HUMBOLDT HISTORY: Those Daring, Quasi-Suicidal Young Men in Their Flying Balloons

Peter A. Palmquist / Saturday, July 20, 2024 @ 7:30 a.m. / History

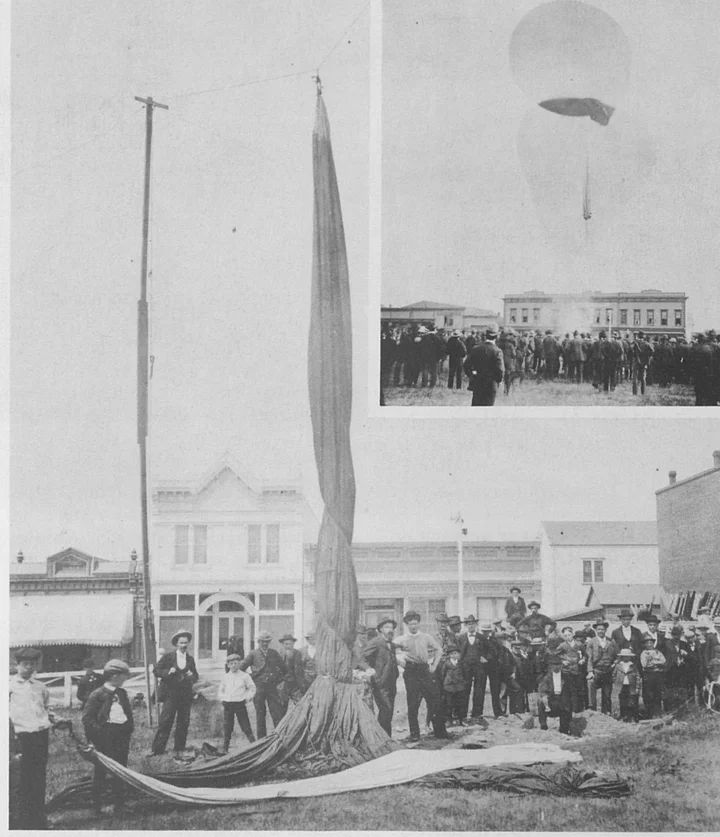

Photos above and above right show preparations for an ascension on the Arcata Plaza. A crudely lettered caption noted that after the aeronauts had taken off they had landed in a bunch of trees and were killed. Presumably the writer was speaking of the same fatal ascent which had occurred in Eureka. It also suggests, however, that these photos may picture the very same balloonists shortly before their tragic attempt in Eureka. Photos by A. W. Ericson, c. 1897 via the Humboldt Historian.

Horse racing has been labeled the “King of Sports” because of its great appeal as a spectator event. Hot air ballooning, however, was very nearly as popular near the turn of the century and had several interesting advantages as well.

Volunteers were often asked to assist with laying out the balloonist’s gear at the launch site, helping to erect a guy-line to hold the balloon in an upright position, gathering firewood, and the like.

Especially exciting were the events of launch day. The fire had to be built just so, and the limp bag manipulated to capture as much hot air as possible. Soon the restraining ropes began to take on a life of their own and the assembled crowd began to buzz with anticipation.

The aeronauts were young men of daring, often with an exaggerated swagger in their walk. No matter how nervous they might feel inside, it was important to show no fear as the moment of ascent approached. In the final seconds everything was checked and rechecked. Was the wind too strong? Were those nearby buildings and trees too close? Enough ballast? Too much? Now!

If they were successful, the rewards were great — instant fame and a chance to see faraway places. After a few years on the circuit the balloonists could sport the title “professor” and enter the celebrity limelight. Many, however, had dreadful scars or bad limps attesting to aborted flights and hard landings.

