Jury Finds Eureka Man Guilty of Child Sexual Abuse With Two Victims

LoCO Staff / Wednesday, July 12, 2023 @ 5:05 p.m. / Courts

Press release from the Humboldt County District Attorney’s Office:

Today, a Humboldt County jury found Frederick Adams (43) of Eureka, guilty of the six felony charges brought against him by the District Attorney, including two counts of continuous sexual abuse of a child against different victims.

Adams faces a sentence of over 15 years to life in prison.

On May 13, 2021, 16-year-old Jane Doe disclosed to an interviewer with the Child Abuse Services Team that her father, Adams, had been sexually abusing her since she turned 11. Additional investigation by the Rio Dell Police Department uncovered another victim, Adams’ step-daughter, whom he continuously abused from the time she turned 11 years old.

During the trial, jurors heard testimony from both survivors, now aged 18 and 21. District Attorney Stacey Eads commends the victims who showed incredible bravery testifying in front of their abuser.

Adams is scheduled to be sentenced on August 25 by Judge Christopher Wilson, as he presided over the trial.Deputy District Attorney Luke Bernthal prosecuted Adams with assistance from District Attorney Investigator Ryan Hill and Victim Witness Advocate Caitlyn LaHaie. Deputy Public Defender Zack Curtis of the Conflict Counsel’s Office represented the defendant.

BOOKED

Yesterday: 9 felonies, 10 misdemeanors, 0 infractions

JUDGED

Humboldt County Superior Court Calendar: Friday, Feb. 13

CHP REPORTS

No current incidents

ELSEWHERE

KCRA: Yuba Water Agency assesses damage, works with outside company after ‘catastrophic’ pipe failure

Action News Now: Redding man charged with attempted murder, assault with a deadly weapon after driving into group of people in a neighborhood

KRCR: Tehama County Search and Rescue finds missing 80-year-old hiker alive and well

East Bay Times: Train collides with car on tracks in Emeryville

UPDATE: In a Shocking Development, Fortuna Police Have Determined That Carnies are Not Attempting to Kidnap Children After All

LoCO Staff / Wednesday, July 12, 2023 @ 3:23 p.m. / Non-Crime

PREVIOUSLY:

###

Press release from the Fortuna Police Department:

The original story regarding the alleged attempted kidnapping of an individual at the carnival event in Fortuna, California has gained some traction in the media, causing unnecessary fear and panic. After conducting a thorough investigation, the Fortuna Police Department has yet to find any credible evidence to support that any crime or attempted crime occurred.

During follow-up investigation by Fortuna Detectives, a clear case of mistaken communication between parent and child was confirmed to have occurred. Police now know through extended interviews that there was no grabbing or attempt to grab at any of the involved juveniles. In addition, no proper identification of any suspect(s) was made and there is a high probability of a real time misidentification of the carnival employee that was listed previously as a “person of interest”.

In addition, the aforementioned person of interest has been identified and contacted by Fortuna Police and has been fully cooperative.

The employee is no longer in the Humboldt County region and there is no immediate threat to the community. Members of the public and/or witnesses can still reach the Fortuna Police Department at 707-725-7550 with any information on this matter.

U.S. Senators Ask Rob Arkley and Other Donors for Itemized Lists of Gifts to Supreme Court Justices

Ryan Burns / Wednesday, July 12, 2023 @ 1:40 p.m. / Courts , Government

Rob Arkley in 2013. | File photo.

###

###

On the heels of last month’s bombshell investigative story from ProPublica, which revealed that U.S. Supreme Court Justice Samuel Alito accepted and failed to disclose lavish gifts from Republican donors, a pair of powerful U.S. Senators is asking occasional Eureka resident Robin Arkley II and other donors to submit itemized lists of gifts they’ve bestowed on justices of the Supreme Court.

Senator Sheldon Whitehouse (D-RI), who is chair of the Judiciary Subcommittee on Federal Courts, and Senate Majority Whip Dick Durbin (D-IL), chair of the Senate Judiciary Committee, authored the letters. The Judiciary Committee is currently considering legislation aimed at strengthening the ethics rules and standards that apply to the Court.

If you missed the ProPublica story, by all means, go back and give it a read. It detailed a luxury Alaskan fishing vacation that Justice Alito took in 2008. The trip was planned and attended by conservative activist Leonard Leo, and the VIP guests reportedly stayed for free at a luxury fishing lodge owned by Arkley.

The ProPublica story also found that Arkley gave valuable freebies, including lodging and a trip to Kodiak Island on his private jet, to Justice Antonin Scalia, who also failed to disclose the gifts. Arkley attended that particular trip, according to the story.

