A dog took me out at the knees last November. It was painful but provided me with investing illustrations galore.

I like to run, and at the beginning of one of my routes, I found myself knocked to the ground with a moving creature enveloping me. I didn’t see it happen. I felt it happen. The stock market is like that. The triumph and terror of sudden volatility.

That’s the risk one takes when exercising with AirPods blasting music straight into your cochlea.

Noise can be distracting for runners and investors. Our attention is caught up in our favorite news channel or podcasts. And sometimes their investment opinion doesn’t play out the way we think in our portfolios.

Back to the dog.

Having been bitten before as a teenager, I immediately prepared myself for another munching.

Thankfully, it turned out to be one of those annoyingly anxious yet otherwise amiable dogs that enjoys a jog whenever its owner arrives home from work. Thrilled to be outside, to release the pent-up energy of being enclosed all day, the dog found another human running too. So the pooch, in all its tail-wagging canine glee, decided to come with. What it meant by “come with” was come in-between each of my moving legs.

The good news is I didn’t lose any more skin than I had already lost from the fall. I had not been bitten.

The happy beast proceeded to flee down some other street on its merry way through undiscovered neighborhoods. I, on the other hand, can assure you that if I had a tail, it would not have been wagging.

I stood up feeling the pain that comes from a 45-year-old body being flattened to the cement with an elbow gashed and hip bashed.

The pet parent said, “Are you alright?”

I paused and glared, replying, “I’ll know in a few minutes.”

I was silent, shaking my head, eyes shooting anger beams.

Let’s be honest. The only thing worse than seeing the infamous dog is seeing the owner of said dog.

What you really want to say in that moment is a sarcastic, “What do you think?” Or something uglier that sounds like this looks: “!#%$@&^!”

Have you ever said that to your investment portfolio or CNBC in the middle of a crashing market?

By God’s grace, I kept it clean, and eventually announced, “I’m all right.”

I also had a choice to make: walk home limping, nursing my wounds, or continue running a 5K before the soreness got worse.

This decision mirrors what every investor must do when facing inevitable market declines—sell, sit, or buy more.

I chose to run.

Earlier that day, I had been speaking to a client about market risks—specifically how sometimes it’s the things that no one sees coming that derail the stock market. That was not a prediction. It was simply a risk management conversation that a financial advisor must have, especially when markets are soaring. Everyone embraces risk when stocks are rising. They don’t like it so much when the market takes a beating.

Here’s the thing: Stocks don’t always go up.

Sometimes things can hum along wonderfully when seemingly out of nowhere a correction—or even a crash—comes. In investing parlance, we don’t call these dogs; we call them Black Swans—rare, unexpected events that carry significant impact.

These events, like my canine encounter, can appear without warning and knock you off your feet.

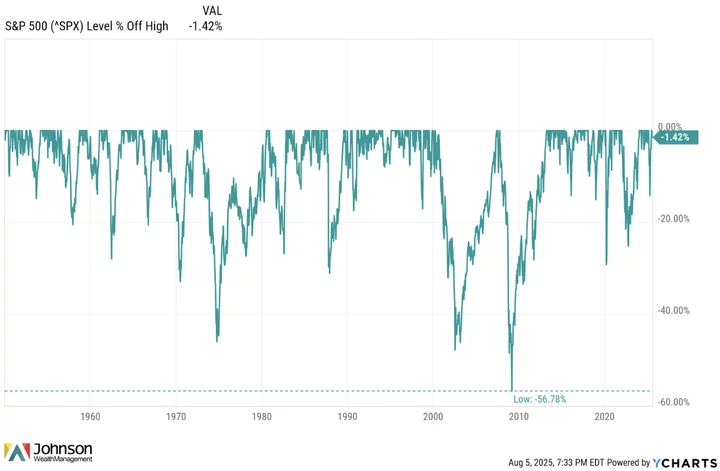

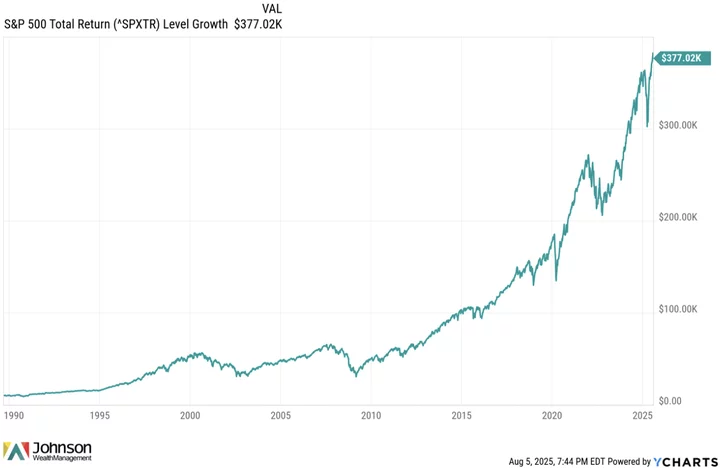

The S&P 500, our primary benchmark for U.S. large-cap stocks, has experienced many knockdowns over the last three quarters of a century:

Significant market declines will happen again. When? Who knows.

