OBITUARY: Marcia Mills, 1935-2024

LoCO Staff / Wednesday, June 19, 2024 @ 6:56 a.m. / Obits

It is with great sadness that we announce the passing of Marcia Mills. She passed

peacefully on April 5, 2024.

Marcia was born January 19, 1935 to Jack and Muriel Allen in Eureka. She grew up in McCann and graduated from South Fork High School, valedictorian of her class. She went to work for the county of Humboldt until she met the love of her life, Eldon Mills. They married August 15, 1953. They moved to Weott and started their family. In 1964 they moved to Eureka and finished raising their children.

Marcia and Eldon loved to travel. They had many travel friends to travel and cruise abroad with. Marcia had her favorite place, Kauai, Hawaii. Marcia and Eldon went many times to Kauai together before Eldon passed in 2009. She continued to go every year with her best friend, Maudie Walker, for many years after.

Marcia is survived by her children, Lisa (Mike) Barreto, Frank Mills and Leslie (Dan) Scott; grandchildren, Brian (Bethany) Barreto, Wiatt (Jasmine) Barreto, Shannon (Tony) Mills, Haley (Matt) Pedamonte, Wylee Scott, Ashtyn Scott, and Lindsey (James) Harris; great-grandchildren Jerykah (Austin), Bryson, Jayla, Kira, Bristol, and Nash; and great-great-granchild, Tatum.

Marcia is preceded in death by her husband of 56 years, Eldon Mills, and her son, Steven Mills.

Please join us to celebrate the life of Marcia Mills. Share stories and memories. Saturday, July 13 from 1-4 p.m., at her home.

###

The obituary above was submitted on behalf of Marcia Mills’ loved ones. The Lost Coast Outpost runs obituaries of Humboldt County residents at no charge. See guidelines here.

BOOKED

Yesterday: 8 felonies, 6 misdemeanors, 0 infractions

JUDGED

Humboldt County Superior Court Calendar: Friday, Jan. 2

CHP REPORTS

Us101 N / Scotia Ofr (HM office): Trfc Collision-Unkn Inj

ELSEWHERE

RHBB: Driver Trapped After Seizure Reportedly Leads to Crash at Fourth and I Streets in Eureka

Mad River Union: APD: Arcata declares State of Emergency

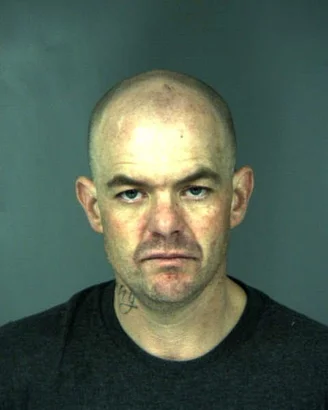

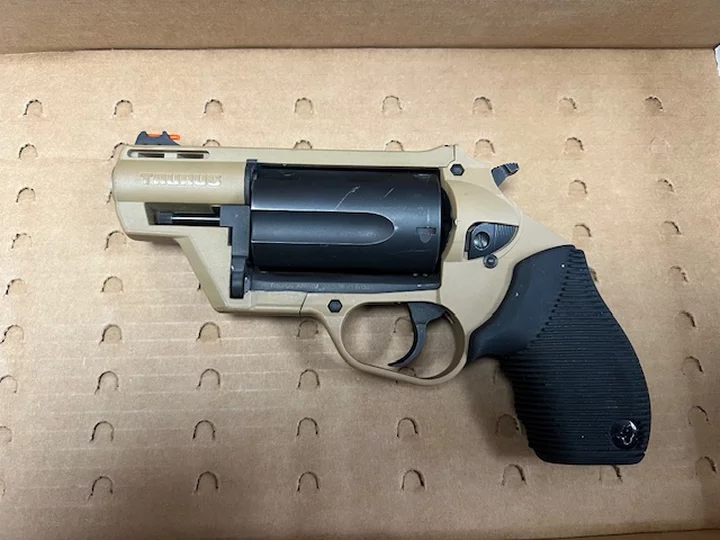

Fortuna Police Seeking ‘Armed and Dangerous’ Suspect They Say Fled From Chop Shop Where Multiple Stolen Vehicles Were Found

Andrew Goff / Tuesday, June 18, 2024 @ 7:55 p.m. / Crime

Photos: FPD

Fortuna Police Department release:

On Tuesday, June 18, 2024 at about 1:14 P.M. a Fortuna Police Officer located a stolen vehicle in the 1600 block of Meadowlark Court in Fortuna.

As the investigation ensued, the scene was determined to be a chop shop as the location was being used to store multiple stolen vehicles. Stolen vehicles were located parked in front of the residence and inside the garage. In total, three stolen vehicles were recovered. The suspect was identified as Daniel Ray Fidler (age 50) of Fortuna. Fidler fled the residence into the Jameson Creek area and densely wooded area directly behind the residence. A K9 was deployed however Fidler had escaped the area prior to the deployment.

Mutual aid was requested and Fortuna Police coordinated officers efforts in an attempt to establish a perimeter around the creek and wooded area. Information was obtained that Fidler was potentially in possession of a handgun and was making comments regarding “suicide by cop”.

