OBITUARY: Antonio (Tony) Fimbres, 1957-2025

LoCO Staff / Thursday, Feb. 5 @ 6:56 a.m. / Obits

Antonio

(Tony) Fimbres

October 4, 1957-Dec. 20, 2025

Tony was born in San Pedro, California on October 4, 1957 to Antonio Ruiz and Anita Rubio Fimbres. Tony passed away far too young at 68 years old in the presence of family.

He was the oldest of five children and loved hunting and fishing with his family.

He spent his childhood in Southern California and then moved to Eureka with his wife Marion and daughter Rachel in the latter part of 1978. Their second daughter, Diana, was born in Eureka 1979. His son, Tony, was born in 1976.

He was preceded in death by his parents, Tony and Anita Fimbres, and brother Eddie. He is survived by his loving wife, Marion, and his three children, Tony (wife Alex), Rachel (husband Jeff) and Diana (husband Dominic) and 12 beautiful grandchildren.

Tony attended church with his wife, Marion, at Eureka the Pentecostal Church for many years, and went to Bible studies together with Dave and Rebecca Ramsey.

Tony worked with Danielson Construction for many years as a traffic controller. On his off time, Tony and his wife enjoyed going for long drives, walking their dog Osito and stopping for lunch.

He was a loving husband and the best father. He was generous and he was kind. We will miss him forever. Anyone who had the privilege of knowing him was a blessed person.

There will be a memorial held to celebrate Tony’s life at Eureka the Pentecostal Church, on 1060 Hoover Street, on Friday, Feb. 27, at 6 p.m.

###

The obituary above was submitted on behalf of Tony Fimbres’s family. The Lost Coast Outpost runs obituaries of Humboldt County residents at no charge. See guidelines here. Email news@lostcoastoutpost.com.

BOOKED

Yesterday: 8 felonies, 12 misdemeanors, 0 infractions

JUDGED

Humboldt County Superior Court Calendar: Friday, Feb. 6

CHP REPORTS

No current incidents

ELSEWHERE

RHBB: New Fire Engines Roll Into Remote Humboldt and Mendocino Communities

RHBB: Trinity County Board Outlines CAO Recruitment Process, Emphasizing Transparency and Legal Compliance

RHBB: Shasta-Trinity National Forest Planning Prescribed Fire Operations This Monday

RHBB: Fire Fully Engulfs Vehicle at Benbow Offramp, Briefly Closing Southbound Highway 101

Coastal Commission Approves Sweeping Consent Agreement to Tear Down and Remediate Schneider Project, Give Site to Wiyot Tribes

Ryan Burns / Wednesday, Feb. 4 @ 3:37 p.m. / Government

NOTE: This post was updated on Feb. 5 at 11:52 a.m. to include a clarifying comment from Coastal Commission staff regarding an archeological study referenced during the hearing.

###

Vegetation has begun to grow over an unpermitted access road on the Schneider property, located at at the end of Walker Point Road. | Screenshot from today’s meeting.

###

The California Coastal Commission today unanimously approved a sweeping consent agreement to address a host of major Coastal Act violations tied to a controversial luxury home project overlooking Humboldt Bay.

The deal, which was developed by Coastal Commission staff in collaboration with Wiyot-area tribes and property owners Travis Schneider and Stephanie Bode, requires the partially built 21,000‑square‑foot house to be demolished and the site to be fully restored. The agreement also includes a $400,000 administrative penalty and calls for the land to be transferred to one or more of the Wiyot-area tribes. Commission staff described the agreement as “a creative and valuable resolution” to serious violations.

The case, as the Outpost has reported on extensively (see links below), centers on two adjacent parcels on Walker Point Road in Bayside overlooking the Fay Slough Wildlife Area, a 484‑acre wetland complex managed by the California Department of Fish and Wildlife. The properties contain critical wetland habitat and lie on the remnants of a pre‑contact Wiyot village.

Despite specific protections in a 2017 Humboldt County coastal development permit (CDP), Schneider and his hired contractors conducted major unpermitted grading, performed vegetation removal in an environmentally sensitive habitat area (ESHA), and began constructing a house more than two and a half times the size of what was approved, with portions encroaching into a 100‑foot wetland buffer.

