One Suspect at Large After Armed Robbery at Fairway Market Last Night

LoCO Staff / Tuesday, Oct. 1, 2024 @ 1:53 p.m. / Crime

Press release from the Humboldt County Sheriff’s Office:

On Monday, Sept. 30 at about 9 p.m., Humboldt County Sheriff’s Office (HCSO) deputies responded to the report of an armed robbery at the Fairway Market on Herrick Ave. in Eureka.

The store owner reported the incident shortly after it occurred, prompting immediate response from deputies in the area. According to the store owner, a person entered the market and pointed a firearm at the owner. The suspect demanded cash, and threatened to shoot the owner if he did not comply. The suspect then fled on foot and was last seen in the area of Carolyn Ct. Deputies arrived on the scene within minutes of the 911 call; however, after an exhaustive search they were unable to locate the suspect.

The suspect is described as a white male adult, approximately 6’ tall and weighing between 150-160 lbs. He was last seen wearing a black hooded sweatshirt, black pants, and black gloves, and was seen carrying a blue canvas bag. If anyone has information about this crime or a potential suspect, they should contact HCSO.

This case is still under investigation.

Anyone with information about this case or related criminal activity is encouraged to call the Humboldt County Sheriff’s Office at (707) 445-7251 or the Sheriff’s Office Crime Tip line at (707) 268-2539.

BOOKED

Yesterday: 4 felonies, 7 misdemeanors, 0 infractions

JUDGED

Humboldt County Superior Court Calendar: Yesterday

CHP REPORTS

No current incidents

ELSEWHERE

RHBB: ‘We Will Not Accept the Response’: Students Remain Overnight in Cal Poly Humboldt’s Nelson Hall

RHBB: Humboldt County Road Construction Notice: Central Avenue

RHBB: Electrify Home Appliances and Improve Efficiency, Says Arcata

Governor’s Office: Governor Newsom releases 2025 judicial appointment data

TODAY in SUPES: Board Passes Two New Ordinances to Increase Flexibility in Housing Development

Ryan Burns / Tuesday, Oct. 1, 2024 @ 1:25 p.m. / Local Government

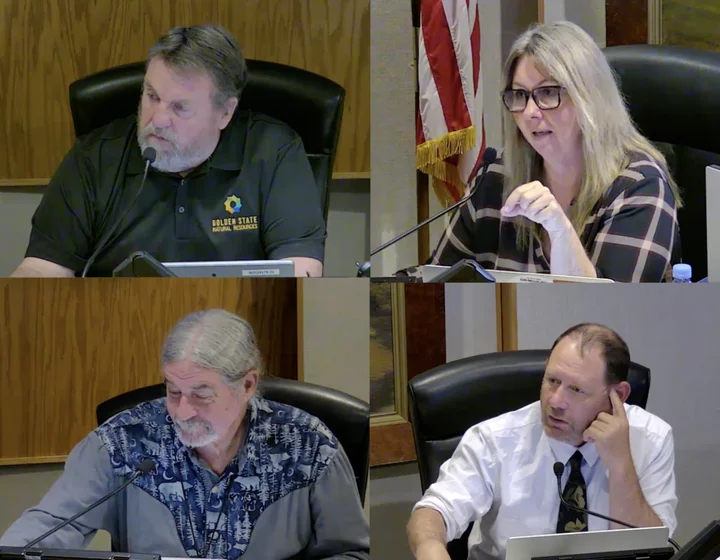

Clockwise from upper left: Humboldt County supervisors Rex Bohn, Michelle Bushnell, Mike Wilson and Steve Madrone. | Screenshots from Tuesday’s meeting.

###

The Humboldt County Board of Supervisors today took a couple of small steps toward increased flexibility in multi-family housing development.

With Fourth District Supervisor Natalie Arroyo absent, the board passed a pair of ordinances that will implement and expand upon a state law that took effect last year. That law, called the Middle-Class Housing Act of 2022, allows housing to be built in zones where office, parking or retail are permitted.

There are certain restrictions on those allowances. For example, any new housing projects must be located within an “urban cluster,” and here in Humboldt they’ll have to be built at a density between 15 and 30 units per acre. No single-family houses and no huge apartment complexes, in other words.

