We used to live in a culture that suppressed emotions. Think John Wayne.

Now we live in a culture that expresses emotions. Think crying videos on TikTok.

This goes for the economy too.

Svend Brinkmann, a Danish philosopher and psychologist, leaning on the work of sociologist Eva Illouz who coined the term emotional capitalism, defines it as: “a culture of emotions, in which feelings play a significant part in personal transactions between individuals.”¹

This may be the case in corporate America and in our service economy, but feelings can be problematic if they lead an investor’s decisions about investing.

Expressing your authentic self about the stock market can be the worst thing you can do.

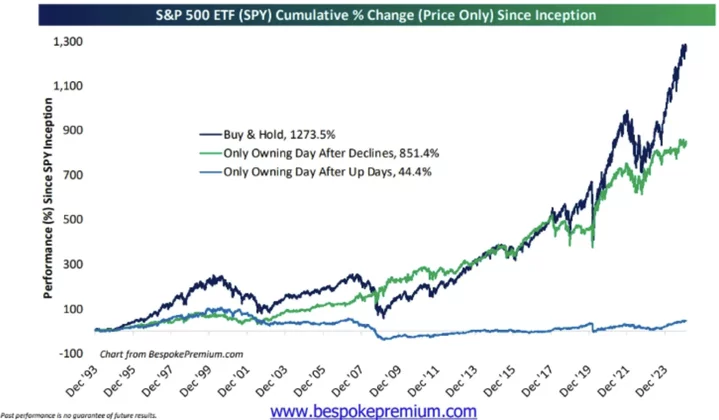

Bespoke research shows that since the 1990s only buying after down days has been far more profitable than only buying after up days.²

The reward of feeling bad after a down day and buying anyway, compared to the cost of only buying after an up day when you felt better, is stark.

Like by hundreds of percentage points.

This validates Warren Buffett’s famous line about trying to time the market in his 2004 letter to shareholders: “…if they insist on trying to time their participation in equities, they should try to be fearful when others are greedy and greedy only when others are fearful.”³

The thing is, when everyone else is fearful, it’s easy to be fearful, and when everyone else is greedy, it’s easy to be greedy. We all experience FOMO and loss aversion.

And we humans love a crowd.

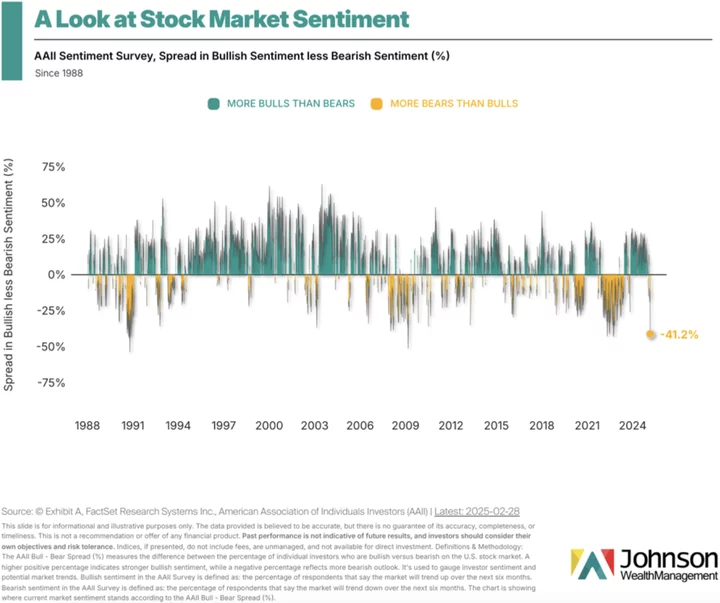

Recently, the crowd has mostly negative feelings about the stock market. Between concerns about tariffs and a drastic drop in potential first quarter GDP estimates over at the Atlanta Fed⁴, some market participants are spooked. This is captured in one popular survey from the American Association of Individual Investors (AAII) that shows the spread in Bullish sentiment (the stock market will go up!) less Bearish sentiment (the stock market will go down!).

