It’s been a stormy week on the Lost Coast.

How do you prepare for financial storms that life will inevitably bring?

One of the best ways is through building an emergency fund. This is step one in personal finance, and the training wheels of money management. Let’s use an educator’s interrogative grid to nail down the fundamentals.

Who? Answer: YOU. You should have an emergency fund. Whether you are old or young, retired or still working, a seasoned or amateur investor, everyone should have one.

Why? It protects you from having to go into debt when life throws you a curveball. Jobs are lost. Vehicles break down. Earthquakes break things. Medical problems seemingly arise out of nowhere. When these kinds of events occur, you can run to your fund instead of giving in to the allurements of the credit card.

The “whys” don’t have to all be reactive though. Emergency funds can help prepare you to proactively not “stay stuck” and give you a pathway to switching careers or moving to a new place.

What? This is not an investment account. Boredom is the goal. The important thing is: it should be risk-free. Avoid investment risk and avoid terms that have penalties for withdrawal. Remember the reason for an emergency fund is so that the money is there when you need it and not at a value less than what you started with.

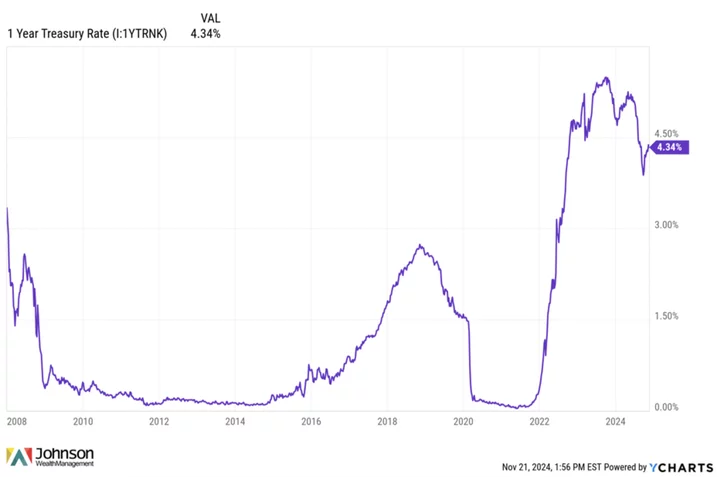

Where? Not in your checking account, that’s for sure. Normally the money should be earning interest in an FDIC-insured account, money market, or high-yielding savings account. After all, the current interest rate on “safe” money, which can follow US Treasuries, is higher than it has been for many years.

Click to enlarge

The key is to make your emergency fund easy—but not too easy—to access. Therefore, you might consider putting it in a high-interest savings account at a different bank than the one you regularly use as a psychological buffer. This helps you think twice before pushing the button to transfer it into your checking.

When? NOW. If you don’t have one, don’t wait another minute to start one. Go to your local bank or look for an online one. You could start setting one up faster than reading this article.

How? There are two of these Hs: how should I build this fund and how much should I put in it?

The answer to the first question is: set up an automatic withdrawal amount each month. Whether it is $50 or $500, this should automatically be set up monthly. If you make it manual, human nature will kick in and suddenly months will slide by without the account accumulating.

The answer to the second question is a bit more debatable. Three to six months of living expenses seems to be the standard. Some even say a year’s worth. I say, start with one month and build from there.

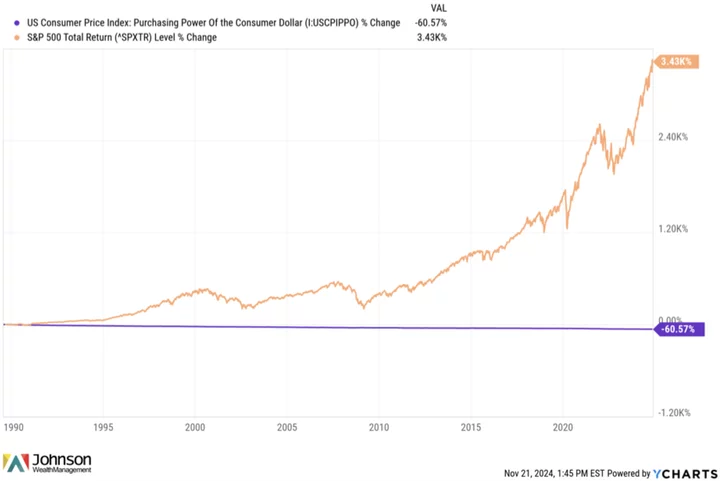

But if you’ve built past a year or two into multiple years, you’ve likely moved away from an emergency fund into an “End of the World” fund. The error of this is that your fear of risk is now munching away at your fund’s value by the stealthy inflation monster. You may need to consider investing.

After all, emergency preparedness can be a virtue, but it can also become an addiction that is a vice. This occurs when it’s no longer about preparing for crisis, but about control.

A significant part of life is engaging in risk. Safetyism can be a disease. Or, as the authors of The Coddling of the American Mind write: a cult.

Safetyism is the cult of safety—an obsession with eliminating threats (both real and imagined) to the point at which people become unwilling to make reasonable trade-offs demanded by other practical and moral concerns.1

While the authors are focused on how this way of thinking impacts children and the next generation, it can be applied in finance too. Being so obsessed with safe investments and anticipating the next emergency can hijack your future. It makes you think you’re planning for the future, when you actually aren’t. Safety, to use the word of Gollum, can be “tricksy” like that.

You can sit in government bonds forever or have cash in your local bank till kingdom come. Inflation will still eat it. You can put your money in a safe inside your house inside your gated community, and it will do just that—sit there.

Investing in stocks has been one of the best ways to beat inflation. While the purchasing power of the dollar has dropped significantly through the decades, the US Stock Market has done quite well.

Yes, prepare for the storms of life and have and emergency fund, but don’t make that your only long-term financial plan.

# # #

Sources:

- 1 Greg Lukianoff & Jonathan Haidt, (Penguin Books, 2019), p. 32.

Brandon Stockman has been a Wealth Advisor licensed with the Series 7 and 66 since the Great Financial Crisis of 2008. He has the privilege of helping manage accounts throughout the United States and works in the Fortuna office of Johnson Wealth Management. You can sign up for his weekly newsletter on investing and financial education or subscribe to his YouTube channel. Securities and advisory services offered through Prospera Financial Services, Inc. | Member FINRA, SIPC. This should not be considered tax, legal, or investment advice. Past performance is no guarantee of future results.

CLICK TO MANAGE