Fortuna Police Officers, a Fortuna K9, the Fortuna Unmanned Aerial Vehicle and allied agency officers searched the area for Fidler with negative results. It is believed that Fidler arranged for an associate to pick him up and then fled the area.

As a result of the investigation, Daniel Ray Finder is wanted in connection to the following crimes:

- California Vehicle Code Section 10801 – Operating a Chop Shop

- California Penal Code Section 496(d) – Possession of a Stolen Motor Vehicle (X3 counts)

- California Penal Code Section 29800 – Possession of a Firearm by Prohibited Person

- California Penal Code Section 33215 – Possession of a Short Barrel Shotgun

- California Penal Code Section 30305(a)(1) – Felon in Possession of Ammunition

- California Penal Code Section 1203.2(a) – Violation of Probation

- California Penal Code Section 148(a)(1) – Obstructing, Resisting, Delaying a Peace Officer

- California Penal Code Section 466 – Possession of Burglary Tools

It should be noted that Filder is on active felony probation and has an active felony arrest warrant for Kidnapping.

While officers were processing the scene, Rio Dell Police became involved in a high speed pursuit involving a vehicle known by police to be associated with this incident. A stolen silver Jeep led Rio Dell Police on a high speed pursuit that ended in the rural area of Ferndale. The vehicle was found unoccupied but it is believed that the two incidents are connected.

This is an active and ongoing investigation, Fidler is believed to be armed and dangerous. Fidler is a career criminal with known access to firearms. Anyone with information regarding his whereabouts is encouraged to contact the Fortuna Police Department at (707)725-7550.

We would like to thank our allied agencies, California Highway Patrol, Rio Dell Police Department, Ferndale Police Department, Humboldt County Sheriff’s Office and Cal Fire Law Enforcement for their assistance with this incident.

CULTURE PLAYER: Juneteenth is More Than a Day

Gabrielle Gopinath / Tuesday, June 18, 2024 @ 10:47 a.m. / Culture

Monique “Mo” Harper-Desir and Harrel Deshazier strike a pose while volunteering with Black Humboldt during last year’s celebration. File photo: Isabella Vanderheiden.

For leaders of local arts and culture organizations, Juneteenth National Independence Day, taking place this Wednesday, June 19, is an opportunity to celebrate African American history and heritage through the arts. Juneteenth, which marks the anniversary of the June 19, 1865, emancipation of enslaved people in Texas and other former Confederate states, honors the experience of the millions of Black people who suffered under slavery and recognizes the struggle of the many who resisted and fought for freedom. The holiday celebrates liberation, self-determination and empowerment — qualities that are also central to social justice work.

Humboldt County’s first official Juneteenth celebration was organized in 2019 by members of Black Humboldt. This community-based collective was co-founded by artist and community organizer Mo Harper-Desir alongside visionary Dionna Ndlovu, with support from the NAACP. Black Humboldt, an Ink People DreamMaker Project, has continued to play a major role in organizing the five annual Juneteenth festivities that have taken place since, working this year alongside the Eureka chapter of the NAACP and members of the Black community to program a diverse roster of cultural events taking place in Fortuna, Eureka and Arcata.

The theme of this year’s Juneteenth Cultural Festival is “Visions of a Liberated Future – celebrating freedom and unity in Humboldt County.” The series kicks off Wednesday, June 19, with a family party and a Juneteenth hip-hop show at RampART Skate Park in Arcata. It culminates Saturday, June 22, with a day party at Eureka’s Halvorsen Park featuring local Black and Brown artists, vendors, workshops, performances and informational “Knowledge for Power” sessions.

This year’s festival hosts a Hip Hop Zone, a Kids’ Zone and a “Black & Green Zone,” with free activities including a food sovereignty market, food starts and plants, recycled art projects, aquaculture sensory tables, a hands-on watershed model, a build- your-own-bouquet table, a how-to-recycle center, cultural storytelling and nature-inspired performances.

Festival programming also includes live music and open mic events, a visual arts exhibition, a Black community speakers series, a karaoke takeover, a Pride tribute, a family skate night and a Black Student Union barbecue. “Visions of a Liberated Future,” a Juneteenth-themed art exhibition conceived in rapport with the Festival, is on view through June at Los Bagels in Eureka.

“This holiday is very important and empowering for Black communities all over the United States, but especially for Humboldt County,” writes Black Humboldt on a website for the event. “This community makes up a very small percentage of the (county’s) population, and is often oppressed as a result. Black history is a part of the United States’ history and is important to celebrate, as we create safe spaces and inclusion for the Black community in Humboldt County. … This is a learning opportunity to highlight American history, as well as an opportunity to create a legacy for the Black and Brown community of the North Coast.”

Several additional Juneteenth celebrations taking place in Arcata throughout the month complement festival offerings. HC Black Music and Art Association, an Ink People DreamMaker Project based in Arcata, works with young BIPOC people to develop Afrocentric, youth-focused cultural programming. Valletta Molofsky, the group’s founder and leader, said that the group would be celebrating Juneteenth in two summer youth programs taking place this summer in the group’s Harambee Cultural Center.