In the letter to Arkley, which you can download via a link at the bottom of this post, the senators also ask Arkley for:

An account of how you came to provide Justice Alito with a gift of free lodging in July 2008, including who invited Justice Alito, when you learned of that invitation, when you learned that you would be attending the trip to Alaska, and the names of other attendees.

The Outpost sent an email to Arkley seeking comment. We’ll update this post if we hear back from him.

In the meantime, below is a press release from Senator Whitehouse’s office:

Washington, DC – Senator Sheldon Whitehouse (D-RI), Chairman of the Judiciary Subcommittee on Federal Courts, and Senate Majority Whip Dick Durbin (D-IL), Chair of the Senate Judiciary Committee, today announced that they sent three letters seeking information from Leonard Leo and two right-wing billionaires implicated in recent reporting on the Supreme Court’s ethics crisis. The senators are seeking to identify the full extent of payments or gifts of travel and lodging given to Supreme Court justices as the Committee considers legislation to fortify ethics rules and standards at the Court.

“To date, Chief Justice Roberts has barely acknowledged, much less investigated or sought to fix, the ethics crises swirling around our highest Court. So if the Court won’t investigate or act, Congress must. Answers to these questions will help the Committee’s work to create reliable ethics guardrails at the Court, under Congress’s clearly established oversight and legislative authority,” said Whitehouse and Durbin in a joint statement.

The letters follow a bombshell report by ProPublica last month that found Justice Samuel Alito accepted and failed to disclose a luxury Alaskan fishing vacation with Republican billionaires Paul Singer and Robin Arkley II. According to the report, Justice Alito’s billionaire-funded vacation was planned and attended by Leonard Leo. Leo is the orchestrator of right-wing influence campaigns around the Supreme Court. A subsequent New York Times report raises to six the number of right-wing billionaires that have provided services and benefits to Justices Clarence Thomas and Alito.

The senators’ letters are the latest in a longstanding oversight effort by Senate Judiciary Committee Democrats to ensure transparency and accountability at the Supreme Court and in the federal judiciary. On Monday, Whitehouse and Durbin announced that the Committee will mark up Whitehouse’s Supreme Court Ethics, Recusal, and Transparency (SCERT) Act on Thursday, July 20. The bill would require Supreme Court justices to adopt a code of conduct, create a mechanism to investigate alleged violations of the code of conduct and other laws, improve disclosure and transparency when a justice has a connection to a party or amicus before the Court, and require justices to explain their recusal decisions to the public.

Congress has an appropriate and well-established role in oversight of the judiciary and updating ethics laws that apply to federal officials, including justices and judges. Congress passed the Ethics in Government Act, which the justices are subject to, and created through statute the Judicial Conference, which administers that law.

The senators’ letter to Singer can be found here, the letter to Arkley can be found here, and the letter to Leo can be found here.

###

DOCUMENT: Letter to Arkley

87-Year-Old Woman Injured and Transported to ER After Being Hit by ‘The Choo Choo Train’ at Redwood Acres Fair on Opening Weekend

Stephanie McGeary / Wednesday, July 12, 2023 @ 1:15 p.m. / News

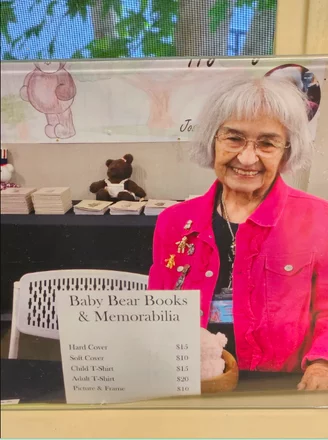

Josephine Silva, an 87-year-old Eureka resident and children’s books author, was recently injured in a bizarre accident when she was hit by “The Choo Choo Train” – a small train-like shuttle vehicle – at the Redwood Acres Fair on June 22.

Reached by the Outpost on Tuesday, Silva said she had just been released from Providence St. Joseph Hospital on Monday after a more than two-week stay, during which she received stitches and multiple blood transfusions.

“It’s gonna take a while still,” Silva said weakly over the phone. “I’m just gonna lay low for a few days and get back my strength.”

The incident occurred in the afternoon on Thursday, June 22, when Silva was walking near the exposition building and the train, which ferries kids around the grounds, struck her from behind. Silva fell, striking her head on the pavement, and the vehicle came to a stop on top of her legs. Silva was conscious the entire time, she said, but was unable to see everything that was happening. She did say that someone lifted the vehicle off of her and EMTs transported her to St. Joe’s.

