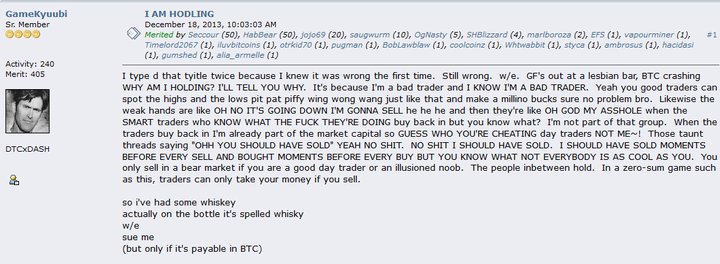

How many times do we know exactly — time and date — when a new word enters the lexicon? If you answered two or more, you’re way ahead of me — move along, nothing to see here. If you answered “one” you probably know that the word HODL joined the zeitgeist on December 18, 2013 at 10:03:03 AM, when “GameKyuubi” posted to the bitcointalk.org forum. I AM HODLING, he announced — Bitcoin was going through one of its (rather predictable) midlife crises, and he wasn’t selling. “I type d that tyitle twice because I knew it was wrong the first time. Still wrong. w/e. GF’s out at a lesbian bar, BTC crashing…” He went on to say that he was a bad day trader (isn’t that a tautology?). He confesses, “so i’ve had some whiskey actually on the bottle it’s spelled whisky.” Gotta love this guy.

And just like that, the meme arrived, spread and took over. If you don’t sell your stocks and bonds (no matter what the market’s doing) you hold; but do the same with cryptocurrency and you hodl. Which seems sort of right, cryptocurrency being this weird shit that no one seems to know exactly what it is (hence “crypto”).

As a

public service (someone called me on “nigrescent” last week),

other terms you might run into in the curious world of Bitcoin et

al:

FUD: Fear, Uncertainty, Doubt, i.e. life, concentrated

FOMO: Fear Of Missing Out (see previous)

Pump and dump: A bunch of investors all buy at the same time, pushing the price of Bitcoin (or any of the other thousand-odd cryptocurrencies) up — then sell. (This, of course, has been around since the stock market was born in the 17th century.)

Whale: Someone holding a shitload of Bitcoin (etc.) who can manipulate the market with a big sell-off. (Again, see prev.)

Mooning: Spike in the price of a cryptocurrency, as in, heading to the moon.

Back

to hodling/holding. When it comes to the stock market, holding is

generally a good strategy. For instance, when you allow for

inflation, dividends and the limited focus of the Dow Jones, it took

less than five years to recover from the crash of 1929. This

same link will tell you that, following down markets

since 1900, “…the average recovery time is just over two years,

when factors like inflation and dividends are taken into account.”

But what about the crash of 2008? What would holding have done for you then? Actually, you’d have been fine. “For example, people who invested $1,000 in the S&P 500 at the beginning of 2008 and again at the start 2009 were back in positive territory by the end of 2009…” according to this.

Staying the course won’t always work, though, as that great observer of human behavior, Kenny Rogers, reminded us (a bit late for me), “If you’re gonna play the game, boy/You gotta learn to play it right/You’ve got to know when to hold ’em/Know when to fold ’em/Know when to walk away/And know when to run…” (written by 23-year old Don Schlitz in 1976).

Hold or fold? I’ve been talking about the stock market and cryptocurrencies, but it seems this dichotomy can be a metaphor for so much of this drama we call life. Hold on to your job, your car, your smartphone, your clothes, your abode, your spouse? Or fold? (Maybe — FOMO! — there’s a better deal waiting around the corner.) If 45 years this week counts as gf/spouse-hodling, I’m in. Ditto my Miata, turning 28 later this year. I wear my clothes down to the bone, resist getting haircuts. Same Old Town apartment since 2001…Come to think of it, this is why coming up with a new topic every week is the perfect antidote for a congenital hodler.

CLICK TO MANAGE