OBITUARY: Lynn Patrick Dillon, 1948-2025

LoCO Staff / Tuesday, Feb. 25, 2025 @ 6:56 a.m. / Obits

Lynn

Patrick Dillon, 76, passed away on January 30, 2025, in Mad River. Born on May 9, 1948, in Scotia, he lived a

life defined by hard work, generosity, and deep devotion to his

family and community.

Lynn spent his early years in Ruth, attending Ruth School from first through eighth grade before graduating from Fortuna High School. He later pursed his passion for mechanics at Shasta College, where he completed the diesel mechanics program. His career was a testament to his dedication and resilience. He was the owner and operator of Dillon Construction Company and worked as a logger, truck driver, heavy equipment operator, rancher, volunteer firefighter, volunteer first responder, and a contracted wildland firefighter. His commitment to serving others extended beyond his professional life; he was always ready to lend a helping hand when needed.

Family was at the heart of Lynn’s world. He is survived by his children: Julie Morss (Tommy), Jaylin Dillon (Heather), and Jeanette Rolff (Jabe Richardson); his grandchildren: Briana Lofing-Rolff, Rex Rolff, Kaitlynn Arroyo, Karly Dillon, Jerrad Morss, Mariah Garlinghouse; and his great-grandchildren: Gavin Lofing, Phoebe Lofing, Addison Arroyo, Jameson Rolff, Timberlyn Morss, Raelynn Morss, and Harper Garlinghouse; his nieces and nephews: Marcus (Jennifer) Rezentes and Leah Rezentes. He was preceded in death by his beloved wife Shirley Dillon; his parents Earl and Alta Dillon; his brother Lowell Stone; and two cherished grandchildren, Tommilyn Morss and Riley Young.

Lynn found joy in the simple pleasures of life- caring for his cows on the land he loved so much and spending time with his family. He had a special appreciation for Shirley’s homemade desserts and never missed an opportunity to sample her latest creation. Known for his wisdom and storytelling ability, Lynn had a way of captivating those around him with tales that reflected both humor and insight. His selflessness and protective nature made him a pillar of strength for those who knew him.

A man of faith, Lynn worshipped with numerous congregations in the Southern Trinity area and attended Shiloh Community Church in Fortuna. His faith guided him throughout his life as he remained steadfast in values of kindness and service to others.

Lynn’s legacy is one of unwavering dedication- to his family, friends, work, and community. His presence will be deeply missed but fondly remembered by all who had the privilege of knowing him. May his memory bring comfort to those who loved him.

A service to celebrate the life and legacy of Lynn will be announced at a later date for sometime this Spring.

###

The obituary above was submitted on behalf of Lynn Dillon’s loved ones. The Lost Coast Outpost runs obituaries of Humboldt County residents at no charge. See guidelines here. Email news@lostcoastoutpost.com.

BOOKED

Today: 8 felonies, 17 misdemeanors, 0 infractions

JUDGED

Humboldt County Superior Court Calendar: Friday, Feb. 6

CHP REPORTS

Us101 N / Newton B Drury Scenic Pkwy Ofr (HM office): Traffic Hazard

Us101 N / Newton B Drury Scenic Pkwy Onr (HM office): Traffic Hazard

4593 Mm299 E Tri 45.90 (RD office): Report of Fire

ELSEWHERE

100% Humboldt, with Scott Hammond: #107. Jan Friedrichsen: Veteran Rescuer Explains How Search Dogs Track, Find, And Bring People Home

RHBB: Crash Blocks Lane on Northbound U.S. 101 at Humboldt Hill Onramp

RHBB: Crash off 101 into Trees North of Willits

Study Finds: When Moths Freeze: How LED Streetlights Are Silencing the Night

OBITUARY: Edgar Waldo Roberts Jr., 1941-2025

LoCO Staff / Tuesday, Feb. 25, 2025 @ 6:56 a.m. / Obits

Edgar

Waldo Roberts Jr. passed away peacefully at home, surrounded by the

family that he loved, at the age of 83, on February 6, 2025, in

Loleta, where he lived for the last four years with his wife, oldest

son and daughter-in-law.

Edgar Jr. was born in Los Angeles on May 26, 1941, to Edgar Waldo Roberts and Lois Lindley. Soon after, the family relocated to Vista, California, where Edgar grew up.

Edgar Jr. attended Vista High School, where he met his future wife, graduating with the class of 1959.