According to Talia Flores, public information officer for Humboldt Bay Fire, a call came in at 2:02 p.m. that a pedestrian had been “struck by a small train ride [that was] a similar size to a golf cart.” One HBF engine and a City Ambulance responded to the fairgrounds to find Silva on the ground. The report, Flores said, stated that the vehicle had already been lifted off of Silva by a group of bystanders by the time responders arrived on the scene.

“She had a deformity of the lower right leg and heavy bleeding,” Flores told the Outpost, reading from the incident report. “[The responders] did place a tourniquet above the right knee until the bleeding stopped.”

“The Choo Choo Train” at Redwood Acres Fair on opening day, June 21 | Photo: Stephanie McGeary

Flores added that, according to the report, Silva also had a small cut on her forehead, but most of the damage was to her right leg. Silva’s vitals were pretty regular, Flores said, and she “denied losing consciousness.” Silva was transported to the ER via City Ambulance with no further incident.

It is not exactly clear how Silva was hit by the train, since she was hit from behind and did not see the vehicle or who was driving. But she can only assume that the driver was unable to see her. Though she was wearing a bright pink jacket at the time she was hit she is a very small woman – only about four feet, three inches tall, she said. It does concern Silva, however, that the driver could not see her at a fair, where a lot of small children are running around.

“If I had been a child, he probably would’ve killed me,” Silva said.

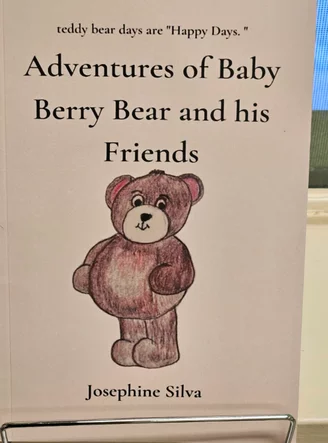

The timing couldn’t have been worse for Silva, who had a booth at the fair where she was selling her recently published “Baby Berry Bear,” a series of five children’s books Silva has written about the adventures of a teddy bear.

Silva has a great love of teddy bears and also sews stuffed teddy bears, dressing them in different costumes. This was Silva’s first time selling her books in public, she said, and she was very excited to be making her big debut.

Of course, following the accident, Silva’s booth – which was being manned by her son at the time she was hit – had close. Silva also had a booth booked at Eureka’s Fourth of July Festival, which she had to cancel because she was still in the hospital.

When asked if she planned to press charges, Silva said that she has hired a lawyer but is not sure how she wants to proceed. She believes this was an accident and said she’s not even mad at anyone. She mostly just wants to focus on getting better.

It’s also unclear if any type of investigation is being done into the incident. Multiple attempts to reach Redwood Acres CEO Mic Moulton were unanswered by the time this article was published. The Outpost will update if we hear more.

Though the incident was very difficult, both physically and emotionally, Silva is maintaining a surprisingly positive attitude and is hopeful that she’ll be good as new in no time. Silva said she is getting her stitches taken out tomorrow and is already feeling much better than when she was released Monday.

“I was scared, very scared, and I’m still very weak,” Silva said. “But I’ll be all right. I’m a tough little cookie.”

Humboldt Supervisors Approve Construction Agreement for Earthquake-Related Repairs to the Grandstands at the Ferndale Fairgrounds, Consider Expansion of Teleworking Policy, and More

Isabella Vanderheiden / Wednesday, July 12, 2023 @ 1:06 p.m. / Local Government

Screenshot of Tuesday’s Humboldt County Board of Supervisors meeting.

###

The Humboldt County Board of Supervisors on Tuesday gave its final stamp of approval to a $1 million funding request to pay for emergency repairs to the earthquake-damaged grandstands at the Ferndale Fairgrounds.

The board authorized the initial funding request during a special meeting at the end of last month and directed staff to return to the board if additional funds were required. Despite a bit of confusion on the matter, yesterday’s agenda item was not a request for additional funding but a bookkeeping item to document the increase in expenditures to the Department of Public Works and approve a construction agreement with Aquatic Designing, Inc. and Mobley Construction.

Speaking during Tuesday’s meeting, County Administrative Officer (CAO) Elishia Hayes reminded the board that the funds would come from the 2020 Finance Plan and would, essentially, serve as a loan from the county to the county.

“These are dollars that are grown from ourselves,” Hayes said. “These dollars are pretty strictly available for county infrastructure repair and replacement needs. … This is the last remaining availability in the Finance Plan, and there are no other foreseeable needs immediately on the table at this point in time where these funds could be utilized.”

Hayes added that she is “very cognizant [of] the current budget situation” and emphasized that the funds could not be used to fund county road improvements, “retain staffing or to reduce the General Fund structural deficit.”

“They do – very explicitly at this point in time – have to be used for infrastructure needs,” she said. “I just wanted to make that clear because I think there’s some confusion in the community on the purpose of these funds.”

