Image via the California Department of Cannabis Control

###

A bill currently working its way through the state legislature aims to provide a bit of tax relief for California’s legal cannabis industry, which has seen nearly four straight years of declining revenues in both wholesale and retail sales. Industry professionals and their advocates in Sacramento say this tax break is necessary to salvage the state’s regulated marketplace at a time when the black market still accounts for roughly 60 percent of the weed consumed in California.

Here in the Emerald Triangle, where the post-legalization “green rush” sent property values and grow shop receipts through the roof, the legal weed industry has crumbled. Those who remain in business say a higher tax bill will only send consumers to the black market, prompting more bankruptcies and thus fewer taxable sales.

“I don’t think it’s a secret that the legal market is not doing well,” said Ross Gordon, a policy analyst with the industry nonprofit Origins Council. “For most businesses, I think they’d characterize it as a state of collapse.”

On July 1, the state’s excise tax jumped from 15 percent to 19 percent as part of a political bargain struck in 2022 to help stabilize the fledgling marketplace. The deal, passed via a budget trailer bill, AB 195, eliminated the state’s $161-per-pound cultivation tax, which had generated $166 million in state revenue the previous year.

In order to make up for that lost revenue — which financed childcare programs and youth groups; environmental, wildlife and conservation programs; law enforcement and justice organizations; drug treatment prevention centers and other Tier 3 programs — AB 195 allowed state regulators to increase the excise tax after three years. That’s what happened on July 1.

A new industry-sponsored bill, AB 564, would suspend this tax increase for the next six years at least, and while industry professionals say this lifeline is necessary, critics argue that it would come at the expense of children and the environment.

Jim Keddy, executive director of the Sacramento nonprofit Youth Forward, is among the people working to keep the bill from passing.

“What we’re trying to do is protect these funding streams that are crucial to child care, to youth services and to the environment,” he recently told the Outpost. As a member of the state’s Prop 64 Advisory Group, Keddy helps determine which programs receive cannabis tax revenues, and he argued that this tradeoff — taxing a vice to finance a public good — is exactly what California voters approved when they passed Prop 64 in 2016.

“Voters supported an initiative they believed would provide funding for kids and for the environment,” he said. “That’s what the legislature and the governor need to respect. And if the cannabis industry wants to get out from under paying taxes, they should put a statewide ballot measure together and ask voters to approve it.”

Tax benefits

The North Coast has benefited disproportionately from Prop 64 tax revenues. In the 2024-25 fiscal year alone, Senator Mike McGuire’s district received more than $38 million in state Fish and Wildlife grants for a long list of environmental projects including watershed enhancement, cleanup remediation, research and more.

Meanwhile, the district has received almost $29 million in youth and child care grants since 2022, providing financing for programs from Humboldt County’s Department of Health and Human Services, the Yurok Tribe, Cal Poly Humboldt, McKinleyville Family Resource Center, Two Feathers Native American Family Services, Centro del Pueblo and other local organizations.

These tax revenues are the state’s only just one funding stream for Alternative Payment Programs, which provide vouchers or subsidies to help eligible low-income families pay for child care. [CORRECTION: While these cannabis tax monies do go toward the state’s AP programs, they represent just a fraction of the state’s $7 billion annual child care budget.]

Terry Supahan is the executive director of True North Organizing Network, which was the recipient of a $600,000 Prop 64 grant to provide wraparound support services for Tribal and Latinx youth while addressing adolescent risk factors for substance use, misuse and disorder. He’s incensed by the prospect of reductions to such funding for the sake of propping up the state’s weed marketplace.

“The cannabis industry is trying to get some tax rebate at the expense of our kids and our futures,” Supahan said. “It makes me insane to a degree.”

He has found his work with Tribal youth immensely rewarding. He said it provides kids with a kind of spiritual, moral and disciplinary shield that he didn’t have growing up.

“The best thing I’ve ever done is be part of expanding and strengthening tribal ceremony and language and culture upriver,” he said.

Supahan doesn’t think much of the cannabis industry. Its embrace of the term “green rush” offends him, given the cultural upheaval and violence that accompanied the gold rush. He recently confronted one of his own adolescent grandchildren who’d been smoking cannabis, telling them that they’re too young; their brain is still developing. And he views legalization as a Faustian bargain.

