The Bear River Family Entertainment Center Will Shut Down for Remodeling at the Beginning of the Year

LoCO Staff / Friday, Dec. 19 @ 9:59 a.m. / Entertainment

File photo: Andrew Goff.

Press release from the Bear River Band of Rohnerville Rancheria:

Bear River Band of the Rohnerville Rancheria announces temporary “Hibernation” of the Bear River Family Entertainment Center for exciting renovations and new amenities.

The Bear River Band of the Rohnerville Rancheria announces that the Bear River Family Entertainment Center will temporarily close for renovations beginning after its final day of operation on December 31, 2025. This is part of a restructuring change and the facility will be operated by the Bear River Casino Resort and its staff. On January 1, 2026, the facility, new name TBD, will enter a special “hibernation” phase as plans move forward to enhance the space with new amenities and expanded experiences for the community.

The upcoming renovations are part of a broader effort to reimagine the Family Entertainment Center, creating a refreshed destination that will offer upgraded features, improved comfort, improved service, and new attractions designed for guests of all ages. The Tribe anticipates welcoming guests back with a grand reopening sometime in Summer 2026.

“We are incredibly excited about what’s ahead”, said General Manager John McGinnis. “This transformation will allow us to better serve our community and visitors with a more modern, engaging, and family-friendly environment. We are deeply grateful for the ongoing support and patience as we prepare for this next chapter”.

The Bear River Band kindly asks the community to continue their support throughout this transition and to stay connected for progress updates, sneak peaks, and reopening announcements by following Bear River Casino Resort’s website and social media channels.

More information about the renovation timeline and upcoming amenities will be shared in the coming months.

BOOKED

Yesterday: 2 felonies, 6 misdemeanors, 0 infractions

JUDGED

Humboldt County Superior Court Calendar: Yesterday

CHP REPORTS

9303 MM1 N MEN 93.00 (UK office): Trfc Collision-1141 Enrt

1500 MM36 E HUM 15.00 (HM office): Mud/Dirt/Rock

1656 Union St (HM office): Closure of a Road

ELSEWHERE

RHBB: Passing the Good Fortune Along: Grant-Funded Engines Reach Piercy—and Roll On to Alderpoint

RHBB: Study Finds Wildfires Can Transform Soil Nutrient Into Long-Lasting Groundwater Contaminant

RHBB: Highway 36 Closed, Driver Describes Narrow Escape as Slide Sends Rocks Onto Road Near Grizzly Creek

RHBB: Large Redwood Falls Across Mattole Road Near Honeydew, Blocking Traffic

California’s Minimum Wage Is Increasing in 2026 as Los Angeles Debates $30 an Hour

Cayla Mihalovich / Friday, Dec. 19 @ 8:47 a.m. / Sacramento

This story was originally published by CalMatters. Sign up for their newsletters.

###

Californians will see the minimum wage increase to $16.90 per hour starting Jan. 1. The adjustment — a boost of 40 cents per hour — was calculated in August by the Department of Finance as part of its minimum wage annual review required by state law.

California has been raising its minimum wage over the past decade. Former Gov. Jerry Brown in 2016 signed a watershed law to increase minimum wage from $10.50 per hour to $15 per hour, plus annual adjustments for inflation.

The current rate of $16.50 per hour suggests that a minimum wage worker needs to work 98 hours per week to afford a one-bedroom rental at fair market rent in California, according to the National Low Income Housing Coalition.

California is one of 19 states to raise minimum wages in 2026, according to payroll company ADP. Cities and counties can also set their own minimum wages. This year, over two dozen local jurisdictions have increased local minimum wages. West Hollywood will have a $20.25 minimum wage starting in January — the highest of any California city, according to the UC Berkeley Labor Center.

Voters last November narrowly rejected a ballot measure that would have increased the minimum wage to $18 per hour. But some low-wage workers this year have successfully lobbied for bumps in pay in specific industries.

Under laws Gov. Gavin Newsom signed in 2023, fast food workers earn a minimum wage wage of $20 an hour and health care workers are on track to make $25 an hour.

