Fear sells.

Not just in marketing, but in the markets.

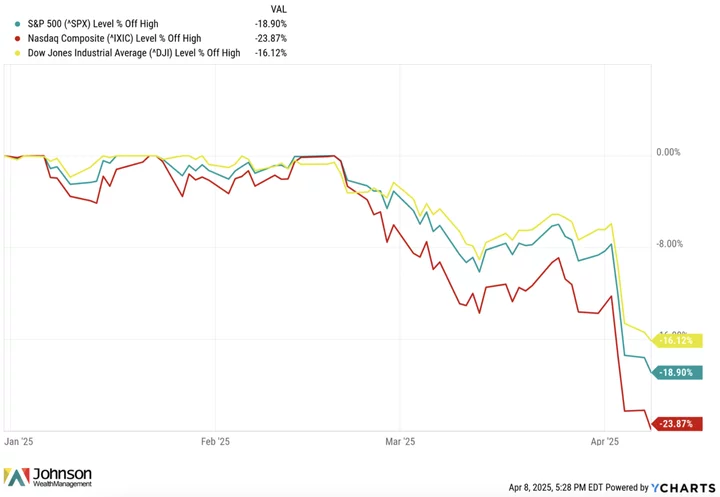

President Trump’s “Liberation Day” occurred last Wednesday in the Rose Garden, and the stock market did not get the liberating memo. Stocks followed up with their worst day since the pandemic in March of 2020, and the sharp selling has escalated dramatically. Bespoke research notes,

4,915 is bear market territory for the S&P. The S&P is at 4,920.

On pace for the 3rd fastest 20%+ drop from an all-time high in market history. COVID and 1929 were the only ones faster.¹