“If we’re going to make this pact with the devil, then the devil should adhere to what they said they were going to do when it was legalized,” he said. “If we’re gonna trade legalization for taxes then by God they should honor what they set out to do.”

The legislature’s elimination of the cultivation tax in 2022 has resulted in more than $600 million in lost revenues for environmental and child care programs. Keddy said the only reason youth and environmental groups didn’t oppose AB 195 was because both the legislature and Governor Gavin Newsom pledged to replace that lost revenue through the excise tax adjustment that took effect July 1.

‘Just a PR campaign’

Many others agree. In an April letter to San Francisco Assemblymember Mark Berman, a coalition of 98 organizations, including True North, Friends of the Eel River and the Environmental Protection Information Center (EPIC), wrote, “If the promise made in AB 195 is not kept, we risk losing at least $150 million per year for childcare, youth, and environmental programs.”

Keddy said that by pursuing AB 564, the state is going back on its word. A spokesperson for Newsom recently told the L.A. Times that if the bill passes, as seems likely, the governor’s office will work with the legislature to ensure there are no cuts to child care. Keddy’s not sure how the state will manage that in the midst of a $20 billion budget deficit. And he’s not convinced by the industry’s pleas this time around.

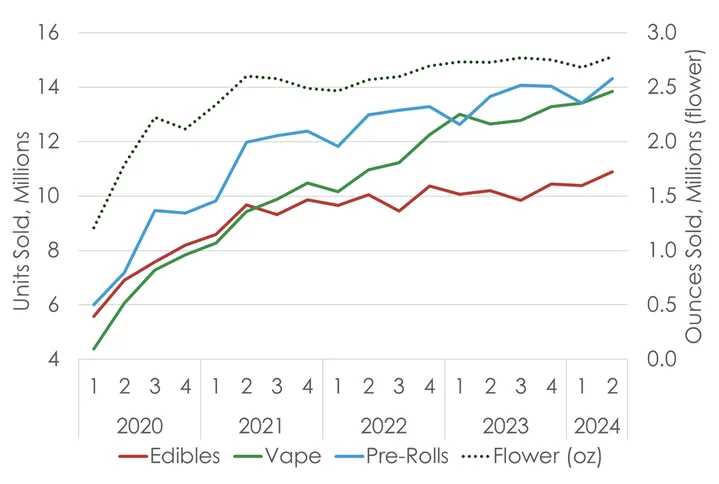

He pointed to a recent report from the Department of Cannabis Control indicating that legal cannabis production has increased by 70 percent since 2020 and the number of units of cannabis products sold increased by more than 5 percent last year.

“There’s a lot of wishful thinking that goes on where the cannabis industry tells everybody that, you know, if you give them a tax cut they’ll be more profitable and there will be more revenue,” he said. “That’s what they said in 2022, and it’s just a PR campaign, in my opinion.”

Far from it, according to Chrystal Ortiz, owner of Arcata dispensary Herb & Market. She noted that the recent state tax hike came on the heels of Arcata’s recent sales tax increase from 8.5 percent to 10.25 percent, which took effect on April 1. This double whammy, in conjunction with our region’s anemic economy and the rising costs of everything from groceries to PG&E bills, is having “a huge, huge impact on our customers,” she said.

Quarterly units sold by product. | Chart via DCC.

###

While the legal market may be selling more flower and derivative products than ever before, as Keddy points out, Ortiz said the market is being saturated with sub-par weed produced by deep-pocketed interests that can tolerate tiny profit margins, or even losing money.

Given the increased tax burden and declining demand, “Really the only place you can budge is on the purchase price, which encourages [dispensary owners] to support these kind of corporate entities that are financially backed [and] that are intentionally operating at a loss because they’re the only ones who can afford to shoulder some of that [burden],” she said.

When July 1 rolled around, some companies took advantage. “Big corporations started immediately offering tax incentive deals, like, ‘Oh, we know you’re struggling with this huge tax increase. We’re going to give you X, Y and Z of a discount,’ Ortiz said. “Whereas, for the average small farmer or small product maker, there already isn’t the margins [for such incentives].”

Gordon, the policy analyst, agreed.

“More and more of the legal market is composed of commodity products produced by large companies at a low cost, and small farmers and craft products are being edged out of the market,” he said.

