Each day in the market right now feels like a set of whitewall tires, as if from another century, compared to the day before. We live in a world where sudden market movement can happen from a social media post. Time feels like it’s speeding up.

As you probably know, the President made an adjustment to some tariffs this last Wednesday after he felt like people were getting a bit yippy. Here is the quote: “They were getting a little bit yippy, a little bit afraid.”¹

Indeed.

That’s what happens when you renegotiate the world.

Stocks went up ferociously in response, doing in one day what it can do in a whole year—around 10% depending on the index. Thursday it headed back downward.

Not only has the stock market been volatile, the bond market has too with some significant interest rate spikes, which some believe played a pivotal role in POTUS’s decision to pause tariffs.

Back in the 1990s, Democratic strategist James Carville said it illustratively:

I used to think that if there was reincarnation, I wanted to come back as the president or the pope or as a .400 baseball hitter. But now I would like to come back as the bond market. You can intimidate everybody.²

Touché.

The eyes of the leaders of our country and investment firms will likely continue to be bound to bonds. Attempting to adjust to all this information coming so fast is extremely challenging for us as individuals and as investors.

Philosopher Byung-Chul Han discusses the problem with an information society that I think has a bearing on investing and this cultural moment. He states,

Our obsession is no longer for objects, for information and data. Today we produce and consume more information than objects. We actually get high on communication…

Information puts the cognitive system itself into a state of anxiety…

And information, due to its ephemerality, makes time-consuming cognitive practices such as experience, memory or perception disappear.³

If you make investment decisions on the glut of shifting information guided by your own personal algorithm curated just for your tastes without taking a step back and engaging memory, it could be a significant mistake.

You must remember why you started investing in the first place. Getting back to the basics is beautiful, and so easily forgotten.

- What are your financial goals?

- What is your risk tolerance?

- What kind of diversification do you need?

- How will you deal with the impact of inflation?

- Should you consult with a financial professional?

- What is your time horizon for the funds invested?

In moments like this, we don’t need to get clever or act like we know more than we do. Even acclaimed investors like Howard Marks write memos with titles like the following which he released last week: “Nobody Knows (Yet Again)”.

Watching the news—whether it’s FOX or MSNBC or CNBC or your favorite YouTuber—is not an investment strategy.

