I talk a lot about stocks. What about bonds? Should you own them in your investment portfolio? Like questions about whether you should own any investment, it depends.

When you buy an individual bond, you are essentially lending money to a corporation, government, or municipality, and they are paying you a fixed interest rate (this is why they fall in the “fixed income” investment category) for borrowing your money. They also promise to pay your principal back on a specific date in the future as long as they stay solvent.

When you buy a bond fund, you are buying a basket of individual bonds in bunches. While you do not get the principal protection, you do receive the income along the way from your diversified basket of bonds. You also must accept the price fluctuation over time with the expectation that the value of the fund may be worth more or less when you liquidate it.

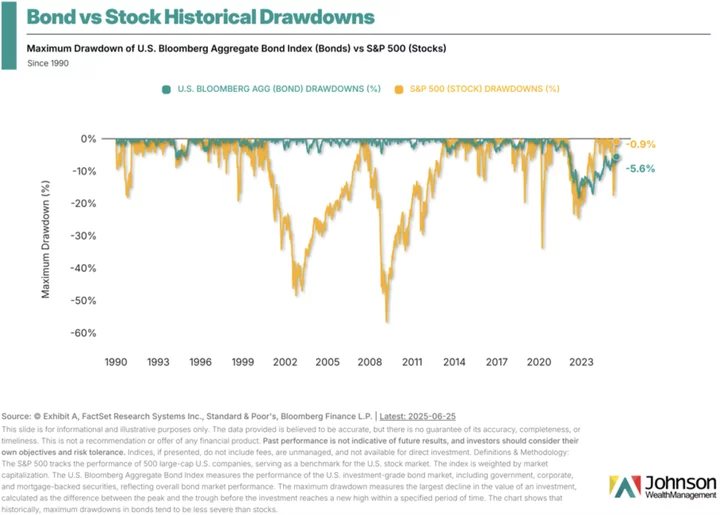

Generally speaking, bonds primarily hold the place in a portfolio of producing income with lower volatility than stocks.

(Click graphics to enlarge)

Oftentimes, people diversify between stocks and bonds because the appropriate mix can serve as a remedy for panicking in a stock market selloff.

An investor can only go so far like character Bob Wiley in What About Bob? nervously repeating: “I feel good, I feel great, I feel wonderful… I feel good, I feel great, I feel wonderful… I feel good, I feel great, I feel wonderful…” over their portfolio when stocks tank.

You’re fine, until you’re not.

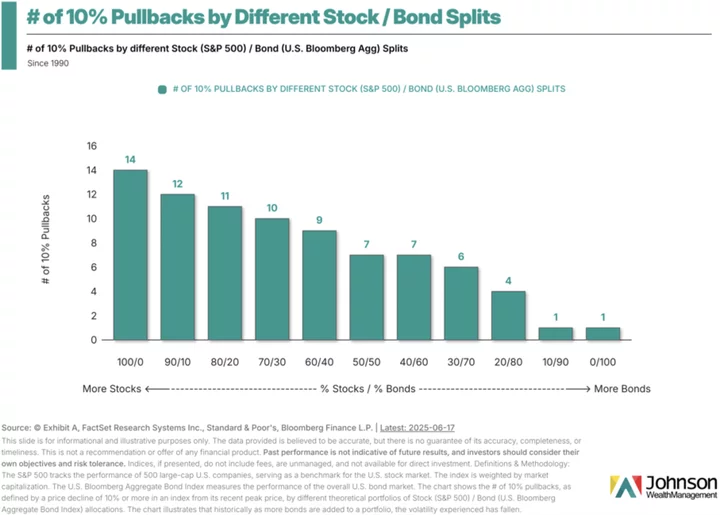

The more bonds within a portfolio, the fewer the large pullbacks to said portfolio:

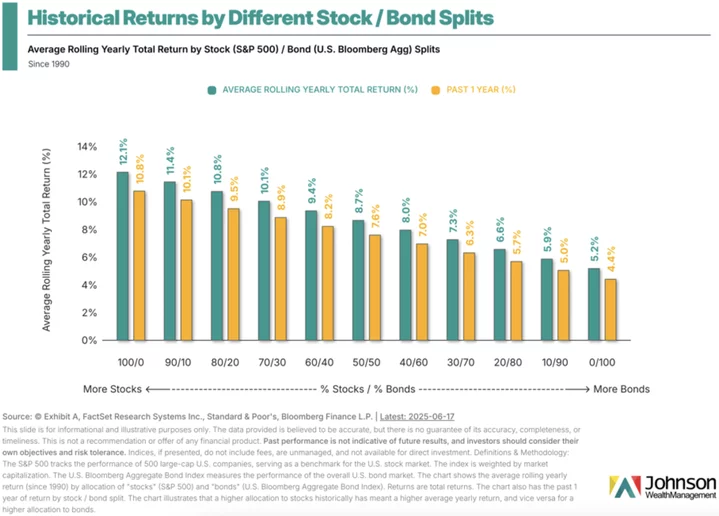

Of course, it likely puts a ceiling on total return:

If you are looking for higher growth, you accept the higher volatility of stocks; if you are looking for a more precise, steady stream of income, you accept the likely lower investment return of bonds to experience lower volatility.

