From left: County Administrative Officer Elishia Hayes, Fourth District Supervisor Natalie Arroyo, Third District Supervisor Mike Wilson, First District Supervisor/Board Chair Rex Bohn, Fifth District Supervisor Steve Madrone and Second District Supervisor Michelle Bushnell. | Photo by Ryan Burns.

###

Hoping to generate revenues for much-needed road maintenance and repairs across the county, the Humboldt County Board of Supervisors today unanimously voted to place a one percent (1%) transactions and use tax measure on November’s General Election ballot.

In a presentation to the board, Deputy County Administrative Officer Sean Quincey sought to explain why such a tax measure is needed. He highlighted the increased frequency of natural disasters, including wildfires, flooding, earthquakes and landslides. When the state or federal governments declare emergencies, the county can recoup much of what it spends managing such disasters, but Quincey noted that such declarations aren’t always made, and even when they are it can take years to get reimbursed.

“That situation is taking a toll on the county,” he said.

Quincey also said that over the past 30-odd years, the state government has taken more than $500 million in local property tax revenues that should have gone into the county’s general fund but were instead redirected to state coffers.

The dollar amount nabbed by the state goes up every year, according to Quincey. “And in Fiscal Year 23-24 that amount was more than $25 million that would have otherwise gone to the general fund to take care of local needs,” he said.

With natural disasters becoming an everyday part of life in Humboldt County, Quincey said, “we need to reorient the way that we deliver public services in light of this reality for the county.”

Public Works Director Tom Mattson agreed, noting that the county is currently managing five separate disasters with limited funding and a departmental deficit that ranges from $5 million to $10 million from day to day. While the county government waits to be reimbursed by FEMA or state agencies, more natural disasters inevitably strike.

That has left his department with only enough funding to conduct short-term damage repairs on roadways, rather than the more expensive long-term fixes that are needed, fixes such as retaining walls, improved rock slope protections and, in some cases, reroutes, he said.

“This is a viscous circle, because we’re taking our maintenance money and using it for storm damage, and then we’re waiting six to 10 years to get reimbursement,” Mattson said.

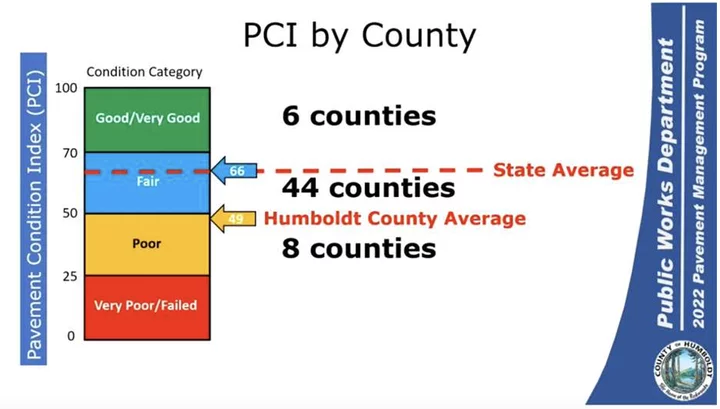

Meanwhile, the pavement on county roadways continues to deteriorate. Up until the mid 2010s, the county’s roads had an average Pavement Conditions Index score in the mid-sixties. (The PCI operates on a scale of 1-100, with 100 being perfect and scores of 70 and above serving as the target for governments to minimize operation and maintenance costs.) The current average score for county roads had dropped to 49, which Mattson said is bad enough to require a full rebuild of many local roads.

Image via County of Humboldt.

###

Implementing a tax to fund roads would also qualify Humboldt as a “self-help” county, making us eligible for more state and federal grants and other sources of revenue, according to staff.

The county retained the public-opinion polling firm FM3 to survey local residents about their priorities and willingness to support a roads-specific tax measure. Miranda Everitt, a senior vice president with the firm, appeared via Zoom today to go over the results. Of the 649 people who responded to the survey, 70 percent said they consider road conditions an “extremely” or “very serious problem.” That figure represents a 13 percent jump from just last year, Everitt said.