Robert Broadway, a Marine Corps veteran and martial arts specialist with a background in Chinese Kung Fu and Yang style Tai Chi, is offering a series of HCBMAA classes in Tai Chi Chuan and Choy Li Fut to celebrate Juneteenth. Classes emphasize self-defense, self-confidence, concentration, awareness and flexibility. HCBMAA will also be hosting the Harambee Youth Connections summer program, a two-week series of workshops for young people starting in July. This “Pan-African celebration of traditions and food” will feature a special guest, poet and performer Amde Hamilton of political poetry group the Watts Prophets. Young participants will be able to take classes in African cooking, bookmaking, art and beadwork, drum making, gardening, martial arts, video projects, dancing, and hip-hop dance.

Juneteenth also marks the initiation of a mural project being facilitated by Arcata public arts group REBOUND, a community-based arts and culture organization committed to using good design to realize projects that enhance community life. REBOUND, an Ink People DreamMaker Project, will be partnering with the City of Arcata, the Eureka chapter of the NAACP, the Arcata Rotary and the family of Josiah Lawson to facilitate the creation of a large-scale memorial and mural celebrating the life of David Josiah Lawson, a Black student leader at Cal Poly Humboldt whose 2017 murder by stabbing in Arcata remains unsolved.

The memorial, which will be located on the exterior of the D Street Community Center in Arcata, will incorporate a living wall planted in native vegetation, a collaborative mural painting based on a portrait of Lawson drawn by his aunt, and text rendered in a facsimile of Josiah Lawson’s own handwriting. Members of the public are invited to take part in this act of communal creation as a gesture of community healing and remembrance, in solidarity with the Lawson family and members of Humboldt’s Black community.

Drop-in painting sessions are scheduled to begin June 19, 2024 and will continue through June 27. “Participation from the public is encouraged! Professional muralists will be on site to assist members of the community during drop-in painting sessions,” said artist and educator Benjamin Funke of REBOUND. “All painting supplies and safety equipment will be provided.”

“The organizers of Juneteenth are incredible leaders, and I honor their leadership in bringing these celebrations of African American resilience to Humboldt County,” Leslie Castellano, executive director of the Ink People Center for Arts and Culture, said in response to a request for comment. “The entire North Coast region has benefited from the many ways leadership in the black community builds cultural power, celebrates black joy and furthers the long tradition of marching towards freedom.”

###

To learn more about the 2024 Juneteenth programming events featured here or to support them by making a donation, go to https://blackhumboldt.com , https://hcblackmusicnarts.org and https://www.r-e-b-o-u-n-d.net . To contact representatives of the organizations mentioned in this article, email blackhumboldt@gmail.com , info@hcblackmusicnarts.org and team.rebound.humboldt@gmail.com .

Gabrielle Gopinath is the grant writing and communications director for the Ink People Center for Arts and Culture.

Restraining Order Against Former Arcata City Councilmember Brett Watson Upheld by Appellate Court

Jacquelyn Opalach / Tuesday, June 18, 2024 @ 10:17 a.m. / Courts

When things started to fall apart for Brett Watson in 2021 amid allegations of sexual harassment, he embarked on a campaign of denial, refusal and counter-accusations: denial that he’d sexually harassed a city employee; refusal to step down from city council; claims that he was the true target of harassment and discrimination at Arcata City Hall.

It’s been a couple years, but Watson is still fighting the fight. He was again shot down last week when a California appellate court upheld the restraining order that prohibits Watson from entering Arcata City Hall and contacting four city employees. In his appeal, Watson claimed that the restraining order overextends the language of the law, is based on a lack of evidence and violates his constitutional rights.

The City of Arcata sought the restraining order after a city-commissioned investigation concluded that Watson sexually harassed a city employee for nearly two years, and, when his harmful behavior came to light, created a hostile work environment that some employees said made them feel unsafe. Issued in March 2023 by the Humboldt County Superior Court, the “workplace violence” restraining order is nearly halfway through its three-year lifespan.

The appellate court decision, issued on June 11, recounts the uncomfortable details of the years-long ordeal. Watson, who was a council member from 2017 to 2022, began to harass the employee in 2019 while he was mayor. Watson’s behavior included contacting the staff member frequently outside of work hours, making comments about his feelings for the employee that made her feel uncomfortable and “sick,” asking her for long hugs that were “creepy,” and threatening the employee’s job when she tried to set boundaries. In 2021, another city official witnessed Watson’s behavior and expressed concern to the staff member, who then reported Watson for sexual harassment and workplace violence.

In the months that followed, the City Council passed a vote of no confidence in Watson, who voluntarily stepped down as mayor but stayed on the council. The City commissioned an investigation that sustained the harassment claims, which Watson insisted was biased. Following the findings of that investigation, the City Council stripped Watson of his committee assignments and created protocols to limit his access to staff, which he quickly broke, according to the appellate decision document. The City got a temporary restraining order against Watson in October 2022 prohibiting him from entering City Hall and accessing four employees. He was arrested within days when he cc’d one of the protected four in an email.