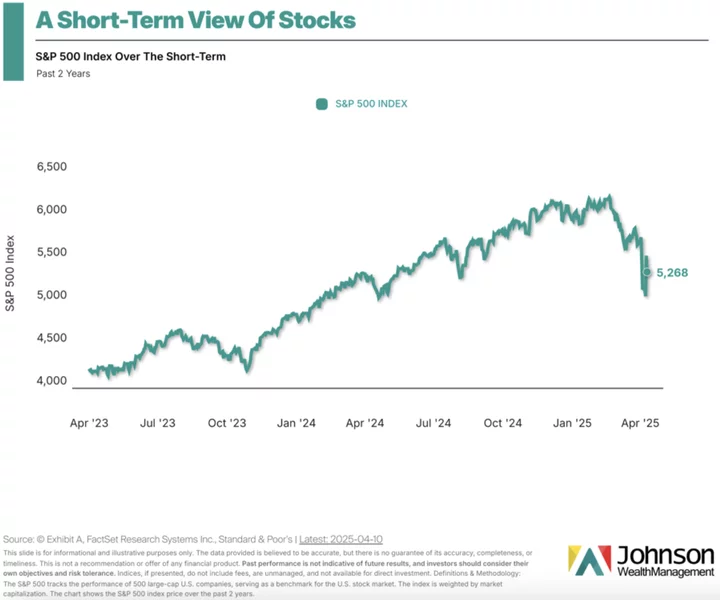

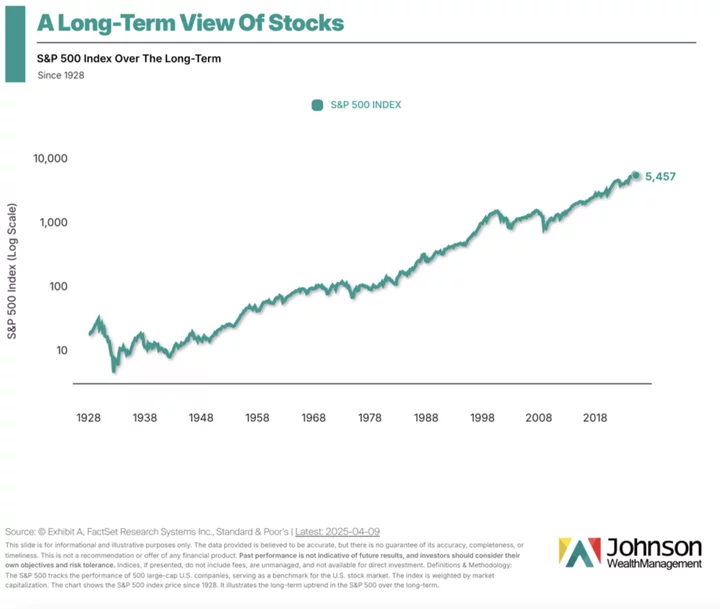

We must also engage our memory of history. Here is the difference between a short-term and long-term stock market memory.

You will feel “yippy”—if that’s what we are calling fear and anxiety now—throughout your investing journey because life hits you in the face sometimes with hard markets or heartbreaking personal events.

These kinds of negative events and their effects can last a long time. Or turn around faster than you think.

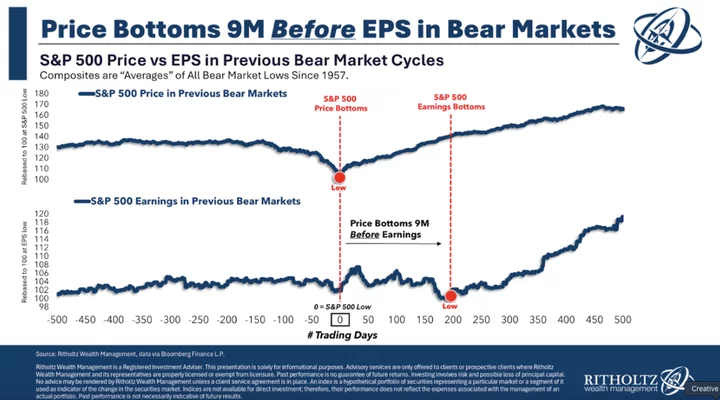

Here is another thing to remember. Stocks can bottom way before the economic pain of something like recession is felt on Main Street and lower earnings are realized on Wall Street. Plaster this classic chart, from Data Researcher Matt Cerminaro, across your investing heart:

Therefore, do not get so caught up in the now that you lose your financial memory and your financial plan in the process.

Oddly enough, I was encouraged this week by a barista’s handwritten note on a Starbucks cup: “What if it all turns out all right?”

Yippy Ki-Yay.

—-

Sources:

- “Trump Pauses “Reciprocal’ Tariffs, but Hits China Harder” (Wall Street Journal, April 9, 2025).

- Quoted in “The Daily Prophet: Carville Was Right About the Bond Market” (Bloomberg, January 29, 2018).

- Byung-Chul Han, “I Practice Philosophy As Art” (December 2, 2021).

# # #

Brandon Stockman has been a Wealth Advisor licensed with the Series 7 and 66 since the Great Financial Crisis of 2008. He has the privilege of helping manage accounts throughout the United States and works in the Fortuna office of Johnson Wealth Management. You can sign up for his weekly newsletter on investing and financial education or subscribe to his YouTube channel. Securities and advisory services offered through Prospera Financial Services, Inc. | Member FINRA, SIPC. This should not be considered tax, legal, or investment advice. Past performance is no guarantee of future results.

CLICK TO MANAGE