4th of JULY ROUNDUP: Where to Celebrate Your Patriotism this Year, Plus a Word of Caution From Calfire

Jacquelyn Opalach / Tuesday, July 2, 2024 @ 1:02 p.m. / :)

Fireworks over the bay in Eureka. Photo: Eureka Main Street

It’s an interesting time to be an American! It’s an even more interesting time to be a proud American, some might wager, but if that’s you, you’re in luck. Just about every major municipality in Humboldt is hosting some kind of Independence Day celebration this week, should you find yourself feeling patriotic (or just hungry).

See below a list of the larger celebrations that will honor this fine country as its founders intended (that is: by consuming highly processed carnivorous foods and craning your neck to gape at deafening light shows).

At a glance, ALL of these events will have food and music, and you can see fireworks in Fortuna, Benbow and Eureka. If you are looking for something a little more intimate to do, check out the Lowdown for more happenings.

And finally, for the love of America, remember that it’s going to be fucking scorching this weekend. If you plan to set off your own fireworks, Cal Fire asks you to please be mindful of the serious risks associated with that choice. See their full message below.

Okay! Here’s the list:

Fortuna

Fortuna Fireworks Festival

July 3 / 5:30-10:30 p.m. / Newburg Park / Fireworks at dark

Kid-oriented, bring your own fireworks

This looks like the busiest and most ambitious of the 4th of July gatherings, and it’s not even on the 4th of July! You MAY bring your own fireworks to set off in the parking lot behind the event, if that sounds fun to you. It will also be any true American child’s absolute dreamscape: A $10 wristband will buy “three hours of unlimited fun” including but not limited to bounce houses, mechanical bulls and a petting zoo. After that, you can see fire dancers, and then you can dance, and then, at dark, you can see more fireworks.

Arcata

4th of July Jubilee

July 4 / 11:00- 4:00 p.m. / Arcata Plaza

Weirdest attractions

Arcata is bringing it. There will be a dunk tank. There will be aerial silks performances. What more do you need to know?

Eureka

4th of July Festival

July 4 / 10-5 p.m. / Old Town / Fireworks at 10:00 p.m.

Music festival energy! There are TWO stages at this one.

This looks like Friday Night Market on steroids. Eureka Main Street tells us that in addition to pursuing the many vendors, “attendees can also enjoy fire trucks, police cars, horse & carriage rides, speeder car rides, Madaket Bay Cruises, and more.” Cute!

Ferndale

4th of July Barbeque, 4th of July Parade

July 4 / 11-2 p.m. / Ferndale Memorial Veterans Hall

The most classic of the gatherings

Here, folks will find a traditional picnic atmosphere. Bring your blanket, spread out on the lawn, eat some BBQ and, at noon, watch a charming parade of firetrucks and other patriotic floats roll down Main Street.

Garberville

Fireworks at Benbow State Park

July 4 / 1-7 p.m. / Benbow State Recreation Area / Fireworks at dusk

In nature

After a four-year hiatus, Humboldt’s southernmost 4th of July bash is back. It’s got what all the other celebrations have got – music, vendors, food – but in the boondocks.

###

Release from Cal Fire Humboldt:

With the 4th of July just a few days away, it is important to consider the dangers of fireworks. CAL FIRE Humboldt – Del Norte Unit Chief Kurt McCray would like to remind everyone that very hot and dry weather will increase the risk of wildfire this week and to use extra caution during outdoor activities.

Every year fires are caused by illegal and unsafe use of legal fireworks. This puts members of the public, first responders, and property at risk. Those responsible for starting a fire due to illegal use of fireworks can be held financially and criminally responsible. Possession of illegal fireworks could lead to fines and jail time. Some illegal fireworks are considered a destructive device, and possession constitutes a felony.

The use and sale of Safe and Sane fireworks is decided by local governments. Permitted Safe and Sane fireworks will bear a seal from the Office of the State Marshal. Be sure to check for specific restrictions in your area and take all precautions when using Safe and Sane fireworks if they are permitted.