The City sought a permanent restraining order, which involved a trial and was issued in March 2023 (permanent restraining orders, despite their name, typically only last three years but can be extended as necessary). By then, Watson was out of the political scene; he’d lost re-election in November 2022.

Watson is not permitted to enter City Hall or go within 100 yards of the four protected people’s workplaces, homes or cars. He also can’t possess firearms throughout the duration of the restraining order. Watson could face a fine of up to $1,000 or jail time up to a year if he violates the terms.

In his appeal of the restraining order, Watson claimed that the trial court misinterpreted the law, argued that there isn’t evidence to suggest his stalking behavior will continue, said that the protections for three additional people are essentially unnecessary and claimed that the restrictions from City Hall and city staff violate his constitutional rights.

The appellate court struck down every argument.

Watson claimed that the trial court improperly inflated the Workplace Violence Safety Act to include emotional and psychological harm in its interpretation of “safety.” But the act defines unlawful violence as “any assault, or battery, or stalking” – and, the court held, Watson was stalking the employee.

To that point, Watson claimed that there wasn’t sufficient evidence of stalking. But the court identified “substantial evidence of stalking behavior,” citing incidents occurring outside of work hours and unrelated to work matters across the years-long fiasco, including Watson’s admission that he was “addicted” to the employee.

Watson’s third challenge of the restraining order was that because he is no longer a city council member, there isn’t evidence to suggest he will continue to stalk and harm the staff member. The court noted that changed circumstances do sometimes warrant dropping a restraining order, but held that this is not one of those times. The court cited multiple occasions when Watson attempted to contact the protected staff members when the city-commissioned investigation was underway and he’d been asked to keep his distance.

“Given the extensive evidence of Watson’s obsessive conduct, his repeated tendency to push boundaries and his admission to being ‘addicted’ to [the staff member], substantial evidence supports the finding of a reasonable likelihood the stalking will recur,” the decision reads.

Watson also argued that the trial court abused its discretion by including the three additional protected persons on the restraining order, claiming that his interactions with those people didn’t indicate a reasonable threat of violence.

But the court again disagreed. “Watson had multiple interactions with each employee and engaged in a course of conduct that resulted in the employees fearing for their safety,” the report reads.

“The court need only find unlawful violence or a credible threat of violence against one employee […] and may then exercise its discretion, on a showing of good cause, to include other employees in the protective order without a separate finding of unlawful violence or credible threat of violence.”

Finally, Watson claimed that the restraining order violates his rights to free speech, freedom of association and civic engagement because he is not allowed to enter City Hall or contact the protected employees. However, Watson couldn’t back up exactly how these rights are violated by the restraining order, and so the appellate court considered the argument forfeited. Even so, the court pointed out that Watson can provide public comment during city council meetings via Zoom.

So that’s that for Brett Watson, for now. The restraining order will expire in March 2026.

###

PREVIOUSLY:

- Arcata Mayor Brett Watson Arrested for DUI, Drug Possession Late Last Night

- Arcata Mayor Brett Watson Issues Statement on His Arrest for DUI, Drug Possession

- Is Arcata Mayor Brett Watson Being De-Mayored? Amid Mysterious Circumstances, Arcata City Council Calls Special Meeting to Elect New Mayor and Vice-Mayor

- Arcata City Council Casts Vote of ‘No Confidence’ in Brett Watson, Removes Him as Mayor

- Arcata City Councilmember Says He’s Entering 30-Day Rehab Program to Deal With Personal Issues; Will Make Decision About His Future as Public Servant at a Later Date

- Residential Rehab Program Completed, Former Mayor Brett Watson Rejoins the Arcata City Council

- (UPDATE, BRETT RESPONDS) City of Arcata Announces It is Investigating Allegations Against Councilmember Brett Watson

- Arcata City Councilmember Announces Resignation, Citing Family Medical Issues, Poor Local Healthcare Options

- Arcata Councilmember Brett Watson Reveals That He Suffers from a Learning Disability as Mysterious Investigation Continues to Limit His Access to City Staff

- (UPDATE) Investigation Sustains Sexual Harassment Allegations Against Arcata City Councilmember Brett Watson; Former Mayor Was ‘Obsessed’ With Staff Member, Report Finds

- Arcata City Council to Consider Disciplinary Action, Including Possible Restraining Order, Against Councilmember Brett Watson in Response to Sexual Harassment Investigation

- Arcata City Councilmember Brett Watson, on the Verge of the City Seeking a Restraining Order Against Him, Says That He is the Actual Victim of Harassment and Discrimination

- Brett Watson, You Must Resign: An Open Letter From 50+ Local Women Leaders

- The City of Arcata Will to Have to Live With Brett Watson for a Few More Months, as the Councilmember Refuses to Allow Himself to Feel Shame or Remorse

- Arcata City Councilmember Brett Watson Accuses City Staff of ‘Lies and Deception’ During Very Long and Uncomfortable Council Meeting

- Arcata Councilmember Brett Watson Arrested for Violating His Restraining Order

These Cities Have a New Tactic to Evade California Housing Laws. Legal Experts Are Dubious

Ben Christopher / Tuesday, June 18, 2024 @ 7 a.m. / Sacramento

A pedestrian walks their dog through downtown Pleasanton on June 16, 2024. The city of Pleasanton the possibility of becoming a charter city — a possible end-run around California housing laws. Photo by Loren Elliott for CalMatters

When a judge ruled recently that a controversial state housing law did not apply to a handful of southern California cities, Julie Testa saw it as an invitation.