The proposed tax measure would be a “general service tax,” which means it would only need to be approved by at least 50 percent of voters plus one vote to pass. FM3’s survey found that 60 percent said they’d vote “yes,” with 36 percent indicating they’d vote “no” and four percent unsure.

Quincey said staff was recommending a one percent tax focused on roads, public transit and 9-1-1 response times, with spending to be overseen by the county’s existing Audit Committee. That committee is staffed by Auditor-Controller Cheryl Dillingham, Treasurer-Tax Collector Amy Christensen, County Administrative Officer Elishia Hayes, members of the Board of Supervisors and several citizen representatives.

The board spent some time discussing the matter. Fourth District Supervisor Natalie Arroyo, who also serves as chair of the Humboldt Transit Authority’s Board of Directors, said she appreciated the inclusion of bus service in the draft language of the ballot measure.

Third District Supervisor Mike Wilson agreed and said that while the county’s last voter-approved tax, implemented a decade ago via Measure Z, has its share of critics, its expenditures are managed via “one of the most transparent processes in the state of California for local funds.” He’d like the county to arrange for something similar in this case.

Fifth District Supervisor Steve Madrone said he thinks the county may have “over-promised” to the public about the potential of Measure Z. “We all thought that it might cover all the public safety issues – and roads are clearly one of those public safety issues – but it really wasn’t enough to do all that,” he said. Madrone added that this roads measure, if passed, would take some of the pressure off of Measure Z.

During the public comment period, a procession of speakers voiced support for directing revenues toward public transit, including bus services. Colin Fiske, speaking on behalf of the nonprofit Coalition for Responsible Transportation Priorities, lauded the Humboldt Transit Authority, calling it “an extremely effective and efficient agency” that provides a vital service to many residents.

Several other residents and nonprofit leaders echoed that sentiment.

One commenter noted that residents in the county’s urban areas will be asked to contribute to this fund even though the revenues would mostly go toward roads that span across the most rural parts of the county.

When the matter came back to the board, Madrone pointed out that every resident in the county uses county roads, just as rural residents generate tax dollars for cities by spending money there. “It’s a community, including all the cities in the county,” he said, “and we’re going to need everybody’s support to really get this over the finish line.”

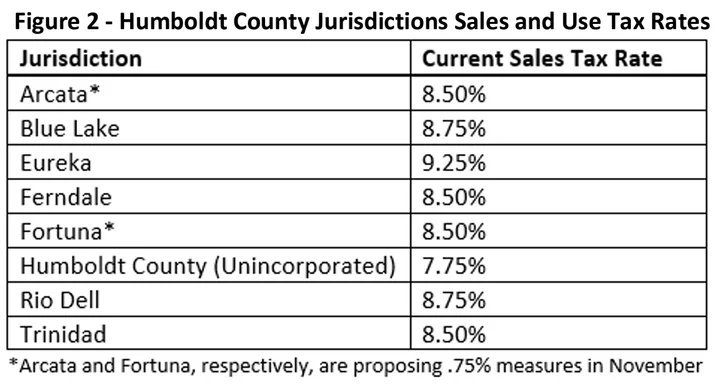

If the measure passes, it would increase sales tax in the unincorporated parts of the county from 7.75 percent to 8.75 percent. Below is a list of the other local sales tax rates, which would all increase by one percent should this county tax measure pass (and potentially even more in Arcata and Fortuna if voters there approve municipal tax increases in November).

Quincey explained that the tax increase would not apply to groceries sold as food, prescription drugs, medical/dental services, real estate, diapers, feminine hygiene products, education or rent.

Arroyo made a motion to accept staff’s recommendation and send the measure to voters on November ballots. Second District Supervisor Michelle Bushnell seconded the motion, which passed unanimously.

Check the Outpost tomorrow for more coverage of Tuesday’s Board of Supervisors meeting.

CLICK TO MANAGE