In 1960 Edgar Jr. enlisted in the U.S. Army and worked as a communications specialist for a missile artillery battalion while stationed in Italy, where he learned the skills that he would make his career after being honorably discharged in 1963. Edgar Jr. attained the rank of Sergeant E-5, and his service was a point of pride throughout his life.

In December 1966, Edgar Jr. became engaged to his high school sweetheart, Caryl Ann Colvin. They were married March 25, 1967, in Poway, California. Caryl and Edgar Jr. rented an apartment in Rancho Peñasquitos, until they bought their first and only home there in 1971, in which they lived happily for 51 years.

Edgar Jr. worked for AT&T and the various Bell companies like Pacific Bell and Southwestern Bell after divestiture, in local switching offices, for more than 40 years, retiring in 2003.

Edgar Jr. and Caryl raised two sons, Edgar III and Christian. He was heavily involved in his sons’ activities, including co-founding the Poway Youth Soccer Organization, coaching both boys’ soccer teams for numerous years, and a long tenure as a Webelos Den Leader and Assistant Scoutmaster of Boy Scout Troop 622 in San Diego.

Edgar Jr. had many hobbies, including collecting and building plastic military model kits and re-enacting Civil War battles with the 20th Regiment Maine Volunteers. He was an amateur historian, focusing on World War II; his appetite for knowledge on the subject was ravenous and his library was the envy of many. Edgar Jr. enjoyed camping and traveling with his wife, spending as much time in their RV as they could, savoring their retirement. When he wasn’t out in the woods camping and fishing, he volunteered aboard the U.S.S. Midway Museum, at Gillespie Field, and the San Diego Aerospace Museum, restoring aircraft for display. He was awarded a leather flight jacket by the Midway Foundation for his volunteer work, which he was immensely proud of, and it will accompany him to his final resting place. Edgar Jr. was a lifelong fan of the San Diego Padres.

In February of 2021 Edgar Jr. and Caryl relocated to Loleta to live with their son Edgar III and daughter-in-law Laysha to receive the support they needed in their golden years. After selling their house in San Diego, Laysha convinced Edgar Jr. to enjoy his retirement, encouraging him to purchase another Ford Mustang, his favorite car, which he did, and he thoroughly enjoyed the car until he passed.

Edgar Jr. said many times that you make a lot of acquaintances in life, but you’re fortunate if you can call one person a true friend. Edgar Jr. was lucky enough to find that one true friend in Alan Chevalier. They met in 1977 and worked together for 40+ years, and continued their friendship after retirement, volunteering together on the Midway and at Gillespie Field. Edgar III was honored to facilitate one last phone call between the two best friends the day before Edgar Jr. passed.

He would often say he had lived a wonderful, fulfilling life.

Caryl and Edgar Jr had 56 very happy and loving years of marriage together. Caryl passed on October 4, 2023, in Loleta, surrounded by her family. When his time came, Edgar Jr. was more than ready to be reunited with the love of his life.

He was preceded in death by his wife, Caryl Ann (Colvin) Roberts; his youngest son Christian Erik Roberts; his twin sisters Janice (Roberts) Oliver and Joan (Roberts) Sorg, and his parents, Edgar W. Roberts and Lois Wilma (Lindley) Roberts.

He is survived by his oldest son, Edgar W. Roberts III and his wife, whom Edgar Jr. loved like the daughter he never had, Laysha Ann (Janak) Roberts, of Loleta; his grandchildren Molly Roberts of Fortuna and her partner Aaron Bradley; Callie Roberts of San Diego and her partner Jacob Ackenhusen; Daniel Roberts of Dayton, Ohio and his fiancé Mickenzie Grubb; Edgar W. Roberts IV and his wife Gillyanne (Noel) Roberts of Fortuna, and his great-grandchildren Edgar W. Roberts V, “Quinn”, Liam, Fisher and Krew Roberts; Ryan Yakely of Eureka, whom he loved like a grandson; his sister-in-law Dianna Henretty of Noel, Missouri and her husband Gary; his nephew Joe Henretty of Tulsa, Oklahoma and his wife Bethany, and his niece Jenny Omondi of Tulsa, and her husband Kevin.

Edgar Jr. will be laid to rest with military honors in the National Cemetery at Miramar Marine Corps Air Station in San Diego, California on Friday March 7 at 0915. In lieu of flowers, donations can be made in Edgar Jr’s name to Hospice of Humboldt.