Translation: there are a lot more bears than bulls right now.

Does that mean the stock market will drop significantly? Maybe.

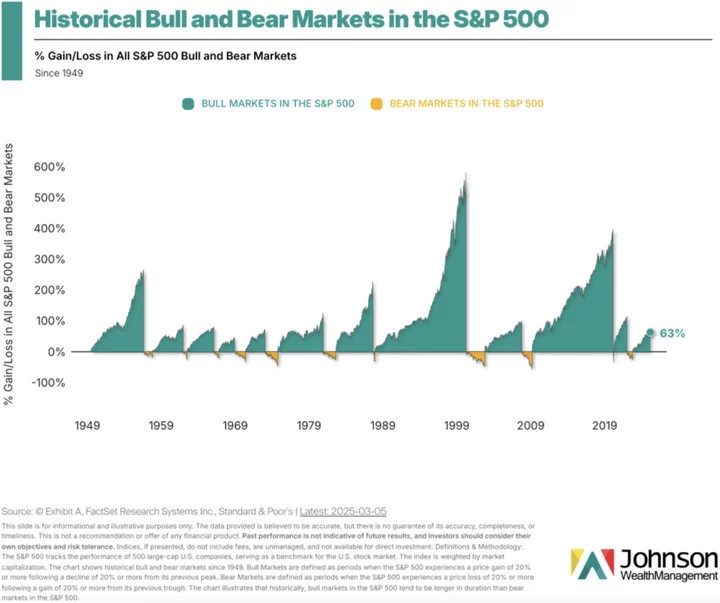

It should surprise no one when stocks go into a bear market (20% or more drawdown), as those have occurred over the past 150 years an average of every six years.⁵ If you only go back to the year that preceded the Great Depression, it’s an average of every four years.⁶

Therefore, if you don’t have an investment portfolio that can handle a bear market, you likely do not have the right portfolio.

Write that down. Put it on a sticky note next to your monthly statement or plaster it on your wallpaper on your computer.

The good news is that bear markets are often much shorter than bull markets.

Bearish sentiment can also be contrarian. Emotions can have an inverse relationship to stock market returns.

Sometimes when there are a ton of people negative about the stock market, the forward returns for the stock market can be quite good. For example, there are around 60% bears in that sentiment reading, which is quite high historically, and when that occurs, investment returns a year later can be quite good: up a median of 17.8% since 1990.⁷

How do you guard against the very human tendency to live by your emotions as an investor?

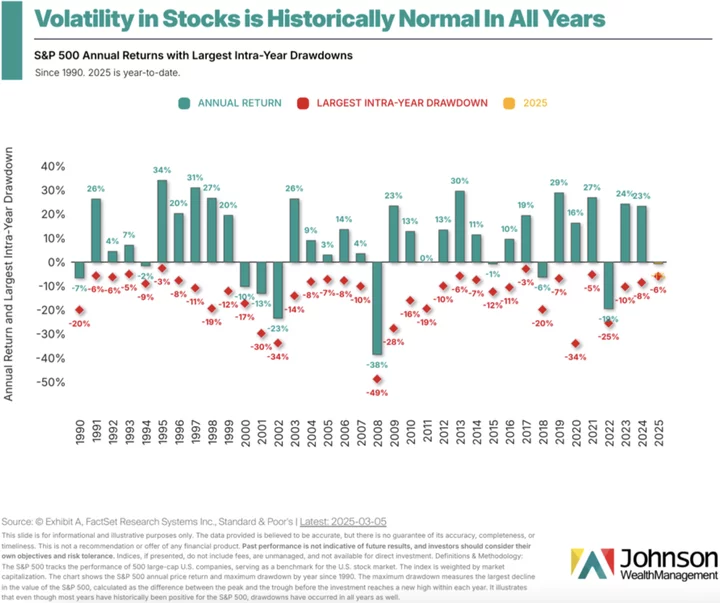

First, discipline yourself to remember that the market is volatile. This is easy to remember when stocks are falling, and not so easy when stocks are up. Don’t forget: volatility itself is the subscription price you pay in the stock market for investment returns.

