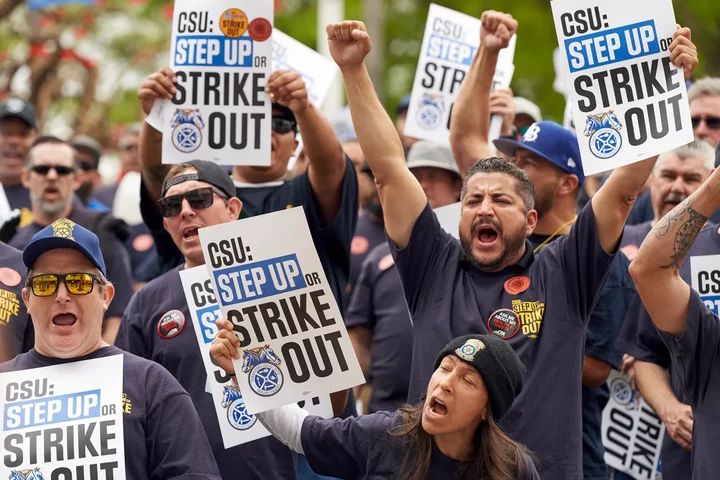

Members of Teamsters, CSUEU, UAW 4123, and CFA Faculty gathered to ask for fair wages outside the CSU Chancellor’s office in Long Beach on May 23, 2023. Photo by Lauren Justice for CalMatters.

The nation’s largest public four-year university is presently incapable of affording itself.

A 70-page report nearly a year in the making by leaders of the California State University details the massive gulf between the money the system currently generates from tuition and receives in state support and the actual costs of educating its nearly 500,000 students and employing 60,000 workers.

All told, CSU’s revenues account for only 86% of the system’s overall costs — a gap of nearly $1.5 billion in 2021-22. Support for student services is the least funded relative to costs, at just 68%. The analysis is based on a highly technical set of assumptions and system data. That gap doesn’t even include Cal State’s roughly $6 billion backlog in construction maintenance projects.

A central premise of the report is that the CSU cannot afford to do the things it should be doing to help students succeed.

“The model explains why there never seems to be enough money to pay for what the universities think they need,” the report states.

As a consequence, ongoing tuition hikes are likely forthcoming. Likely more system tumult awaits, as unions are threatening to strike.

The report’s findings were presented to the Cal State Board of Trustees today.

Emma Joslyn, center, a member of UAW 4123, and Nora Cisneros, right, with CFA, during the rally. Members of Teamsters, CSUEU, UAW 4123, and CFA Faculty gathered to ask for fair wages outside the CSU Chancellorís office in Long Beach on May 23, 2023. Photo by Lauren Justice for CalMatters

“This is a lot like climate change,” said Julia Lopez, a CSU trustee and co-chairperson of the working group that wrote this report. “If we don’t heed the warning signs right now, we’re going to find ourselves in a world of hurt down the line. So that’s what we’re trying to do, to get ahead of that.”

The Cal State’s revenues from tuition and state support will be 29% to 41% less than what the system needs by 2030 unless the system finds new sources of money, warn the report’s authors, a mix of CSU trustees, provosts, campus presidents, senior system staff, a leading professor, outside consultants and the president of the student association. And that’s “even with aggressive assumptions about increases in state General Fund and tuition.”

These cost gaps don’t necessarily mean cuts to key services are imminent. “It’s not really about what cuts we’re going to make, it’s … opportunities that we do not have to invest in additional things that we should be investing in,” said Jeni Kitchell, executive budget director for the CSU.

A major cost driver for the CSU is its status as a national engine of social mobility. Its students are often low-income or the first in their families to attend college, and require more academic support to graduate, as well as added money to afford food, housing, mental health and other basic needs, Lopez said.

“If we don’t heed the warning signs right now, we’re going to find ourselves in a world of hurt down the line.”

— Julia Lopez, CSU trustee

Part of the report’s analysis included how much it would cost to improve the graduation rates of low-income students and students of color by examining the few campuses that have made the most progress in closing equity gaps. The analysis also introduced new data that’ll be closely watched, like the cost of providing each major.