Fourth District Supervisor Natalie Arroyo noted that the supplemental budget request attached to the agenda totaled $2 million and asked if staff could offer an explanation or correct the item. Hayes explained that the document accounts for $1 million in the revenue line and another million in the expenditure line, “so it nets to $1 million in overall increases in the budget but the overall transaction totals to $2 million.”

“Rest assured, it is a $1 million expenditure from the 2020 Finance Plan,” Hayes added. “Revenue from the 2020 Finance Plan [is] offset by a $1 million expenditure in fixed assets.”

Third District Supervisor Mike Wilson, who was not present during the June 29 special meeting, asked if the Humboldt County Fair Association has done any private fundraising to raise money for repairs to the grandstands.

“I mean, if you think about when Food for People had their disaster occur at their facility, there was a lot of private fundraising around that,” Wilson said. “The reason I ask it in this in this context is also because … I heard that Supervisor Arroyo was really adamant [that] the $1 million [would] not go over … that budget amount [and] if there’s work being done to prepare for the possibility that there may be the need for private funds [in addition].”

From a government standpoint, Hayes said the Fair Association could seek potential support from the Headwaters Fund for potential support, but deferred the question to Jill Duffy, interim general manager of the Humboldt County Fair Association.

“The short answer is no,” Duffy said. “Does that mean it is not being thought about? Absolutely it’s been thought about, [but] this is the short-term fix. This isn’t the final project. We’re gonna have to [put] together a more comprehensive capital campaign for the purpose of making all of the upgrades to the facility, and that’s going to include ADA and other types of amenities. When that time comes, it’s not going to be a million-dollar fix – it’s going to be significantly more.”

Right now, Duffy said, the Fair Association is focused on getting everything in line for the fair, which opens on Aug. 17. “I’m just moving forward with a lot of contracts at the moment,” she said. “After we get through the fair – provided that the structure is stabilized [and] we’re able to utilize them – we’ll need to sit down with the CAO’s office … and we will have to work out what some form of a repayment structure is going to be.”

There’s a possibility that the California Office of Emergency Services (CalOES) will reimburse the county for some of the money spent on repairs to the grandstands because it was damaged during the Dec. 20 earthquake, but it’s not a guarantee. CalOES will not pay for deferred maintenance at the fairgrounds.

Speaking during public comment, fair board member Clint Duey thanked the Board of Supervisors for moving so quickly to address the repairs to the grandstands and reiterated his board’s commitment to “working to repay our portion over time.”

“I just want to express our commitment to continuing that relationship,” Duey said, referring to the memorandum of understanding (MOU) the board was poised to approve. “I completely agree with you [that] there is deferred maintenance that needs to be addressed on the fairgrounds, but we’re not here again because of deferred maintenance issues. We’re here right now because of a major earthquake that caused significant damage across the county into a county building that is, quite frankly, beyond our means to do on our own.”

Following public comment, Wilson asked for more consistency in communications between the county and the Fair Association moving forward.

“It seems like a lot of the times when we’re talking about the fairgrounds and the fair board’s issues, it’s always [an] emergency [or] some issue has popped up,” he said. “Although we may have a relationship – and some would say it’s good – it doesn’t seem to be consistent. … I want to make sure that whatever MOU is structured here really speaks to that. About our … fiscal relationship but also from an infrastructure perspective.”

Wilson added that he would like to see some “visioning” from the fair board surrounding diversity, equity and inclusion, noting that he has seen vendors flying confederate flags flying at the fair. “That is something we have to deal with,” he said.

Duffy acknowledged Wilson’s concerns and agreed that there are “a number of items to be addressed” surrounding fiscal sustainability and diversity. “It’s not for me to have that conversation, but for the two boards to have that,” she said. “The question that we’re here for today is to do the authorization of the funding, in addition to the contracts. That’s the important stuff that needs to move forward.”

Second District Supervisor Michelle Bushnell made a motion to authorize both the construction contract and the MOU with the Fair Association. First District Supervisor Rex Bohn seconded, and emphasized that contractors have already broken ground on repairs to the grandstands. He reminded the board: “If we don’t vote for this today, we’re liable for all funds spent up into this point.”

“The big iron showed up today, it’s custom cut, so it’s not a return possibility,” he said. “If you remember, the motion that was made on [June 29] was that all structural fixes that we do now have to tie into the permanent fix. … So there’s so much more to this.”

The motion passed 5-0.

Expanding Telework Opportunities

The board also considered a request, brought forth by Bushnell, to revisit the county’s telework policy and potentially expand the availability of remote work to provide rural residents with better job opportunities.

