Stocks will drop.

How’s that for a headline? This isn’t clickbait. This isn’t a forecast for the rest of 2025. Nor is it about whether stocks are currently priced fair, cheap, or expensive.

This is common investment knowledge. You can’t say I didn’t warn you.

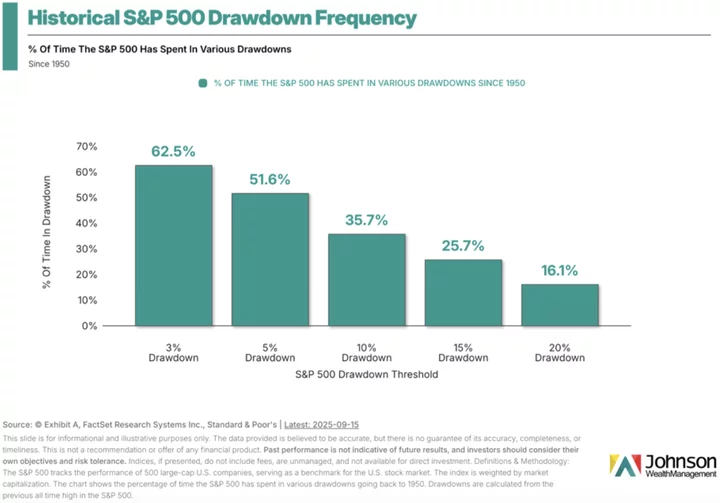

In fact, since 1950, the S&P 500 spends most of its time off of its highs.

This means the biggest companies on Wall Street are in a 3% drawdown more than 60% of the time and in a 5% decline more than half the time.

The more worrisome corrections happen about one-third of the time, and terrible bear markets about 16% of the time.

Say it again with me, stocks go down.

This is an essential truth to realize as a long-term investor. What’s more essential than that is to recognize that the pathway in the past to experiencing growth in the stock market is to endure it anyway.

You know what else is true? Even though stocks have usually been down from their highs and recessions have occurred throughout the decades, stocks are up big since the 1950s.

Living by fear is rarely the answer to anything in life, let alone investing.

To paraphrase a quote attributed to famed investor Peter Lynch, preparing for, and acting on the fear of losing money in the stock market has lost more money than being invested in the stock market itself.

Many know the problem with investors panic-selling based on fear during rapid market declines. But there is also another problem that can plague some investors: the wait-and-see approach (also based on fear) during market gains.

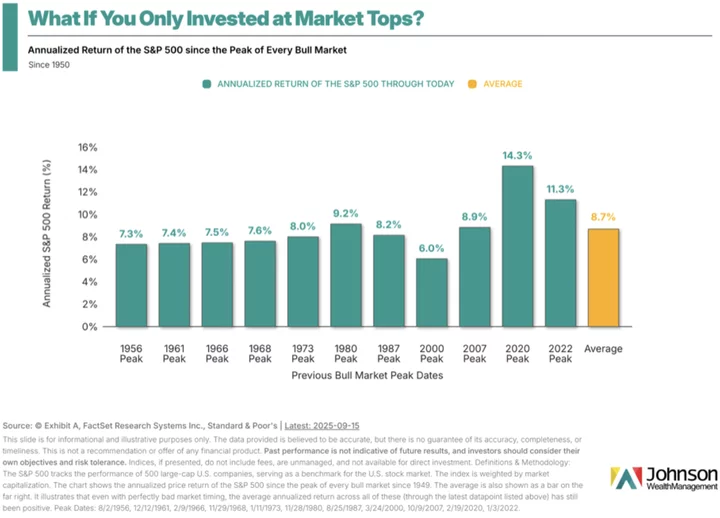

Here is a shocking statistic. Did you know that those who invested at every stock market peak since 1950 have averaged an 8.7% investment return?

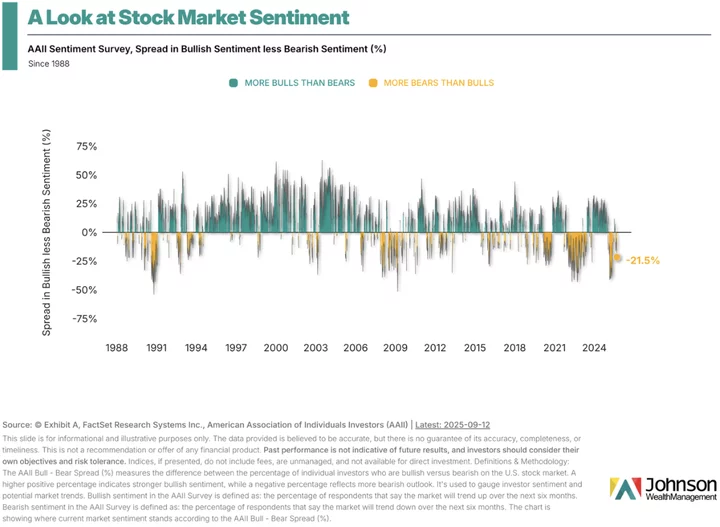

Why are you talking so much about fear? Isn’t the market at or near all-time highs? As of mid-way through September 2025, yes.

What may also come as a surprise: according to one popular survey, there is still more bears then bulls right now.

None of this means you should go headfirst into stocks. Investment allocation and risk management go hand in hand.

It does mean that making money over the long term in the stock market normally requires remaining appropriately invested and investing while the stock market goes down.

I have no idea when the next drop might come.

But I know it will.

The question is not simply what will you do with your money when it happens, but what are you doing with it while you wait?

Invest based on something more significant than dopamine hits from headlines juiced by greed, envy, or fear.

In an attention economy you must know that many headlines you read about investing aren’t geared toward you or your family’s long-term financial success, but for clicks and profits. It’s so easy to be distracted and to have your attention on things that may feel urgent in the short-term but are not for your long-term benefit.

Educate yourself about investing and/or find a trusted financial advisor who can help.# # #

Brandon Stockman has been a Wealth Advisor licensed with the Series 7 and 66 since the Great Financial Crisis of 2008. He has the privilege of helping manage accounts throughout the United States and works in the Fortuna office of Johnson Wealth Management. You can sign up for his weekly newsletter on investing and financial education or subscribe to his YouTube channel. Securities and advisory services offered through Prospera Financial Services, Inc. | Member FINRA, SIPC. This should not be considered tax, legal, or investment advice. Past performance is no guarantee of future results.

CLICK TO MANAGE