Fireworks Safety Tips:

• Use only State Fire Marshal approved fireworks

• Local ordinances should be verified before purchasing and/or using fireworks

• Always read directions

• Always have an adult present

• Only use fireworks outdoors

• Never use fireworks near dry grass or other flammable materials

• Light one firework at a time

• Have a bucket of water and a hose nearby

CAL FIRE encourages celebrating by viewing a professionally licensed firework show. For those using their own fireworks, we urge only the use of Safe and Sane fireworks in a manner that provides for the best safety of persons and minimizes the risk of fire.

BOOKED

Today: 8 felonies, 8 misdemeanors, 0 infractions

JUDGED

Humboldt County Superior Court Calendar: Yesterday

CHP REPORTS

No current incidents

ELSEWHERE

Times-Standard : Civic calendar | Fortuna will consider a hiring freeze with a few exceptions

RHBB: ‘We Will Not Accept the Response’: Students Remain Overnight in Cal Poly Humboldt’s Nelson Hall

RHBB: Humboldt County Road Construction Notice: Central Avenue

RHBB: Electrify Home Appliances and Improve Efficiency, Says Arcata

Stay Cool! Humboldt County to Open Cooling Centers in Garberville and Along the Highway 96 Corridor to Help Residents Beat the Heat Wave

LoCO Staff / Tuesday, July 2, 2024 @ 11:43 a.m. / Emergencies

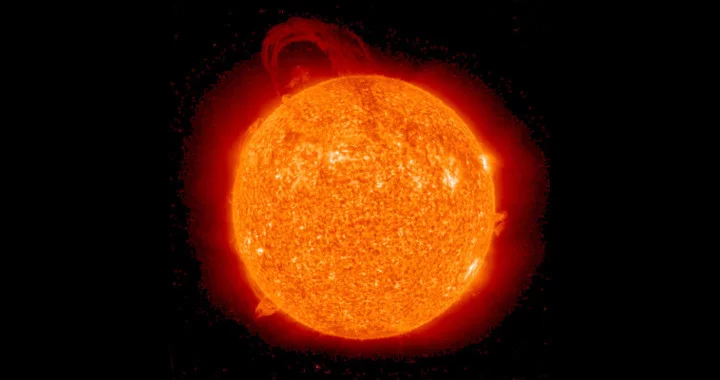

This week’s villain: The sun. Photo: NASA.

Press release from the Humboldt County Department of Health and Human Services:

In response to the extreme heat forecast for the coming days, Humboldt County is opening cooling centers at the Hoopa, Willow Creek and Garberville library branches. These centers will provide a safe and cool environment for residents seeking relief from high temperatures that are expected to reach into the 100s in some locations.

Health & Human Services Director Connie Beck said ensuring the safety and well-being of our community during extreme weather conditions is a high priority. “We encourage everyone, especially those most vulnerable to heat, to take advantage of these cooling centers and get some relief from the unusually hot weather.”

Cooling centers will be opened at the following locations and times:

Kim Yerton Memorial Library (Hoopa)

370 Loop Road, Hoopa

Hours of Operation

Tuesday, July 2: 10 a.m. to 1 p.m. and 2 to 5 p.m.

Wednesday, July 3: 10 a.m. to 1 p.m. and 2 to 8 p.m.

Thursday, July 4: Closed for the holiday.

Friday, July 5: 10 a.m. to 1 p.m. and 2 to 5 p.m.

Saturday, July 6: 10 a.m. to 1 p.m. and 2 to 5 p.m.Phone: 530-625-5082

Willow Creek Library

39 Mayfair St. (at Highway 299 & 96), Willow Creek

Hours of Operation

Tuesday, July 2: Closed

Wednesday, July 3: noon to 5 p.m.

Thursday, July 4: Closed for the holiday.

Friday, July 5: noon to 4 p.m.

Saturday, July 6: noon to 4 p.m.

Phone: 530-629-2146

Garberville Library

715 Cedar St., Ste. A, Garberville

Hours of Operation

Tuesday, July 2: 10 a.m. to 5 p.m.

Wednesday, July 3: noon to 7 p.m.

Thursday, July 4: Closed for the holiday.

Friday, July 5: noon to 6 p.m.

Saturday, July 6: noon to 4 p.m.

Phone: 707-923-2230

Karuk Natural Resource Center (Orleans)

39051 Highway 96, Orleans

Hours of Operation

Thursday, July 4: 10 a.m. to 5 p.m.