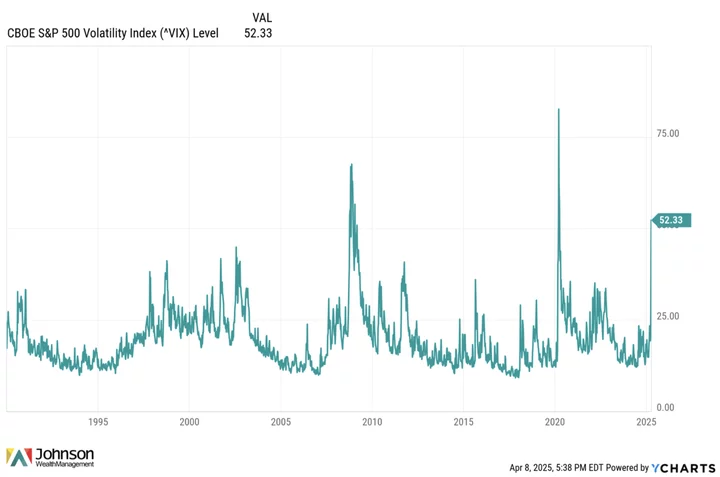

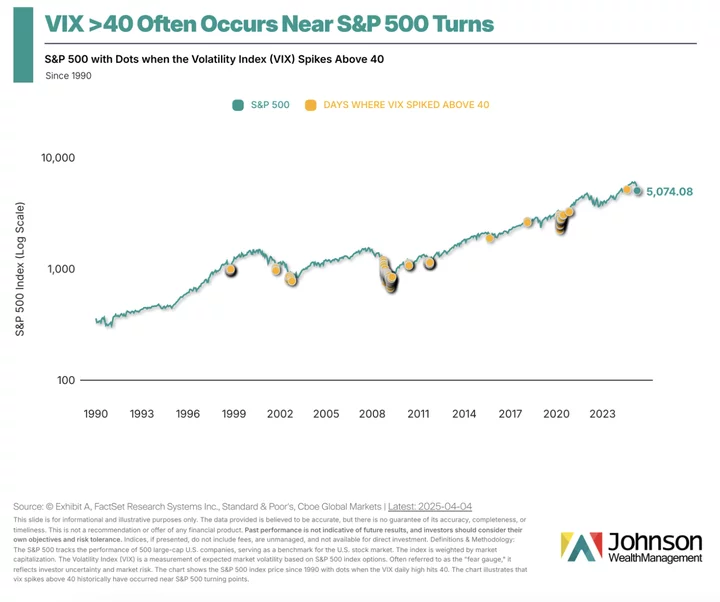

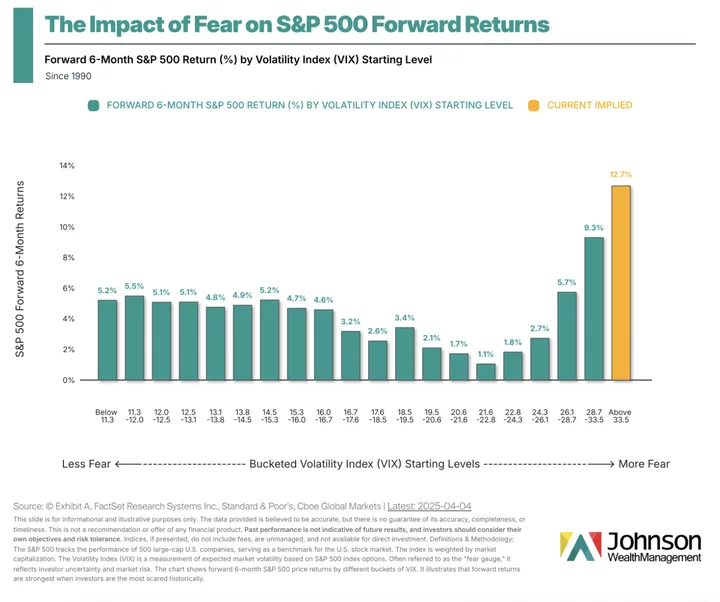

The selling of stocks due to fear within investors is pervasive and palpable. The VIX index—what some call the “fear gauge” that measures volatility on Wall Street—has spiked to levels not seen since the days of COVID and the Great Financial Crisis (though it has not quite reached those heights).

This trepidation is driven by uncertainty. Uncertainty around tariffs and their impact on the American economy. Uncertainty around whether companies can or will issue forward guidance in the upcoming earnings season when they don’t know what the costs might be.

All of this creates a concoction that, as even conservative economists like Thomas Sowell say, “is a formula for having people hang on to their money until they figure out what you’re going to do” and, if it continues over the long-term, has had negative results historically.²

Will the President of the United States and the author of The Art of the Deal negotiate a result in the short-term that works for the long-term? Whether you agree with it or not, this is the administration’s argument.

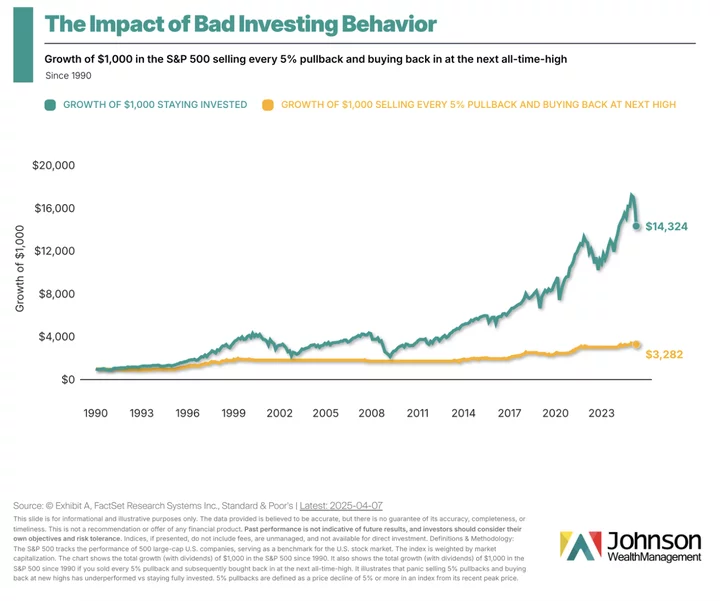

Investors should be careful in trying to guess what the market may or may not do based on the constant stream of news updates. If you change your portfolio as much as the news changes on tariffs, you might make a trade that is more contingent on the present than where you want to be financially in the future—and drive yourself a little bonkers all along the way.

Jason Zweig, the wise financial writer from the Wall Street Journal, captured this reality and issued a caution to investors in his column last Friday:

If you overhaul your entire portfolio in response, you aren’t just acting as if you know what the market is going to do next, which is close to impossible. You’re also acting as if you know what Donald Trump is going to do next—which is impossible.³

