Screenshot of Tuesday’s Eureka City Council meeting.

###

The Eureka City Council met for a special budget study session on Tuesday evening to review the proposed spending plan for the 2024-25 fiscal year, and to take a closer look at city departments and divisions funded by the General Fund.

The City of Eureka is looking at a $1.1 million budget deficit in the upcoming fiscal year due to “relatively flat” sales tax revenues and rising employee salaries and benefits. At the council’s last meeting budget hearing on June 4, Eureka Finance Director Lane Millar reassured the council that it is not unusual for the General Fund to show a deficit, noting that sales tax goes up and down every year.

“[This] tells us that things are a little bit tighter than they were a couple of years ago,” Millar said at last night’s study session. “On the expenditure side, labor agreements, salaries and benefits are going up almost across the board … and those are hitting the department’s budgets.”

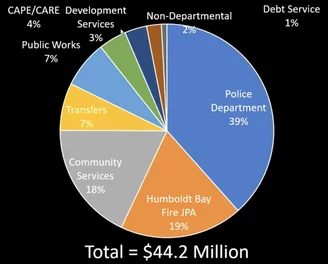

Millar went over the projected expenditures for each department and division that receives funding from the General Fund. The Eureka Police Department is projected to receive $16.9 million from the General Fund, up by about $898,000 from the current fiscal year.

EPD is broken into two divisions: communications and enforcement. Millar noted that the growth rate for enforcement is projected to be “less than average” in the next fiscal year due to a reduction in unfunded liability payments through CalPERS. “Fortunately, we expect that to go down by about $300,000 next fiscal year,” he said. “But unfortunately, it’ll go right back up the following fiscal year.”

The city has also earmarked $8.2 million for Humboldt Bay Fire, $7.9 million for Community Services, $3.1 million for Public Works and $1.8 million for the Community Access Project for Eureka (CAPE) and Crisis Alternative Response Eureka (CARE), the city’s homeless outreach programs. The remaining General Fund allocations are broken down in the pie chart to the right.

Millar’s presentation focused on the benefits of Measure H, a 1.25 percent sales tax approved by voters in 2020. The tax measure has boosted the city’s finances in recent years and is expected to contribute $12.5 million in the upcoming fiscal year, representing roughly 30 percent of the General Fund’s revenues.

“Measure H has significantly changed operations in a very positive way,” Millar said. “It’s made us more financially sound but I think we’re at a point where growth has slowed down, and I believe that we will plateau at this point, in terms of growing staff and operations and incorporating new services.”

Still, the tax measure has allowed the city to expand critical services, including its CAPE and CARE programs, which are partially funded by outside sources.

Eureka City Manager Miles Slattery added that Measure H “has been huge” for the city’s parks.

“We’ve probably increased our staffing in the parks [division] by 30 percent,” Slattery said. “Since Measure H, we’ve got a dedicated maintenance worker in Old Town [and] a dedicated maintenance worker along the Waterfront Trail. … Carson Park wouldn’t have been done without Measure H [and] Highland Park – which will be done by the end of June – wouldn’t have been done without Measure H. It’s been invaluable to our quality of life facilities and programs as well.”

Turning to questions from the city council, Councilmember Leslie Castellano asked Millar to explain why EPD’s unfunded liability payments were predicted to fluctuate in the next few years.

“CalPERS has an investment portfolio, and every year they earn or lose a certain amount of money, but that rate isn’t applied right away,” Millar explained. “[T]here’s typically three years before that change to the portfolio hits our unfunded liability payment. You may remember that what happened during COVID was a huge market correction and then it quickly went back up. … That one year with that large return, essentially, reduced future unfunded liability payments.”

He added that the city could look into pension obligation bonds as a means to fund the unfunded portion of its pension liabilities and prevent fluctuation, but said: “Rates are still too high to consider that option.”

Councilmember G. Mario Fernandez asked if the staff was equipped to handle potential funding cuts at the state level that would affect CAPE and CARE. Millar said both programs will continue to receive grant funding “for at least another year,” but acknowledged that many of the positions within those programs are funded through state grants.

After a bit of additional discussion, the council agreed to accept the report but did not take any formal action on the item.

The city council is expected to finalize the proposed budget at its next meeting on Tuesday, June 18. That agenda can be found here.

CLICK TO MANAGE