Humboldt County originally permitted an 8,000‑square‑foot residence with limited grading, but the as‑built structure reached roughly 21,000 square feet, with about 15,000 cubic yards of imported fill — 10 times the authorized amount. An unpermitted gravel access road was cut through buffer areas on both parcels, and native California blackberry and riparian vegetation were mowed or removed, allowing invasive Himalayan blackberry and grasses to take hold.

Work onsite continued after county staff issued a stop-work order in early 2022.

The project’s wetland buffer encroachment inadvertently put the project into the Coastal Commission’s area of jurisdiction, and in March of 2024 the agency took over the remediation project.

Prior to today’s hearing, the commission received letters of support for the agreement from the Wiyot Tribe, the Bear River Band of the Rohnerville Rancheria, the Surfrider Foundation and two concerned residents. Ted Hernandez, the Wiyot Tribal’s former chair and current historic preservation officer, appeared before the commission. He said the site “holds … traditional knowledge for us and our medicine and ceremonies” and voiced support for staff’s work on securing a land-back agreement.

Several public commenters expressed surprise and indignation about the violations. Adam Leverenz, for example, noted that Schneider’s credentials as a developer and owner of civil engineering firm Pacific Affiliates helped him to secure an alternative owner builder permit for the property, “which allowed some level of self-monitoring and self-approval of code inspections,” he said. “That is a problem, I think.”

Leverenz’s voice trembled with emotion as he continued. “I’m not against wealth and affluence,” he said. “I’m against when it leads to a level of entitlement that you can so severely violate so many things.”

Wiyot Tribal Administrator Michelle Vassel also attended today’s hearing in Half Moon Bay. She said that when the tribe and others first alerted the county to violations on the property they were met with “public displays of racism, threats, accusations [and] called liars, among other offensive language.”

Vassel said her only concern about the consent agreement is about Schneider’s compliance.

Under the agreement’s terms, Schneider and Bode must remove the partially built home and unpermitted road, conduct remedial grading to return the site to pre‑violation contours, install erosion-control measures, eradicate non‑native invasive plants and re‑vegetate with native species, including culturally important native blackberry.

The restoration work will be monitored for a minimum of five years, with monitoring extended and additional actions required if success criteria are not met. The respondents will also fund tribal cultural monitors during all ground‑disturbing work, and a cultural resources survey and cultural materials plan must be prepared and implemented under experts approved by commission staff with tribal input.

A central feature of the settlement is the commitment to transfer both parcels — about 6.1 acres — in fee title to one or more Wiyot-area tribes at no cost, with $100,000 of the penalty earmarked to support long‑term stewardship by the eventual tribal landholder. The remaining $300,000 will go to the state’s Violation Remediation Account.

Local attorney Bradley B. Johnson, who formerly represented the Rob Arkley-affiliated Citizens for a Better Eureka, spoke on behalf of Schneider and Bode. He initially spoke briefly, expressing his clients’ support for the agreement. Following the public comment period he again briefly addressed the commission, saying, “I do want this commission to understand that not everything you’ve heard is accurate or true.”

Coastal Commission Vice Chair Dr. Caryl Hart remarked that she “became more and more stunned at the violations here” as she read through the staff report. “The cultural damage is so, just, incredibly disturbing. The natural resource damage is incredibly disturbing.”

Johnson, the attorney, pushed back against some of the criticism. He pointed to an archeological study conducted by the firm William Rich and Associates and said, “Their report is unequivocal — unequivocal — that the activity did not result in the destruction of any cultural resources on the site and did not result in the destruction of the site’s ability to convey cultural significance.”

Regarding concerns about Schneider himself doing the remediation work, Johnson said that his client wasn’t the contractor who actually built the structure and would not be personally doing the remediation work.

Hart admitted that she had not read the archeological study [NOTE: see clarification below], but staff from the commission’s enforcement team later chimed in to note that while the report in question found that no archeologically significant items had been broken or crushed, harm can occur in many other ways, including displacement and failure to screen or rebury objects properly.