Second, curate your media consumption. Don’t let the algorithm of your social networking or your favorite news channel dictate your investment decisions. Our willpower is often weak, and if your diet is constant fear, clickbait, and political bias, your portfolio may experience heartache.

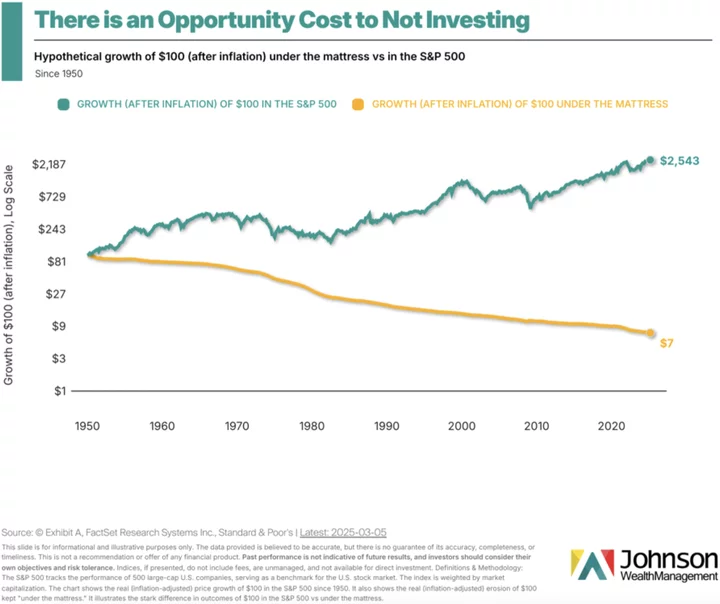

Third, invest according to your time horizon. If you need money quickly, the stock market can be a very dangerous place. If you are looking to beat inflation over the long term and don’t need it for many years, it has been one of the best places for investors’ money.

Fourth, consider automatic investing and dollar cost averaging in your financial plan. If it’s automatic, you will buy whether you feel like it or not and capture the dips, highs, and all the spots in between of the market over time.

Fifth, partner with a financial advisor that you trust. Those last three words are far more important than just hiring any financial advisor. Talk to people you trust about who they use. Look up the wealth advisor’s background through brokercheck.finra.org or adviserinfo.sec.gov. Ask a bunch of questions when you meet with the professional. Sometimes the best way to manage your emotions for you and your family’s financial journey is having someone help.

Emotions aren’t bad.

They are a gift.

But allowing them to govern your investment decisions can be financially disastrous.

###

Sources:

- “Stand Firm” (Polity Press, 2017), p. 64.

- Chart from Sam Ro’s column “It’s OK to have emotions—just don’t let them near your stock portfolio 📉” published March 2, 2025. Accessed online: https://www.tker.co/p/stock-market-performance-after-down-days

- Accessed online: https://www.berkshirehathaway.com/letters/2004ltr.pdf

- Accessed online: https://www.atlantafed.org/cqer/research/gdpnow

- “What Bear Markets Mean for You and Your Money”, published by Fidelity Smart Money on August 14, 2024. Accessed online: https://www.fidelity.com/learning-center/smart-money/bear-market

- “How Often Do Bear Markets Occur?”, published by Ben Carlson on February 11, 2024. Accessed online: https://awealthofcommonsense.com/2024/02/how-often-do-bear-markets-occur/

- Published 2/27 on X by Ryan Detrick. Accessed online: https://x.com/RyanDetrick/status/1895107530931474799/photo/1

###

Brandon Stockman has been a Wealth Advisor licensed with the Series 7 and 66 since the Great Financial Crisis of 2008. He has the privilege of helping manage accounts throughout the United States and works in the Fortuna office of Johnson Wealth Management. You can sign up for his weekly newsletter on investing and financial education or subscribe to his YouTube channel. Securities and advisory services offered through Prospera Financial Services, Inc. | Member FINRA, SIPC. This should not be considered tax, legal, or investment advice. Past performance is no guarantee of future results.

CLICK TO MANAGE