Tenants of Hillsdale Apartments File Class Action Lawsuit to Stop Landlord’s ‘Unlawful Rent Increases’

Ryan Burns / Saturday, Feb. 22, 2025 @ 12:22 p.m. / Courts

Hillsdale Apartments renters Don Swall and Vanessa Vachon have filed a class action lawsuit against their new landlord, Anil Dwivedi. | File photo by Ryan Burns.

PREVIOUSLY

- Eureka Apartment Tenants Say They Were Manipulated Into Big Rent Hikes; Landlord Says They Freely Chose to Help Him Make Ends Meet

- Tenants at Eureka’s Hillsdale Apartments Successfully Fight Back Against Illegal Rent Hikes

###

Renters of Eureka’s Hillsdale Apartments have filed a class action lawsuit against their new landlord — Dwivedi Tower, LLC, owned by 33-year-old real estate investor Anil Dwivedi — in order to prevent unlawful rent increases and other alleged violations of the California Tenant Protection Act.

The lawsuit, filed Thursday in Humboldt County Superior Court, accuses Dwivedi of evicting tenants without just cause and refusing to provide relocation assistance as required by law. It also says Dwivedi has threatened and continues to threaten to evict tenants who refuse to sign the unlawful new lease terms.

The suit was filed by attorney Jeffrey Slack, a partner with the Eureka firm of Janssen Malloy, LLP, on behalf of tenants Don Swall and Vanessa Vachon, as well as any other state residents who are or were tenants of the two buildings recently purchased by Dwivedi: the Hillsdale Apartments, at 1140 E Street, and Eureka Central Residence, at 333 E Street.

“Since purchasing the Eureka Central Residences and Hillsdale Apartments, Defendants have systematically attempted to impose unlawful rental increases on its tenants through intimidation and threats of eviction if their demands for unlawful rental increases are not met,” the complaint says.

In an email to the Outpost, Slack says there’s a court hearing scheduled for Monday to request a temporary restraining to prevent Dwivedi from charging the unlawful rent increased and from evicting tenants who refuse to pay it.

Some of the residents, including Swall and Vachon, had already enlisted the help of Legal Services of Northern California, a nonprofit organization offering free legal assistance to low-income people and other vulnerable populations. However, this class action suit is broader in scope. It seeks a court injunction and financial damages while aiming to represent not just the current tenants but also those who were evicted or who moved out in response to the new lease terms.

The suit asks the court to void any and all of the unlawful new leases and award defendants triple damages, which it says are warranted because Dwivedi acted “willfully with oppression, fraud or malice.”

After purchasing the Hillsdale Apartments last month, Dwivedi imposed rent increases ranging from 59 percent to 82 percent, the lawsuit alleges. Unless he’s restrained, the complaint argues, Dwivedi actions will continue to present his tenants with “the impossible choice” of becoming homeless and risking their health “or foregoing necessities of life in order to afford their rent.”

An email seeking comment from Dwivedi was not immediately returned. We’ll update readers if and when he replies.

Scroll down for links to both the complaint and the application for restraining order.

The Hillsdale Apartments, a 106-year-old building on E Street in Eureka, were purchased last month by Dwivedi Tower, LLC. | File photo by Andrew Goff.

###

DOCUMENTS

BOOKED

Today: 4 felonies, 8 misdemeanors, 0 infractions

JUDGED

Humboldt County Superior Court Calendar: Today

CHP REPORTS

Alderpoint Rd / Sr36 (HM office): Traffic Hazard

498-799 Us101 (HM office): Trfc Collision-No Inj

ELSEWHERE

Governor’s Office: What they’re saying: strong support for Governor Newsom’s $200M ZEV program

KINS’s Talk Shop: Talkshop February 6th, 2026 – Miles Slattery

KINS’s Talk Shop: Talkshop February 9th, 2026 – Michael Davis-Hughes

THE ECONEWS REPORT: The Makers of the New Documentary on Baduwa’t Tell Us Why They Told the River’s Story

The EcoNews Report / Saturday, Feb. 22, 2025 @ 10 a.m. / Environment

Image: Dave Feral.