The late April opinion from Los Angeles County Judge Curtis Kin held that a 2021 state law letting homeowners split up their houses into as many as four separate units regardless of local zoning restrictions had no effect in Redondo Beach, Carson, Torrance, Whittier or Del Mar. The reason: The five SoCal jurisdictions are “charter cities” — jurisdictions with their own municipal constitutions that grant them extra independence from state law.

Testa, the vice mayor of Pleasanton, wanted what Redondo Beach was having. She wanted to turn her bedroom community east of San Francisco Bay into a charter city.

“The state Legislature has declared war on our cities,” said Testa. “We think that this is a turning of that tide.”

Since first winning local office in 2020, Testa has spent much of her short political career chafing against the spate of new state housing laws that force local governments to automatically approve apartment buildings, duplexes and backyard cottages. She cobbled together a loose group of like-minded politicians under the banner of the California Alliance of Local Electeds. A few days after Kin’s ruling, the group’s weekly Zoom meeting saw near record turnout, she said.

Now Pleasanton is one of at least three California cities, all San Francisco Bay Area suburbs, that have taken the first step toward adopting a charter since the April ruling. Testa and three of her four city council colleagues instructed city staff to look into making the transition in mid-May. City councils in nearby Brentwood and the hyper-affluent Silicon Valley suburb of Atherton followed suit this month.

“We must do what we can do to defend our constitutional right to local control.”

— Julie Testa, vice mayor of Pleasanton

Becoming a charter city — as roughly 120 of California’s 482 cities have done over the course of the state’s history — requires local voter approval. Before that, city officials have to actually write a charter, a comprehensive, technical governing document that covers everything from local election procedure to the dos and don’ts of municipal debt management. The three cities are probably kicking off that lengthy process too late for this November’s election, meaning that voters in the three cities won’t weigh in until at least 2026 — if at all.

“We will see a lot of irreversible consequences in that period of time, so I am disappointed, but I do believe that we must do what we can do to defend our constitutional right to local control,” said Testa.

Jovita Mendoza, the Brentwood council member who is pushing the charter effort in her city, said housing policy isn’t her sole motivation. Charter cities have more flexibility over contracting and purchasing policies, election procedures and taxation. But the recent ruling out of Los Angeles “definitely helped” provide fresh inspiration.

Brentwood’s council voted unanimously to begin the process last Tuesday. At a late evening hearing on the subject, Planning Commissioner Rod Flohr endorsed the idea.

“Most of the public is still kind of unaware of how restricted we’ve become, almost to the point where it feels sometimes like the planning commission and city council can’t really do anything anymore,” he said. “This may be our only avenue to…keep working to make Brentwood the jewel of east county.”

Gov. Gavin Newsom’s administration has ordered local governments to plan for an additional 2.5 million new homes through the end of the decade in an effort to bring down prices and rents. That’s part of a broader political shift in Sacramento as the governor, the attorney general and the Legislature have more aggressively promoted more housing, even over the objections of local elected officials and residents.

Mendoza in Brentwood was one of the chief proponents of a proposed statewide ballot initiative that would have allowed local governments to override state land use laws. The measure failed to gather enough signatures for this year’s election.

The April ruling opened up a new potential strategy. “If the charter cities win on appeal, I think you’re going to see it happening more and more,” she said.

On housing, the tie often goes to the state

Many legal experts are skeptical that the ruling will hold — and if it does, whether that would be the death blow to state land use authority that many local control advocates hope it will be.

“If I were looking to become a charter city in order to avoid (the state’s duplex law), I would not waste my time,” said UC Davis law professor Darien Shanske. “This decision will be overturned.”

Since the 1880s, California cities have come in two distinct flavors: “General law” cities, which have to govern themselves under rules set forth by the state Legislature, and charter cities, which the state constitution grants autonomy when it comes to “municipal affairs.”

Unhelpfully, the constitution doesn’t actually specify what those “municipal affairs” are. That makes the precise scope of a charter city’s political autonomy from the state an uncertain and moving target that courts have had to address on a case-by-case basis.

New homes under construction in Pleasanton on June 16, 2024. The city of Pleasanton has voted to explore the possibility of becoming a charter city. Photo by Loren Elliott for CalMatters

As state lawmakers have unleashed a raft of pro-construction bills over the last decade, the courts have typically allowed them to apply to charter and general law cities alike.

“The courts generally have not been very receptive to charter city arguments given the housing crisis,” said Barbara Kautz, a land use attorney who regularly represents cities and counties.

Kautz’s law firm, Goldfarb & Lipman, has represented Pleasanton, Brentwood and Atherton, but is not doing so in their current quests to become charter cities.

The April ruling is a notable exception to the trend. But it’s also an exceedingly narrow one and not something on which to hang a legal revolution in land use policy, said Kautz. “As a long term strategy to avoid (state housing law), I just don’t know if it would have any effect,” she said.

