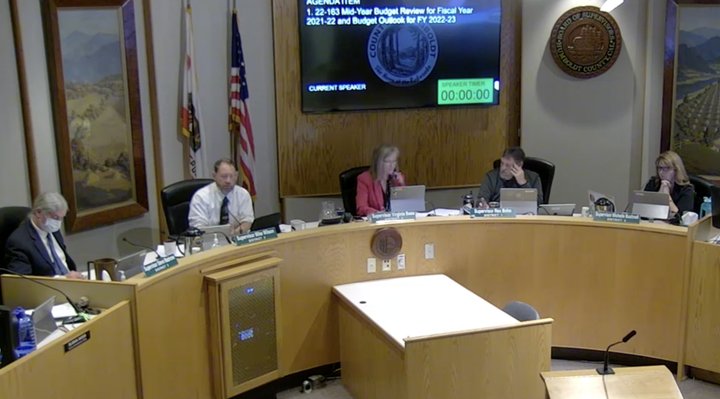

The Humboldt County Board of Supervisors (from left): Fifth District Supervisor Steve Madrone, Third District Supervisor Mike Wilson, Fourth District Supervisor Virginia Bass, First District Supervisor Rex Bohn and Second District Supervisor Michelle Bushnell. | Screenshot.

###

Humboldt County’s growing backlog of delinquent financial reports is costing the county money, damaging its reputation and making it difficult to plan for the future.

That was the message that Chief Financial Officer Tabatha Miller delivered Tuesday in her mid-year budget report to the Humboldt County Board of Supervisors.

The county is two years behind in submitting at least three of its state-mandated financial reports, which makes it challenging to give the board “timely and valid” fiscal information to guide decision-making, Miller said. A staff report also noted that the resulting lack of information boosts the county’s risks for “significant and permanent loss of federal and state funding and budget instability.”

Among California counties, Humboldt is now “dead last” in submitting its 2019-20 Financial Transactions Report to the State Controller’s Office. (The Auditor-Controller says her staff is scrambling to meet a March 16 deadline to avoid legal repercussions.)

The county has ordered a new credit report to be conducted later this month, and a bad municipal credit rating could impact the county’s ability to borrow money and obtain grants. The ensuing damage to the county’s reputation could negatively affect community partnerships and public perception.

“There’s something broken, and we need to fix it,” Miller said during her presentation.

However, it wasn’t all bad news. The county roughly doubled its general fund balance over the past year, going from $15.4 million at the start of the 2020-21 fiscal year to an ending balance of $29.8 million, though Miller cautioned that those figures are “unaudited, unreconciled and not final” because of the overdue fiscal reporting.

Nevertheless, “That is huge,” she said. “That is a real benefit to the community. … But the challenge here is that I can’t necessarily say that we can rely on these numbers.”

The bad news was delivered via a balance sheet for the county’s roads fund, which Miller said was $13.2 million in the hole as of yesterday (again, on paper at least). She added that there are some “unposted receivables,” including some relief money from the Federal Emergency Management Agency, but the county is still looking at a $6.5 million deficit in its roads fund.

More bad news: For the upcoming 2022-23 fiscal year, the county has a projected budget shortfall of $17.7 million due to a number of factors, most notably an increase to employee salaries and benefits. However, Miller noted that the $9.6 million projected expenditure increase from salaries and benefits accounts for full employment, which the county is currently nowhere near — staff shortages are a problem in nearly every department. The county will also see a reduction in Measure S cannabis tax revenues thanks to the board’s decision last month to grant struggling cultivators a big tax break.

To make up that projected deficit, Miller said staff will recommend covering some of the employee pay increases and pension liability from the general fund while limiting supplemental budget requests and budgeting in a 10 percent employee vacancy rate.

“We know that our vacancy rate — we will always have a vacancy rate, even in the best of employment times,” Miller said, adding that it’s currently at about 17 percent countywide.

Fifth District Supervisor Steve Madrone highlighted the importance of funding road maintenance, noting that he gets more calls about that issue than any other.

Third District Supervisor Mike Wilson said aging county-owned facilities should also be considered given the difficulty in financing deferred maintenance.