In one of his recent memos, famed fixed income investor Howard Marks, answered this tradeoff question this way:

Which of the two is “better,” ownership or debt? We can’t say. In a market with any degree of efficiency – that is, rationality – it’s just a tradeoff. A higher expected return with further upside potential, at the cost of greater uncertainty, volatility, and downside risk? Or a more dependable but lower expected return, entailing less upside and less downside? The choice between the two is subjective, largely a function of the investor’s circumstances and attitude toward bearing risk. That means the answer will be different for different investors.¹

Investopedia has the historical returns of both since 1928:

The historical returns for stocks have been between 8-10% since 1928. The historical returns for bonds have been lower, between 4-6% since 1928.²

That may not seem like much of a difference, but over time, due to inflation, the difference can be staggering.

If inflation is roughly 3% a year, this means that stocks may have a real return between 5-7% while bonds may have a real return between 1-3%.

This vindicates the maxim that being an owner is more profitable than being a loaner. You may make more money being an owner of stocks, but you also might have more indigestion.

Bonds can hand out their own stomach aches, though. Notice the large drawdown in bonds that the first chart shows, which occurred in 2022 due to an inflation and interest rate spike.

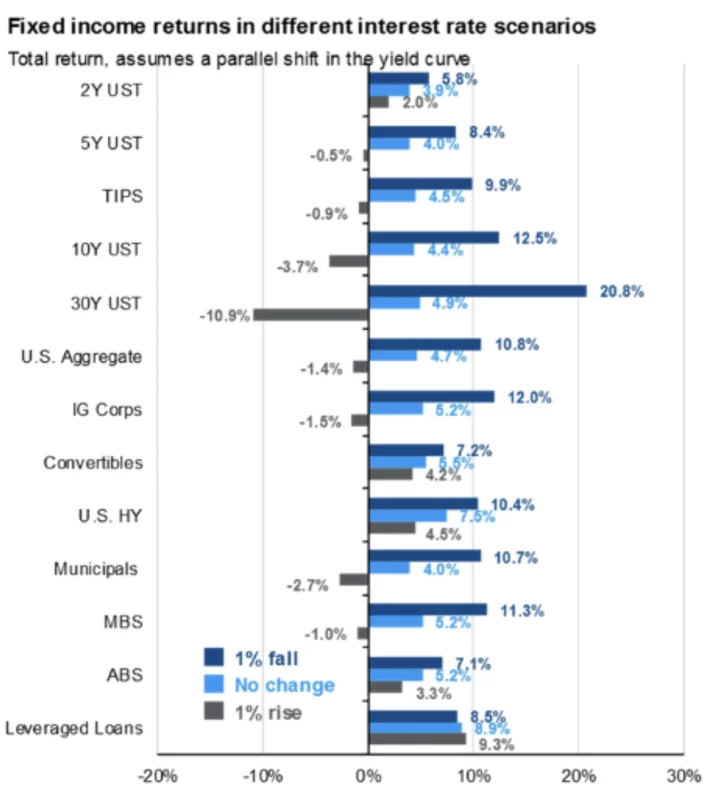

Interest rates are one of the most important risk factors for bonds. This chart from J.P. Morgan shows the impact of the ups and downs of interest rates on bonds³:

Notice how the longer the term of the bond, the more impact a 1% change can have on rates. While a 1% interest rate move on a 30-year treasury bond might send the price of that bond soaring 20% or declining 10%, the shorter the treasury bond’s term, the smaller the price shift.

What investments are best for you? No matter what asset class we are talking about, it depends upon your financial goals and life plan.

If you are buying a house in a year, you may not want to have that bucket of money in the ups and downs of the stock market. Instead, you might put it in a US Treasury bond backed by the US government to receive a fixed interest rate and receive your money back next year. If you are trying to retire 30 years from now, you may not want many bonds because inflation will eat into the real return of bonds, while the power of compound interest via stocks might grow your money significantly over decades. You could be in retirement now and may have a mix between the two along with other asset classes because you need income to live but also need growth to keep you going through a longer lifespan.

Overall, one of your goals is having an investment portfolio you can handle in the present amid the chaos of life and the world and one that sets you up for the future. Threading the needle in that tension is not easy.

Like Bob Wiley, take some baby steps in understanding the pros and cons of investing or get someone to help you along the way—just make sure it’s not a “professional” like Dr. Leo Marvin.

# # #

Sources:

- “Ruminating on Asset Allocation”, October 22, 2024.

- “Buying Stocks Instead of Bonds: Pros and Cons”, April 11, 2024.

- Chart taken from J.P. Morgan Asset Management’s “Guide to the Markets”, May 30, 2025, page 36.

# # #

Brandon Stockman has been a Wealth Advisor licensed with the Series 7 and 66 since the Great Financial Crisis of 2008. He has the privilege of helping manage accounts throughout the United States and works in the Fortuna office of Johnson Wealth Management. You can sign up for his weekly newsletter on investing and financial education or subscribe to his YouTube channel. Securities and advisory services offered through Prospera Financial Services, Inc. | Member FINRA, SIPC. This should not be considered tax, legal, or investment advice. Past performance is no guarantee of future results.

CLICK TO MANAGE