That momentum extended to Los Angeles hotel and airport employees. Labor organizers in May secured a city minimum wage increase to $30 per hour for those workers by the 2028 Olympics. Large businesses fought back, arguing that wage hikes will only increase challenges for the tourism industry, which is still struggling to find its footing after the pandemic.

After failing to gather enough signatures for a ballot measure to repeal the new minimum wage, business groups later filed a different measure that could gut millions of dollars of revenue from the city’s general fund.

Following the move, Los Angeles City Council President Marqueece Harris-Dawson this month introduced a motion to delay the full wage increase from taking effect until 2030, according to reporting from the Los Angeles Times.

Labor leaders rebuked the motion, calling it “repulsive.”

“You can’t threaten to blow a hole in our budget and then the only way to stop it is on the backs of workers,” said Kurt Petersen, co-president of the union that represents many hotel workers, UNITE HERE Local 11. “That kind of raw extortion and shakedown has no place in our city.”

According to Peterson, a coalition of community organizations and unions are beginning to collect signatures for a ballot measure that would raise the minimum wage to $30 per hour for all workers in Los Angeles.

“The power is everyone together,” said Peterson. “Working people need help and raising wages is the easiest, most straightforward thing to do. Going up 40 cents per hour in 2026 doesn’t move the needle at all.”

###

Cayla Mihalovich is a California Local News fellow.

Redway Couple Arrested on Charges of Kidnapping and Maintaining a Drug House, Sheriff’s Office Says

LoCO Staff / Friday, Dec. 19 @ 7:54 a.m. / Crime

Press release from the Humboldt County Sheriff’s Office:

On Nov. 22, 2025, at approximately 3:29 p.m., Humboldt County Sheriff’s deputies responded to the 3200 block of Redwood Drive in Redway to investigate a reported robbery and kidnapping. Deputies contacted a 41-year-old male victim and through their investigation and subsequent follow-up, deputies identified the suspect as 25-year-old Dylan Cody Olivas of Redway.

On Dec. 15, 2025, deputies obtained a Ramey warrant for the arrest of Olivas on charges of PC 211 Robbery and PC 207(a) Kidnapping. A search warrant was also obtained for Olivas’ residence, located at 77 Mill Rd. in Redway.

On Dec. 17, 2025, at approximately 7:00 a.m., deputies, with the assistance of the Humboldt County Sheriff’s Office SWAT Team, responded to 77 Mill Rd. to execute both the arrest warrant and search warrant. Deputies located Olivas inside the residence along with his live-in girlfriend, 37-year-old Jazmyne Roe, and several other individuals.

During the search of the residence, deputies located evidence that established probable cause to believe Olivas and Roe were operating a drug house. Both were arrested and transported to the Humboldt County Correctional Facility, where they were booked.

The other individuals who were located inside the residence were released from the scene.

Olivas was booked on the following charges:

- PC 211: Robbery

- PC 207(a): Kidnapping

- HS 11366: Operate/Maintain a Drug House

Roe was booked on the following charges:

- HS 11366: Operate/Maintain a Drug House

- PC 273.6: Violate Domestic Violence Court Order

Anyone with information regarding this case or related criminal activity is encouraged to contact the Humboldt County Sheriff’s Office at (707) 445-7251 or the Sheriff’s Office Crime Tip Line at (707) 268-2539.

California Utilities Will Keep Almost All Profits as Regulators Ease Up. They’re Still Upset

Malena Carollo / Friday, Dec. 19 @ 7 a.m. / Sacramento

California regulators voted to cut utility profit margins but backed down on the amount, ultimately cutting them just 5/100ths of a percent. Power lines in Elk Grove on Sept. 20, 2022. Photo by Rahul Lal, CalMatters

###

This story was originally published by CalMatters. Sign up for their newsletters.

###

Regulators on Thursday approved a slight reduction to the profits shareholders are allowed to receive from California’s three major investor-owned utilities.

The decision dropped all three major investor-owned power companies’ returns by 0.3%, bringing the shareholder return for Pacific Gas & Electric to just below double digits for the first time in at least two decades. A decision proposed last month would have imposed a slightly larger profit cut of 0.35%.