As for the county’s delinquent financial reports, Miller said the reporting requirements are on the Auditor-Controller’s Office, and the county as a whole needs to find a solution, whether it’s assigning staff from other departments, taking some responsibilities away from the A-C or some other approach. She suggested putting together a committee to develop a plan for getting current with the reports.

Miller received kudos for her concise and informative presentation.

Treasurer-Tax Collector John Bartholomew emphasized the importance of addressing the county’s unfunded pension liability, saying he’s been concerned about it for a number of years and is grateful for the county’s newly created chief financial officer position.

First District Supervisor Rex Bohn suggested that Miller and the staff in the County Administrative Office go ahead and create a working group to address the late fiscal reporting, noting that the county’s 2020-21 single audit is already late.

County Administrative Officer Elishia Hayes said she, too, has “very serious concerns that the ‘20-21 audit will be more delinquent than the ‘19-20 is, which is already six months past the extended due date of September [2021].”

The report to the board was received and approved unanimously.

Transient Occupancy Tax

Earlier in the meeting, the board considered whether or not to place a measure on June election ballots that, if passed, would increase the transient occupancy tax rate in the county’s unincorporated areas from 10 percent to 12 percent while also making the tax applicable to overnight RV parks and certain campgrounds.

The matter had been placed on the consent calendar, meaning it was slated to be approved without any specific discussion or public engagement, but Second District Supervisor Michelle Bushnell pulled it for discussion, saying she had received many emails and phone calls from people who felt “blindsided” by the proposal.

Indeed, during the public comment period, several representatives of the hospitality industry, including local hoteliers, voiced frustration with the county’s process and concerns over the proposed tax hike.

Julie Benbow, executive director of the Humboldt County Visitors Bureau, said that while members of her organization support including RV parks and campgrounds in the tax base, they don’t believe it’s a good time to increase the tax by two percent.

John Porter, owner of the Benbow Historic Inn and Benbow KOA, complained that he and other hotel owners weren’t adequately informed about this matter, and he pointed out that the county is already seeing increased revenues from its transient occupancy taxes just due to inflation and increased room rates.

“The fact that the industry wasn’t wasn’t notified, and nobody called us and talked to us, you know, puts a bad taste in our mouth,” he said, adding that he and others may decide to launch a campaign to defeat the measure at the polls. “I don’t know what we’ll do,” he said before running out of his allotted three minutes to speak.

Chuck Leishman, a marketing consultant with the Humboldt Lodging Alliance, said the tax would give an unfair advantage to hotels in incorporated cities, where the tax does not apply. (Cities create their own.) He, too, complained about the lack of notice, saying his organization didn’t have time to call a meeting to discuss the issue.

Meanwhile, members of the local arts community called in to voice support for the tax increase, noting that some of the revenues could go toward supporting the arts.

“I think that raising the TOT tax makes an enormous amount of sense for our community,” said Jacqueline Dandeneau, co-founder and artistic director of the Arcata Playhouse.

Leslie Castellano, a Eureka city council member and executive director of Ink People Center for the Arts, said “investing in the arts is also investing in tourism.” She added, “More than ever, people are looking for authentic experiences in where they choose to visit, and arts and culture are determining factors when people make their decisions on where to travel.”

Board members wondered aloud if they could take more time to consider the matter while still having time to get a measure placed on June ballots. However, after taking a short break to research the matter, Registrar of Voters Kelly Sanders informed the board that a decision must be made today because the deadline for getting measures on the ballot is this Friday.

Hayes, the county administrative officer, took the blame for the insufficient public notification, saying, “The message has been heard loud and clear today that my office could have done better in engaging for this tax measure,” though she added that there’s still time to get feedback on how the revenues should be spent.

Wilson said he’s in support of putting the measure on the ballot. He also noted that many local homes are being converted to Airbnb rentals, depleting the housing stock and exacerbating problems with homelessness and affordability. He suggested using some of the TOT revenues to plan for increased hotel services in the county. He also noted that the board was simply being asked whether to let voters decide on the matter.

The motion to place the tax increase on the ballots was approved by a vote of 4-1, with Bushnell voting against it.

CLICK TO MANAGE