Potential locations for this new housing development include Fields Landing, Cutten, Scotia and the long stretch between McKinleyville and Fortuna.

There were some differences of opinion among the board members as they discussed potential tweaks to the Commercial Residential Ordinance, which the Planning Commission passed along with a recommendation for approval from the supes.

Third District Supervisor Mike Wilson argued that multi-family housing shouldn’t be put in commercial zones right next to industrial zones, and he said the ordinance should specify that new housing development must occur only in areas with existing services, such as public water and sewer and access to public transportation.

“I’m not agreeing with everything you’re saying,” Second District Supervisor Michelle Bushnell interjected. Regarding his call for housing to be located in existing service areas she said, “For the very unincorporated areas, especially in my district where housing could be appropriate there, I’m not feeling his language change.”

In particular, Bushnell asked about the potential for development in the Cooks Valley region, and Planning and Building Director John Ford said Wilson’s suggestion would indeed exclude that area.

Wilson said that’s justified.

“Housing is very needed,” he said, “but we can create a pretty substantial service burden, from a local government perspective, if we’re putting multi-family housing in areas that are quite isolated.”

The two wound up compromising by having the ordinance say that multi-family development in areas without services may be allowed, but they’ll require a special permit.

Another point of disagreement arose in a discussion about parking requirements. Wilson suggested eliminating parking requirements for all housing that’s within half a mile of a bus stop. First District Supervisor Rex Bohn pushed back on that idea.

“I mean, I know we’re trying to get everybody out of their cars and everything else, but I’m pretty sure we all drove here this morning,” he said. “So I just think [allowing development with] no parking is an issue.”

Ford said that the Planning Commission also struggled with this topic but decided that parking requirements should not be required for affordable housing projects or those served by public transit.

Bohn also made the argument that excessive red tape is preventing housing from being developed.

“We’re not building a lot of stuff,” he said. “Everybody wants to get a piece of their pie, and it just seems like — .” He stopped himself. “I’m going through the same rant that I always do,” he lamented.

Wilson said today’s decisions should actually help resolve that complaint.

“In general, this ordinance increases entitlements and decreases restrictions for building housing,” he pointed out.

The board voted unanimously to pass the Commercial Residential Ordinance after excising parking requirements for developments within half a mile from a bus stop and specifying that any developments that aren’t in an “urban cluster” must first get a special permit.

Considerably less debate accompanied passage of the Zoning Updates Ordinance — tweaks to existing regulations “that individually are quite small,” Ford said, adding, “Cumulatively, they’re not significant.”

The changes involved such matters as fence heights the and definition of the terms “family” and “mini-storage.”

Bohn objected to an element of this ordinance that will prohibit mini-storage units in certain zones in an effort to keep them on the periphery of mixed-use commercial and residential areas. As such, he wound up voting “no,” but the motion still passed with a vote of 3-1.

A Glorious Multi-acre Bonfire in the Table Bluff Area Tomorrow Will Rid the Land of Invasive European Beachgrass

LoCO Staff / Tuesday, Oct. 1, 2024 @ 12:59 p.m. / Non-Emergencies

Die. Photo: Malene Thyssen (User Malene), CC BY-SA 3.0, via Wikimedia Commons

Press release from the Calfire Humboldt-Del Norte Unit:

What:

Professionally controlled prescribed burn planned for the consumption of invasive European Beachgrass involving approximately 14-50 acres, as conditions allow.

When:

The prescribed burn is planned for Wednesday, October 2nd, 2024.

Where:

Ocean Ranch southwest of Table Bluff. Four miles northwest Loleta.

Why:

This burn is part of a multiyear prescribed fire study for invasive plant management and hazardous fuels reduction. The treatment will help to enhance the health of the native plant communities, aid in the control of non-native plant species, protect and enhance habitat for multiple dune species, and aid in the reduction of hazardous fire fuels.

Who:

California Department of Fish and Wildlife (CDFW), CAL FIRE. During these prescribed fire operations, residents may see an increase in fire suppression resource traffic, smoke will be visible and traffic control may be in place. Please be cautious for your safety as well as those working on prescribed burns.