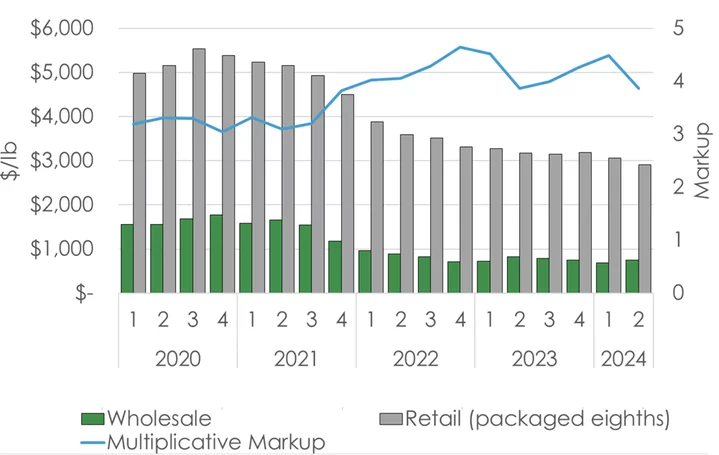

Pointing to that same DCC report that Keddy cited, Gordon noted that while legal production continues to increase (licensed cannabis production grew 11.8 percent to 1.4 million pounds in 2024), lower retail and wholesale prices are driving many licensees out business while the black market thrives. (An estimated 11.4 million pounds of illicit cannabis is produced in California each year, according to the DCC report, though much of that gets exported to other states.)

Chart showing California’s wholesale and retail prices and markups. | Via DCC.

###

Gordon said small-scale operators were betrayed from the outset of the legal market by the elimination of an agreed-upon one-acre cultivation cap for the first five years of sales, and they continue to be disadvantaged by a lack of legal access to tools that support small craft businesses in any other sector, such as direct-to-consumer sales.

“So I don’t think it’s surprising that if you build a market that doesn’t include those pathways that are appropriate for small producers [then] the market becomes very challenging for small producers,” Gordon said.

He acknowledged that returning the state tax rate to 15 percent won’t solve all of these problems but said he thinks it’s “one necessary piece of having what I think most people want, which is a sustainable and viable legal market.”

Keddy agreed that the game is rigged, to some extent.

“The legislature has been terrible to your part of the state, in my opinion,” he said. And he granted that corporate growers with massive Central Valley greenhouses are undercutting traditional growers in the Emerald Triangle, as is the emergency of THC-boosted hemp as a competitive product. But he also noted that it’s impossible to save every operator.

“You see it with restaurants and all kinds of retail — things open, things close,” he said.

And Keddy sees it as a bit hypocritical of the industry to call for a reduction in taxes when some of those that money goes toward law enforcement efforts to eradicate black market operators, though he also sees such operators as a fact of life.

“Frankly, I don’t see the illegal market going away anytime soon,” he said. “It’s been part of California for decades, and you know, there are all these other factors at play here.”

Ultimately, Keddy returned to the concept of public relations.

“I think the industry has had the advantage that they can point to taxes, and nobody likes taxes,” he said.

A viable market

But Gordon argued that there are plenty of indicators that California’s legal weed marketplace could be operated more effectively and more profitably, which would benefit everyone.

“I don’t agree with the framing of this conversation as zero-sum,” he said. “Look at states like Oregon and Michigan and see that they’re getting dramatically higher tax revenue per capita because they have legal regulatory structures that support that. It’s not because they’re putting a bunch more money into law enforcement. It’s because they are trying to create a viable market.”

Humboldt County is officially in support of AB 564. In February, County Administrative Officer Elishia Hayes sent a letter to the bill’s author, San Francisco Assemblymember Matt Haney, expressing “strong support” for the bill and describing it as “a critical piece of legislation that supports the sustainability and growth of the cannabis industry in California.”

The Board of Supervisors approved this stance in January as part of its annual legislative platform adoption.

AB 564 has already been approved by the Assembly, and last week made it out of the Senate Appropriations Committee. As with all bills in the Legislature, this one has until Sept. 12 to be passed. Newsom would then have until Oct. 12 to sign the bill into law, which he has vowed to do.

CLICK TO MANAGE