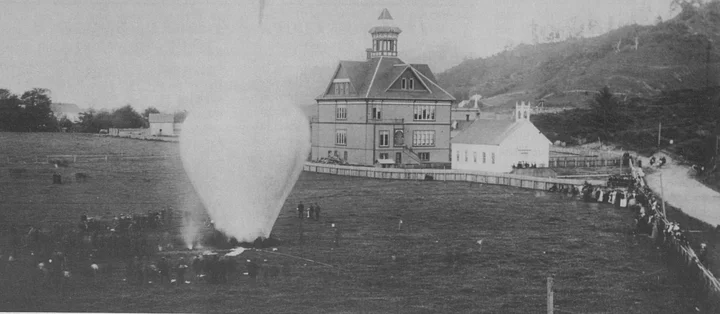

Getting a balloon ready for flight near the Ferndale Elementary School in 1892. Photo by William Wax, via the Humboldt Historian.

Ballooning came to Humboldt County in the 1870s and continued as a popular spectator event, especially around the 4th of July, into the early part of this century. The Arcata Plaza was a favorite site, as was Eureka’s Sequoia Park. In Ferndale the most popular place for balloon launches was the playground of the Ferndale Elementary School.

When the balloonist positioned himself in the sling below the giant bag he never knew exactly what would happen. The balloon could rise straight up, or a sudden wind could send it swiftly towards disaster. The following account, from the local “Daily Standard,” July 6, 1897, clearly attests to the dangers of the balloonist’s profession:

A HORRIBLE ACCIDENT:

Yesterday afternoon at 1:30 o’clock several hundred people witnessed a very distressing accident. Prof. Weston and his helpers had announced that on account of the wind an ascension would be made from a sheltered point on Twelfth street between the alder trees. The people had gathered there to witness the ascension, and as announced the balloon men were on hand and proceeded with their work.

Finally the balloon was inftated, and the order was given to let go. Up it shot with Prof. Weston on the trapeze and also with one of the helpers caught in the ropes. The helper was H. Tapscott, whose duty it was to lie on his back in the balloon and watch the flame which generates the hot air. He thought he was clear of the ropes, but he had evidently been lying on one. He rose about twenty-five feet when he disentangled himself and fell violently to the ground, striking his head. He sustained a concussion of the brain and a compound fracture of the right thigh.

The balloon had not gone up far enough to clear the trees when the extra weight of the helper changed its course and it threw the aeronaut against the trees, and he too suffered a frightful fall, sustaining concussion of the brain, a compound fracture of the right thigh and several broken ribs. The sight was horrifying and weakened the strongest men in the assemblage.

Several physicians who were nearby rushed to the assistance of the unfortunate men who were removed to the Humboldt General Hospital where everything possible was done to alleviate their sufferings, but the general verdict of the physicians was that neither would survive. The verdict was all too true, for at ten minutes to five this morning Mr. Tapscott died, and at five o’clock, just ten minutes later, the aeronaut passed away.

Full particulars of the past of these men have not been learned as yet, but it is claimed that Weston was bom on March 2, 1871, in Olney, Oregon, and has been in the aeronaut business for several years with considerable success. It is said that he has a mother and sister in San Francisco. His unfortunate companion was about thirty years of age and was a resident of Aberdeen, Washington.

Since the above was put in type it is learned that Weston’s real name is George Weston Daggett. Among his effects were found a number of photographs of ascensions he has made in other places. It is the general belief that had the helper not become entangled in the ropes yesterday the ascension would have been very successful. The balloon was not sufficiently strong to carry both men up above the trees, but with only the weight of one man to lift, the trees would have been cleared and all would have been well.

Crowd watches preparations for balloon ascent. Note poles with guy ropes used to hold the balloon above the inflating wood-fired blaze. This event is thought to have taken place at New Era Park in about 1907. Photo: R.J.Baker, via the Humboldt Historian.

###

The story above was originally printed in the May-June 1986 issue of the Humboldt Historian, a journal of the Humboldt County Historical Society. It is reprinted here with permission. The Humboldt County Historical Society is a nonprofit organization devoted to archiving, preserving and sharing Humboldt County’s rich history. You can become a member and receive a year’s worth of new issues of The Humboldt Historian at this link.