[CLARIFICATION: After this story was published, Coastal Commission staff followed up with the following information: “The archeological study referenced on Wednesday by Travis Schneider’s attorney, Bradley Johnson, wasn’t included in the staff materials provided to the public and the commissioners. This is a common practice to protect confidential information about the nature and location of cultural resources. In addition, as mentioned at the hearing, staff determined that the report didn’t sufficiently address all potential impacts at the site, which will be evaluated and addressed under the work to be done under the agreement.”]

In her concluding remarks, Hart commented on the significance of this agreement.

“Every day I’m proud to be a commissioner … [but] no more than today,” she said. Addressing staff, she said, “I can’t thank you enough. It’s an enormous violation, and to have a land-back provision … . You want to talk about environmental justice; there is no more just result than the one here.”

Humboldt County Supervisor and Commissioner Mike Wilson — in whose district the project sits — said he was “grateful” that a long and contentious saga would end with permanent protection of wetlands, ESHA and a culturally significant village site under tribal stewardship.

“I’m grateful for the protection of this culturally significant site … and the return to the Wiyot people is just an extremely important step forward,” he said.

The commission closed the hearing by voting unanimously for all three motions, formally adopting the consent cease-and-desist order, restoration order and administrative penalty against Schneider and Bode.

###

PREVIOUSLY

- Heated Meeting Sparks Accusations of Dishonesty and Discrimination, Opening Rift Between Tribes and Humboldt County Planning Commission

- Despite Silence From Tribes, Mega-Home Builder Optimistic Ahead of Tonight’s Continued Planning Commission Hearing to Address Permit Violation Fallout

- A Tour Through the Half-Built Dream Mansion of Travis Schneider, Who Remains Hopeful Amid Mounting Permit Problems

- Planning Commission Set to Rescind Permit for Controversial Schneider Home as Developer Prepares to Tear it Down, Remediate Damage to Property

- Schneider Offers Emotional Apology as Planning Commission Approves Tear-Down of His Permit-Violating, Half-Built Family Dream Home

- Coastal Commission Finds ‘Substantial Issues’ With Schneider’s Plans to Demolish Half-Built Dream Mansion, Takes Over Jurisdiction of the Project

- Here’s Why Travis Schneider’s Half-Built Mansion Has Yet to be Torn Down

- Schneider Agrees to Pay $400K in Penalties for Mega-Home Permit Violations, Fully Restore Property and Then Give It to a Tribe, Nonprofit or Government Agency

Crabbers Find Body in Ocean

LoCO Staff / Wednesday, Feb. 4 @ 2:03 p.m. / Emergency

‘A Huge Endeavor’: Eureka City Council OKs Regional Climate Action Plan

Isabella Vanderheiden / Wednesday, Feb. 4 @ 1:56 p.m. / Local Government

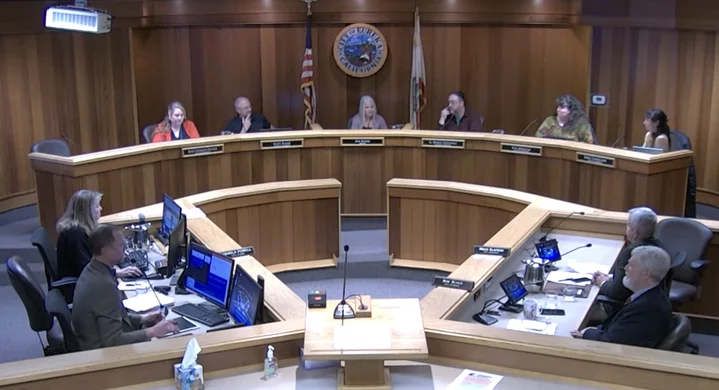

Screenshot of Tuesday’s Eureka Council meeting.

###

Humboldt’s Regional Climate Action Plan (RCAP) cleared another bureaucratic hurdle on Tuesday, securing unanimous approval from the Eureka City Council.