Friday, July 5: 10 a.m. to 5 p.m.These cooling centers will be equipped with air conditioning, water, seating and reading materials to ensure a comfortable and relaxing environment. Library staff will be on hand to assist visitors and provide information on staying safe during extreme heat.

Residents are reminded to take precautions during high temperatures, including staying hydrated, wearing light clothing and avoiding strenuous activities during peak heat hours. Special attention should be given to children, the elderly and pets, who are more susceptible to heat-related illness.

For more information about the cooling centers or tips on staying safe during extreme heat, please visit humboldtgov.org/emergency or contact the Humboldt County Sheriff’s Office of Emergency Services (OES) at 707-268-2500.

YEE-HAW! Cal Poly Humboldt and CR Launch Men’s and Women’s Competitive Rodeo Program

LoCO Staff / Tuesday, July 2, 2024 @ 11:08 a.m. / Education

LoCO’s suggestion for a celebratory temporary addition to Cal Poly Humboldt’s main gate

Cal Poly Humboldt press release:

Cal Poly Humboldt and College of the Redwoods are excited to announce the launch of a new men’s and women’s rodeo program, set to launch in Fall 2024. This innovative collaboration will provide students exceptional opportunities to engage in rodeo activities while pursuing their degree at both institutions.

CR’s rodeo program will begin as a club sport with plans to transition to a full intercollegiate athletic team. The rodeo program at Cal Poly Humboldt will launch as a competitive sports club. In preparation for the program’s debuts, both CR and Cal Poly Humboldt plan to search for rodeo coaches and leaders. These coaches will play a pivotal role in training and mentoring student-athletes, as well as overseeing the overall management of the program.

The rodeo programs will benefit from a strategic partnership with Ferndale Fairgrounds, where both teams will practice and call home. These collaborations will provide students with access to top-notch facilities and resources, enriching their training and competitive experiences, while the pathway for students from CR to Humboldt will be seamless. This collaboration will also deepen the partnership between both institutions and the community, while offering significant advantages to local student-athletes. To ensure the financial sustainability of both the men’s and women’s programs, a fundraising initiative has begun and will be expanded.

This rodeo program underscores the broader commitment by CR and Cal Poly Humboldt to expand academic and extracurricular offerings and to provide diverse opportunities to students.

Cal Poly Humboldt President Tom Jackson, Jr. says, “Since 2019, our two institutions have been strategizing about the implementation of a rodeo program that provides a home for our local students to compete in a championship environment. That time has come, and we are excited about the future of collegiate rodeo in Humboldt County.”

College of the Redwoods President Keith Flamer is very excited to partner with Cal Poly Humboldt to bring collegiate rodeo to the area:“I am very proud of our partnership with Cal Poly Humboldt to create these rodeo programs. This collaboration offers a wonderful opportunity to elevate college rodeo in our area and create new pathways for student-athletes to pursue their academic and rodeo dreams.”

Crews Extinguish Large Vegetation Fire East of Arcata

LoCO Staff / Tuesday, July 2, 2024 @ 9:40 a.m. / Fire

AFD

Arcata Fire District release:

On Tuesday, July 2 at 1:38 A.M., the Arcata Fire District was dispatched to a commercial vehicle fire on HWY 299 at exit 3A.

The first arriving unit stated that it was not a vehicle on fire, but foam blocks covered in plastic on the side of the highway were heavily involved. The initial response only dispatched two engines and a duty officer, however additional resources were ordered immediately. Two water tenders were dispatched from Blue Lake Volunteer Fire and Fieldbrook Volunteer Fire as well as four additional engines from Humboldt Bay Fire, CalFire Trinidad, Westhaven Volunteer Fire and Kneeland Volunteer Fire as it appeared that the fire was spreading to nearby vegetation.

Arcata police was initially on scene, but called in units from Caltrans to assist with traffic control.

The fire was fought to the point that Kneeland’s engine was released to cover the Arcata station, and Westhaven’s engine was released to cover the Mad River station. Both cover engines ran medical calls and one small 5x5 fire call during their coverage of Arcata Fire’s stations.

Arcata Fire would like to extend our gratitude towards our mutual aid partners Humboldt Bay Fire, Blue Lake Volunteer Fire, Fieldbrook Volunteer Fire, Westhaven Volunteer Fire, CalFire Trinidad, Kneeland Volunteer Fire, Arcata Police and Caltrans.