BOOKED

Today: 7 felonies, 18 misdemeanors, 0 infractions

JUDGED

Humboldt County Superior Court Calendar: Friday, Feb. 27

CHP REPORTS

Us101 / Hilfiker Ln (HM office): Assist with Construction

ELSEWHERE

RHBB: Driver Trapped After Solo Crash Into Embankment on Highway 101 North of Hopland

EcoNews: President’s Column, by Kathryn West

Humboldt County Officials Respond to Recent Turbine Blade Collapse at East Coast Vineyard Wind Farm

Isabella Vanderheiden / Friday, July 19, 2024 @ 2:19 p.m. / Offshore Wind

Wind turbine under construction at Vineyard Wind 1, located off the coast of Martha’s Vineyard in Massachusetts, in April 2024. Photo: Maia Cheli, Schatz Energy Research Center.

###

Operations were suspended this week at Vineyard Wind 1, an offshore wind farm located about 35 miles off the coast of mainland Massachusetts, after a damaged wind turbine blade broke apart and fell into the ocean. The cause of the incident remains unknown.

Project developer Vineyard Wind, a joint venture between Avangrid and Copenhagen Infrastructure Partners, is an affiliate of Vineyard Offshore, the company planning to build a floating offshore wind farm here on the North Coast.

In a statement issued Monday, Vineyard officials noted that the project is still in its commissioning phase and offered reassurance that the company has “detailed plans to guide its response” to such incidents.

“Following those protocols, Vineyard Wind established a safety perimeter and worked with the U.S. Coast Guard to issue notice to mariners,” the statement says. “GE [Vernova], as the project’s turbine and blade manufacturer and installation contractor, will now be conducting the analysis into the root cause of the incident.”

Map of Vineyard Wind 1. Image: Vineyard Offshore (Click to Enlarge)

Massachusetts officials closed several beaches on Nantucket Island to accommodate debris removal. The 107-meter blade – nearly the length of a football field – left behind “mostly non-toxic fiberglass fragments ranging in size from small pieces to larger sections,” according to Vineyard. A “significant part” of the remaining blade detached from the turbine and fell into the ocean on Wednesday morning. As of this writing, clean-up crews have recovered more than 17 cubic yards of debris.

Reached for additional comment this afternoon, Vineyard spokesperson Kathryn Niforos told the Outpost that the blade’s manufacturer, General Electric Vernova, is responsible for recovery efforts and is tasked with investigating the cause of the incident.

“They are responsible for the blade itself until it’s completely commissioned, tested and turned on; then it turns over to [Vineyard],” she said. “This incident happened in that trial run. The [project] isn’t in full operation yet. So, GE has to answer the cause of this and is ultimately responsible for recovery efforts.”

This isn’t the first time a GE Vernova blade has come apart. A Reuters article published Thursday points to a similar incident that occurred earlier this year at the Dogger Bank A project, located just off the coast of Yorkshire, England. “Several onshore wind turbines in Germany and Sweden have also broken in recent years,” according to the article.

Asked whether Vineyard is reconsidering its relationship with GE Vernova, Niforos declined to comment, saying, “All we can do is recover the debris and wait for the root cause analysis.”

Rob Holmlund, development director for the Humboldt Bay Harbor, Recreation and Conservation District, said Vineyard contacted the district shortly after the incident occurred.

“We are watching closely as Vineyard works to evaluate their damaged blade,” Holmlund told the Outpost. “From my understanding, they have detailed plans to guide their response to such incidents. This is a good opportunity for us to observe how offshore wind energy companies manage unexpected events. We support Vineyard and look forward to seeing how this is resolved. In the meantime, we are proceeding with our project and look forward to applying lessons learned.”

Niforos added that Vineyard is “committed to delivering safe and reliable offshore energy to Northern California” and will work with local stakeholders “to make sure we get that all correct.”

