No one knows the future.

But every single year, Wall Street strategists like to pretend they do.

This year is no different.

Yardeni Research summarizes several year-end forecasts for the S&P 500 (the stock market index for the largest US companies) that range from an annual investment return of essentially 0% to 18%.¹

Bloomberg puts together a summary of even more 2025 investment outlooks. They report the overall findings of over 50 financial institutions for the US stock market:

Pretty much every institution warns investors not to expect another year of equity returns topping 20%, just like they did a year ago. But few are ready to call an end to the artificial intelligence-fueled stock boom. BNY believes “AI’s role in the world will surpass that of other technologies that propelled earlier periods of tidal change.” While no one else quite matches that bullishness, many expect gains to broaden as adoption of the tech spreads.²

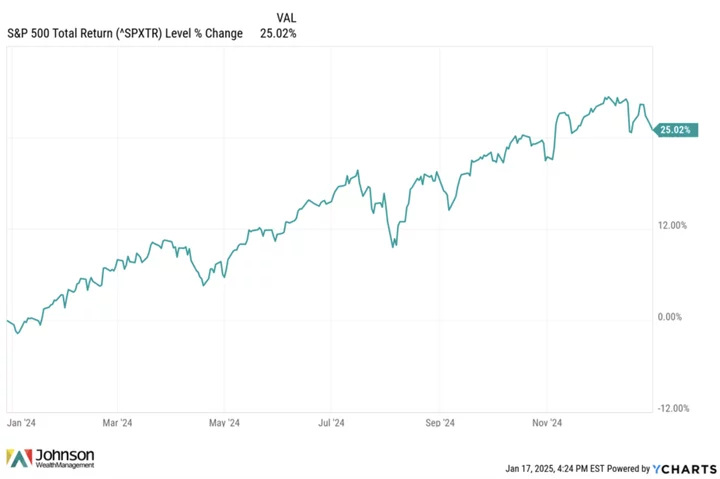

Last year, the S&P 500 had its second year in a row of being up over 20%.

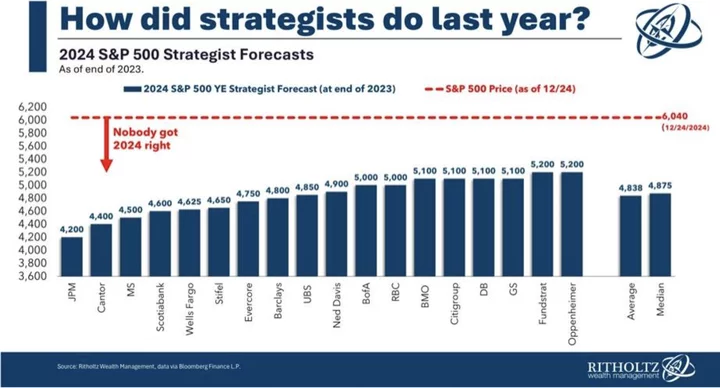

How did the investment forecasters perform in 2024? Not nearly as good as the market.

Here is a chart from Ritholtz Wealth Management with data from Bloomberg³:

Strategists were nowhere close to predicting how stocks performed.

This kind of thing led Warren Buffet, who is ironically called the Oracle of Omaha, to write things like this back in 1993:

Even now, Charlie and I continue to believe that short-term market forecasts are poison and should be kept locked up in a safe place, away from children and also from grown-ups who behave in the market like children.⁴

We still haven’t learned our lesson. Human beings love prophets and experts, especially when they mix and talk about money.

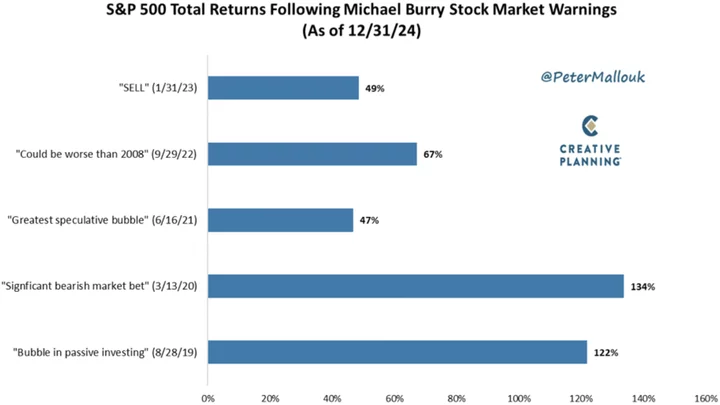

Furthermore, Wall Street enjoys anointing individuals who got one crisis right in the past to make headlines for predicting what may go wrong in the future.