Edgar Jr. was a loving and devoted son, husband, father, grandfather (affectionately known as Poptart, while Caryl was Graham Cracker) and great-grandfather, and will be deeply missed by those who love him.

###

The obituary above was submitted on behalf of Edgar Roberts Jr.’s loved ones. The Lost Coast Outpost runs obituaries of Humboldt County residents at no charge. See guidelines here. Email news@lostcoastoutpost.com.

OBITUARY: Alyse Pettit, 1937-2025

LoCO Staff / Tuesday, Feb. 25, 2025 @ 6:56 a.m. / Obits

Alyse Pettit

‘Ma’

May 18th, 1937 - February 14th, 2025

Alyse passed away peacefully at 5:30 p.m. on Feb 14, 2025 at the age of 87, with her daughter by her side.

She spent 40+ years as a speech-language pathologist for northern California, from her private practice to her work with almost all of Humboldt County schools. Aylse’s love for teaching and children had a large impact on many families’ lives. As a mother and a teacher, she will be sorely missed.

Born in Iowa on May 18, 1937, predeceased by her daughters Lynette Johnson and Laurie Pettit and son Mark Pettit, Alyse is survived by her daughter Stacy Pettit and grandchildren Jesse Carterby, Michelle Ramirez, Trisha Allen and Thomas O’Brien; sister Darlene Oniel and her husband Bob; and her nieces Bridget, Brenda, and Sharon; great-grandchildren Emma and Athan Ramirez.

A special thank you to Heart of the Redwoods (Hospice) and Dana Pape for your support and loving guidance through this process.

Mom will be missed.

###

The obituary above was submitted on behalf of Alyse Pettit’s loved ones. The Lost Coast Outpost runs obituaries of Humboldt County residents at no charge. See guidelines here. Email news@lostcoastoutpost.com.

OBITUARY: Nathaniel O’Lee Hawk, 1986-2024

LoCO Staff / Tuesday, Feb. 25, 2025 @ 6:56 a.m. / Obits

Nathaniel O’Lee Hawk

February 25, 1986 – December 7, 2024

Nathan was born at home in Elk River. He passed away unexpectedly just before his 39th birthday. He grew up on his family’s ranch in Humboldt County, where he spent his childhood exploring the Redwoods, and fishing with his dad and brother. Nathan enjoyed a childhood of making mischief and loved being outside—hiking, fishing, riding motorcycles and skim-boarding. As he got older, he enjoyed backpacking, golfing, softball, disc golf, boxing and hunting for marbles.

Nathan was a natural athlete and excelled in school. He attended Pine Hill Elementary, Winship Junior High, Eureka High School, College of the Redwoods, Grossmont Community College in San Diego, and Humboldt State University. His studies focused on engineering and business, and he had a special interest in astrophysics and marine biology. He worked on getting patents for apps he developed.

Nate was an extrovert and always wanted to be surrounded by friends. He also loved dogs and had a special bond with his canine companions. Kujo and Blue.

He leaves behind his family that loved him dearly — father Dan Hawk (Renee); brother Gabriel Hawk (Samantha); niece Sonja; aunts Lisa Backus, Cindy Christiansen (Gary), Wendy Stone, Jensine Bard (Dan); uncles Art Stone (Brenda), Austin Backus (Belinda); cusins Zack and Ben Christiansen, Jennifer and Merrick Stone. He was preceded in death by his mother Cindy Stone, grandmother Sonja Heaton, and grandmother Mora Stone. A private celebration of life will be held for family and friends. Contact Dan Hawk for more information. Donations in Nathan’s memory can be made to the Sequoia Humane Society or another animal rescue.

Happy Heavenly birthday, son.

###

The obituary above was submitted on behalf of Nathaniel Hawk’s loved ones. The Lost Coast Outpost runs obituaries of Humboldt County residents at no charge. See guidelines here. Email news@lostcoastoutpost.com.

Blue Lake City Council to Consider Controversial Battery Storage Facility at Tomorrow’s Meeting

Isabella Vanderheiden / Monday, Feb. 24, 2025 @ 5:01 p.m. / Local Government

An aerial view of the proposed battery energy storage system. | Screenshot

###

A standing-room-only crowd packed the Blue Lake Fire Hall on Sunday to voice opposition to a controversial project that, if approved, would turn the city’s defunct power plant into a lithium-iron-phosphate battery energy storage facility. The Blue Lake City Council is expected to make a decision on the proposed project at a meeting tomorrow night.

