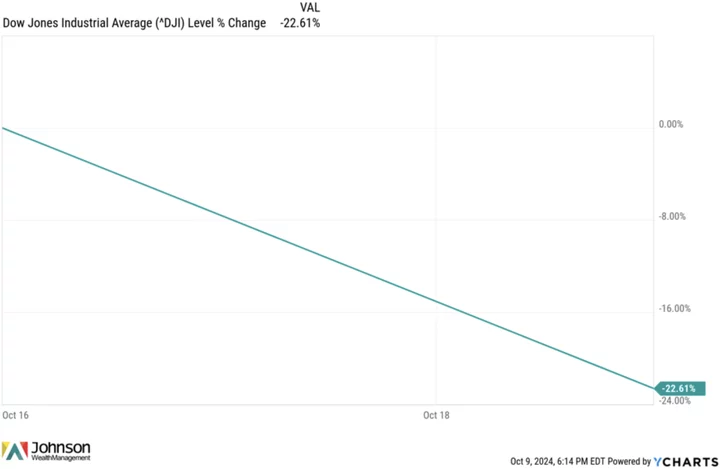

Imagine watching 22% of your entire investment account value vanish in one day.

Read that again. Not a year. Not a month. Not a week. One single day.

Unsettling, isn’t it?

This scenario isn’t hypothetical. It’s what happened to investors whose portfolios were entirely in the Dow Jones Industrial Average on October 19th, 1987. Later this week marks the anniversary of that infamous day: Black Monday.

The $500,000 portfolio you had while you sipping your morning coffee, before using your Aqua Net hairspray to make yourself presentable for the day, would have been worth less than $400,000 during the news with Dan Rather that evening.

Talk about a severe case of the Mondays.

But what if I told you there’s something worse than watching your portfolio’s value plummet by that magnitude?

Much worse.

Imagine selling that day. Reacting to the nausea of that moment by liquidating all your stock investments.

Unfortunately, many who are prone to this kind of behavior are often those who should never do so. Frequently, these investors have years of investing ahead of them, or their heirs have decades of market participation left.

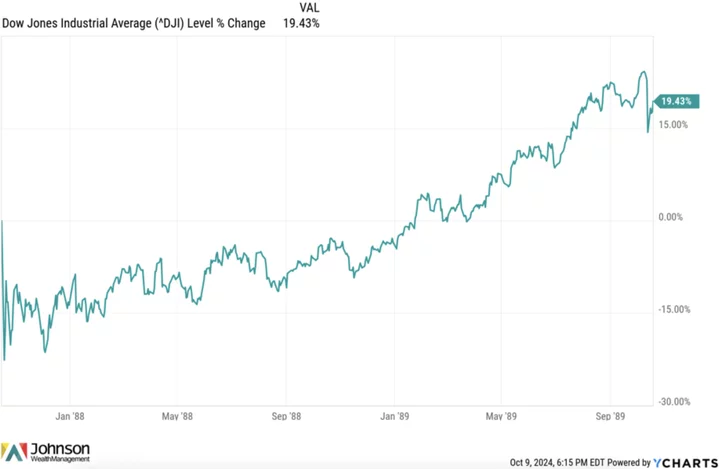

You see, the world didn’t end on Black Monday.

In fact, as the above chart reveals, if investors had held on for just two years, their investable assets would have been worth significantly more than the Friday before that ugly Monday. It would have taken only about a year and a half to get back to even. A year in a bad market feels like dog years, yet in the scope of one investing lifetime, which is often composed over decades, a few years is merely a blip.

Is it easy to hold? No. Does this mean one should never sell? Same answer.

It’s normal human behavior to wonder, when this kind of volatility happens, if it’s different this time. Every investor and context is unique, too, but selling in the worst declines has historically been the worst time to do so.

Remember that.

And I hate to tell you this, but when a stock market crash happens again, you are probably going to forget.

To paraphrase the famed investor Benjamin Graham: one of the most common problems investors have is amnesia, and they tend to suffer from it at the worst possible time.¹

Don’t.

# # #

Source:

- Quoted by Wall Street Journal investing columnist Jason Zweig on October 7, 2024.

Brandon Stockman has been a Wealth Advisor licensed with the Series 7 and 66 since the Great Financial Crisis of 2008. He has the privilege of helping manage accounts throughout the United States and works in the Fortuna office of Johnson Wealth Management. You can sign up for his weekly newsletter on investing and financial education or subscribe to his YouTube channel. Securities and advisory services offered through Prospera Financial Services, Inc. | Member FINRA, SIPC. This should not be considered tax, legal, or investment advice. Past performance is no guarantee of future results.

CLICK TO MANAGE