“Offshore wind is a federally regulated industry, and we will follow all of the procedures in developing offshore wind wherever our projects are,” she added.

Reached for additional comment on the matter, Tom Wheeler, executive director of the Environmental Protection Information Center (EPIC), one of the organizations behind the North Coast Offshore Wind group, said blade failure and similar incidents “are recognized to be very rare.”

“Like any machine, offshore wind turbines sometimes experience failure,” Wheeler said. “Nevertheless, I imagine that GE Vernova is pretty embarrassed by this one and we encourage a robust investigation to ensure that this remains an isolated event. But unlike fossil fuel development, when an offshore wind turbine experiences a failure it doesn’t leave birds and beaches covered with oil.”

Additional information about the blade incident can be found on Vineyard’s website.

(UPDATE) Fire Erupts in Greenbelt Behind Eureka Sushi Spot After Reports of an Explosion

Ryan Burns / Friday, July 19, 2024 @ 2 p.m. / Fire

###

UPDATE 4:25 P.M.:

Press release from Humboldt Bay Fire:

On 7/19/2024 at approximately 1:13p.m. Humboldt Bay Fire responded to the report of a vegetation fire at the 400 block of V Street in the brush between Fourth and Fifth Streets. One Engine initially responded but while approaching the scene the Engine reported a large amount of smoke and flames visible with possible exposures to near-by structures. The response was upgraded to a structure fire at that time. This added two additional engines as well as the ladder truck and Battalion Chief to the response.

Units arrived on scene to find an unoccupied transient encampment on fire that had spread into surrounding vegetation. Humboldt Bay Fire had the fire knocked down within 20 minutes of the first arriving unit.

Humboldt Bay Fire crews remained on scene for approximately two additional hours to ensure extinguishment. Additionally, one Humboldt Bay Fire Support Volunteer provided traffic control for the duration of the incident. The fire was investigated by an HBF Fire Investigator and the cause of the fire was undetermined. There were no civilian or Firefighter injuries. Eureka Police Department was also on scene to assist with traffic control.

Humboldt Bay Fire would like to thank City Ambulance, EPD, and Cal Fire for their standby services and assistance during this incident.

Humboldt Bay Fire would also like to remind the public that we are now in the hot and dry season. It is never a good idea to leave a fire unattended and to make sure all smoking materials are dead out. There is currently a state-wide burn ban which means Smoke Alarms Save Lives. burning is prohibited. Brush fires can move quickly in the dry weather and cause larger wild fires. If you see someone burning or you see smoke please call 9-1-1 immediately.

Images courtesy of Humboldt Bay Fire unless otherwise attributed.

###

Original Post:

A fire broke out this afternoon following an explosion at the north end of Eureka, in a greenbelt between Sushi Spot and Siam Orchid Thai. Emergency responders have closed down V Street at the intersection of Fifth.

California Highway Patrol is currently on scene managing traffic.

Eureka Police Department spokesperson Laura Montagna tells the Outpost’s Andrew Goff, on the scene, that people were seen leaving the premises after the fire started. She added that the cause of the blaze remains under investigation.

Guillermo Sandoval, the owner of the property, says he was aware that people had been camping and building structures in this area and had contacted the city about helping to remove them but nothing was done.

One reader reports that she was inside Kiskanu, a cannabis dispensary on Fourth Street, when she heard explosions outside. She emerged to see a black plume of smoke, which was visible across Eureka and even into Humboldt Bay. One reader snapped photos from aboard the Madaket:

Reader-submitted photo.

Here’s a photo submitted to the Outpost by Fourth District Humboldt County Supervisor Natalie Arroyo:

Photo by Seth Ostrom. | Submitted.

Photo by Seth Ostrom. | Submitted.

Photo by Seth Ostrom. | Submitted.

Photo by Andrew Goff.

Photo by Andrew Goff.

Photo by Andrew Goff.

