A home for sale on Second Street in Eureka. | Photo by Ryan Burns.

###

Buying a home in Humboldt County is a dangerous investment — at least according to the real estate analytics company ATTOM.

The private equity-backed firm, which claims to be “passionate about real estate data,” recently released its latest U.S. Housing Risk Report, which ranks Humboldt County at #2 on its list of the riskiest housing markets in the U.S. The top spot on the risk list went to our NorCal neighbor Butte County. El Dorado and Shasta counties also made the top five.

What do these rankings mean? Well, a post on the company’s website says they’re based on an assessment of vulnerability in county-level housing markets during last fiscal quarter. The rankings are based on a variety of factors, including relative home affordability, equity levels and unemployment rates. (And apparently only 580 of the nation’s 3,000-plus counties have sufficient data to analyze in this way.)

The Outpost obtained a copy of the data ATTOM compiled for its report. Humboldt’s report card came in as follows:

- 50.2% of income needed to buy

- 3.1% of properties underwater

- 1 in every 803 properties with foreclosure filings

- 6.1% July 2025 unemployment rate

The figure that immediately jumps out is the 50.2 percent. That’s how much of the county’s median income you’d have to spend each month in order to afford the median-priced home here. Experts typically recommend spending no more than 30 percent of your gross income on housing.

The “underwater” figure represents properties where the amount owed is more than it’s worth. It’s a safe guess that the collapse of our local cannabis industry has influenced that number here.

Meanwhile, the county’s unemployment rate in July (which is the most recent data we have, thanks to the federal government shutdown) was 6.1 percent. That’s equal to the statewide rate but higher than the national rate of 4.6 percent, according to the California Employment Development Department.

ATTOM’s analysis found that 16 of the 50 highest-risk markets were located in California. Your real estate investments are safer in Wisconsin, Tennessee and Montana, according to the report, which doesn’t address matters of living quality and natural beauty.

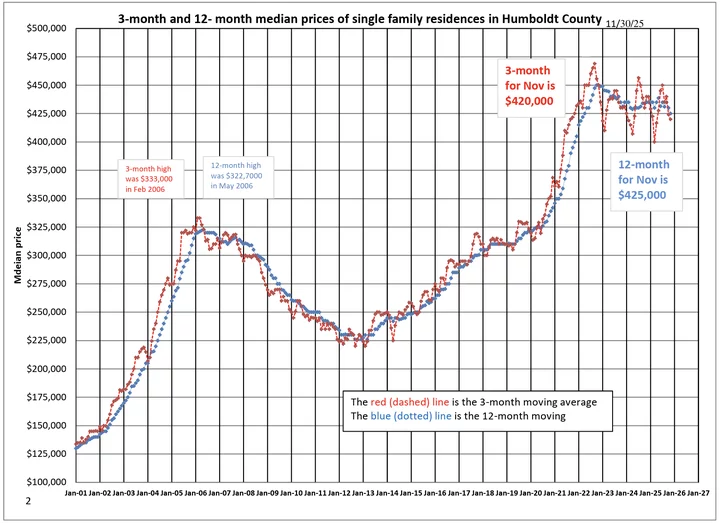

Local realtor and seasoned number-cruncher Charles McCann releases his own regular reports on local real estate trends, as represented in a series of graphs. His latest report was just issued this morning, and it includes the chart below. It reveals that local housing prices, which spiked during the pandemic, have since stalled.

Median price of single-family residences in Humboldt County over time. | Graph via Charles McCann. Click here to download a pdf.

###

As you can see, since peaking in late 2022, prices have been on a slight downward trajectory, albeit with a lot of seasonal volatility.

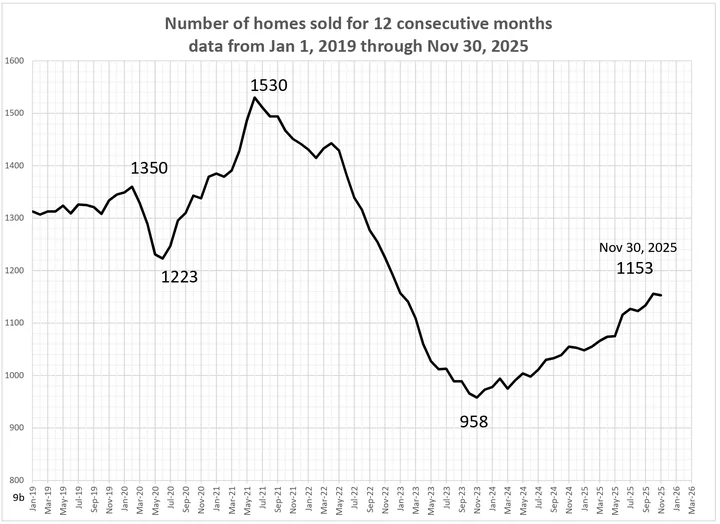

If you’re looking for a bit of good news, the number of home sales in Humboldt County has been on the rise over the past two years, as shown in the chart below.

Chart via Charles McCann. Click here to download a pdf.

###

ATTOM CEO Rob Barber is quoted in a post on his company’s website last week as saying, “A lot of attention has, deservedly, gone to affordability concerns stemming from the rising price of homes. But what really separated the riskiest markets in our third quarter assessment were their high rates of foreclosures and unemployment.”

“If a community is losing jobs, those homeowners will find it harder to pay their monthly mortgage bills,” he added. “That means more foreclosures, which can hurt the broader local housing market.”

But Humboldt County’s unemployment rate has remained fairly stable over the past year or so. (It rose just 0.3 percent since August of 2024.)

Given that Humboldt County ranked among the nation’s hottest real estate markets as recently as 2021, we should probably take all these charts and rankings with a grain of salt. And if our conversations with real estate agents over the years have taught us anything, it’s that now is always a great time to buy.

CLICK TO MANAGE