“As we all know the rural areas – especially in my district [in] Southern Humboldt – [are] having an economic downturn and there are not a lot of jobs that are available down there for people who are wishing to stay in their communities,” Bushnell said. “Throughout our organization, there are a lot of jobs that aren’t necessarily forward-facing or public-facing, that could be very well served with teleworking. At this time, it is discretionary to the department heads, so my idea behind this is just to have a discussion and to ask the department heads’ input.”

The county’s existing telework program, adopted in February 2022, notes that “eligibility for teleworking is based on both the position and the employee and is subject to department approval” based on several guidelines surrounding productivity, dependability and responsibility. On top of that, teleworking agreements vary from regular/recurring to occasional/temporary, depending on the position and the individual employee.

Bushnell acknowledged that more teleworking opportunities often mean more work for department heads who would have to monitor their remote employees but asked if there would be any interest in revisiting the topic to accommodate people experiencing “transportation hardships” who live more than 20 miles from their place of work.

Human Resources Director Zachary O’Hanen noted that the county’s existing policy “doesn’t preclude us from doing this,” but reiterated the point that it is up to department heads.

“I can speak about my department,” he said. “One of the considerations that I’ve made is when gas prices were $6 a gallon, I said, ‘Hey, does anyone want to telework?’ So we have a number of employees in HR who telework at least one or two days a week.”

But Bushnell was asking for specific language that would guarantee teleworking opportunities for an individual in the future. “You’re not going to get someone to apply for a job if some if the department head says, ‘Well, I can take that back anytime’ and there’s no policy that accommodates it [to] ensure that they won’t be living two hours away and all of a sudden the department head says, ‘No, you can’t tell work anymore because I’m done with that and I don’t want to do that in my department anymore,’” she said.

Hayes noted that “there’s not necessarily a surety” that a prospective employee would be a good fit for a given position or someone who would be an effective employee.

“In my mind, this is more of a policy statement from the board that you want to encourage that this be utilized in a more robust fashion for those folks who do reside in those areas,” she said. “I think that this could be a separate policy statement whereby you keep intact the current policy, which does allow for revocation of telework if an individual isn’t meeting certain performance standards. I do think that’s important that we still retain that ability for an employee who has proven over time to be somewhat ineffective in the telework situation.”

Bushnell said she knew of existing county employees that want to telework but their supervisors will not let them “and they have no criteria for saying no, they just don’t want to do it.”

Bohn felt as though the vast majority of department heads were willing to accommodate remote employees in certain situations but expressed concern for a drop-off in productivity.

“I just remember hearing one time that the [effiency rating of people in the office] work[ing] at home was like 65 percent,” he said. “I don’t want to put the department head on the spot but I think that’s what John Ford said.”

Several department heads offered their perspective on the matter. County Clerk-Recorder and Registrar of Voters Juan Pablo Cervantes said he would be open to additional teleworking opportunities in his office but said there are currently too many variables.

“We’re a small county and our departments are lean, we’re scrappy and we’re having to do more with fewer resources, and that means that the nature of the job can change,” he said. “I see positions in my departments that I’m wanting to move towards telework [but] the hesitancy is, what happens when the ground under me changes and I’m having to redeploy them in a different facet that would require them to come into the office? … I can’t fathom, you know, the next few months or the next year or two allowing me that kind of discretion, even though I’d like to find those opportunities.”

Public Works Director Tom Mattson said he supported the county’s current policy of allowing department heads to decide where teleworking is appropriate.

“I would hate to get into a situation where it becomes a right and it’s grieved over who can do this and which position can and cannot,” he said. “I have a lot of people that do telework that operate very effectively. I have some that don’t operate very effectively teleworking – myself included. … Financially, structure-wise it is good for the county and it is good for employees, but don’t let it become a right that can be grieved.”

Speaking specifically to his department, Planning and Building Director John Ford raised the quality control issue.

“We can have people answering phones remotely, we have done that,” he said. “We can have people answering emails remotely, we have done that. One of the things we experienced when we do that is a lack of quality control, whereby the people who are remotely saying things aren’t being overheard by a senior staff or by a manager and are giving wrong information. Then we have a problem with somebody coming back in and saying, ‘You told me I could do this,’ and they can’t.”

It’s not a one-size-fits-all issue, he added.

Connie Beck, director of the county Department of Health and Human Services (DHHS), said she agreed completely with Mattson, adding that some of her employees are effective teleworkers while others are not.

“There [are] some programs that we work mostly in the field and having the ability to telework when you’ve been out in the field all day is a nice gesture for people,” she said. “And then we have people that have actually moved to other areas and are still working for us. So, because our staffing levels are so critical, we need to have the ability to do that. We are actually even looking at having training available in different areas of the county because one of the things that we worry about is the support and training that happens with individuals when they’re first hired.”

