“Why?” is the perennial question. From philosophers to theologians to conversations between children and their parents, and now to the next generation of athletes, that deeply human question is being asked.

Recently, Nike switched up their marketing from “Just Do It” to “Why Do It.” Advertisers clearly felt that there was a vibe shift in the culture. They see a realignment from risk to hesitancy among young consumers.

In Nike’s own words about their latest ad campaign: “…the film stands as a challenge to the hesitant generation: Greatness isn’t handed out, it’s chosen—and sometimes the most important choice is to simply begin.”1

Nike’s not the only one identifying caution sociologically. From the impact of COVID to NYU professor Jonathan Haidt’s book The Anxious Generation, there seems to be an uptick in safetyism. This kind of ethos creates the questions the commercial asks: What if we just do it? Is it worth the risk of failure?

The ad, voiced by Tyler, the Creator, ends asking: “What if you don’t”?

I don’t mean to indict the up-and-coming generation. Every generation has its strengths and weaknesses. After all, I remember Bud Dry’s “Why Ask Why” campaign in the 1990s. That implied a dismissive who-cares-about-why approach—just drink the beer. But not only is that beer now discontinued, purpose matters.

Investors should be asking the why question too.

Athletic greatness (or skill) doesn’t come from sitting on the sidelines. Wealth-building doesn’t either. Of course, there is risk. But it cuts both ways.

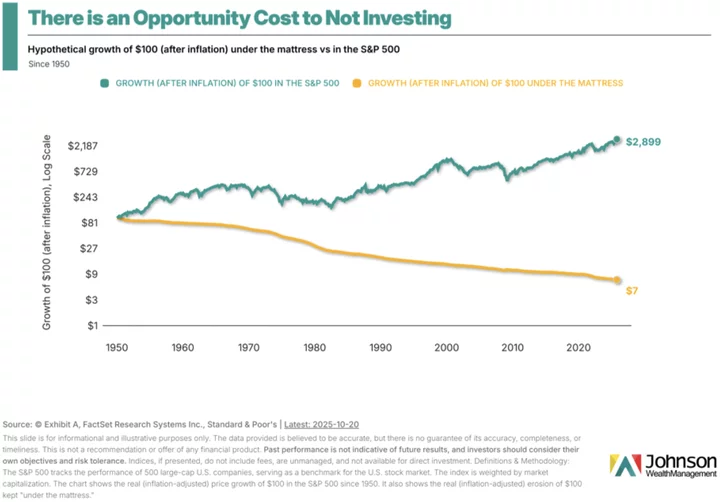

There is a cost to not investing. Since 1950, a $100 held in cash is worth less than $10, while that same single Benjamin Franklin would be worth $2,899 today if it had been invested in the stock market via the S&P 500.

Many times people come to me asking the “what” questions first.

“What should I invest in?”

Or, even worse, they call announcing what they’ve heard they should invest in.

And they want me to give a quick yes/no answer.

A good financial advisor can’t answer that question without uncovering the why behind it.

- Is the money for your future retirement?

- Is the money for a future down payment on a house?

- Are you trying to earn income off it to pay bills?

- Will you need the money in 1 year or 20 years?

- Is this for your children’s school or your children’s inheritance?

- Why are you investing now and what are your goals?

“I want to make money” isn’t a good enough answer.

Why precedes what in financial advice. You can’t know the what or how to get there without answering the why question first.

Why comes first because if you focus on the what first, and your investment starts to sink, you may stop investing or switch your investments at the worst possible time.

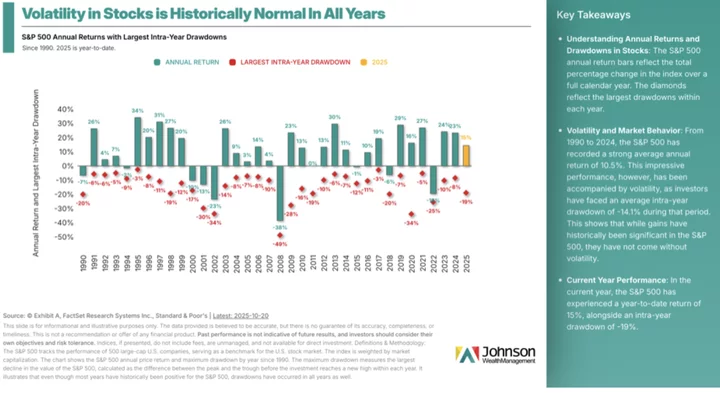

Consider 2025 year-to-date as an example. In order to be up 15% in the S&P 500, you had to endure a -19% drawdown along the way.

If you are only focused on the performance of what you are invested in, you may not make it.

If you zoom out even further, since 1990, investors have had to endure an average of -14% intra-year declines to experience a 10.5% annual return.

It’s been said, “He who has a why can deal with any what or how.” True in life. True in investing. Though not easy in either.

Why are you choosing to invest or not?

What if you don’t?

# # #

Brandon Stockman has been a Wealth Advisor licensed with the Series 7 and 66 since the Great Financial Crisis of 2008. He has the privilege of helping manage accounts throughout the United States and works in the Fortuna office of Johnson Wealth Management. You can sign up for his weekly newsletter on investing and financial education or subscribe to his YouTube channel. Securities and advisory services offered through Prospera Financial Services, Inc. | Member FINRA, SIPC. This should not be considered tax, legal, or investment advice. Past performance is no guarantee of future results.

CLICK TO MANAGE