Filmmakers Dave Feral and Michelle Hernandez talk with The EcoNews Report about their new film about Baduwa’t — a.k.a., the Mad River.

PREVIOUSLY:

HUMBOLDT HISTORY: First-Hand Accounts of the Tuluwat Massacre, Which Happened 165 Years Ago This Week

Ryan Bass / Saturday, Feb. 22, 2025 @ 7:30 a.m. / History

February

26, 2025 marks the 165th anniversary of the 1860 Wiyot Massacre. The

event remains one of the most appalling mass-casualty incidents in

California history and stands as a permanent scar on Humboldt

County’s collective memory. Where traditional narratives of the

massacre have centered around settler-colonial perspectives, it is

important to remember this event with emphasis on the experiences of

Wiyot victims. Essential to this perspective are the Wiyot

History Papers,

a collection of documents published and digitized through Cal Poly

Humboldt Digital Commons — they are a collection that everyone

should read. One of the testimonies included in these papers was by

Jane Sam, a 15-year-old Wiyot survivor.

During the last week of February 1860, Wiyot people across Humboldt converged at Tuluwat Island for the World Renewal Ceremony.1 This long-held tradition anticipated the continued prosperity of the world. Days of jump dancing were hosted in honor of the Creator to bring balance back into the world. In 1860, revelers may have prayed for an end to the settler-indigenous conflict that had consumed the area for a decade.2 Moreover, the World Renewal Ceremony served as a community gathering of the Wiyot — people traveled from around Humboldt Bay, Eel River, and Mad River to visit the island; even some Yurok were in attendance.3 The ceremony was also a period of reunion with distant families. Some took the opportunity to make new friends, share gathering methods, and play celebratory games. After several days of intense celebration, the renewal ceremony finally came to a close.4 Jane Sam, a Tuluwat survivor, was there the night before the horrific massacre:

The dance was 5 nights. The dance was over one day. The wind blew and rough weather on account of this nobody went home. That night [after] the dance all were asleep. There were four houses and one sweat house making five in all probably including the dance house.

Some of the most industrious men left the island to gather food and water for their families, leaving behind their exhausted families after days of dancing. The lingering celebrants likely found comfort in this extended time together, sharing some final stories and meals as the February winds whipped across the bay. Children may have played among the village houses, while elders shared news from their various communities. In their homes and around the fire, the Wiyot people could reflect on the profound connection they had reinforced with the Creator and with one another. As the revelers fell asleep that night, they were perhaps hopeful of the year to come: were their prayers heard, and might they be fulfilled? The peaceful rhythms of their ancestral ceremony, echoing across the waters of Humboldt Bay, seemed to promise renewal and prosperity even in these challenging times. None could have known that this particular ceremony would be their last on Tuluwat Island for more than 150 years, or that the violence they had prayed to prevent would descend upon them with such swift and terrible force.

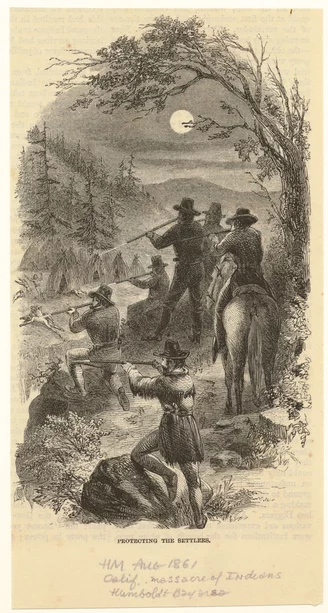

“Protecting the Settlers.” Illustration in Harper’s Magazine, Aug. 1861. Source.