Learn more how you can prepare for wildfire by visiting: www.ReadyForWildfire.org.

For more information, please contact the CAL FIRE Humboldt – Del Norte Unit Public Information Officer line at: (707) 726-1285.

ALL CLEAR: Eureka High School Evacuated Due to Bomb Threat; EPD Determines Report ‘Not Credible’

LoCO Staff / Tuesday, Oct. 1, 2024 @ 12:21 p.m. / Emergencies

Eureka High School release:

Dear Eureka City Schools Families and Staff,

This morning, a bomb threat was reported at Eureka High School. The Eureka Police Department (EPD) responded promptly and thoroughly investigated the situation. After a detailed assessment, the threat was determined not to be credible.

As a precautionary measure, all students and staff were evacuated while the investigation was conducted. We are happy to report that all students and staff are safe, and regular school operations have resumed.

We appreciate the quick response from EPD and the cooperation of our students and staff during this incident. The safety and well-being of our school community are always our top priority.

Thank you for your continued support.

Sincerely,

Gary Strorts

Superintendent, Eureka City Schools

LoCO KARAOKO: LoCO is Giving Away Two Redwood Coast Music Festival All-Event Passes! You Just Have to Sing For Them!

LoCO Staff / Tuesday, Oct. 1, 2024 @ noon / Music

Well, what do we have here?! We realize this is kind of last minute, but LoCO finds itself in possession of a pair of four-day passes to this weekend’s Redwood Coast Music Festival and they’re burning a hole in our pixel-y pocket! Perhaps you’d like ‘em, yeah? Maybe you were thinking, “Gee golly, I’d like to go to that thing, but $170 per pass seems a bit steep for me at the moment. I’ll just listen to 8-tracks in the garage again.” Well, here’s your chance to boogie down for free on LoCO. But you’ll have to earn it.

How, you ask? We’re gonna play LoCO KARAOKO. Follow along, music lover, for directions on how this is gonna go:

- First, record a new under-60-second video of yourself singing a song of your choosing. We are not limiting your genre or song selection, just try to think of a song that will win over your Humboldt neighbors. You can sing acapella or with musical backing. It doesn’t matter. Just be entertaining.

- At 7 p.m. on Tuesday, Oct. 1, we will launch the official LoCO KARAOKO post on our Facebook page, which we’ll link HERE to make it easy to find.

- Upload your video to the comment section of that Facebook post. One entry per singer.

- Then, hopefully, Humboldt’s Facebook users will organically find and enjoy your musical stylings enough to grace you with a “like” or a “heart” or whatever (but we know that you’ll probably all be rallying your troops, which is fine).

- This all culminates, at noon on Thursday, Oct. 3, when we will close voting. Whichever singer garners the most reactions will be declared the winner. (We will weigh “like”s, “heart”s, “wow”s, etc. equally, in this instance.)

Does that make sense? We’ve done contests like this on our Facebook page in the past with some success, so we have no reason to believe this won’t work again (though, sometimes things go hilariously sideways). A couple more notes for voters, though:

- LoCO is watching. To those who might like to game the system by voting through their business/artist/political campaign pages, we see you.

- Now, can you vote for multiple entries? Sure. If you’d like to dilute your vote that way, LoCO is not going to stop you. You are full of love and appreciation, and that’s fine.

OK. Let’s try this out! Again, you’re competing to win two $170 passes to the RCMF. So that’s — hold on… uh… carry the one — a $340 value, people! Hot damn. Thank you in advance for your dulcet tones. And good luck!

# # #

[Note: While it’s true we used a dog in our li’l graphic for this contest, entrants must be human to be eligible to win. Thank you for understanding.]

California Now Has an Official Crustacean!

LoCO Staff / Tuesday, Oct. 1, 2024 @ 10:23 a.m. / Wildlife

Metacarcinus magister (Dungeness crab). Photo: (c) Josh Houston, some rights reserved (CC BY-NC)

From the Office of Assemblymember Jim Wood:

Governor Newsom signed a bill by Assemblymember Jim Wood (D- Healdsburg), AB 1797 recognizing the Dungeness crab – Metacarcinus magister – as California’s official crustacean. Senator Mike McGuire (D-Healdsburg) is the principal coauthor and Assembly Members Dawn Addis (D-Morro Bay) and Gail Pellerin (D-Santa Cruz) are coauthors.

