I suck at finances. When we lived in Bellingham, Wash. over 30 years ago, we found ourselves a CPA to do our taxes, not because we made that much—our joint gross income was less than $35K—but because we both worked for ourselves. The idea of trying to figure it all out for ourselves was anathema (one word: depreciation). And no Quickbooks or TurboTax back then. Joe still does our taxes—we send him a fat manilla envelope every March with all our receipts, IRA forms and the like, and he does the rest, for such a modest amount that I’m embarrassed to mention it here. Doing taxes = avoid at all costs.

Similarly with investments. I’ve lost money in options, futures, junk silver, dot.com stocks (caught in that bust). I don’t understand money and I don’t want to understand money. If I had the gambling gene, I’d be broke.

About two years ago, I started hearing about this weird new digital currency called Bitcoin. Sensing a good story, I took a worldly neighbor out for coffee in what turned out to be the best $2 investment I ever made. D knew all about Bitcoin — in fact he owned some — and patiently explained to me how it worked. “Sounds like a scam,” I said at some point. He’d just been telling me that the largest Bitcoin exchange in the world at the time, Mt. Gox (based in Japan, named after a cat), had been ripped off by hackers to the tune of nearly half a billion dollars, causing the value of Bitcoin to plunge. “Scam?” he said. “Yes and no. In some ways, it was a good thing, because all the other exchanges tightened up their security, and now I think it’s pretty safe.”

I was intrigued by this “cryptocurrency” that was neither a physical asset, like land or gold; nor a fiat currency, like government-issued (and insured) dollar bills and treasury notes. (Imagine Marco Polo returning from China, trying to explain the Emperor’s fiat paper money to the doges of Venice!)

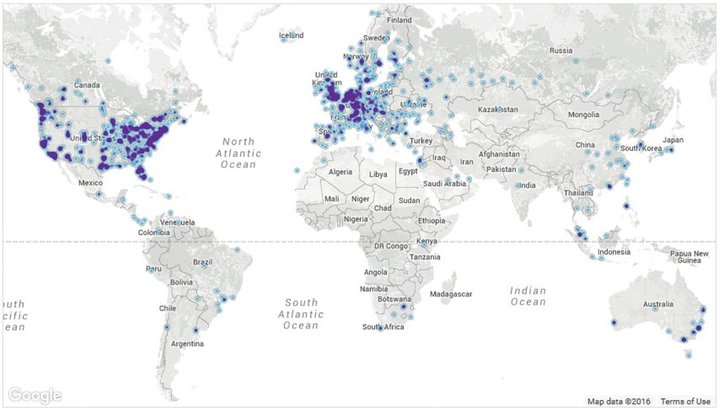

In April last year, over 7,000 Bitcoin nodes (blue on map) in nearly 90 countries kept track of every transaction in real time. There are now over 11,000 nodes in 101 countries. (Addy Yeow/Bitnodes).

This is how I summed it up in my May 5, 2016 “Field Notes” column [Cash, Plastic or Bitcoin?] in the Journal: “Bitcoin is a decentralized (no overarching authority), peer-to-peer (users transact directly), virtual (no physical coinage), secure (cutting edge cryptography) currency system in which every transaction is recorded in a single, public, master registry: the “blockchain.” The blockchain is stored simultaneously in more than 7,000 global databases. In a canny system by which new Bitcoins are “mined” at a predetermined rate, the operators of these Big Data nodes are paid in Bitcoins.”

Got that? Me neither. I could have added that Bitcoin is inflation-proof (unlike fiat currency) since there’s an upper limit to the number of Bitcoins that will ever exist: 21 million. Currently, less than 17 million are in “circulation.” The 21 million limit will be reached in 2040.

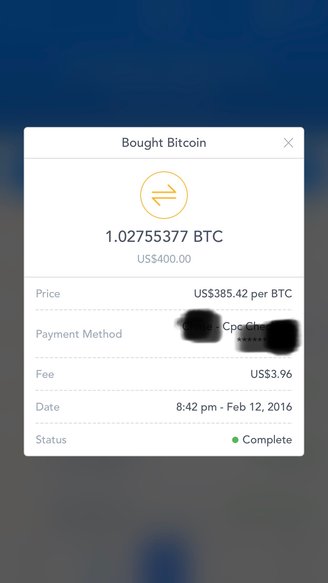

The point, though, is that I didn’t think I could legitimately write about Bitcoin without owning one, just to see what the whole process was all about. Turned out, it was pretty easy. San Francisco-based Coinbase is the largest Bitcoin exchange in the U.S., and they make it easy to open an account. (They should, since they charge 1.5% commission on transactions.) A few key clicks and I was the proud owner of 1.02755377 Bitcoins (BTC). Total investment $400. If I lost it all, I could handle it…including telling Louisa.

As

I write this on December 1, Bitcoin is trading at over $10,000. Yeah,

I’m going to hang on to my tiny slice of the pie — who knows where

this might end up? (Answer: no one.) Maybe it will all turn out for

the worst—the CEO of JP Morgan, Jamie Dimon, called Bitcoin “a

fraud” last October, while the boss of Goldman Sachs reflected that

view last week saying, “Something that moves 20% [overnight] does

not feel like a currency. It is a vehicle to perpetrate fraud.”

Wonder how many he owns?

Fraud

or not, I’m feeling pretty good about my $400 investment. I might

even treat my neighbor to another coffee…this time, with a bagel.

CLICK TO MANAGE