Hill Fire Held at 4,544 Acres, 0 Percent Containment

LoCO Staff / Friday, July 19, 2024 @ 10:22 a.m. / Fire

Hill Fire as seen from Hyampom. Image via Six Rivers National Forest.

###

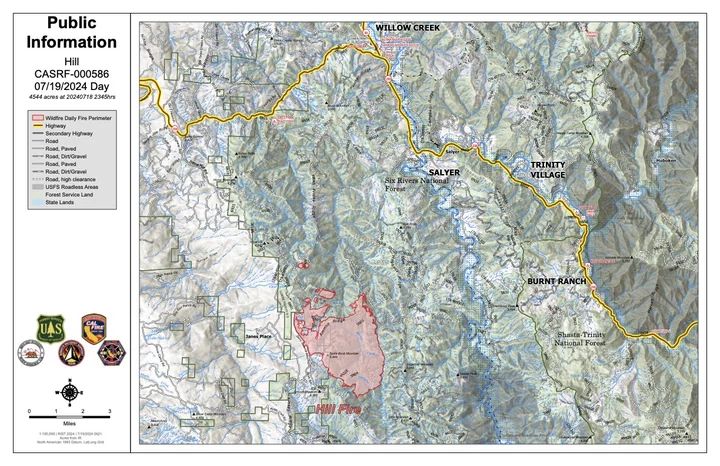

As of Friday morning, the Hill Fire burning south of Willow Creek has grown to approximately 4,544 acres with 0% containment.

An evacuation order remains in place for residents in Zone HUM-E077-A. The evacuation order for HUM-E077-C has been downgraded to an evacuation warning. Still, residents should “be ready to leave at a moment’s notice if conditions deteriorate,” according to the Humboldt County Sheriff’s Office.

The following additional information comes from Six Rivers National Forest:

Yesterday, spot fires along Friday Ridge were successfully contained. Firing operations were completed along Route 1, reinforcing that road as a potential containment line. Crews constructed direct and indirect dozer line along the south and southwest corner of the fire and continued to scout along the west side of the fire for opportunities to go direct.

The latest Hill Fire perimeter map. Click to enlarge.

Today firefighters will continue with firing operations along Route 1 to reinforce that potential containment line. Crews will mop-up the spot fires to the north to ensure they stay within the footprint of their fire perimeters. Crews will also continue scouting to the north and east of the fire for opportunities to go direct or possibly indirect depending on potential risk to firefighter safety. As a precaution, a structure protection group will be assessing structure protection needs within the communities of Friday Ridge, Willow Creek and South Fork Road. Air resources continue to perform water and retardant drops along the perimeter of the fire. Despite commercial airline disruptions, incident air operations will not be impacted.

Fire weather includes low humidity recovery along the ridgetops, continued dry conditions, with temperatures in the 80’s along the ridgetops. Winds will be north and northwesterly with gusts up to 10- 15 mph during the day.

Fire behavior is expected to be relatively moderate, similar to yesterday with flanking and backing activity to the north. The north side of the fire is burning within the footprint of Ammons fire where the fuels are sparse which results in minimal fire behavior in that area. There is potential for growth to the south of the fire due to the north/northwesterly winds.

Evacuation Information:

Evacuation order and warnings remain in effect. For current updates on evacuations, visit https://www.facebook.com/HumboldtSheriff and https://humboldtgov.org/2383/Current-Emergencies. Conditions are subject to change at any time, visit https://protect.genasys.com/search for a full zone description.

Sign up for Humboldt Alert emergency notifications at https://humboldtgov.org/2014/Emergency-Notifications.

Closures:

Forest Closure Order currently in effect for the area impacted by the Hill Fire. It is temporarily prohibited to be on any national forest system land, trail, or road within the closure area. To view the closure order and map of closure area visit the following link www.fs.usda.gov/Internet/FSE_DOCUMENTS/fseprd1191963.pdf

Road closures are currently in place on Friday Ridge Rd. at Forest Service Route 6N06, Friday Ridge Rd. at Forest Route 5N01 and Friday Fridge Rd. at Forest Route 5N04. For updated road closure information, visit protect.genasys.com or humboldtsheriff.org/emergency.