Following a brief public comment period and a bit of additional discussion from the board, Arroyo made a motion to keep the teleworking policy as is for the time being and directed staff to look into ways to strengthen the policy in a way that could accommodate more teleworking opportunities. She also asked staff to return to the board in roughly six months with some data on county employees who are already working remotely. Bushnell seconded the action.

The motion passed in a unanimous 5-0 vote.

###

Other notable bits from the meeting:

- The board unanimously approved a letter of complaint to the California Public Utilities Commission (CPUC) regarding recent local service interruptions with Frontier Communications. The letter was prompted by a recent four-and-a-half day outage that took out telecommunications – including 911 services – throughout the Mattole Valley. The letter calls upon the CPUC to address Frontier’s negligence. The item was approved in a unanimous 5-0 vote.

- The board also reviewed and approved several grant awards from the Friends of the Eel River (FOER) Mitigation and Remediation Grant Fund to fund sediment reduction programs associated with roads that serve cannabis cultivation sites and/or are located in impacted watersheds. FOER Executive Director Alicia Hamann said the grant funds would further projects that will “improve water quality for our native fish” for years to come. The board approved the list of grant applications in a 5-0 vote. You can read more about those projects here.

- The board also approved two amendments to the General Plan – a transitional and supportive housing zoning ordinance and an emergency shelter zoning ordinance – to conform to state laws surrounding housing projects and shelter. Both items were approved in 5-0 votes.

Three Arrested in Fortuna As Drug Task Force Executes Fentanyl Trafficking Warrant at P Street Home

LoCO Staff / Wednesday, July 12, 2023 @ 11:35 a.m. / Crime

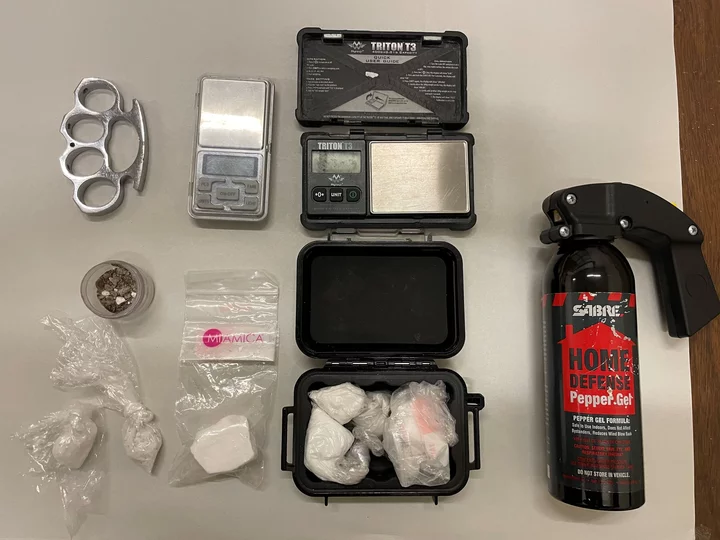

Photos: HCDTF.

Press release from the Humboldt County Drug Task Force:

On July 11th, 2023, Humboldt County Drug Task Force Agents and Officers with the Fortuna Police Department executed a probation search at the residence of Brian Andrew Coffman (Age 37) located in 1000 block of P Street in Fortuna. The HCDTF had received information that Coffman was traveling out of the area to purchase large quantities of fentanyl and then trafficking the fentanyl back to Humboldt County for the purpose of sales. Coffman was currently on felony probation with a search clause for narcotics sales and he had an active felony warrant for his arrest for narcotics sales.

Upon arrival at Coffman’s residence, Agents located and detained Coffman without incident. inside the residence. Agents began clearing the residence and located two additional subjects attempting to hide themselves inside of a bathroom. The two subjects were identified as Bianca Welton (Age 37) and Kenneth Anderson-Rose (Age 36). Both subjects were detained without incident. Anderson-Rose attempted to provide a false name to HCDTF Agents but was immediately identified due to Anderson-Rose having multiple contacts with the HCDTF. It was later confirmed that Anderson-Rose had a felony warrant for his arrest for narcotics sales. Welton had two felony warrants for her arrest for vehicle theft and PRCS revocation.

While clearing the scene, an adult female accompanied by two young children were also located inside the residence. After further investigation it was later determined that the adult female and two young children were residing with Coffman. Child Welfare Services was contacted and advised of the living conditions for the two young children.

Once the scene was secure, HCDTF Agents searched the residence and located 3 ½ ounces of fentanyl, ¼ ounce of methamphetamine, digital scales, packaging material, metal knuckles, a large cannister of pepper spray, and approximately $8,000 in US Currency. All items were collected as evidence and the US Currency was seized as asset forfeiture.