The cause of the fire is currently unknown. This is a reminder to the community that with the rising temperatures and dried grasses, fire season is upon us. Use extreme caution this weekend if and when you choose to use fireworks, barbecues or bonfires, and always have a way to extinguish any small fires that may occur like an extinguisher or hose nearby.

Does a Proposed $10 Billion Bond Favor Richer California School Districts?

Carolyn Jones / Tuesday, July 2, 2024 @ 7:35 a.m. / Sacramento

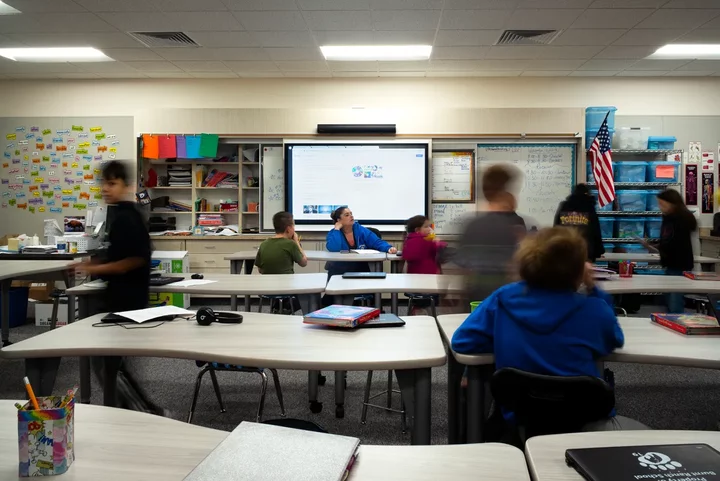

A new classroom at Burnt Ranch Elementary School in Trinity County on Dec. 13, 2019. Photo by Dave Woody for CalMatters

As lawmakers finalize a school facilities bond for the November ballot, some superintendents from low-income and small districts say the proposal leaves them with an all-too-familiar feeling: underfunded and overlooked.

“Am I mad? Yeah, I am very mad,” said Gudiel Crosthwaite, superintendent of Lynwood Unified, in a low-income area in Los Angeles County. “California has a responsibility to educate its children, regardless of where they live. This bond favors larger, higher-wealth districts at the expense of districts like ours.”

Lawmakers struck a deal late Saturday night on Assembly Bill 247, a $10 billion bond that would pay for repairs and upgrades at K-12 schools and community colleges throughout the state. Schools desperately need the money: The current fund for school repairs is nearly empty and the voters rejected the state’s last school facilities bond, in 2020.

Everyone agrees on the need for money to fix dry rot and build new science labs. But some superintendents, as well as the civil rights law firm Public Advocates, had been pushing for a more equitable way to distribute the money. Currently, the state doles out facilities funding through 50-50 matching grants, which means that districts that can raise a lot of money locally — typically, higher-income areas — can get more state money.

Public Advocates has threatened to sue California if it doesn’t adopt a wider sliding scale for distributing the money. The current deal does include a sliding scale, but it’s only from 60% to 65%, not the 5% to 90% that Public Advocates wanted. Under the deal’s scale, the state’s wealthiest districts would only get slightly less than its poorest.

Also under the current proposal, schools could get more money if they hire union contractors for their construction projects. That gives an edge to urban areas where union labor is easier to find.

“California has a responsibility to educate its children, regardless of where they live. This bond favors larger, higher-wealth districts at the expense of districts like ours.”

— Gudiel Crosthwaite, superintendent, Lynwood Unified Dchool District

Brooke Patton, spokeswoman for the State Building and Trades Council of California, said hiring union workers would benefit any school project because the workers are highly trained and efficient. Union projects also include apprentices, who may be from the local community.

“Not only does California end up with new school facilities, but also a new generation of workers who can afford to live in California and contribute to our economy for years to come — a worthy investment of public funds,” Patton said.

The bill still needs to pass both houses with a two-thirds majority and be signed by the governor this week. To go into effect, it needs approval from a simple majority of voters in the fall.

‘It’s a compromise’

While the bill doesn’t satisfy every need for California’s schools, it’s better than nothing, some education advocates said this week.