This sobering analysis echoes what the state’s nonpartisan bean counters, the Legislative Analyst’s Office, said in January: Cal State’s tuition and state support will fall $100 million short of its likely costs in 2023-24.

But the solutions the report describes will be bitter pills to swallow. Annual tuition hikes are necessary to increase revenue for the CSU, the report argues, reversing course for a system that has raised tuition only once in the last 12 years.

Even steep tuition hikes, however, won’t be enough to stabilize CSU’s finances.

“From the student perspective, I don’t think we’re ever going to be fine with tuition increases.”

— Krishan Malhotra, Cal State Student Association president

CSU’s trustees should adopt a tuition-hike plan by September, the report said.

The CSU Chancellor’s office is doing just that. It will present a tuition hike to the board in July after consulting with the Cal State Student Association, a system requirement. The plan is to have the board approve a tuition-hike policy in September that would kick in fall 2024, said Steve Relyea, CSU’s chief financial officer.

“From the student perspective, I don’t think we’re ever going to be fine with tuition increases,” the association president, Krishan Malhotra, said in an interview Tuesday.

But a predictable model that students can budget for and that sends more financial aid back to students, “there’s definitely benefit there.”

What tuition hikes would look like

How much more revenue the CSU would generate from tuition hikes depends on whether the system continues its enrollment slide or begins attracting additional students. Another factor is whether tuition goes up 3% for every student annually, or increases once by 5% for every new incoming class of students, similar to the policy the University of California adopted in 2021. The Legislative Analyst’s Office credits those tuition hikes for UC’s stable finances.

Under either model, revenue soars by as much as $765 million annually compared to no tuition increase at all by 2030 — assuming the trustees approve tuition hikes for 2025, the report said.Still, tuition hikes alone may not be enough to plug CSU’s operating hole. The system’s revenues were $1.5 billion below total costs in 2021-22, according to the report. A tuition hike would only generate between $150 million and $200 million in its first year.

For new undergraduates, the hikes proposed by the report would equate to a tuition increase of $5,000 or $8,000 over a five-year period by 2030.

Any tuition hikes would primarily affect middle class students: 60% of Cal State’s undergraduates don’t pay tuition because they receive state and campus grants due to their low family incomes.

The middle class families most affected are getting more financial aid through the state’s new expanded Middle Class Scholarship.

CSU’s California students are charged an average of $7,550 for tuition and fees, among the lowest in the country; the national average for public universities is nearly $11,000. And because of state and campus financial aid, more than half of students don’t pay any tuition. The CSU already routes one third of its budget to student aid.

At least one lawmaker who has pushed aggressively for more student financial aid told CSU officials to increase tuition rather than coming to the state for more money, especially as the state faces a $31.5 billion budget hole.

“There’s something you can do which is moderate and predictable,” Assemblymember Kevin McCarty, a Democrat from Sacramento who is chairperson of the budget subcommittee on education, said during a March hearing. “You can do what the UC did.”

Worker frustration

The CSU needs money now, in no small part due to workers signaling they’re ready to go on strike if they don’t get raises soon.

Scores of educators and other staff assembled outside the CSU headquarters Tuesday in Long Beach to kick off a “summer of solidarity” among CSU unions. Several dozen poured into the public gallery during the trustees meeting Tuesday. For most of the nearly two-hour public comment period, union members inveighed against unfair pay and stalled labor contract negotiations with CSU officials.

“We’re here to sound the alarm, trustees, because we are on a collision course with a labor dispute of historic proportions,” Jason Rabinovitz, top officer for Teamsters Local 2010, told CSU trustees Tuesday. “And the reason is that you’ve been paying workers too little for too long and the situation is coming to a head.”

Kevin Wehr, California Faculty Association’s Vice President and Professor at California State University – Sacramento, speaks to Presidents at CSU, Leadership, and the Board of Trustees during public comment to ask for fair wages outside the CSU Chancellor’s office in Long Beach on May 23, 2023. Photo by Lauren Justice for CalMatters

The faculty union, the largest within the system representing about 30,000 workers, wants 12% raises across the board for this fall.

That would cost the CSU $318 million more annually, a system spokesperson wrote.

But the faculty union argues the CSU has the money. Its research team points to the $472 million in excess revenue above costs that the system generated in 2021-22.