Coffman was arrested and transported to the Humboldt County Jail where he was booked for the following charges:

11351 HS: Possession of narcotics for the purpose of sales

273a(a) PC: Child endangerment

22810 PC: Felon in possession of a tear gas weapon

21810 PC:Possession of metal knuckles

Felony Warrant

Anderson-Rose was arrested and transported to the Humboldt County Jail where he was booked for the following charges:

11351 HS: Possession of narcotics for the purpose of sales

148.9 PC: Providing a false identity to a peace officer

Felony Warrant

Welton was arrested and transported to the Humboldt County Jail where she was booked for the following charges:

11351 HS: Possession of narcotics for the purpose of sales

Felony Warrants

Anyone with information related to this investigation or other narcotics related crimes are encouraged to call the Humboldt County Drug Task Force at 707-267-9976.

Cal State Has a New Chancellor. Her Challenges Include the System’s Massive Budget Gap and Sexual Misconduct Allegations

Mikhail Zinshteyn / Wednesday, July 12, 2023 @ 11:23 a.m. / Sacramento

Fomer CSU Fullerton President Mildred García speaks during an event in 2016. Photo via California State University, Fullerton

A $1.5 billion budget shortfall, student outrage over planned annual 6% tuition hikes for at least five years, stubborn racial gaps in graduation rates and widespread distrust over how the university handles sexual assault claims.

This is the job that awaits Mildred García, who was named chancellor of the California State University today.

García will oversee the nation’s largest four-year public university system and its nearly 500,000 students at a time when public confidence in the value of a bachelor’s degree is at a nadir.She’ll begin her post October 1.

One more challenge to overcome? Persuading more students to enroll at Cal State’s 23 campuses as the system is beset by an enrollment decline that’s also upending its finances.

“I am honored, humbled and excited for this opportunity to serve the nation’s largest four-year university system and work alongside its dedicated leaders, faculty and staff, and its talented and diverse students to further student achievement, close equity gaps and continue to drive California’s economic prosperity,” she said in a statement.García, who’ll become the first Latina chancellor in the system’s 63-year history,

is no stranger to the CSU. She led Cal State Fullerton from 2012 to 2018 and Cal State Dominguez Hills from 2007 to 2012. At Dominguez Hills, she became the system’s first Latina president.

She left her post at Fullerton to lead a national association representing 350 public colleges and universities, the American Association of State Colleges and Universities, where she’s remained since. Among the association’s members are all 23 Cal State campuses and one University of California campus, UC Merced.

While at Cal State Fullerton, García oversaw a rapid rise in graduation rates:

- The four-year graduation rate grew from 14% for students who started as freshmen in 2008 to 25.5% for students who began in 2014.

- The six-year graduation rate grew from 51% for students who started as freshmen in 2006 to 67.8% for students who began in 2012.

During her tenure, Cal State Fullerton’s six-year graduation rate actually surpassed the systemwide average after being nearly identical when she took over as president.

The six-year graduation rate gap between racial and ethnic groups also narrowed some while she was president. For example, between 2012 and 2018:

- The graduation rate gap between white and Black students at Cal State Fullerton decreased from about 15 percentage points to approximately 9 percentage points;

- Systemwide, the gap remained wider overall between those two groups, shrinking slightly from about 24 percentage points to around 20 percentage points.

- And while the graduation rate among Latino students was the same at Fullerton and systemwide — 44.6% — the rate jumped nearly 19 percentage points in that time period at Fullerton while climbing just under 12 percentage points across the CSU.

- Systemwide, the gap between white and Latino students narrowed slightly from 13.8 percentage points to 12.4 percentage points. At Fullerton, the trend was similar, dropping somewhat from a gap of 11.4 points to 9.8 points.

Systemwide graduation rate gaps

It’s those wide gaps across the system that will likely consume much of Garcia’s reign at the CSU. Cal State still graduates just under half of Black students within six years — 49% — who started as freshmen. That rate has been about 20 percentage points lower than that of white students for at least 16 years, as CalMatters has reported.

Cal State’s program to grow graduation rates and close gaps among identity groups, Graduation Initiative 2025, now receives $380 million a year in state and institutional support, wrote Amy Bentley-Smith, a Cal State spokesperson, in an email. Since the initiative debuted in 2015, rates for all ethnic and racial groups grew, but the gaps among specific racial and ethnic groups remain.

García will have just two years to steer the system toward reaching a key 2025 goal of doing away with any differences in graduation rates among racial groups.