All of the utilities asked for a return of more than 10%. The decision is unlikely to significantly impact customer bills, which remain the second-highest in the nation after Hawaii.

Darcie Houck was the only “no” vote on the California Public Utilities Commission, saying the decision did not properly take into account the cost to ratepayers.

“Every economic indicator tells us that we’re living in a time of extreme precarity for working Californians,” she said. “I do not think the decision threads the needle sufficiently to consider the full impact to the customer interest.”

Utilities say that a high potential rate of return for shareholders is important to bring in needed funding for infrastructure projects, which are typically paid for up front by investors and bonds and later reimbursed by ratepayers once regulators approve costs. This return is considered compensation for the risk of doing business.

The returns are not listed specifically on customers’ bills, instead baked into the rate customers pay.

The decision set 2026 potential shareholder returns for PG&E at 9.98%, Edison at 10.03%, and San Diego Gas & Electric at 9.93%. These returns are not guaranteed and can be affected by a utility’s financial performance throughout the year, going down if a utility has cost overruns. Historically, only San Diego Gas & Electric achieves its full shareholder return, while PG&E and Edison typically fall short of the full amount.

The three utilities’ approved returns have hovered around 10% for decades, which is also the national average for utility shareholder returns, often going above that. Academics and ratepayer advocates have argued for years that this is a problem because a higher return rate is meant to compensate for risk, but utilities are a historically low-risk industry. Their rates are set by regulators and their income is largely predictable and effectively guaranteed by ratepayers, who will continue needing services like electricity. U.S. 10-year Treasury bonds, which are considered the baseline for a risk-free investment, are about half of the utilities’ approved rate. Utilities regularly push back on this point, saying that wildfires in particular have made their industry more risky.

Utilities criticized the proposed drop in shareholder rates, saying it would exacerbate already high bills for ratepayers. The California Public Advocates Office, which advocates for ratepayers before the commission, pushed back on this, saying that claim is “entirely without merit.”

“The evidentiary record shows the [utilities’] claims for increasing their respective [returns] are based on flawed methods and would inevitably result in unreasonably high customer rates,” it said in a December response to utilities’ comments.

The utilities said the decision isn’t an accurate reflection of the risks their industry faces in the state.

“We think the reduction from current ROEs doesn’t reflect the unique risk environment facing California IOUs and their investors,” David Eisenhauer, spokesperson for Edison, said.

Similarly, PG&E was “disappointed that the final decision fails to acknowledge current elevated risks to help attract the needed investment for California’s energy systems,” Mike Gazda, PG&E spokesperson, said. “We will keep working with regulators and state leaders to ensure adequate funding needs and reasonable long-term rates for customers, so we can continue stabilizing our energy prices and funding critical energy system improvements for customers.”

Anthony Wagner, spokesperson for SDG&E, did not address the regulators’ decision directly, saying the company is “working every day to manage our costs responsibly while continuing to provide the essential service our communities depend on – offering tools and resources to ensure every customer has access to the support they need.”

The shareholder profits are a percentage of a utility’s “rate base” – the total value of its assets that it can earn a return on. This includes things such as power plants. While a utility’s approved shareholder returns fluctuate, the rate bases for California’s three utilities steadily rise. Each utility’s rate base is billions of dollars, earning hundreds of millions for shareholders even if a utility doesn’t reach its full shareholder return.

In 2023, for example, Edison had a rate base of $29.7 billion, and it was allowed to earn $198 million for shareholders that year. If its approved return was one percentage point lower, it would still have been allowed to earn $178 million for shareholders. Though it came in far short of this that year, it still brought shareholders $91 million from ratepayers.

In Houck’s dissent, she noted that the rate bases for the utilities, including Edison’s natural gas arm, are expected to go up by about 10% each year, with the combined authorized potential returns approaching $1 billion more than 2025. Her analysis for this included Edison’s natural gas arm, SoCalGas.

Houck recommended that regulators revisit this issue annually instead of every three years. California ratepayers are facing an affordability crisis for power bills because of factors such as wildfire recovery and hardening. Shareholder profits, which impact bills, have also risen in recent years because of utilities’ growing rate bases.