“The Dungeness crab is an iconic crustacean in California and one that has made a significant contribution to the economies of coastal communities in California and to those in the commercial fishing industry,” said Wood.

The Governor noted in his signing message that “Dungeness crab is one of the oldest commercial fisheries” and “remains a pillar of the state’s local economy.” The industry supports fishing ports and bolsters retail and hospitality businesses, bringing patrons in to restaurants and inns. It is a key delicacy that is often at high demand when Californians ring in the New Year.

“We must recognize, however that the Dungeness crab industry is not without its challenges,” said Wood. “We need to ensure that the fishing industry, the ocean and its inhabitants are all well protected.”

Both commercial and recreational fisheries for Dungeness crab exist in California, having slightly different seasons within the two distinct management areas, divided north and south by the Sonoma/Mendocino line.

“I’m proud to have helped the Dungeness crab become the state’s official crustacean,” said Wood. “It’s important to the commercial fishing industry and to the communities that depend on its health and abundance.”

GUEST OPINION: Take it From Someone Who Lives There — The Bulb-Outs and Bike Lanes on H and I Streets are Great

LoCO Staff / Tuesday, Oct. 1, 2024 @ 7:15 a.m. / Guest Opinion

PREVIOUSLY:

###

Six years ago, I wrote a guest opinion about H and I streets in the LoCO. It’s been roughly six months since the upgrades to the two streets, and as a resident of H Street, I can attest that traffic is calmer and slower, people on bicycles are enjoying the new bike lane, and people are able to actually cross the streets without fearing for their lives.

In my previous column, I wrote about the many problems of H and I streets: that there were more than three times the number of collisions relative to comparable streets in California. That I watched high schoolers run across the streets (in crosswalks) while speeding motorists ignored their presence. That it was dangerous for both motorists and pedestrians when there were crosswalks across (essentially) a highway. H and I streets are right in the center of town, and they have a lot of cross traffic and pedestrians. The way the road became highway-like wasn’t because of thoughtful design, it was because of lack of design, and the streets unfortunately served to cut Eureka in two.

And so, the city council and staff decided to update the roads to account for the different ways people use them. They reduced the lanes from three to two, created a buffered bike lane, put in flashing lights at crosswalks, and installed bulb-outs to aid people crossing the street.

I’ve seen some criticism of the changes to the streets and it’s true: many cars now need more time to get down these streets. This is because the average speed of vehicles has been reduced to closer to the actual speed limit.

But the benefits have been immense. The crosswalks, once only decorative, have become functional. The groups of high schoolers heading to and from school cross H and I streets safely. Cars stop because of the flashing crosswalk lights, and the bulb-outs mean that people crossing don’t have to run across so many lanes to get to their destination. The bike lanes feel safe and I see a lot of folks bicycling on them. The other night, I was on my bike on H Street, stopped at a traffic light. A couple rode up behind me, one of them with a toddler in a seat on the front of her bike. We rode together for a few blocks, chatting about how nice it was to be on H Street – as cars passed us safely on our left.

The reduced speed, and reduced swerving across three lanes, has made our streets feel more like the city streets that they are. Families with kids, older folks walking dogs, teenagers on skateboards, bicyclists in lycra tights and bicyclists in skirts, all get to use these streets, alongside cars. Their prior design made most modes of transit unsafe. The upgrades now mean that people are able to enjoy H and I streets more safely.

Six years ago, I wrote that “I think that the proposed H and I Streets project helps us to prepare for the future we want, rather than living with the infrastructure we are stuck with.” Now I can start to see the changes that the H and I upgrades have brought. People can cross the streets and ride their bicycles to downtown and to Henderson Center. And they can also still drive down those streets. I drive down those streets. And I appreciate knowing that everyone is safer, in cars and outside of cars, while doing so.

###

Erin Kelly lives on H Street.