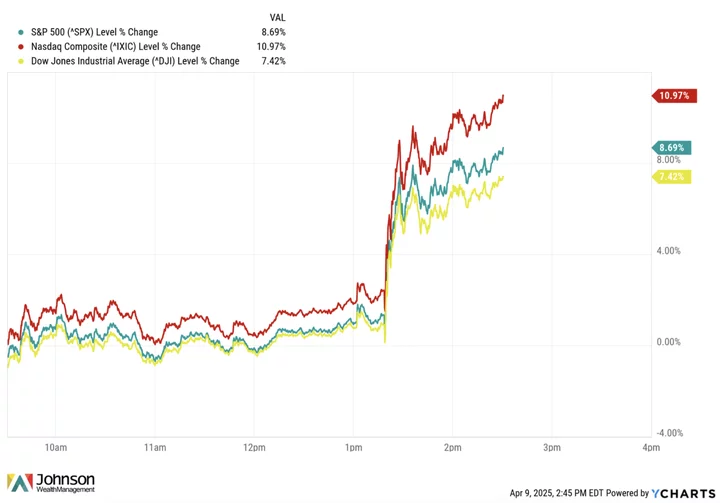

Speaking of the President, literally as I’m writing this, news has broken of a pause on some tariffs and the market is soaring.

It’s totally normal right now to be fearful and curious as to where “the bottom” is in the markets and wonder if this most recent news was it. But allow me to let you in on a secret: that is virtually unknowable.

This may mean that in order for you to be a good investor, you need to think about decreasing your intake of news and social media. A dopamine-driven culture does not form durable investors let alone resilient humans. Nor does surrounding yourself with constant pessimism. As one investor put it, “The greatest trick the devil ever played was making you believe that the pessimists are the good guys.”

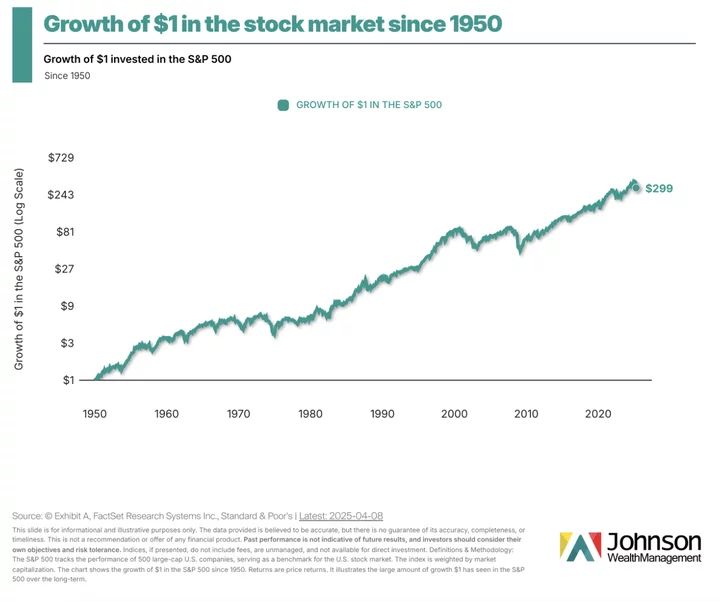

US stock market history is replete with pockets of short-term pain and a plethora of long-term gain.

One thing we can know right now is that in the past when volatility spikes, recoveries can follow.

One must be realistic though.

Notice how those can cluster. This means the downtrend can last awhile.

The good news is that this kind of fear has historically been followed by excellent returns.

Treat stock market volatility as the regular subscription price you pay for investing for long-term returns. Those who want higher returns will need to treat market swings as an integral feature of investing.

It’s just the way it works.

Of course, this does not mean that everyone should be in stocks. Some have short-term financial needs or simply cannot handle it. Times like this are a good reminder of the necessity of risk management.

Here is something to keep at the forefront of your mind in all this.

Life is not determined by a bad few months. Nor is your investment life.

Investment portfolios and financial plans don’t normally survive making erratic trades.

Be careful that you don’t make an investing mistake now based on fear that leads to financial regret later.

# # #

Sources:

- Posted by @bespokeinvest on April 8, 2025 via X. Accessed online:

- “Thomas Sowell Discusses the Trump Tariffs” in an interview with Hoover Institution on April 2, 2025.

- “Trump Just Shredded the Economic Playbook: Here Are Your Next Investing Moves” (April 4, 2025).

# # #

Brandon Stockman has been a Wealth Advisor licensed with the Series 7 and 66 since the Great Financial Crisis of 2008. He has the privilege of helping manage accounts throughout the United States and works in the Fortuna office of Johnson Wealth Management. You can sign up for his weekly newsletter on investing and financial education or subscribe to his YouTube channel. Securities and advisory services offered through Prospera Financial Services, Inc. | Member FINRA, SIPC. This should not be considered tax, legal, or investment advice. Past performance is no guarantee of future results.

CLICK TO MANAGE