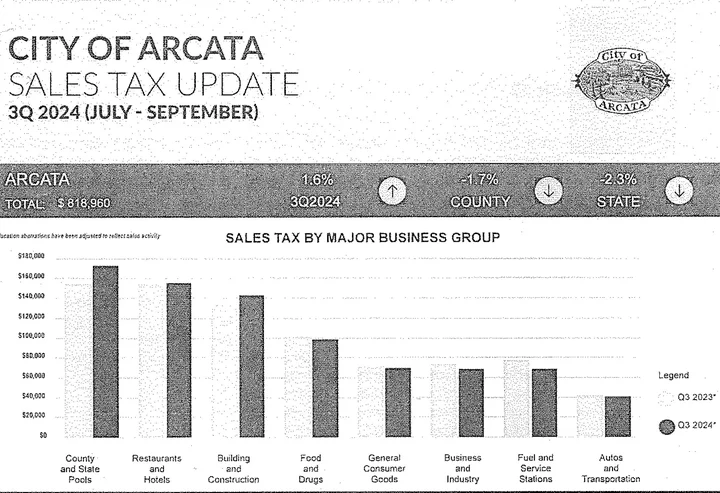

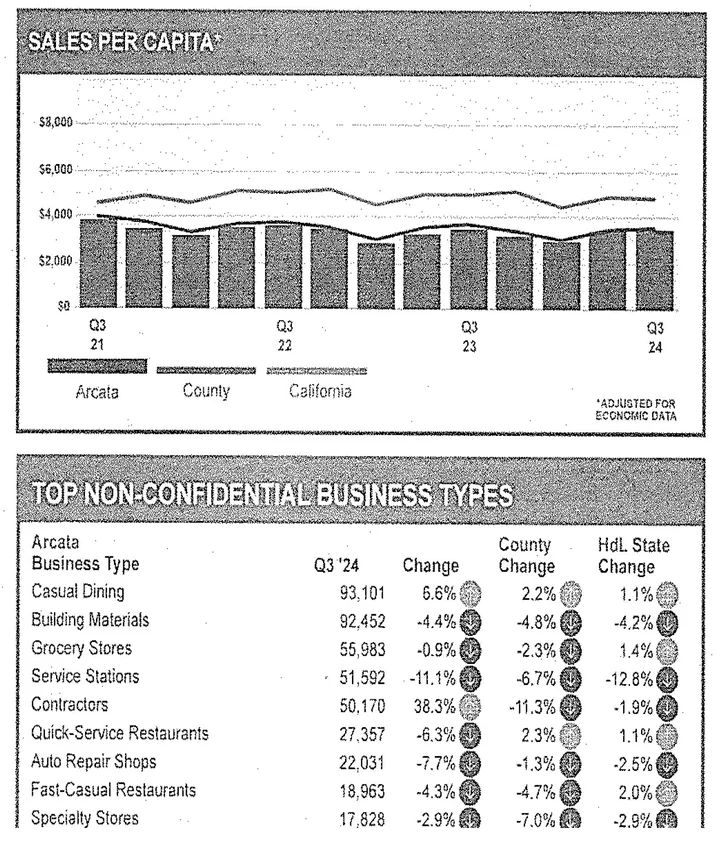

Arcata’s in-person sales tax revenues have dropped over the last several years, but income from state and county pools, made up of taxes collected from online purchases, are compensating for the dip.

Data from Arcata’s finance department shows that sales tax revenues are down across the board in categories like fast-casual restaurants, service stations, grocery stores, and building materials.

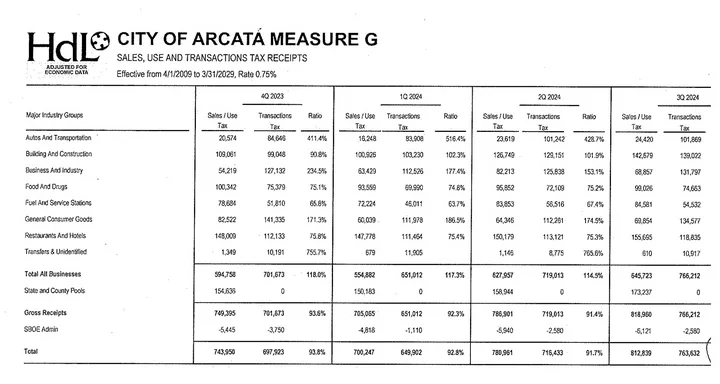

However, Arcata collected roughly $173,000 from July-September of 2024 from state and county state tax pools, collected from online sales taxes, a $15,000 (12.2%) increase from the previous quarter.

Previously, Arcata averaged about $150,000 per quarter from those funds. Arcata’s director of finance Tabatha Miller told the Outpost that the gains came from more people buying goods online instead of from local vendors.

“It would be great if it meant that we were way up and were getting that much more overall tax,” Miller said. “But what it’s really doing is covering all of the places that are down…There are lots of people buying their regular goods and services online, as opposed to locally, which is not necessarily good for our local vendors.”

It’s the most profitable category in Arcata’s sales tax earnings, which includes everything from restaurants and hotels, food and drugs, and construction.

It’s just enough of a bump over earlier earnings that total revenues are keeping pace with inflation.

Statewide, the trends are similar, though not as exaggerated. A projection from auditing and budget company HdL Companies predicts money collected from state and county pools will grow 3% in 2025’s fiscal year.

Automobile Transactions and Use Taxes are also taking the place of other lost sales taxes. When someone buys a car in Eureka and registers it in Arcata, they pay a 0.75% TUT into Arcata’s coffers. Arcata made over $300,000 last year on these TUTs.

Arcata hopes that Measure H’s 0.75% sales tax, when it kicks in on April 1, will help to make up for the flat sales tax revenue. Miller also said that they’re taking a look at projects they voted to fund several years ago but have increased in price since their inception. They’ll decide if they’re worth the money and either find cost-cutting solutions or scrap them altogether.

CLICK TO MANAGE