What the ruling does — and doesn’t — say

California courts have generally let the Legislature steamroll local authorities, even in charter cities, if state lawmakers can prove that they are addressing a matter of “statewide concern” and that the bill they’re passing is narrowly tailored to address that concern.

The 2021 law itself specifies that the “statewide concern” in question is to ensure “access to affordable housing.”

Unfortunately for the state, “affordable housing” has multiple definitions. Affordable housing might refer to units that are legally required to be reserved for people making under a certain income with regulated rents or prices, sometimes called “deed-restricted affordable housing.” Or the term can simply refer to housing that’s cheap.

“If I were looking to become a charter city in order to avoid (the state’s duplex law), I would not waste my time.”

— Darien Shanske, law professor at UC Davis

In his ruling, Kin concluded that the Legislature, in laying out its “statewide concern,” must have meant “affordable” in the first, deed-restricted sense. Because letting homeowners split their houses into duplexes “has, at best, an attenuated connection to affordable housing,” he wrote, the law wasn’t written narrowly enough to advance its stated goal and therefore doesn’t have the authority to trample over the rights of charter cities.

In short, the ruling dings the state duplex law because it didn’t justify its intent with the right term. UC Davis’ Shanske referred to the ruling jokingly as a “Simon didn’t say” legal test.

Kin has yet to submit a final judgment, which will clarify whether the ruling applies to just the five cities that sued or to every one of the more than 100 charter cities across California.

What the ruling doesn’t say is that charter cities are exempt from the duplex law because the state fundamentally lacks the authority to regulate how homes can be divided up. Nor does it say that charter cities are exempt from state housing requirements in general, which would have been at odds with a slew of recent court rulings.

Chris Elmendorf, one of Shanske’s colleagues at UC Davis School of Law who regularly opines on housing policy on social media, called Kin’s conclusion “a weird, narrow decision that turns on a lawyerly sleight of hand.”

A residential street in Pleasanton on June 16, 2024. The city of Pleasanton has voted to explore the possibility of becoming a charter city. Photo by Loren Elliott for CalMatters

Even some of those who welcomed the ruling as a victory for local control were tempered in their enthusiasm, if only because the ruling seems to invite the Legislature to simply fix its wording with another bill. San Diego Democratic Sen. Toni Atkins, who authored four-unit housing law, is working on a bill this year, Senate Bill 450, which aims to make it harder for local governments to obstruct the earlier duplex law by delaying approvals or imposing costly or unworkable size, design and setback requirements. An analysis last year by the UC Berkeley Terner Center found that the duplex law had resulted in precious little new housing, partially as a result of such restrictions.

Asked whether Atkins plans to respond to Kin’s ruling with a legislative fix, the senator’s spokesperson, Meredith McNamee, said in a statement that the senator believes “some legislative clean-up” would improve the implementation of the law she wrote.

The California Justice Department, which represented the state in the Redondo Beach case, has already filed a notice of appeal.

###

CalMatters.org is a nonprofit, nonpartisan media venture explaining California policies and politics.

‘Automatic’ Registration Would Boost California’s Voter Rolls. What’s the Downside?

Sameea Kamal / Tuesday, June 18, 2024 @ 7 a.m. / Sacramento

Rally attendees cheer as Sen. Monique Limón speaks in support of a bill to expand voter registration efforts, at the state Capitol in Sacramento on June 12, 2024. Photo by Cristian Gonzalez for CalMatters

Under the blistering Sacramento sun outside the Capitol last week, advocates for Black, Latino and Asian communities spoke about the importance of diversifying California’s voters.

That’s why they’re part of a coalition of dozens of organizations backing a bill to automatically register people to vote at the Department of Motor Vehicles. “We must ensure that every eligible citizen … can exercise our rights to vote with as few barriers as possible,” said Sydney Fang, policy director at the advocacy group AAPI-Force.

The bill aims to capture the state’s 4.7 million residents who are unregistered but eligible to vote — and who are predominantly Black, Latino, Asian or younger.

“That is 4.7 million Californians whose voices are not being heard,” Sen. Monique Limón, the bill’s author, said at the small rally at the Capitol.“It is unacceptable that working-class communities of color continue to be systematically left out of access to political power,” the Santa Barbara Democrat added in a statement after the rally. “We must take the necessary steps to ensure that California’s diverse population becomes a diverse electorate that truly represents the power of our state.”

In the 2022 general election, close to 27 million people were eligible to vote in California. About 22 million were registered, and about half voted.

The proposal is the latest effort to try to expand California’s “motor voter law,” which directed the DMV beginning in 2018 to register people to vote when they apply for a license or ID or change their address — if they indicate they’re eligible and unless they opt out. The bill proposes registering everyone who is eligible without prompting, and informing them later with a postcard.

But the bill, revived from last year, has drawn concern from groups that support expanding voter access, including the League of Women Voters of California, the American Civil Liberties Union of Northern California and NALEO, a nonprofit group focused on Latino civic engagement.

They say registering to vote should be voluntary — and they don’t see the bill as an effective way to increase voter diversity.