“It’s not perfect; it’s a compromise,” said Derick Lennox, senior director at California County Superintendents, which represents school administrators and is supporting the bill. “(The bond) takes incremental, important steps toward equity that will do a lot of good.”

The bill includes some help for smaller and low-income districts, such as providing extra money to hire project managers and expanding the number of districts that qualify for hardship funds. It also sets aside 10% of the money for small districts.

The California School Boards Association is also supporting the bill, along with a companion bill, AB 2831, sponsored by Assemblymember Josh Hoover, a Republican from Folsom, that would provide more relief for small and low-income districts if the school bond passes in November.

“We’re more than sympathetic to the needs of small districts,” said association spokesperson Troy Flint. “But times are tight, and we feel it’s crucial to get a school bond on the ballot. … It’s not what we need, but it’s what we could get. Now we have to focus on getting it passed, for the health and safety of California students.”

Old heaters, outdated kitchens, no AC

Trinity County Superintendent Fabio Robles said that some of the schools in his county are so dilapidated that any money is welcome. Passing local bonds is almost impossible, he said, because the county is so poor. So schools are almost totally reliant on the state for repairs.

In Lewiston, the gym has no air conditioning and the kitchen dates from the 1950s, Robles said. At Van Duzen Elementary, a small K-8 school in the mountains, the heater is 40 years old.

“Would a 5-90% sliding scale have been better? Yes. But what’s being proposed now will be a big help to us,” Robles said. “I’ll take that any day of the week.”

In Lynwood, Superintendent Crosthwaite said he’s tired of low-income students having to put up with broken air conditioners and leaky roofs while their more affluent peers enjoy state-of-the-art facilities. His district, for example, is going to ask voters this fall to approve a bond for $80 million. Across town, Pasadena Unified is moving forward with a $900 million school facilities bond. If the state offers matching grants, Pasadena will get even more money.

“We’re more than sympathetic to the needs of small districts. But times are tight, and we feel it’s crucial to get a school bond on the ballot.”

— Troy Flint, spokesperson, California School Boards Association

Meanwhile, students in Lynwood Unified lack basic facilities, he said. A middle school only has a blacktop, no green space. An elementary school lacks hot water. The district doesn’t have enough performance spaces or science labs.

“Our kids think this is normal. It should not be ‘normal,’” Crosthwaite said. “In California we call ourselves progressive, but we need to take a hard look at how we allocate our resources.”

###

CalMatters.org is a nonprofit, nonpartisan media venture explaining California policies and politics.

OBITUARY: Patricia Joan Hassler, 1935-2024

LoCO Staff / Tuesday, July 2, 2024 @ 6:56 a.m. / Obits

Patricia Joan Hassler (Kitchen) passed away peacefully June 22, 2024, in Arcata, surrounded by her loving family.

Pat was born March 14, 1935, to Wesley and Florence Kitchen in McCook, Nebraska. Born the eldest of three children, Pat grew up in a loving family with many relatives living close by to guide her. As a young girl, Pat was a happy blend of princess and tomboy enjoying fishing and boating with her dad and helping her mom in the kitchen. She was an attentive older sister and treasured the company of her two siblings. Pat graduated from McCook High School in 1952, where she was active in athletics, both basketball and baseball. She was a member of the Student Council and the Pep Club, a cheerleader for the athletic teams and disc jockeyed a teen program for a local radio station. Patricia asked a young Tom Hassler to attend the Sadie Hawkins Day dance in their junior year and thus began a lifelong romance.

Pat was awarded scholarships and worked summers as a clerk at Clapp’s Store and the McCook Packing Corporation to help fund her education. Pat went on to attend McCook Community College where she earned an AA Degree and later attended the University of Nebraska at Lincoln graduating with a Bachelor of Fine Arts in Education in 1956. She was a proud member of her college sorority, Alpha Phi, and served as chairperson of the scholarship committee.

Patricia married Thomas Joseph Hassler on December 27, 1956, in McCook, Nebraska and she began her teaching career at Beatrice Junior High School as an Art teacher. They moved to Logan Utah in 1957 where Tom continued his graduate work and Pat became mother to their four children: Jed, Michael, Wesley, and Tracy. She would often quip that she remembered little of those years as she was so busy chasing after all of them.