Fire Restrictions:

Forest fire restrictions currently in effect across the Six Rivers National Forest. Campfires and stove fires are restricted to those developed areas listed in the forest order located at https://www.fs.usda.gov/Internet/FSE_DOCUMENTS/fseprd1188610.pdf.

Smoking, welding, and operating an internal combustion engine also have restrictions in place.

‘Pass the Torch’: Huffman Joins Calls for President Biden to Step Aside

LoCO Staff / Friday, July 19, 2024 @ 8:58 a.m. / Politics

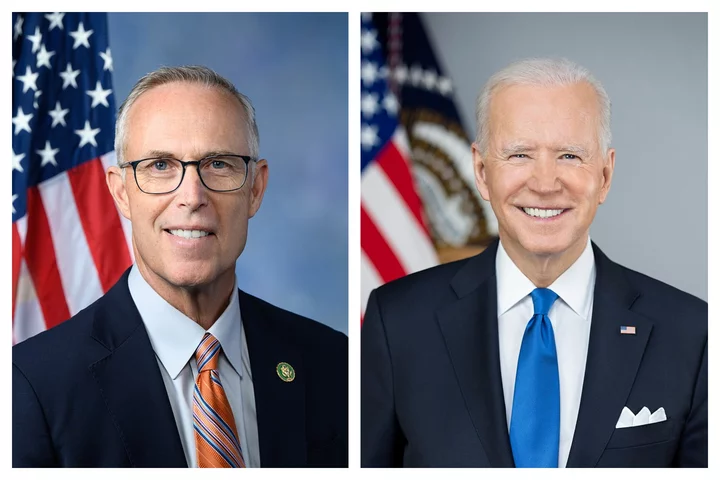

Huffman and Biden. | Official portraits via Wikipedia.

###

Rep. Jared Huffman this morning joined the growing chorus of Democrats calling on President Joe Biden to step aside as the party’s 2024 nominee.

Huffman and three of his colleagues in the U.S. House of Representatives publicly issued a joint statement urging Biden to “pass the torch” to a younger generation of party leaders.

Here’s the introductory message Huffman posted to social media, followed by the statement:

Thomas Paine famously said, “the times have found us.” I believe winning this election is a moral, democratic, and existential imperative. With that in mind, and with a firm belief that we can turn this around and win, here is the statement I am releasing this morning with three of my congressional colleagues:

###

Joint Message to President Biden from Representatives Jared Huffman, Marc Veasey, Chuy Garcia, and Mark Pocan

Washington, D.C. - Today, U.S. Representatives Jared Huffman (CA-02), Marc Veasey (TX- 33), Chuy Garcia (IL-04), and Mark Pocan (WI-02) released a joint message to President Joe Biden:

“Mr. President, with great admiration for you personally, sincere respect for your decades of public service and patriotic leadership, and deep appreciation for everything we have accomplished together during your presidency, it is now time for you to pass the torch to a new generation of Democratic leaders. We must defeat Donald Trump to save our democracy, protect our alliances and the rules-based international order, and continue building on the strong foundation you have established over the past four years.

“At this point, however, we must face the reality that widespread public concerns about your age and fitness are jeopardizing what should be a winning campaign. These perceptions may not be fair, but they have hardened in the aftermath of last month’s debate and are now unlikely to change. We believe the most responsible and patriotic thing you can do in this moment is to step aside as our nominee while continuing to lead our party from the White House. Democrats have a deep and talented bench of younger leaders, led by Vice President Kamala Harris, who you have lifted up, empowered, and prepared for this moment. Passing the torch would fundamentally change the trajectory of the campaign. It would reinvigorate the race and infuse Democrats with enthusiasm and momentum heading into our convention next month. Mr. President, you have always put our country and our values first. We call on you to do it once again, so that we can come together and save the country we love.”