Late on the night of February 25, 1860, a group of men assembled at the docks of Buhne’s Point (King Salmon).5 Armed with axes, knives, and clubs, the mob plotted attacks on Wiyot villages across the county. Five or six men rowed to Tuluwat Island around 3:00 AM in the early morning of February 26, intending to ambush the Native Americans while they slept.6 A restless woman sitting on the shore spotted the marauders before they landed, shouting to alert others.7 Some inhabitants awoke, fleeing to the nearby brush, diving into the water, and hiding wherever they could. Many Wiyot were cornered in their homes — the marauders entered the dwellings and systematically murdered people where they lay.8 Jane Sam recalled the atrocity in detail:

The doors was blocked by white men as the people were asleep, not expecting any thing to happen. They were not on the look out. When they found out what was up they began to scatter and was struck down by clubs, knives, and axes, all met the same fate, children women and men. I got out and hid in a [trash] pile. That is how I was saved. When I got away from [the trash] pile I sneaked away near the edge of the marsh by a blind slough [and] laid there.

I did not hear any noise nor scream from the people. Must of all been killed, sure enough. These white men took all things such as beads baskets fur, hide, bows and arrows. all the property belonging [to] the dead that was not taken was [destroyed] by burning. Woman and children were killed when they lay asleep or they did not make any effort to escape as they thought the white men would not molest them. A few men got away, the exact number being forgotten. At break of day I saw two boat loads of white men going across to Eureka. These were the men that done the [massacring].

About fifty-six people were killed at Tuluwat Island, three-quarters of whom were women and children.9 The murderers acted in coordination with several other marauding bands that night, continuing to target the Wiyot people for several days. At the same time the island was attacked, a raid on the South Spit killed sixty-eight Wiyot Natives.10 Villages near Buhne’s Point, at the mouth of the Eel River, and along the Elk River were also attacked.11 Smoldering homes could be seen scattered across the bay. Three days after the massacre, twenty-six were killed in an ambush at the Wiyot village near Eagle Prairie (Rio Dell). The following day, there was an attack at the “Slide” (Fortuna) resulting in an undocumented number of deaths.12 A conservative estimate would put the total number of losses at about two-hundred people.

When dawn broke on February 26, 1860, the tragic scene was brought to light. No one but the perpetrators and survivors of the slaughter could imagine the gruesome horrors that covered Tuluwat Island and surrounding villages. As one of the few survivors of the attack, Jane Sam, described the aftermath:

It took all the fore noon to gather up all what bodies men, women, children and babies could be found. One living child was found in the arms of his dead mother and today he is living. Two houses where its occupants were asleep none escaped alive. It took all day to bury the dead. The next morning they was through burying what bodies were buried on the Island. The rest of the bodies that were not buried there were taken to Mad River for burial. Some were taken to the [Peninsula,] some taken to South bay, some to [Freshwater]. This same night there was a massacre at the mouth of Eel river and at the south jetty (now) where men, woman, and children, were killed. What got away were taken to bucksport by the soldiers. I do not know how long they were kept at bucksport. From there we were taken to the Indian Reservation.

The survivors of the Wiyot Massacre carried with them a profound significance in the future of their culture. They were the progenitors of a people, the sole hope from which the Wiyot way of life could be carried on to posterity. Some survivors — such as Jerry James, the baby found in the arms of his dead mother — would go on to become influential tribal leaders, guiding the Wiyot in the eventual reclamation of their ancestral lands. Other survivors possessed essential knowledge of Wiyot craftsmanship; their expertise served as the genesis of all future Wiyot material culture. Likewise, many survivors went on to become the founders of immense lineages, families who today make up the descendants and members of contemporary tribes and rancherias throughout Humboldt County.

But in the aftermath of the Wiyot Massacre, an arduous journey laid ahead: after Wiyot survivors were congregated at Fort Humboldt and Union (Arcata), they were forcibly expelled to the Klamath Reservation in May 1860. The removal marked a decade-long struggle within the California reservation system. Those who survived this nightmare were then forced to contend with a new series of obstacles in the form of convoluted legal structures, economic barriers, and assimilatory forces like the federal boarding school system. The experiences of those who overcame this cycle of abuse reveal a story of grief and perseverance beyond comprehension.

###

Ryan Bass is a historian of Yurok-Karuk descent at Cal Poly Humboldt. After receiving the Charles R. Barnum Award for his research on the 1964 Flood and its effects on indigenous communities in Humboldt-Del Norte, he has shifted his research focus to two particular topics: the Hoopa Valley Boarding School (1896-1932) and the California Genocide (1849-1873). Published works regarding these topics is expected to be released later this year.