In 1963, the family moved to Pierre, South Dakota and Pat taught for the Bureau of Indian Affairs School. She held various positions in local community groups: Vice President of the local chapter for the American Association of University Women, President of the local Lutheran Women’s Missionary League and was a Den Mother for the Cub Scouts.

In late 1972, the family moved to Bayside, California where they enjoyed living in the redwoods and exploring the coast. Pat was an active member of the Lutheran Church of Arcata where she sang in the choir and led Bible Study groups. She was a Girl Scout Leader, a PEO member. Pat enjoyed the close friendship of many dear friends who regularly got together to play bridge, enjoy the culinary surprises of a progressive dinner club and attended various community events. Pat was an enthusiastic supporter of all her children’s athletic pursuits and could be found at their many games cheering them on.

In 1979, Pat began a 17-year career working for the McKinleyville Union School District at Morris Elementary School, working as a teacher’s aide and substitute. Pat returned to school and got a California Teaching Credential from Humboldt State University and taught second grade another seven years before retiring in 1996.

Upon retirement, Pat and Tom enjoyed travelling throughout the United States and Alaska, Canada, and Europe. Together they enjoyed local birdwatching, agate hunting and spending time with family and friends. Pat was a woman of strong Christian faith and a devoted wife and mother. She always marveled at the growth of her wonderful family and was proud of each one. She has left behind a legacy of love that will sustain us all.

Patricia was preceded in death by her husband Thomas Joseph Hassler, her parents, Wesley Byrn and Florence Anna Kitchen and a brother, Robert Wesley Kitchen. Pat is survived by her sister JoAnn “Jody” (Kitchen) Bamesberger and husband Mark of Aurora, Colorado, and her children: Jed Thomas Hassler and wife Jeannette of Arcata, Michael Byrn Hassler and wife Pamela of Reno, Nevada, Wesley Joseph Hassler and wife Mariann of Fieldbrook, and Tracy Ann Hassler-Jacobsen and husband Jeffrey of Mesa, Arizona. Pat is also survived by her 10 grandchildren and 22 great grandchildren.

A small celebration of life will be held at a future date.

###

The obituary above was submitted on behalf of Patricia Hassler’s loved ones. The Lost Coast Outpost runs obituaries of Humboldt County residents at no charge. See guidelines here.

OBITUARY: Dakota Rose Stafslien, 1996-2024

LoCO Staff / Tuesday, July 2, 2024 @ 6:56 a.m. / Obits

With much sadness, Dakota Rose Stafslien unexpectedly passed away at the young age of 28 in the early hours of May 4, 2024. She was born March 19, 1996 in Garberville, but grew up in Shelter Cove. Dakota attended Whale Gulch School, Redway Elementary and South Fork High School.

Dakota had many passions. She was certified in massage and over the past year she attended many classes at College of the Redwoods, including Fire Academy, which she had just graduated and was getting ready to start a career in with friends she made along the way. Dakota recently took a trip sailing to the Bahamas with friends she met online and told us all about the pigs that live on the beaches there. It was a great adventure !

Dakota loved art! All art! She always kept herself busy with a range of hobbies that included art (of course), music, beading, sewing, kayaking, road trips and learning all she could from making kombucha to documentaries that she would put online. Dakota’s ray of sunshine will be sorely missed by everyone who loved her, including her best friend Weston Cole Field who was always there for her. They shared many adventures together, and Arianna Guillette, whom she grew up with, was always by her side.

She is survived by her mother, Sandra Brown (Ferndale); father, Samuel Stafslien (Shelter Cove); sister Jasmine (Torrey) Hass and their three children, Olivia, Oliver and Felix Hass (Garberville); and half-sister Sammy Stafslien (Whitethorn); grandfather Bruce Winter (Mountain View, Arkansas ); and second grandmother Kathy Brown (Fort Bragg).

Dakota is preceded in death on her mother’s side by her second father, Wade Brown (Miranda); and grandmother Kathy Winter (Mountain View, Arkansas); and second grandfather Whitey Brown (Fort Bragg). On her father’s side both grandparents Tim and Barbara Stafslien ( Southern Humboldt area).

I would also like to thank everyone who lent Dakota a helping hand over the years whenever she needed it.

###

The obituary above was submitted on behalf of Dakota Rose Stafslien’s loved ones. The Lost Coast Outpost runs obituaries of Humboldt County residents at no charge. See guidelines here.