OBITUARY: Carl Fullbright, 1942-2024

LoCO Staff / Friday, July 19, 2024 @ 6:45 a.m. / Obits

On June 15, 2024, after a 23-year-long disagreement with prostate cancer, Carl Duane Fullbright passed away in his Arcata home in the comfort of family and friends.

Born October 17, 1942, to Omar and JV Fullbright in Los Angeles, CA, Carl grew up in Pico Rivera with his parents and younger brother, Harrol, graduating from Sierra High School in 1960. Carl was an athlete who played football, ran track, wrestled, and surfed countless Southern California beaches. After one too many moving violations, Carl ended up in front of a judge, who “suggested” that he enlist in the military. Convinced, he joined the Air Force, serving at multiple posts, including Cambria, California, and Kotzebue, Alaska. Carl considered these days as pivotal to his life because it was here that he “opened up a book and found that I had a brain.”

Upon returning home, this epiphany led him to attend UC Irvine, where he graduated with honors, and ultimately to a rewarding career in medicine. Graduating from the USC Keck School of Medicine in 1970, Carl became one of the first board certified emergency room physicians in the United States at Long Beach Community Hospital. It was there and at West Anaheim Medical Center that he met a group of physicians who became his lifelong friends. During this time he also met the love of his life, Anita. In 1980, Carl and Anita moved to the Central Coast, where he continued his medical career at General Hospital in San Luis Obispo, served as the San Luis Obispo County Director of Emergency Services, and began work as a physician at the Cal Poly San Luis Obispo Student Health Center. Carl also nurtured and cherished time with Anita and their four daughters, taking them on numerous adventures canoeing in Morro Bay, hiking sand dunes, and going to Avila Hot Springs.

Ten years later, drawn to the beauty of the redwoods and the North Coast, Carl took a job at the Student Health Center at Humboldt State University, serving as director during part of his tenure. Valuing the challenge and impact it provided, he also continued his role as an ER physician at Redwood Memorial and Mad River Hospitals, ultimately retiring in 2002. Though an expert diagnostician with a vast understanding of medicine, Carl’s joy and focus centered on developing connections with patients and providing personalized healthcare. He flourished working at

the university health centers because he loved interacting with the students. This ability to make and sustain genuine relationships meant that he always had a friend, and time for that friend, wherever he went. From an early age, his grandchildren noticed that wherever they went – whether at the Co-Op, Starbucks, or the beach – he would always end up deep in conversation with someone, even strangers. “Boppy knows everybody!” they would joke.

Carl lived a rich life full of adventure, play, and a deep appreciation for music, art, and food. A lifelong surfer, he was a member of the North Swell Surfing Association, where he made countless friends and memories. Throughout his life, Carl would venture to his favorite spots at the Jetty or his beloved Camel Rock to check the swell, which way the wind was blowing, and who was in the lineup. Even when standing on shore, his spirit was out among the waves. After retiring, Carl and Anita fulfilled a lifelong dream of spending summers living on their sailboat in Hawaii. They returned to Humboldt full of the Aloha Spirit that characterized their life together: loving, generous, and fun. Life was never boring with Carl, and many of his grandchildren’s most cherished memories involve spending time with him, combing the shore for driftwood, crab shells, or walking sticks, making music together, or following his neon orange baseball cap as he maneuvered through the Farmer’s Market.

Carl was a man who put his loved ones at the center of everything he did. He leaves behind an extended network of family and friends bound by their love for him and strengthened by the depth of their memories. Preceded in death by his father, JV Fullbright, he is survived by his wife Anita; mother, Omar; brother Harrol and wife Pat; daughters Kirsten and husband Carl, Monika, Katie and husband Brian, and Jennifer; his nine grandchildren, Hanna, Kyle, Brienna, Peter, Leah, Nathan, Olivia, John, and Ben, along with three great-grandchildren, Beck, Junie, and Addie; as well as countless relatives and friends whose lives he touched.