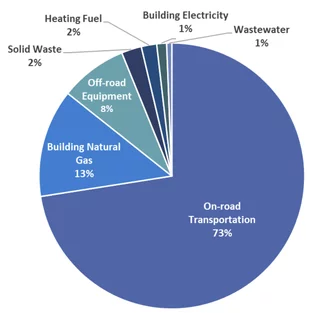

The ambitious environmental document — developed in collaboration with the County of Humboldt, local cities and other government agencies — outlines an array of strategies and measures aimed at reducing regional greenhouse gas (GHG) emissions. Most of these strategies focus on transportation, which accounts for 73 percent of the county’s total GHG inventory, and prioritize expanding access to public transit, electric vehicle charging stations and walking/biking trails.

The RCAP, adopted by the Humboldt County Board of Supervisors in December, aligns with the state’s goal of reducing GHG emissions to 40 percent below 1990 levels over the next four years and achieving carbon neutrality by 2045.

“The RCAP includes over two dozen measures, which are further broken down into well over 100 individual action items,” senior planner Chris Lohoefener explained at last night’s meeting. “Those action items are not mandates. … The city still has local flexibility for moving forward on priorities we’re already working on, and would gain a long-term menu of strategies to draw from as opportunities arise.”

Lohoefener added that the city has “discretion over implementation strategies” and can tailor them to existing policies, including Eureka’s 2040 General Plan. “The RCAP is also designed to be implemented over time with regional progress tracking and periodic updates as conditions, funding and capacities change,” he said.

Once the document gets the rubber stamp from the county’s seven city councils, the Humboldt County Association of Governments (HCAOG) and other regional partners will assemble a Regional Climate Committee and select a Regional Climate Manager to oversee and support RCAP implementation.

“[City] staff would also continue participating in regional discussions to help finalize the recommended placement and structure of the committee and program manager,” Lohoefener said. “Any future steps — whether related to staffing, funding, policy updates or a city-specific work plan — would come back to council for consideration and direction.”

After some discussion among the council, Councilmember Scott Bauer made a motion to approve staff’s recommendation, approving the RCAP and its associated environmental documents. Councilmember Kati Moulton seconded the action.

“This is a huge endeavor,” Bauer said. “We don’t have a lot of time to make pretty significant changes to how we live, and this is the first step, right? This is simply laying the groundwork for us to take real action. … It’s been a long time, and I’m grateful that the staff have put together a great document.”

Councilmember Leslie Castellano echoed his sentiment, adding that she looks forward to “creating a guidebook for how the city is going to [enact] these measures once it goes back to the county and we are further along in the process.”

The motion passed in a 5-0 vote.

###

What else happened at last night’s meeting?

Staff provided a glowing update on the Eureka Visitor Center, which received its official state designation as a California Welcome Center in 2024. In 2025, Old Town Eureka had a total of 1.2 million visitors (not including residents or employees) and 24,000-plus visitors to the welcome center, according to data staff members had sourced from Placer.ai.

The council accepted the report but did not take any formal action on the item.