“This is a solution looking for a problem,” said Rosalind Gold, chief public policy officer for NALEO Educational Fund. “Right now, California should not be spending its scarce resources on something that is not going to have any kind of negligible impact on strengthening our democracy, and in fact, could have some harmful consequences.”

The proposal is scheduled to be heard in the Assembly’s elections committee on June 26.

The bill would take effect for the 2026 election for governor and other statewide offices — or when the Secretary of State certifies a system to make sure the DMV can sort out who isn’t eligible to register, including those who are undocumented but get special licenses.

The Secretary of State, despite commenting on previous election-related legislation, declined comment on the bill to CalMatters.

Eric McGhee, senior fellow at the Public Policy Institute of California, said lawmakers should consider whether their goals are to get people’s names into the system and worry later about turning them into regular voters, or whether they want to focus on registering those who are most ready to vote.

“It doesn’t do anything, by itself, to turn them into voters and make sure that they vote,” he said. “It just removes registration as a hurdle.”

How past registration changes fared

Twenty-five states have a form of “automatic” voter registration at state agencies. California is one of 14 states with a system that prompts you to choose, according to the National Conference of State Legislatures, while another 11 have the kind of system Limón is proposing.

Since California’s “motor voter” law rolled out, registration among the state’s eligible voters has gone up from 75% to 83% in January 2024. Researchers attribute more than half of that increase to the new system.

But making voting easier doesn’t necessarily lead to higher voter turnout, according to Charles Stewart, director of the MIT Election Data and Science Lab.

And California’s current system didn’t boost registration among all the underrepresented groups the current bill aims to help, according to a March analysis by the Public Policy Institute of California. While new registrations increased among Asian voters and those under 35, it didn’t for Latino and Black Californians.

The system has been effective at allowing existing voters to update their addresses rather than adding new voters, according to the report — though that wasn’t the goal of easier registration.

“While all groups have seen gains, registration policy changes have not always improved equity in the way that might have been expected,” the report concluded. “Given that Latino and Black residents and young people participate in elections at lower rates, gains in registration needed to be larger than those of older or white Californians in order to correct these past imbalances.”

But Neal Ubriani, policy and research director for the Institute for Responsive Government, argues that automatically registering people will increase political participation, building on California mailing ballots to all registered voters. Limon’s office confirmed the bill was based on research from the institute, which has pushed for what it calls the “SAVR” bill (Secure Automatic Voter Registration) in 11 other states.

Ubriani is also a member of California’s Motor Voter Task Force, though it has not discussed the bill or automatic voter registration.

“If somebody’s not registered to vote, they’re kind of invisible to grassroots groups, to campaigns, to election officials,” he said. “They can’t reach out to them … They can’t teach them about the issues that are on the ballot. They can’t give them the kind of outreach that might get them excited about maybe a local candidate, or a state Senate race, or even president.”

But the ACLU says people should have the right to decide whether to register, or not.

While the organization is committed to reducing barriers to voting, specifically for underrepresented groups, “we’re also concerned about other issues like privacy, and First Amendment rights, and associational rights — and so we have to consider all of those together,” said Brittany Stonesifer, an attorney with the ACLU of Northern California’s Democracy & Civic Engagement Program.

Stonesifer also said it’s important for people to actively engage in the voting process — “to make meaningful choices that represent their decisions on the ballot.”

Voters cast their ballots on Super Tuesday at City Hall in San Francisco on March 5, 2024. Photo by Juliana Yamada for CalMatters.

The groups who oppose the bill also say automatic registration could make it more difficult for voters if they want to change their political party, especially to vote in presidential primaries, or if they want voting materials in a language different from what they use at the DMV.

Ubriani took issue with the idea that the system deprives people of a choice.

“This process is just turning voting as much as possible into a one-step process to say, we know you’re eligible, we’ve made voter registration as easy as possible for you, if you want to participate, that’s up to you,” he said.

Will ineligible voters get registered?

Both supporters and opponents of the bill say that it’s extremely rare for ineligible people to get on the voter list.

Still, state government’s track record on technology is spotty at best: When California’s current system started at DMV offices in 2018, about 23,000 people were registered with errors — including 1,600 people who hadn’t intended to register, including some non-citizens. Others had incorrect information added to their registrations, such as party preferences. The registrations were canceled by the Secretary of State, the Associated Press reported.

It’s a crime to register to vote, or to vote, when you’re not eligible, such as not having citizenship or not having voting rights restored after a felony conviction. Proponents of the bill say that shifting the burden of erroneous registrations to the state would protect people who might accidentally register under the current system and thus unintentionally break the law.

But opponents say there isn’t enough evidence of that problem. And, according to Stonesifer, the bill could put noncitizens at risk of being deported, losing their legal status or being denied citizenship.

Under current law, if someone registers and they’re not eligible, there are some legal protections in place.

But if someone gets a ballot in the mail because they were registered automatically and sends it back, that person will have voted illegally, she said.

Carol Jasmine Varro votes with her son, Lance Robin Chavez, by her side at the Martin Luther King Jr. Community Center in National City on March 5, 2024. Photo by Adriana Heldiz, CalMatters

And while the motor voter system had a bumpy roll-out, it now works effectively, the ACLU says.