The family gives special thanks to Carl’s oncologist from the start, Celestia Higano, MD, and dear friends Bill Hoopes, Jim Sanders, and Kurt Wendelyn, MD and his wife, Chris.

Carl Duane Fullbright was loved by all who knew him. His kind heart, generosity and sense of humor made everyone love being around him, for he had the rare gift of making anyone he was with feel special and cared for, and he did so with the utmost sincerity.

###

The obituary above was submitted on behalf of Carl’s loved ones. The Lost Coast Outpost runs obituaries of Humboldt County residents at no charge. See guidelines here.

OBITUARY: Silvia Leonardo, 1939-2024

LoCO Staff / Friday, July 19, 2024 @ 6:45 a.m. / Obits

With great sadness our beloved mother, Silvia Maria Leonardo passed away peacefully on July 8, 2024, at the age of 84 with both her children by her side.

Born December 21st, 1939, in Fortuna to John and Lena Saottini. Mom and her older brother Eugene were raised on their parents’ dairy and vegetable farm in the Coffee Creek area of the Ferndale Valley. Spending her entire life in Ferndale, she attended Coffee Creek Elementary School then graduating from Ferndale High School in 1957.

Marrying Frank Leonardo in the spring of 1962. Settling in Grizzly Bluff. Together side by side they worked the dairy. Raising their two children Lydia and Frank. Mother’s love for dairying led to her large cow collection, of which no two were alike. An avid card player, she enjoyed many hours spent with neighbors, friends and family playing her favorite card game ‘Pedro’. She liked to win!

Mom and Dad enjoyed traveling with family and friends. Most memorable were trips to Reno, Willows, Tracy and visiting Italy and Portugal (Azores) They were both very proud of their heritage.

Besides family, volunteering and interacting with community brought her so much joy. A proud and generous supporter of many organizations. A lifelong member of Assumption Catholic Church, the Ladies Guild, helping with the church bazaar and fundraisers.

The District 1 Dairy Princess contest was among Mother’s most rewarding and happiest days. So very proud of each and every contestant. Genuinely encouraging and comforting was her heartfelt nature. Her commitment to the contest and industry spanned over 40 years.

Not only serving on multiple Portuguese Celebration Committees over the years, she was also a member of the Supreme Council of the S.E.S. / PFSA organizations. Serving as Secretary of the Ferndale Council No. 98. Both Mom and Dad traveled throughout the state making forever friendships and memories.

Always eager to volunteer, Mother looked forward to sitting with friends and enjoyed greeting visitors of the Ferndale Museum.

Other organizations that she was a supporting member of were the VFW Ladies Auxiliary, Ferndale Lions Club, Portuguese Hall Association, and the Lady of Fatima.

Survived by her two children Lydia Leonardo and Frank Leonardo. Stepdaughter Merrilee Mosher and Step Granddaughters Shanna Borgensen and Jenna Leonardo.

Proceeded in death by her parents John and Lena Saottini, husband Frank H. Leonardo, brother Eugene Saottini, Stepson Mark F. Leonardo, Brother and Sister in laws Charles and Mary Manzi, Allen (Timer) and Evelyn Paine, and Ione Franz.

A rosary-viewing will be held at the Assumption Catholic Church in Ferndale on Sunday, July 28th from 6 pm – 7 pm. Reciting of the rosary beginning at 7:00 pm. Mass of Resurrection at the Assumption Catholic Church on July 29th at 11 am.

Concluding services for family burial will be at St. Mary’s Cemetery in Ferndale with reception to follow at Portuguese Hall.

Memorial contributions in Silvia’s honor may be made to Assumption Catholic Church – Maintenance Fund, Ferndale Museum or to any charity of your choice.

###

The obituary above was submitted on behalf of Silvia’s loved ones. The Lost Coast Outpost runs obituaries of Humboldt County residents at no charge. See guidelines here.