###

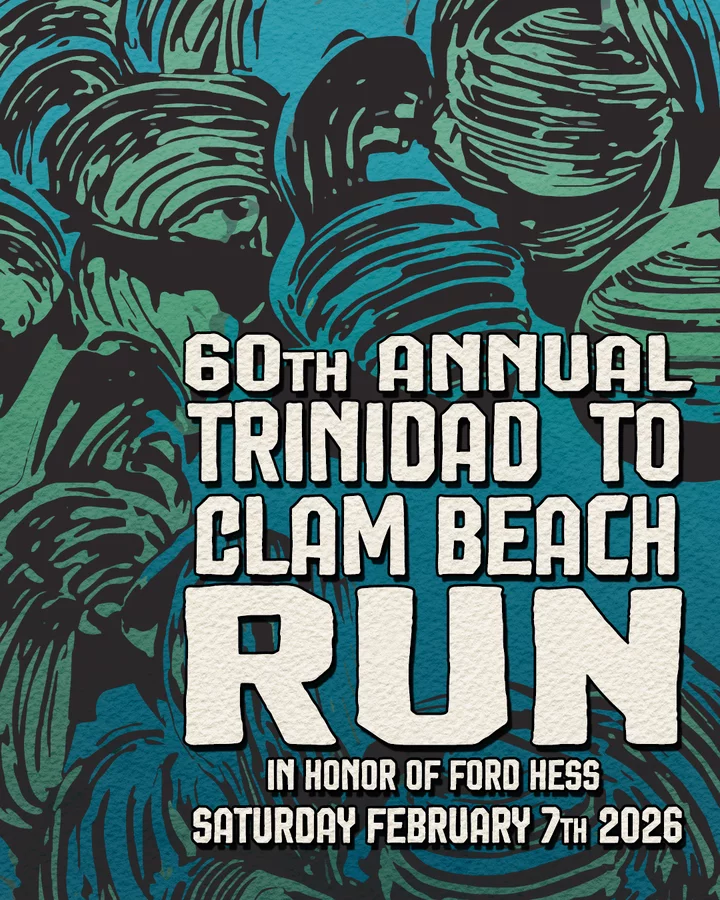

The Clam Beach Run is This Weekend, and It’s a Special One!

LoCO Staff / Wednesday, Feb. 4 @ 10:33 a.m. / Our Culture

Press release from the Greater Trinidad Chamber of Commerce:

The Trinidad to Clam Beach Run returns this Saturday, February 7, 2026, marking the 60th annual running of one of Trinidad’s most beloved community traditions. Participants can run, sprint, or walk the scenic 5¾-mile course beginning at Saunders Park, crossing Little River at Moonstone Beach, and finishing with a celebration at Clam Beach. To register for the event, visit exploretrinidadca.com/tcbr.

GTCC Honors Past Participants

In honor of the race’s milestone, the Greater Trinidad Chamber of Commerce will recognize individuals with ties to the earliest days of the event, including two individuals who ran in the inaugural 1966 race, and one who helped turn a legendary training route into the race known today. Honorees include Bill Ferlatte, Tom Beck, and Darren Walton.

Bill Ferlatte, 5th place finisher in the inaugural Trinidad to Clam Beach Run, helped shape the original course after training runs in the Trinidad area with the Humboldt State team. Ferlatte later built a career as a biologist and was inducted into the Dipsea Hall of Fame in June 2025, joining a small group of Humboldt alumni honored there, including former Clam Beach winners Don Makela (1973 winner) and Ron Elijah (1976 winner).

Tom Beck, former Humboldt State College cross country and track athlete, worked with Ferlatte in 1965 to propose adding the course to the AAU schedule, after being inspired by classic Bay Area races like the Dipsea and Bay to Breakers. Beck later returned to run the Trinidad to Clam Beach Run in 1972, earning a third-place finish. He’ll be traveling from Sonora to attend this weekend’s celebration.

Darren Walton placed 7th in the 1966 race. At the time, he was a sophomore at Novato High School. Sixty years later, he’s returning to run again, after traveling from the Bay Area for the event several times throughout the decades.

Community members and runners are invited to meet the honorees at the Jogg’n Shoppe on Friday, February 6, at 2:30 p.m. Honorees will also attend the annual Pasta Feed on Friday, February 6, at 5:30 p.m. at the Dow’s Prairie Grange (3995 Dows Prairie Rd, McKinleyville). Runners and supporters are encouraged to attend and “carb up” before race day. Plates are just $15, and you can place an advance order at pasta-bar.cheddarup.com. This event benefits the Dows Prairie Grange #505 restoration project. Honorees will also be at the start line on Saturday to cheer on runners.

Racing on Saturday? Here’s what you need to know.

- Cost: $50

- Registration: Register online at exploretrinidadca.com/tcbr

- Start time: 9:30 a.m.