You like history? Consider a subscription to the Humboldt Historian, a journal of the Humboldt County Historical Society. The Humboldt County Historical Society is a nonprofit organization devoted to archiving, preserving and sharing Humboldt County’s rich history. You can become a member and receive a year’s worth of new issues of The Humboldt Historian at this link.

###

1 Raphael, Two Peoples, One Place, 18-19, 168-169.

2 Kroeber, “Wishosk Myths,” 95; Raphael, Two Peoples, One Place, 18.

3 Loud, Ethnogeography and Archaeology of the Wiyot Territory, 331-332.

4 Jerry Rohde ed., Wiyot History Papers, Statement from Jane Sam.

5 Heizer, The Destruction of California Indians, 156, 256.

6 Jerry Rohde ed., Wiyot History Papers, Statement from Jane Sam; Genzoli, Robert Gunther’s Story, in Genzoli Collection, Cal Poly Humboldt Special Collections, 3; Heizer, Destruction, 255; Loud, 330-331.

7 Genzoli, Robert Gunther’s Story, 3.

8 Jerry Rohde ed., Wiyot History Papers, Statement from Jane Sam.

9 Heizer, Destruction, 156.

10 San Francisco Bulletin, March 13, 1860.

11 Charles Rossiter, San Francisco Bulletin, March 2, 1860.

12 Humboldt Times, March 3, 1860.

OBITUARY: Jacques P. Debets, 1941-2025

LoCO Staff / Saturday, Feb. 22, 2025 @ 6:56 a.m. / Obits

Jacques P. Debets

September 26, 1941- January 26, 2025

Early in the morning on Sunday, January 26, 2025, Jacques Debets passed away peacefully with his family around him, in his home, in Fortuna, California. He was 83 years old. Born September 26, 1941, Jacques (birth name: Johannes Jacobus Pietres) was the first born son of parents Johannes Debets and Hendrika van Kraiij of Kerkrade, The Netherlands.

Jacques and his family bravely immigrated to Fort Wayne, Indiana on a Catholic sponsorship in 1956. After completing high school, he immediately joined the United States Marine Corps. The military offered the promise of citizenship, education and the opportunity to see the world — and they did not disappoint. From Vietnam to Waikiki, Hawaii, Jacques told stories of incredible adventures and many valuable experiences during his military service.

While on leave in Hawaii, he met and later married his first wife, the late Shirley Sesna (1941-2021), a native of Fortuna, California. Jacques fell in love with the beauty and lifestyle he could build in Humboldt County with land, horses, a family, and a vibrant community. Shirley and Jacques moved to Fortuna with their baby daughter, Jacqueline, in 1966. Jacques utilized the GI bill to further his education, while pursuing a career in real estate. He was given a start with broker, and mother-in-law, Ruth H. Sesna. Jacques expanded his real estate business with close friend and investor-partner, Frank Rohner (1927-2007). Jacques and Shirley started their American Dream with 10 acres, designed and built an iconic home, rode horses, raised cattle, and spent summers at Ruth Lake, until their divorce.In 1979, Jacques married his second wife, Ineke Botschuijver, also a native of The Netherlands, and together they raised two daughters (Jasmijn and Janne) and one son (Jonathan), all graduates of Fortuna High School and living locally. Together, Jacques and Ineke embarked on an extremely active life in a house full of children participating in all of their many activities. He never tired of hearing “Hey Dad, watch this!”

Jacques was a competitive athlete, keeping in shape well into his eighties — Judo, water skiing, windsurfing, horseback riding, snow skiing, 4-wheeling, weight training, soccer, tennis, jogging, triathlon, and yoga are just a few of his athletic pursuits. For many years, he played tennis, along with Ineke. A few of his tennis comrades called his strong legs “redwood tree stumps.” Jacques loved his career as a real estate broker and especially mentoring new agents. He touched many lives and formed many lasting relationships through his work. He was a proud member of the Humboldt Association of Realtors since 1967, served on many boards and committees, and completed two residential housing developments in Fortuna. His American dream was fully realized when he completed his first residential housing development, Rancho Buena Vista, and moved his young family into a second house of his own design.