OBITUARY: Martha Peabody Traphagen, 1943-2025

LoCO Staff / Friday, Dec. 19 @ 6:56 a.m. / Obits

Martha Peabody Traphagen passed away the evening of November 23, 2025. She was under the care Hospice of Humboldt and residing in Caring Companions Rest Home in Eureka.

Martha was born April 21, 1943 in Pasadena. When she was 12, her mother (also fondly known as Mrs. “T”) and her four daughters moved to a beach house on Balboa Island. She enjoyed time at the beach and a trip to the Fun Zone. Later the Rendezvous Ball Room became a favorite spot.

Martha attended Newport Harbor High School and graduated in 1961. She was the editor of the school yearbook and active in many social and school activities. While attended Orange Coast Junior College she started working part-time as a vault teller at the Balboa Peninsula Branch of Bank of America. This was to be the start of a 45-year banking career. She married the late David Chandler, and her daughter Elizabeth was born in 1964. Several years later, her sister Elizabeth and husband Fred Smith who lived in Eureka encouraged Martha and her family to move north to Humboldt County.

In 1971, Martha transferred to the Arcata Branch of Bank of America, where she worked for 25 years. In 1996 Martha was hired by Humboldt Bank as the Arcata Branch Manager and later as manager for the Eureka Branch. When Umpqua Bank acquired Humboldt Bank, she was promoted to regional manager. She liked to say of her career, “I started at the bottom and worked my way to the top.” The part of banking Martha loved most was commercial lending. She was happiest when her customers’ loans were approved by the loan committee.

Martha enjoyed being involved in her community. She volunteered for: The Arcata Breast Health Project, Cancer Society, Jazz Festival, Planned Parenthood and Future Farmers of America. She served on the boards for: The Redwood Region Logging Conference, First Five Humboldt, HSU Foundation Board, College of the Redwoods Foundation Board and the Lucille Clark Trust. She was a member of Arcata Soroptimist and later Eureka Southwest Rotary Club.

Martha retired from banking in 2007. Her favorite times were spent entertaining friends at Ruth Lake and Perry Gulch Ranch in Mendocino. At Perry Gulf Ranch there was, wine tasting in Anderson Valley, hiking to the Navarro River with a stop to see the albino redwood or cruising the ranch were her favorite past times. Of course, she enjoyed entertaining friends at her home in Freshwater.

Both she and Perry enjoyed traveling. Some of their many trips were to Greece, a boat trip up the Yangtze River and tour of China, all the countries in Southeast Asia, Central America, Spain, Portugal and the British Virgin Islands. When not traveling across the pond, they would load the dog in the “Air Bus” and tour the west visiting sights and friends.

Martha is preceded in death by her father Peter Traphagen and mother Virginia Salisbury Traphagen; her sister Elizabeth Traphagen Smith and husband Fred Smith, and brother -in-law William Bathel. She is survived by her husband Perry Mayrisch, sisters Sara Traphagen and Jan Traphagen, daughter Elizabeth Castro, granddaughter Alexandra Castro Baratto, niece Lura Smith, nephews David Smith, Charles and John Bathel, and grand nephews and nieces Andrew, Gavin, Tessa, Kaylee, Katherine, William, Beckett and Rustin.

A Celebration of Life will be held on January 10th at Baywood Golf & Country Club, Arcata from 1-3 p.m. .

Many thanks to Hospice of Humboldt County for their amazing care and to all the nurses, care providers and friends who comforted her during the past few years. In lieu of flowers donations can be made in memory of Martha Traphagen to Hospice of Humboldt or a charity of your choice.

###

The obituary above was submitted on behalf of Martha Traphagen’s loved ones. The Lost Coast Outpost runs obituaries of Humboldt County residents at no charge. See guidelines here.

OBITUARY: Patricia ‘Pat’ Marion Long, 1937-2025

LoCO Staff / Friday, Dec. 19 @ 6:56 a.m. / Obits

Patricia “Pat” Marion Long

April 18,

1937 – December 16, 2025

Patricia “Pat” Marion Long, age 88, passed away on December 16, 2025, in Eureka, California. She was born on April 18, 1937, in Eureka and was a lifelong resident of Humboldt County.