- Line-up location: Saunders Park, 400 Janis Ct, Trinidad

- Packet pickup: Friday, February 6, from 3-6 p.m. at Jogg’n Shoppe, 1090 G St., Arcata

- Race day packet pickup: Saturday, February 7, from 7:30-9:15 a.m. at Trinidad Town Hall, 409 Trinity St., Trinidad

Sheriff’s Office Investigating Apparent Murder-Suicide in Weitchpec

LoCO Staff / Wednesday, Feb. 4 @ 9:12 a.m. / Crime

From the Humboldt County Sheriff’s Office:

On Feb. 3, 2026, at 8:47 p.m., Humboldt County Sheriff deputies responded to a residence located in the 900 block of Lewis Rd., in Weitchpec to a reported possible murder- suicide.

Upon arrival, deputies located two individuals deceased inside the residence. Based on the preliminary investigation, the incident appears to be consistent with a murder-suicide. The identities of the deceased are being withheld pending notification of next of kin.

The Humboldt County Sheriff’s Office Major Crimes Division is actively investigating the incident and is working closely with the Yurok Tribal Police.

No additional information will be released at this time. Updates will be released as the investigation continues and as appropriate.

Anyone with information about this case is encouraged to call the Humboldt County Sheriff’s Office at (707) 445-7251 or the Sheriff’s Office Crime Tip line at (707) 268-2539.

A Quest for Historical Accuracy Delayed Renovations of U.S. Coast Guard Station Humboldt Bay, But the Project is Finally Complete

Ryan Burns / Wednesday, Feb. 4 @ 7:54 a.m. / Government

The U.S. Coast Guard Station Humboldt Bay — a.k.a. the Humboldt Bay Life-Saving Station — in all its renovated glory. | Photo by Ryan Burns.

###

PREVIOUSLY

###

Well, lookie there! The historic U.S. Coast Guard Station Humboldt Bay has emerged from its chrysalis with a brand-new set of historically accurate windows and doors.

Just over a year ago, the exterior of the building, which is also called the Humboldt Bay Life-Saving Station, was almost entirely wrapped in white plastic, giving the structure a circus tent vibe while sparking curiosity among passersby.

The reason for the wrap, it turned out, was lead paint remediation. The handsome edifice, located on the North Spit near the entrance to Humboldt Bay, was built way back in 1936 (replacing the original 1878 structure), and the old paint still adhered to the siding.

As we reported back in December 2024, the Coast Guard hired local contractors to complete an extensive renovation project, which involved remodeling the bathrooms and replacing all the siding, windows and doors.

The work was supposed to be completed by last summer, but Lieutenant Junior Grade Nathan O’Brien, public affairs officer with USCG Sector Humboldt Bay, tells the Outpost that the project wasn’t completed until late last week.

“The primary cause for the delay was an unforeseen challenge in procuring windows and doors that met the stringent historical requirements of the building,” O’Brien explained in an email.

Why such stringent requirements? Well, the three-story structure has been recognized as the best example of a New Deal-era “Roosevelt Style” Coast Guard station in the western U.S., and in 1979 (or perhaps 1977) it was added to the National Register of Historic Places.

As such, history buffs care very much about this building. In 2020, in a story about the planned removal of the station’s defunct marine railway, the Outpost cited historian Ralph Shanks’ description of the building as “the apex of Coast Guard architecture.” The Coast Guard itself swooned in an official report that the detailing, “such as the period exterior door and window moldings, classical columns, balustrades, gable brackets and ironwork, is especially fine.”

(There are some nice photos of the building at this website. The shots were taken after completion of a roof-replacement project that also required strict historical accuracy.)

O’Brien explained that the California State Historic Preservation Office demanded historical accuracy with the renovation project.

“The station, a landmark in the region, required specialized materials to maintain its unique architectural profile,” he explained in an email. “The prime contractor faced difficulties in sourcing a supplier capable of meeting these exacting standards.”

Custom-built windows and doors were expected to arrive in March but not delivered to the site until October.

“Despite this setback, the contractor has done excellent work on the project,” O’Brien said. “The renovation has been comprehensive, ensuring the building is fully restored to serve the needs of the Coast Guard while honoring its storied past.”

The Coast Guard Air Station located at the Humboldt County Airport in McKinleyville was commissioned in 1977. However, the Life-Saving Station on the peninsula remains an active part of the agency’s search-and-rescue infrastructure, housing a 47-foot lifeboat, among other resources.