The project proposal, submitted by Texas-based energy developer PowerTransitions, outlines plans to demolish and remove some of the existing infrastructure at the disused power plant, though the transformer and substation would be repurposed for a 20-megawatt (MW) battery energy storage system (BESS). Under the proposed agreement, the city would sell two acres of the Powers Creek District site to PowerTranstions and their staff would handle the costs associated with site clean-up, which would cost the city up to $1.5 million to complete.

Once it’s fully built out, the BESS would include 10-20 battery units that would store renewable energy for local providers, including the Redwood Coast Energy Authority (RCEA).

The project has drawn criticism from many Blue Lake residents who fear the facility would have “catastrophic consequences for [the] beautiful small city,” as stated in an online petition against the project that has gained 119 signatures. Some residents fear the facility would contaminate the water supply if a flood were to occur, while others worry that a system failure or a nearby fire could cause “explosions and release toxic gases,” similar to what happened last month at the Moss Landing Vistra Power Plant in Monterey County.

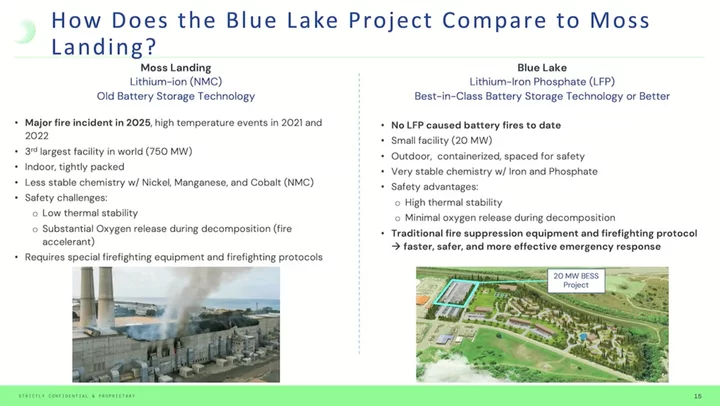

Speaking at Sunday’s contentious meeting, PowerTransitions Senior Advisor Jeff Goldstein went over the various benefits of the project, which would provide a five-day energy supply during a long-term outage. He also said he was “keenly aware of all of the risks associated with this technology,” adding that the Blue Lake BESS would use lithium-iron phosphate batteries, not lithium-ion batteries that can be dangerous if damaged or overcharged. He shared the following slide to illustrate his point.

Screenshot

“What happened at Moss Landing is a tragedy [but] the rules and regulations that we are being held to didn’t exist when [that] project was built,” Goldstein said to the crowd of 100-plus residents, adding that the Moss Landing Power Plant was 750 MW whereas the project proposed for Blue Lake is only 20 MW.

Other residents took issue with PowerTransitions CEO Sean T. Long who used to work for Enron, which filed for bankruptcy in 2001 following a massive accounting scandal that upended the national energy industry. Goldstein was quick to defend his boss, noting that Long’s “ethics are impeccable.”

“Some people here have said ‘You have a corrupt CEO! He worked for Enron, a company that went bankrupt.’ Well, let’s get the truth out,” he said. “This guy was in his 30s … he wasn’t an officer of the company, he was an officer of the region in Africa. Okay? He had nothing to do with what happened in Enron.”

[CLARIFICATION: After the publication of this story, one of our readers shared a link to an article published in the Houston Chronicle that details court proceedings in which Merrill Lynch executives were convicted for aiding Enron in fraudulent accounting practices, including the infamous Nigerian barge deal. The article includes testimony from Long, who “headed Enron’s African investment division … in 1999” and admitted to engaging in “wrongful conduct” and “assisting in the takeout of Merrill Lynch.”]

Unfortunately for Goldstein, many of the meeting attendees didn’t seem interested in hearing what he had to say. The video recording of the meeting — linked below — is almost impossible to understand at some points because Zoom has a tendency to mute when people talk over one another during virtual meetings. Still, it was clear that people weren’t happy.

Reached for additional comment via email, Blue Lake City Manager Amanda Mager was eager to dispel misinformation surrounding the battery storage facility. She emphasized that the proposed project “in no way resembles Moss Landing,” adding that battery storage technology is a critical component in “fully harness[ing] the benefits of renewable resources … .”

“I don’t know anyone in our community that would ever advocate for something resembling that project,” Mager told the Outpost. “The proposed project is not in an enclosed building, does not include the same type of batteries and isn’t anywhere near the size of that facility. The project proposed for Blue Lake is community scale and has been replicated all over the world.”