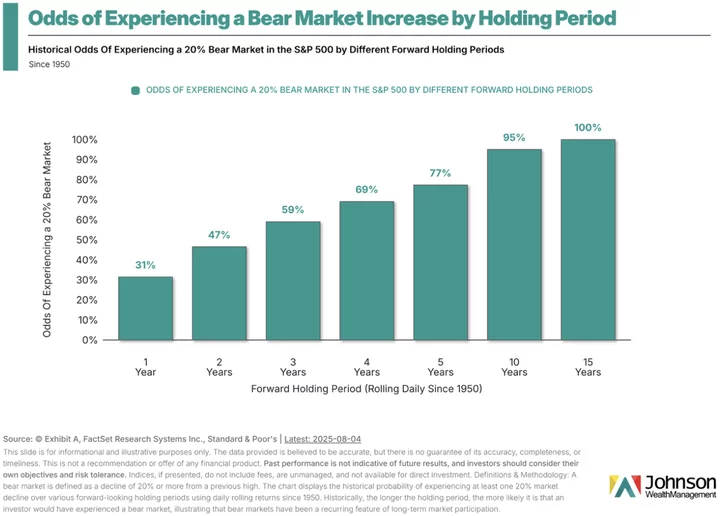

But they will. In fact, your odds of experiencing them increase over an investing lifetime.

The critical question isn’t if disruptions will occur, but rather: will you keep investing? Or will you quit, take your bag and go home?

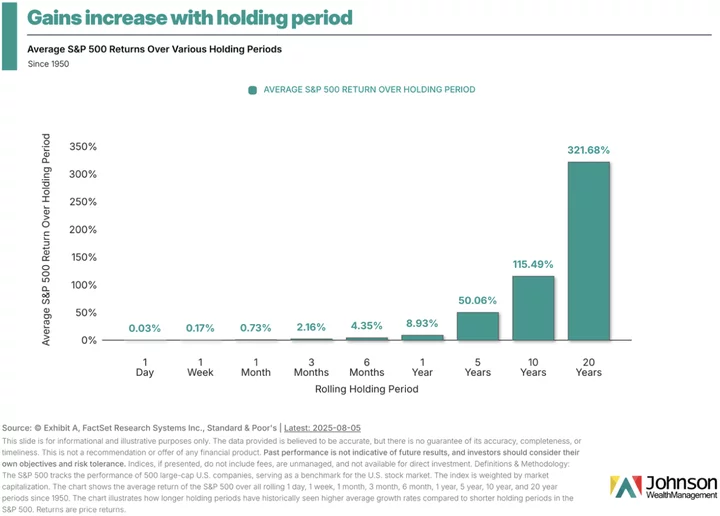

You see, while the odds of facing a 20% or more decline increase the longer you hold stocks, the odds of significant average returns also increase the longer you hold stocks.

Fitness goals demand discipline, so do financial ones. Reality bites—or at least knocks you over—sometimes. Successful investors play the long game anyway.

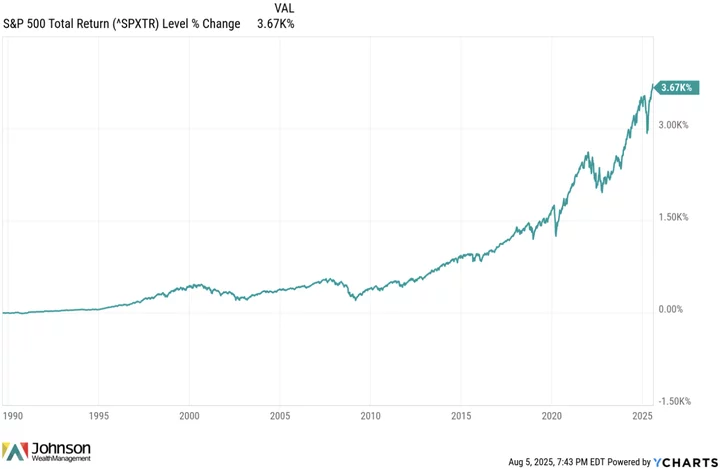

This is not a forecast of doom and gloom. History shows that optimistic investors have triumphed over the long haul in the U.S. stock market.

By far.

Since 1990, the S&P 500 has experienced a total return of a whopping 3,670%.

Translation: Investing $10,000 in 1990 would be hundreds of thousands of dollars today.

Terrible bear market declines don’t look as terrible over several decades.

But they still hurt when you are in the middle of one watching your portfolio get taken out.

So, what can you do? Know your financial goals, understand your risk tolerance, study your stock market history, and maintain appropriate diversification and guardrails.

Life is risky. Running is risky. Investing is too—and there are no guarantees for future outperformance.

But I choose to keep running. The physical and mental payoffs have been a blessing.

Those who have kept investing through the bumps and bruises have likely been blessed too.

But my goodness, the bruises along the way can hurt. I had a colossal and colorful hematoma for months and even now if someone touches my side, I cringe a bit.

This shouldn’t surprise us.

There is no good story—or financial story—without getting knocked down.

The question is: Will you keep investing?

# # #

Brandon Stockman has been a Wealth Advisor licensed with the Series 7 and 66 since the Great Financial Crisis of 2008. He has the privilege of helping manage accounts throughout the United States and works in the Fortuna office of Johnson Wealth Management. You can sign up for his weekly newsletter on investing and financial education or subscribe to his YouTube channel. Securities and advisory services offered through Prospera Financial Services, Inc. | Member FINRA, SIPC. This should not be considered tax, legal, or investment advice. Past performance is no guarantee of future results.

CLICK TO MANAGE