Jacques was a man full of optimism and could visualize opportunity. Those who knew him, enjoyed a friend who was always up for a good time, jumping at almost any opportunity that came his way. He was known for his year-round evenly bronzed tan, bright blue eyes, love of food, music, and dancing, and his unique humor. He was a man who loved his family and lived life to the fullest, taking his young family on winter adventures to Baja to play and fish in the warm sand and surf, and enjoy relaxed time away from work.

Ruth Lake became a home away from home for Jacques, his family and extended community of friends. He and Shirley were among the first to water ski on Ruth Lake when the first campground opened in the 1960’s. Every summer after, many hours were dedicated to boating, swimming, fishing, and teaching people to water ski. He loved each of his five grandchildren, especially swimming with them, telling stories around the campfire, and fishing. He never tired of hearing “Hey Opa, watch this!”

An artist early in life, Jacques rediscovered his love for drawing and painting his favorite places from his childhood, Humboldt County, and his family. Jacques stayed active in the community attending events and serving on boards, practicing his art, and attending his grandchildren’s various sports games. He was proud of his family, military service, real estate career, and art, but nothing compared to the pride he had for his five grandchildren. Seeing them love Ruth Lake life as much as he did was the crowning jewel of his American Dream. Jacques’ legacy lives on through them — athletes, friends, adventurous opportunists, and unseasonably tan.

Jacques was preceded in death by his beloved father, Johannes Debets, mother Hendrika van Kraiij Debets, and brother, Michael Debets, as well as his first wife Shirley Sesna (mother of Jacqueline Debets).He is survived by his wife, Ineke Botschuijver-Debets; his children, Jacqueline Debets (Richard Bend), Jasmijn Kozlowski (Johnny Kozlowski), Marianne Janne Rasmussen (Brandon Rasmussen), and Jonathan Debets; his grandchildren, Johnny Kozlowski, Luc Bend, Jameson Kozlowski, Dean Rasmussen, and Clay Rasmussen; his brother John Debets, sisters Denie Schach (Steve Lewis) and Carol Paris (Brian Paris), sister-in-law Cindy (Debets) Smeltzley, as well as many beloved nieces and nephews.

He was especially grateful to the medical care offered by the Department of Veterans Affairs, Providence Hematology Oncology, Medicare, and end of life care provided by Hospice of Humboldt.

Join us, not in mourning for the end of life, but in celebration of a life fully lived — turn on some Elvis Presley music, put on a cowboy hat, and proost to Jacques Debets.

A service will be planned for a later date. If you would like to attend, please email jacqueline.debets@gmail.com to be put on a list for invitations.

###

The obituary above was submitted on behalf of Jacques Debets’ loved ones. The Lost Coast Outpost runs obituaries of Humboldt County residents at no charge. See guidelines here. Email news@lostcoastoutpost.com.

OBITUARY: David Dale Karr, 1957-2025

LoCO Staff / Saturday, Feb. 22, 2025 @ 6:56 a.m. / Obits

David

Dale Karr — beloved dad,

PaPa, brother,

uncle,

cousin

and friend to many — peacefully left on his final journey from his

long-time McKinleyville home on Sunday, February 16, 2025.

The youngest of four children born to Robert & Mary Karr, he entered life on November 12, 1957 at Trinity Hospital in Arcata and was a McKinleyville resident for most of his life. Dave always lived his life to the fullest, never giving thought to any potential perils his actions might bring. Later in life, we’re certain his proud fulfillment of fourteen years of sobriety and his newly found faith in Jesus gave his family and friends the enjoyment of his company for many additional years. During a recent hospital stay when nursing staff made a comment about Dave’s nine lives, Dave responded, “Oh no sweetheart, I’m on life number fifteen!”.

Dave’s greatest joy in life was raising his daughter despite many life-changing events. The births of his three grandchildren added to his joy and he loved them wholeheartedly and in return they truly loved their PaPa. Despite the physical distance, the close relationship that Dave had with his daughter “Boo Boo” and her children was extraordinary.