Michael Burry, who foresaw some of the 2008-2009 financial crisis, illustrates this. Since then, he has made several calls about the stock market, that have proved outrageously wrong.⁵

Let’s not pick on an individual like Burry too much.

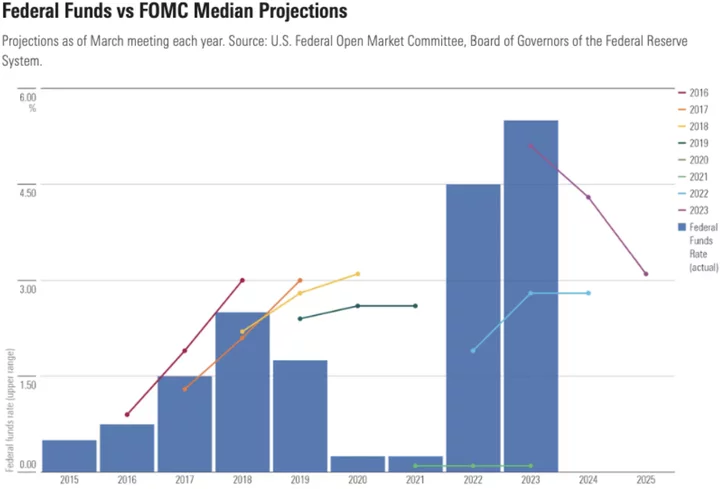

Wall Street firms, big banks, and individual traders aren’t the only ones bad at predicting the future.

The Federal Reserve is too.

Though they set the Federal Funds rate, they have a hard time projecting where the rate will be in the future.⁶

One wonders how numbers for all the above forecasts get picked. I’m sure there is all kinds of mathematics and data analysis, but it can be curious.

Did Bank of America really run all their analysis for 2025 and out popped 6,666? Or were some brilliant, snarky analysts having some apocalyptic fun while crunching numbers with the biblical book of Revelation over lunch?

Here is the point: predicting the future is hard, so don’t get too caught up with investment forecasts no matter where they come from and no matter how fancy the pedigree.

Jason Zweig, a columnist for the Wall Street Journal, zeroes in on what investors should be concerned about while considering their financial future at the beginning of a new year:

“The beginning of the year is the best time to think not about the next 12 months, but all the years to come.”⁷

# # #

Sources:

1. “Wall Street’s S&P 500 Targets”. Accessed online: https://yardeni.com/charts/wall-streets-sp-500-targets/

2. “Here’s Almost Everything Wall Street expects in 2025”, published by Bloomberg on January 1, 2025. Accessed online: https://www.bloomberg.com/graphics/2025-investment-outlooks/

3. Chart from Barry Ritholtz, “Nobody Knows Anything,” Wall Street Strategist Edition”, January 2, 2025. Accessed online: https://ritholtz.com/2025/01/nobody-knows-anything-strategist/

4. March 1, 1993. Accessed online: https://www.berkshirehathaway.com/letters/1992.html

5. Peter Mallouk on X published January 1, 2025. Accessed online: https://x.com/PeterMallouk/status/1874614477666361412

6. Sarah Hansen, “Why Is Everyone Always Wrong About the Fed?”, published by Morningstar on January 26, 2024. Accessed online: https://www.morningstar.com/markets/why-is-everyone-always-wrong-about-fed?utm_source=substack&utm_medium=email

7. “How You Can See Through Wall Street’s Ritual of Wrong,” January 10, 2025. Accessed online: https://www.wsj.com/finance/investing/stock-market-forecast-ritual-of-wrong-add89428?mod=hp_lead_pos11

# # #

Brandon Stockman has been a Wealth Advisor licensed with the Series 7 and 66 since the Great Financial Crisis of 2008. He has the privilege of helping manage accounts throughout the United States and works in the Fortuna office of Johnson Wealth Management. You can sign up for his weekly newsletter on investing and financial education or subscribe to his YouTube channel. Securities and advisory services offered through Prospera Financial Services, Inc. | Member FINRA, SIPC. This should not be considered tax, legal, or investment advice. Past performance is no guarantee of future results.

CLICK TO MANAGE