Distrust over system’s handling of sexual assault claims

García will also have to contend with a Cal State rocked by allegations of sexual harassment and abuse. The fallout began when USA Today published an investigation revealing that the system’s then-chancellor, Joseph I. Castro, mishandled claims that a vice president at Fresno State sexually harassed students and staff when Castro was president of the campus. The allegations against Castro led to his resignation in February 2022.

Since then, news outlets uncovered more instances of sexual misconduct among senior officials at other CSU campuses. For example, according to EdSource, a Bakersfield campus vice president “was fired for viewing pornography on his work computer,” a Monterey Bay campus dean “harassed and demeaned female employees,” and “an administrator at Sonoma State University ‘asserted his dominance’ over a female co-worker and became violent when she rebuffed his advances.”The Los Angeles Times has produced nearly 30 articles in the past 18 months detailing campus claims of rape, assault, harrasment and intimidation. Last year the president of Sonoma State resigned after facing outcry over “her leadership amid a campus sexual harassment and retaliation scandal involving her and her husband.” The newspaper also chronicled allegations of rape and assault aboard a training ship operated by Cal Maritime.

Outside lawyers told Cal State trustees in May that students and staff don’t trust system leaders or processes for handing sexual assault claims. That firm plans to release a formal report on its findings by Monday. On Tuesday, the state auditor also plans to issue a report, requested by lawmakers, about the system’s ability to handle sexual assault claims.These reports will come with recommendations of at least $25 million annually for systemwide changes, such as more data-tracking, training investigators and hiring more staff across the campuses and central office, Cal State senior officials predict.

Funding gap and likely tuition hikes

Cal State faces a growing $1.5 billion shortfall between what it should be spending on student academics and what it actually collects from its main revenue sources — state tax dollars and tuition.

Lawmakers and Gov. Gavin Newsom have approved more than $400 million in new, ongoing education spending for the system in the past two years, part of Newsom’s promise that, if kept, would lead to more than $1 billion in extra revenue by 2026-27.

But that’s still far too little to plug Cal State’s budget hole — and relying on state revenues alone exposes Cal State to California’s often volatile budget, which can have a $100 billion surplus one year and a $31.5 billion deficit the next.

So the system’s trustees are now eyeing annual tuition increases of 6% for all students for at least five years — a plan they’ll vote on in September. Most trustees seemed in favor of raising tuition for several years at the meeting Tuesday, but many balked at the original proposal that the hikes continue without end. Some asked to delay the vote until November. Lt. Gov. Eleni Kounalakis, a trustee, said the timing of the discussion was unfair to students who are now off for the summer.

“I was right that what we would hear was that this was not the right time to do it,” interim Chancellor Jolene Koester said later in the meeting yesterday. She argued that the system cannot wait any longer to pass these hikes.

Undergraduates would see base tuition increase by $342 in the first year. However, around 60% of Cal State’s students would be unaffected by the tuition hikes because they receive non-loan financial aid. The state’s Cal Grant program that covers tuition for many students would automatically adjust to continue covering students’ full tuition, though technically the governor’s office could bill the system for the added costs to the grant.

But for the remaining 40%, annual jumps in tuition will cut deep, especially for “students on the verge of middle class who are still struggling,” said Sacramento State student and activist Michael Lee-Chang, in an interview.

The system’s student government association also opposes these hikes, but backs some kind of increase to tuition, said Dominic Treseler, president of the Cal State Student Association, in an interview with CalMatters. “We’re not opposed to multi-year increases,” he told CalMatters, but 6% is too high, and the association faults the Cal State’s senior leaders for not spelling out specifically how the new tuition revenue will be spent.

Tuition for undergraduates who pay would rise steadily, from $6,084 in the first year of the hike to $7,682 by 2028-29. However, some of that price hike will be curbed by a new state Middle Class Scholarship.

Trustees also fear sticker-price shock will chase away students, no matter how much financial aid they’ll get. Getting the word out that the cost of attendance is much less with grants and scholarships costs money too, Koester said Tuesday.The tuition plan would boost system revenues by $148 million in the first year and grow to an extra $840 million by the fifth year of the tuition spikes. System officials say they will divert 33% of that extra revenue to campus financial aid for low-income students, known as the State University Grant.

With the new revenue from tuition, Cal State wants to pour money into programs to help students graduate faster, narrow the gaps in the graduation rates among racial groups, and respond to the months-long demands of employee unions for salary increases to restore the buying power they lost due to inflation. Professors and counselors seek 12% raises.Increasing employee salaries by 1% alone would cost the system $55 million annually — and already about three-fourths of the system’s operating budget is spent on compensation.

Strikes are on the table, which would cripple Cal State’s education mission.

###

CalMatters.org is a nonprofit, nonpartisan media venture explaining California policies and politics.