The DMV is already overhauling its software system, a project that is scheduled to finish in 2027. That, along with the lack of clear roadmap on how the DMV would sort out those who are eligible, could set the agency up for failure if the state adopted automatic registration, Stonesifer said.

“It creates a much more complicated system than we currently have and puts the responsibility in the hands of the DMV, which doesn’t have the best track record for getting that right,” she said.

Limón, however, said the current bill learns from the 2018 rollout at the DMV. “We know where the technology and where the challenges were,” she said.

How much would automatic registration cost?

It’s unclear how much the bill will cost the state or counties, but Limón acknowledges that with the projected state budget deficit, any bill with additional cost is going to have an uphill battle.

The bill’s opponents say there are more effective ways to increase political participation among underrepresented communities, such as permanent funding into voter outreach.

Gold said a worthwhile investment to engage more Latino voters would be to fund community-based organizations as “trusted messengers” who can explain how to vote, what the issues are and why they matter.

NALEO supports expanding the current program to allow people to register to vote when they apply for benefit programs such as Covered California or CalWORKS, which might better target people from underrepresented communities. Seven states have passed laws since 2019 to allow registration at Medicaid offices, but they’re on hold as officials await guidance from the Biden administration, which has expressed concerns about confidentiality, NPR reports.

Limón said that while some have suggested waiting before making more changes to voter registration, others — including labor organizer Dolores Huerta, who spoke at last week’s rally — have been trying to expand voter rights for decades and say the time to act is now.

“You’ve got to begin this work, and you’ve got to do it so that eventually we get to a place where everybody that is eligible has that opportunity,” Limón said.

###

CalMatters.org is a nonprofit, nonpartisan media venture explaining California policies and politics.

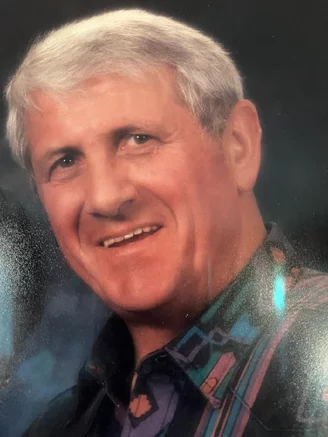

OBITUARY: William (Bill) Laidlaw, 1935-2024

LoCO Staff / Tuesday, June 18, 2024 @ 6:56 a.m. / Obits

William (Bill) Laidlaw

August 24, 1935 —

June 2, 2024

Son, Brother,

Husband, Dad, Grandpa, Uncle.

Bill was born in Fresno to James and Susan Laidlaw. Bill was one of seven children, three brothers and three sisters. The family eventually moved north to Humboldt County. Bill attended Orick Elementary School and graduated from Arcata Elementary School. Bill enlisted in the US Army with one of his best friends, Ed Walker. Bill and Ed chose the Infantry, specifically the 11th Airbourne as a paratrooper, because it paid more.

He spent time in Fort Campbell, Kentucky and Munich, Germany jumping from perfectly good planes all over the globe. Bill was honorably discharged just short of becoming a master Jumper after four years, and returned to Humboldt County, marrying his sweetheart, Marlene. Together they grew a family of two children, all the neighborhood kids and multiple dogs and cats.

Bill had a short stint with the California Department of Forestry, worked in sawmills and eventually found his calling, truck driving. In his career, Bill hauled lumber, produce and food service products. Bill took great pride in his profession, was a very hard worker, and in my opinion, had the best work ethic of anyone. Upon his “retirement” (which he never really did) they traveled with their fifth wheel travel trailer around the US, occasionally with their grandchildren, including Alaska twice. Together, Bill and Marlene were Camp Hosts in Yosemite (Hodgson Meadows) for a number of years, shared their love of salmon fishing and picked an occasional abalone with family. They volunteered for the Cancer Society, created handmade toys for needy children at Christmas and ran the clock for Eureka High football at Albee Stadium. They attended and supported their children and grandchildren’s sports endeavors faithfully.

Bill “used it all up” and lived life to its fullest. The shoes he left behind can never be filled. Bill and Marlene were married for over fifty years until Marlene passed. They are together again, now forever.

Bill is survived by his sister, Florine; children, Kim (Kenny) and Ed (Theresa); grandchildren Jenn (Ryan) and Tori (Riley); aunt, Roberta; brother in-law Bob; sisters-in law, Roxanne and Sue; nephew Robby; and nieces Crystal, Tina and Cara.

Preceded by parents, Jim and Sue; wife, Marlene; brothers, James (Bud), Robert (Bob) and Albert (Shorty); sisters, Mary Jane and Suzanne; grandson Will; niece Lori Ann; and favorite brother in-law, Don.

Dad chose not to have any services. His hope is for everyone to wish him good luck fishing when you are at the ocean or give the universal “Honk your airhorn” sign to a truck driver in his memory.

###

The obituary above was submitted on behalf of Bill Laidlaw’s loved ones. The Lost Coast Outpost runs obituaries of Humboldt County residents at no charge. See guidelines here.