“Any surplus is considered one-time reserves,” CSU spokesperson Amy Bentley-Smith wrote in an email. “Salary increases are ongoing, and using one-time reserves to pay ongoing costs is not fiscally prudent.”

“We’re here to sound the alarm, trustees, because we are on a collision course with a labor dispute of historic proportions.”

— Jason Rabinovitz, top officer for Teamsters Local 2010

The union leadership also flags at least $2 billion that the CSU has placed into its investment accounts since 2022, wondering where that money came from and why it can’t be used for wages and educational expenses instead.

Bentley-Smith pointed CalMatters to a CSU explainer on its investment and reserve strategies. “Designated balances and reserves accumulate annually primarily from tuition, fees, and other revenues in excess of annual expenses,” the explainer reads. The money is meant to support campuses in times of economic downturns and natural disasters, as well help cover “student housing, campus parking, student unions, health facilities, university and educational operating activities, among others.”

Could the faculty union strike by this fall?

“It’s not off the table,” said Kevin Wehr, vice president of the union and a professor of sociology at Sacramento State.

“Salary increases are ongoing, and using one-time reserves to pay ongoing costs is not fiscally prudent.”

— Amy Bentley-Smith, CSU spokesperson

Staff unions demand the CSU adopt the findings of an independent report — funded by lawmakers — that would place staff on salary steps consistent with their skill and experience. The so-called Mercer report found that Cal State staff earn about 12% less than workers in their fields at other job sites and campuses.

Doing so would come with a series of 5% raises. Such an overhaul would cost the CSU $287 million in its first year and nearly $900 million annually after a decade. Staff unions say the CSU is only offering 2% raises.

“I’m living off of credit cards at this point,” said Dennis Sotomayor, 52, a member of Teamsters Local 2010 union who works as a maintenance mechanic at Cal State Los Angeles. He earns about $60,000 a year, he said.

State support already high

Cal State’s fiscal shortfall comes even despite a recent pledge by Gov. Gavin Newsom to provide it with five years of 5% growth in state support for the system’s operations, totaling more than $1 billion. Newsom has made identical promises to the UC.

Despite the massive state budget deficit, Newsom is still promising the second installment of those raises for the 2023-24 fiscal year, which he and lawmakers must approve by the end of June.

Newsom could have won himself more political points with unions by specifying that his 5% raises should go to employee pay and benefits, a senior aide told CalMatters. But Newsom didn’t do that, giving CSU leadership the task of figuring out where the money should go.

The faculty union has written to Newsom asking that a fixed amount of any state support go directly to student instruction, which would benefit faculty.

“We have to set the (university) systems up for success to serve all aspects of each of their respective ecosystems,” said Ben Chida, chief deputy cabinet secretary for the governor and who oversees education policies. “And that can’t be a decision that gets nickeled and dimed out of the governor’s office.”

Enrollment uncertainty

Further crimping the system’s finances is a sudden drop in enrollment: The state gives money to Cal State for every California undergraduate it enrolls.

Enrollment is also tied to tuition. At current rates, tuition revenue will drop 9% by 2030 if the CSU loses about 2% of its students annually — the same rate of projected enrollment loss at California’s high schools.

From left to right, students Gursirat Kaur, Prabhjot Kaur and Ramit Johal walk across campus to their next class at Fresno State in Fresno, on Feb. 7, 2022. Photo by Larry Valenzuela for CalMatters

The system chancellor’s office has already devised a plan to pull some state funding from under-enrolled campuses to instead flow to campuses that are meeting their enrollment targets. If that incentive prompts campuses to recruit more students, then an annual 1% growth in enrollment boosts tuition revenue by 5% by 2030, the report said.

But with a national slowdown in students heading to college, there may not be enough students to go around. Plus, educating students is more expensive than in previous years, as today’s college learners are typically lower-income and require more financial aid and money for sudden homelessness, chronic hunger and mental health support.

“There’s been a historical shift in services provided by the county and state that are now the presumed obligation of higher education,” the report said. “While the kinds of services provided to our students are fundamental and necessary, they have come at a cost not fully reimbursed by the state or federal government.”

###

CalMatters.org is a nonprofit, nonpartisan media venture explaining California policies and politics.

CLICK TO MANAGE