Dave is survived by his daughter Kayla Karr (Marty Kemp) of Barnard, Missouri along with her children, Kylee Moreland-Baker of McKinleyville, and Dawn and Christopher Kemp of Barnard, Missouri. He is also survived by his siblings Tom Karr (Jessica) of Selma, Oregon, Sharon Hiney (Bill) of Eureka, and Kathy Bubenik (Mike) of McKinleyville, his mother-in-law Anna Sparks of Mexico and step-mother-in-law Wendy Sparks of Brookings, Oregon. He is also survived by a large close-knit family of cousins, nieces and nephews both near and far.

Dave was predeceased by his parents, his first wife Dawn, his step-son Michael Duffy, and his father-in-law Don Sparks. He was also pre-deceased by his second wife, Jackie.

Dave was passionate about so many things in his life. From timber falling in his younger days, agate-hunting and rock collecting throughout his life, watching Nascar (or any other form of auto racing), golf which he enjoyed not only as a spectator but also as an active participant in past years, his love of the KC Chiefs in recent years, working on the family farm in Missouri and sunrises and sunsets were integral parts of the life that Dave enjoyed.

Dave touched a great many lives and although some relationships may have started out in adversarial ways, invariably Dave’s big heart would shine through and create friendships that lasted throughout his life. Although an amateur photographer, Dave’s pictures and drone videos of local scenes brought incredible joy to the many individuals fortunate enough to view his photos and videos on social media. The comments from former Humboldt County residents on social media relating to his efforts were especially touching. We truly believe that some of his photos had a higher power involved, for instance a sunrise photo that when viewed closely, reflected a perfect cross in the sky.

Although there will be no formal services held, the family will hold a celebration of Dave’s life on Sunday, March 2, 2025 at the Azalea Hall located at 1620 Pickett Road in McKinleyville. The celebration will be from 2-4 pm in the afternoon and friends and family are invited to bring their favorite potluck dish and share any “Dave” stories. Non-alcoholic beverages will be provided.

We know that Dave is at peace now and joined with all of the family and friends that have gone before him. Please think of Dave when you see a beautiful sunrise or sunset, he is probably taking a picture from up above.

###

The obituary above was submitted on behalf of Dave Karr’s loved ones. The Lost Coast Outpost runs obituaries of Humboldt County residents at no charge. See guidelines here. Email news@lostcoastoutpost.com.

BIZ WHIZZES! These are The Businesses That Ruled Hard at the 2025 Greater Eureka Chamber of Commerce ‘Boldt Gala

LoCO Staff / Friday, Feb. 21, 2025 @ 4 p.m. / Business

Ross Creech, chamber board chair, presiding over the gala | Photos courtesy GECC

Greater Eureka Chamber of Commerce release:

On Friday, Jan. 31, local businesses and individuals from across industries were recognized for their exemplary work and service to the community at the Greater Eureka Chamber of Commerce annual business awards ‘Boldt Gala.

Per tradition, the awardees were selected by fellow members of the Greater Eureka Chamber and were awarded on stage in front of an audience of nearly 400 people.

“The winners of the 2025 business awards are all very deserving of this honor,” said Nancy Olson, CEO of the Greater Eureka Chamber. “I am deeply grateful for what they each bring to our community and how they model a commitment to excellence, creativity, and resilience.”

Business Award winners are as follows:

O & M Industries, Large Business of the Year

Scrapper’s Edge, Small Business of the Year

Cafe Waterfront, Customer Service Award

Scott Hammond - State Farm Insurance, Positive Community Impact - For Profit Award

Alzheimer’s Association of Northern California, Positive Community Impact – Nonprofit Award

Schmidbauer Lumber, Extraordinary Business Award

# # #

Three special awards were also presented, including:

Florence Parks - Big Brothers Big Sisters of the North Coast, Leadership Impact Award

Jose Zapata - Coast Central Credit Union, Ambassador of the Year

Dane Valadao of ReProp Financial was also recognized for his service as Board Treasurer from 2020-2024.