Mager added that the city has been working with the RCEA for years to find a way to transition the power plant. “[W]e entered into an MOU with RCEA to act in an advisory role to the City to specifically look at a small-scale BESS for future investment. As RCEA has been acquiring renewable energy resources as part of the local energy portfolio, it was hoped that the City could leverage the inter-connect that exists on the property to help us clean up the property and to participate in the renewable energy industry.”

###

The Blue Lake City Council will consider an agreement to move forward with PowerTransitions’ proposal at Tuesday’s meeting. The council will meet at 6:30 p.m. at the Skinner Store — 111 Greenwood Road in Blue Lake. The full agenda and remote viewing/participation instructions can be found at this link.

###

Judge Grants Restraining Order Against Hillsdale Apartments Owner, Preventing Illegal Rent Increases

Ryan Burns / Monday, Feb. 24, 2025 @ 4:27 p.m. / Courts

Real estate investor and local landlord Anil Dwivedi (left) recently purchased the Hillsdale Apartments at 1140 E Street in Eureka. | LinkedIn, Andrew Goff.

###

PREVIOUSLY

- Eureka Apartment Tenants Say They Were Manipulated Into Big Rent Hikes; Landlord Says They Freely Chose to Help Him Make Ends Meet

- Tenants at Eureka’s Hillsdale Apartments Successfully Fight Back Against Illegal Rent Hikes

- Tenants of Hillsdale Apartments File Class Action Lawsuit to Stop Landlord’s ‘Unlawful Rent Increases’

###

A Humboldt County Superior Court judge today issued a temporary restraining order against Eureka property owner Anil Dwivedi and his company, Dwivedi Tower, LLC, preventing them from implementing illegally large rent increases on tenants of the Hillsdale Apartments, a three-story apartment building he owns on E Street in Eureka.

The order also restrains Dwivedi and his company from evicting tenants without just cause and refusing to provide relocation assistance as required by law.

Dwivedi’s attorney, Randall Davis, told Judge John T. Feeney that his client has already orally rescinded the rent-increase notices he’d issued to plaintiffs Don Swall and Vanessa Vachon, who live in the Hillsdale Apartments.

“I don’t think that a restraining order is necessary,” Davis said. “As early as today, I believe, Mr. Dwivedi is going to serve all the other tenants at Hillsdale with notices that will explain to them that the rent is increasing in April, but only by 8.8 percent.” That’s the maximum amount that rent can be increased in Humboldt County during any 12-month period for tenants who have lived in their residence for at least a year, per the terms of the California Tenant Protection Act.

Davis said Dwivedi has also agreed to cancel any and all lease agreements that tenants signed agreeing to much larger rent increases. He asked Judge Feeney to omit another apartment building Dwivedi owns — the Eureka Central Residence at 333 E Street — from any court order since rents there are dictated by the U.S. Department of Housing and Urban Development (HUD).

Plaintiffs Swall and Vachon were represented by Jeffrey Slack and Megan Yarnall with the Eureka firm of Janssen Malloy, LLP, and in response to Davis’s arguments, Slack said Dwivedi’s stated intentions aren’t good enough.

“The key word that I heard in Mr. [Davis’s] argument is ‘will,’” Slack said to Judge Feeney. “Relief is still needed today.”

Slack went on to argue that some tenants signed leases with unlawful rent increases while others have refused to sign, and those tenants may still be vulnerable to eviction without a restraining order.

“What we’re asking the court to do is to make assurances to these tenants so they’re not faced with an impossible choice of trying to scrape enough money to [pay for] an unlawful rent increase, or else be evicted from their homes, which in some cases they’ve resided in for over 10 years now,” Slack said.

“Many of these folks are low income and elderly,” he continued. “We haven’t had anything in writing from defendants today … indicating that they will not be evicted come Friday of this week.”

As previously reported, tenants at the Hillsdale Apartments received notices on their doors late last month informing them that Dwivedi Tower, LLC, would implement new leases on March 1 with new rent amounts of $1,065 or $1,132, which represented an increase of anywhere from 30 percent to 80 percent or more. The notice said that any tenant who didn’t agree to those terms “can choose to vacate the property on or before February 28th.”

Judge Feeney said he was encouraged to see that matters appear to be heading toward a resolution.

“But at this point I find that the potential harm to the plaintiffs outweighs the potential harm to Mr. Dwivedi,” he said. “The plaintiffs could lose their homes for not agreeing to what appears to the court to be unlawful rent increase demands.”