Pat was born and raised in Humboldt County, attending Eureka City Schools and graduating from Eureka High School in 1955. Her life was deeply rooted in her community and family. She devoted many years of service to St. Bernard’s Elementary and High School, where she volunteered as the beloved Yard Duty Lady, served as President of the Mothers Guild, ran the snack bar for all sporting events and Sunday bingo, volunteered in the high school office and was a member of the St. Bernard’s Alumni Hall of Fame. She was an important presence at her grandchildren’s school and sporting events throughout the years. Her dedication and generosity touched countless students, families, and colleagues.

Pat is survived by her loving husband of 65 years, James Long; her daughters Kathy (Greg) Rasmussen and Shari (Alan) Borges; and her cherished grandchildren Tiffany (Daniel) Lewandowski, Courtney (Josiah) Matchak, Bethany (Chris) Williams, Brittany Borges, Stephanie (Danny) Diaz, Ben Rasmussen, Ashley Borges, and Hailey Rasmussen. She was also blessed with nine great-grandchildren, who brought her immense joy.

She is further survived by her brother-in-law Jerry (Nema) Long; sisters-in-law Dee Long, Tahni Long, and Allynee Brown; as well as several nieces and nephews.

Pat was preceded in death by her parents Marion “Shorty” and Freda Brown; her brother Ronald Brown; her parents-in-law William and Anita Long; her brothers-in-law William Long and Thomas Long; and her nephew Jerry Long.

Pat will be remembered for her kindness, dedication to family and community, and her lifelong commitment to serving others.

All are invited to attend services on December 29, 2025, at 2 p.m. at St. Bernard’s Cemetery Chapel, with a reception to follow at Old Growth Cellars.

The family would like to thank Dr. Cataldo, Dr. Han, the staff at Granada especially Grace and Seth, Hospice of Humboldt and Melissa Brock.

In lieu of flowers please make a donation to St. Bernard’s Academy Athletics or your favorite charity.

###

The obituary above was submitted on behalf of Pat Long’s loved ones. The Lost Coast Outpost runs obituaries of Humboldt County residents at no charge. See guidelines here.

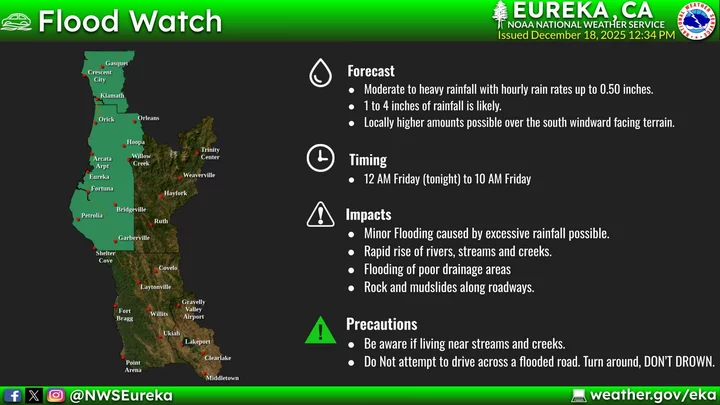

It’s Gonna Rain Like Hell Tonight, and You Should Expect Chaos

LoCO Staff / Thursday, Dec. 18 @ 4:24 p.m. / How ‘Bout That Weather

Graphic: NWS.

Forewarned is forearmed: Our friends at the National Weather Service office on Woodley Island are saying that there’s gonna be a hellacious front striking Humboldt at about midnight tonight, and it’s going to dump rain until about 10 a.m.

There is a flood watch in effect, and with coastal soils already pretty darned wet they’re expecting plenty of slipping and sliding. Here’s the prognosis:

A quick moving cold front will bring moderate to heavy rain to the area tonight into late Friday morning. Rainfall totals of 2-4 inches and rainfall rates up to 0.5 inches or higher an hour are possible. Saturated soils and the heavy rainfall rates will increase the risk of minor flooding impacts to low lying and urban areas. Rises in creeks and streams are likely.

Stay tucked in your beds as long as possible, friends, and expect your usual flood-prone areas to flood.