# # #

The ‘Boldt Gala was an haute couture-inspired evening at The Acres modeled after a renowned NYC fashion and fundraising gala held annually on Fifth Avenue. It focused on bringing a high-fashion and elegant experience for attendees. As they entered the event, local business and community leaders walked the red carpet and were swarmed by paparazzi (Eureka High School students) who captured their creative and chic outfits.

Awards were presented by 2025 Board Chair, Ross Creech of Quality Body Works and Vice-Chair Teresa Conley of Premier Financial, accompanied by an event soundtrack provided by Accurate Productions. After the inspiring ceremony, Thomas Nicholson Stratton of the Foggy Bottoms Boys facilitated an exciting live auction, using his freshly-minted auctioneer chops to help make the fundraising portion of the evening a smashing success.

DJ L Boogie AKA Lorna Bryant, kicked off the party portion of the evening and set the tone for Elle & Ëlle Productions and CAVE Productions to put on a striking fashion show, showcasing clothes from local Chamber member businesses including Belle Starr, Ciara’s Irish Shop, Good Relations, Living Doll, and Proper Wellness. Attendees got the chance to walk the runway themselves and enjoyed specialty cocktails, mocktails, and bourgeois bites coordinated by Meredith Maier of Six Rivers Brewery. Personalized poetry was created for attendees by Peculiar Poets.

The Greater Eureka Chamber thanks its presenting sponsors, Canopy RWE and Vineyard Offshore for their generous contribution to the ‘Boldt Gala. More than 75 other Chamber members provided sponsorships, in-kind donations, and auction items as well. The Annual Awards Gala is the Chamber’s largest fundraiser of the year and allows it to serve the Greater Eureka business community year-round.

Vehicle Search in Samoa Leads to Arrest for Possession of Loaded Gun and Meth Paraphernalia, Sheriff’s Office Says

LoCO Staff / Friday, Feb. 21, 2025 @ 3:49 p.m. / Crime

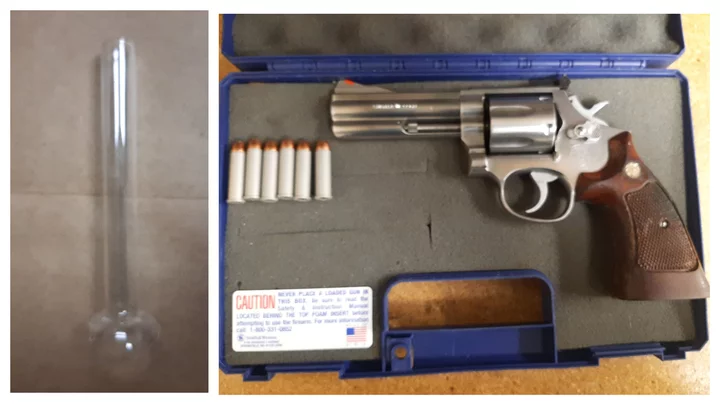

Images provided by HCSO.

###

Press release from the Humboldt County Sheriff’s Office:

On Feb. 19 at about 1 a.m., a Humboldt County Sheriff’s deputy was on patrol near New Navy Base Rd. and Bay St. in Samoa where a vehicle investigation was initiated. While in contact with the vehicle’s occupants, the deputy observed methamphetamine paraphernalia in the vehicle.

The driver, identified as Ronald Patterson, 45, of Eureka, was detained for possession of paraphernalia (H&S 11364(a)) and notified the deputy that there was also an unregistered and loaded handgun in the vehicle.

Patterson admitted that he used methamphetamine and that he was in fact in possession of a loaded firearm in the vehicle. Patterson also exhibited signs of being under the influence of a central nervous stimulant. Patterson was subsequently placed under arrest without incident. He was transported and booked into the Humboldt County Correctional Facility for the following charges:

- Carrying a loaded firearm, not registered owner—PC 25850(c)(6)

- Possession of firearm while under the influence—HS 11550(e)

- Possession of controlled substance paraphernalia—HS 11364(a)

Anyone with information about this case or related criminal activity is encouraged to call the Humboldt County Sheriff’s Office at (707) 445-7251 or the Sheriff’s Office Crime Tip line at (707) 268-2539.