Feeney agreed to issue the temporary restraining order, though it will pertain only to the Hillsdale Apartments and not the Eureka Central Residence.

After the hearing, Slack and Yarnall discussed the case with the Outpost back at the Janssen Malloy office up the street. They said that the case came to them via a social worker with Humboldt County’s Adult Protective Services program, who was concerned about possible exploitation of the elderly after reading the story we published on Feb. 7.

After their firm filed the request for a temporary restraining order on Friday, Davis reached out to say that Dwivedi had “seen the light” and agreed to rescind the rent increases, according to Slack.

“I said, ‘Get me something in writing; that’s a start,” he said.

“We’re really concerned about the whole building, not just our two clients,” Yarnall said. She said there are at least three categories of clients: those like Swall and Vachon, who held their ground and refused to sign the new lease terms; those who agreed to sign the new leases and may have already paid the excessive rents; and, lastly, those who were so intimidated by the new rent demands that they’re planning to move out — or perhaps already have.

“In some ways, those are the people I’m most concerned about,” Yarnall said. “They need relief now. They need to know from the court, ‘Hey, you don’t have to move out.’”

With the class action suit filed last week, Slack and Yarnall hope to ensure that Dwivedi not only rescinds the inflated new lease terms but also that he pays restitution and damages to any tenants who paid the higher amounts or spent money moving out.

“It’s not good enough to just say, ‘We’re not going to continue to charge these [unlawful rent amounts]; he needs to make these people whole,” Yarnall said.

When the Outpost interviewed Dwivedi earlier this month, he argued that the new lease terms he was trying to impose were not illegal because his tenants agreed to them. He pointed to a section of the notice he posted that said tenants have the right to review the proposed new lease carefully and to “negotiate lease terms within reasonable limits.”

But Slack said that notice itself was a violation of the Tenant Protection Act, which includes specific provisions that spell out exactly what information landlords must disclose to tenants about their rights when implementing a rent increase. And those tenants’ rights cannot be waived.

Yarnall agreed. “There’s a huge power dynamic imbalance between the tenants and the landlord,” she said. “And so saying to them, you know, buried in a in a scary notice, ‘By the way, if you don’t like this, you should speak up,’ it’s just not enough.”

Slack and Yarnall said that any residents of the Hillsdale Apartments who agreed to move out or who signed unlawful new leases can call Janssen Malloy and speak to them.

Judge Feeney scheduled a preliminary injunction hearing in the class action suit for March 10 at 10:30 a.m.

Providence St. Joseph Kicks in $2 Million For New Behavioral Health Triage Center in Arcata

LoCO Staff / Monday, Feb. 24, 2025 @ 4:27 p.m. / Health

Mike McGuire speaks at press conference for the Triage Center in December. File photo: Andrew Goff.

PREVIOUSLY:

- ‘A Game-Changer for Humboldt’: State Sen. Mike McGuire, County Officials Announce Additional Funding for Behavioral Crisis Triage Center in Arcata

- ‘This is a Big Deal for Humboldt’: State Awards $12.3 Million in Funding for Behavioral Health Triage Center in Arcata

###

Press release from Providence/St. Joseph:

Providence Humboldt County is pleased to announce a check presentation event in support of the future Behavioral Health Triage Center in Arcata. This event will take place on February 28 at 4 PM in front of St. Joseph Hospital.

The new Behavioral Health Triage Center, which will be located on land generously donated by Mad River Hospital, has recently secured funding and grant approval. This center is a critical development in addressing the local mental health crisis, offering a beacon of hope for the community.

Providence remains dedicated to providing essential resources and support to meet the evolving needs of the community. As part of this commitment, Providence is donating $2 million through our community benefit program to the new triage center.

The event will feature Providence Humboldt County Chief Executive Michael Keleman presenting the $2 million check to Doug Shaw of Mad River Hospital, Connie Beck from County of Humboldt DHHS, and Connie Stewart from Cal Poly Humboldt.

Event Details

- Date: February 28

- Time: 4 PM

- Location: In front of St. Joseph Hospital

The new triage center is expected to break ground in 2025, with a projected completion date in late 2026 or early 2027. This center will address the significant gap in Humboldt County’s behavioral health system by providing much-needed beds and services for individuals experiencing mental health or substance use crises.

Members of the press and community are invited to join us for this important event. For further information, please contact chamia.chambers@providence.org