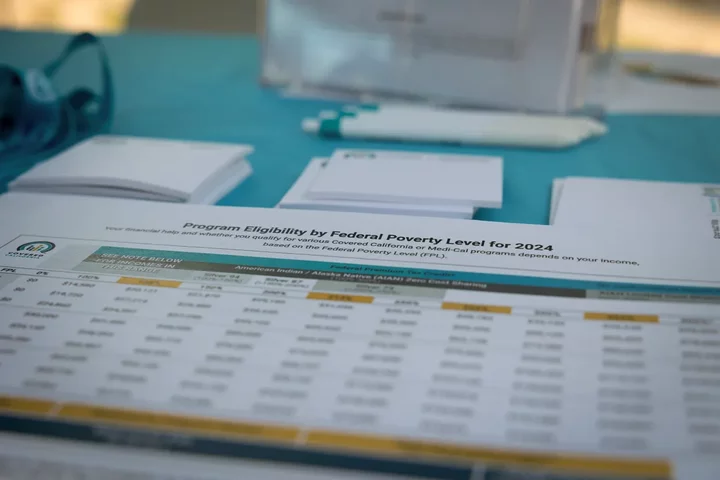

Covered California offers generous subsidies for health insurance through the Affordable Care Act. Enrollees should keep the agency updated of any life changes that might affect their income or they could be hit with a repayment bill from the IRS. Photo by Miguel Gutierrez Jr., CalMatters.

Every tax season hundreds of thousands of Californians are hit with an unexpected bill: They owe hundreds of dollars or more to the IRS because they accepted more money in subsidies for health insurance than they were allowed.

The chargeback can sting. Collectively, 415,000 California households owed the IRS close to $690 million in 2021 in charges related to the health care subsidies, according to agency data from the most recent year available. That is roughly $1,662 per person or family. Many people who end up owing money live in lower-income households.

This repayment rule is connected to the federal Affordable Care Act and the state-based health insurance plans it encouraged. Covered California, the state’s insurance marketplace, offers generous premium subsidies to those who qualify based on their income, but people can unknowingly receive too much aid if they underestimate how much they’ll earn the following year or if they lose a dependent and do not report that change.

The federal government collects any “excess” aid when people file their taxes. The government calls this process “reconciliation.”

Ten years after the rollout of the insurance marketplace, many Californians continue to be caught off guard come tax filing time. Often the charges come as a shock.

“They feel like they’re following the rules, they’re getting their coverage. And, they just kind of feel like they’re getting in trouble for doing everything right,” said Audrey Casillas, assistant director of community economic development services at Koreatown Youth and Community Center. Her nonprofit helps local low-income residents prepare their taxes at no cost as part of a Los Angeles County tax assistance program.

The people who receive excess aid are not wealthy. About half of the households who owed the IRS for excess premium subsidies in tax year 2021 earned less than $50,000, according to data from the agency.

Alex Hernandez, an insurance broker in Merced, said most people can avoid this clawback by reporting any changes in income and dependents to Covered California as soon as possible. This way the agency will adjust the amount of premium subsidies a person or family is receiving, and they’ll avoid an unpleasant surprise come tax filing time.

Hernandez tells clients to report all taxable income to the agency — that includes any extras, such as a bonus or significant winnings from a lucky night at the casino.

“Some members who are doing the enrollment themselves think that they need to go by last year’s income, and that’s not always the case,” Hernandez said. People should instead estimate income based on their current situation, he explained.

Don’t wait for open enrollment

Covered California in an emailed response to questions from CalMatters said it sends a notice reminding enrollees to report any changes, such as income and household size, before they sign up for or renew coverage.

“Consumers are reminded throughout the notice to ensure their information is accurate, and states what the tax implications are if information is incorrect,” Jagdip Dhillon, a Covered California spokesperson, said in an email.

Of course, people shouldn’t wait until open enrollment to declare changes. Enrollees can report changes at any point, either with the help of an enrollment counselor or by calling Covered California directly.

“People may need mid-year reminders, if you’re only getting this (notice) once a year it can be kind of late,” said Cynthia Cox, director of the program on the Affordable Care Act at KFF, a health policy organization that conducts polling and research. “Open enrollment is in November and tax season is April. It might be a good idea to think about it in July.”

The reconciliation rule also works the other way around. People who overestimate their income and receive less subsidies than they’re eligible for could get money back. And for those who make less than 400% of the federal poverty level, there are limits to how much they’d have to repay the IRS if they were to owe.

At the time of learning they’ll owe the IRS, some people question whether they should keep their health insurance, Casillas said. But people may also owe if they go without insurance. That’s because California is one of five states that requires residents to have health insurance. Those who go without it may face penalties.

Many save money with Covered California

Some people who have encountered this issue in the past see it as a tradeoff, Casillas said. They pay very little for their health insurance every month, but pay hundreds or a couple thousand dollars when they file their taxes. For many people, what they end up owing the IRS is still less than what they’d pay for a health plan at full price or what they’d pay for a hospital visit, Casillas said.

“We just tell them, ‘Hey, you know what, these things can be unpredictable. You want to have some savings,’” she said.

Correctly estimating next year’s earnings can be especially difficult for people who freelance or job hop, causing their estimates to be less precise, experts say.

“A lot of people on the ACA marketplace do have incomes that can be very volatile. They might be piecing together part-time jobs or are self-employed or small business owners,” Cox said.

Hernandez said he advises people enrolled in a Covered California plan to find an agent of their own and check in with them every so often. Because agents get commissions from insurance companies, this service is often free to the public. This is the best way to be informed and avoid unexpected charges, he said.

###

Supported by the California Health Care Foundation (CHCF), which works to ensure that people have access to the care they need, when they need it, at a price they can afford. Visit www.chcf.org to learn more.

The CalMatters Ideas Festival takes place June 5-6! Find out more and get your tickets at this link.

CalMatters.org is a nonprofit, nonpartisan media venture explaining California policies and politics.

CLICK TO MANAGE