Two Dead, Including a 16-Year-Old, After Vehicle With 15-Year-Old Driver Hits Embankment Near Willow Creek

Ryan Burns / Monday, Aug. 14, 2023 @ 3:48 p.m. / News

###

In the second of two fatal car crashes in Humboldt County over the weekend, a teenager and an adult are dead after a pickup truck being driven by a 15-year-old went off the side of State Route 299 west of Willow Creek and collided with an embankment, according to the California Highway Patrol.

The first call reporting a vehicle off the roadway came in at 1:17 a.m. Sunday. According to CHP Sgt. Gabriel Parker, the vehicle, a white Toyota Tacoma traveling eastbound, had three occupants, including a 16-year-old passenger in the back seat, the 15-year-old driver and an adult man in the front passenger seat.

Both the adult man and the rear passenger died in the collision, Parker said. The driver was transported to St. Joesph Hospital with major injuries, though he is expected to survive. The accident remains under investigation.

The identities of those involved have not yet been released, but the Outpost has learned that the deceased minor was a student at Hoopa Valley High School, whose principal issued the following statement this morning:

Dear School Community,

On behalf of the staff at Hoopa Valley High School, it is with a heavy heart that I write to you today to share the devastating news of the untimely passing of one of our students and a cherished member of our community.

Our thoughts and prayers are with the families and friends during this incredibly difficult time. As a community, we must come together to support one another through this challenging moment. Grief is a deeply personal experience, and it is essential that we extend our compassion and understanding to those who may be struggling with this loss.

The school counseling team and our staff are here to offer assistance, resources, and a listening ear to anyone who needs it. We are united in our shared sorrow, and it is through this unity that we can find solace and strength.

During this time of mourning, let us remember the value of each life within our community and cherish the moments we share with one another. Together, we can support one another and find comfort in our collective love.

With deepest condolences,

Scotty Appleford

Principal, Hoopa Valley High School

###

PREVIOUSLY: CHP Watch

BOOKED

Today: 7 felonies, 18 misdemeanors, 0 infractions

JUDGED

Humboldt County Superior Court Calendar: Friday, Feb. 27

CHP REPORTS

Bear Dr / Otter Dr (HM office): Roadway Flooding

ELSEWHERE

EcoNews: President’s Column, by Kathryn West

EcoNews: RRAS FIELD TRIPS IN MARCH 2026

19-Year-Old Dies After Vehicle Collides With a Tree Near College of the Redwoods Campus South of Eureka

Ryan Burns / Monday, Aug. 14, 2023 @ 3:05 p.m. / News

A local 19-year-old died Saturday morning after his Honda Accord apparently struck the center median of Hwy. 101, careened to the right and collided with a tree just south of Tompkins Hill Road, near the Eureka campus of College of the Redwoods.

The California Highway Patrol received a call about the incident at 7:53 a.m. Saturday, according to Sgt. Gabriel Parker. The incident was first reported by the Outpost’s automated CHP Watch.

“Our unit arrived on the scene. It was a solo vehicle with a solo occupant, and there were no witnesses,” Parker said.

The driver’s identity has yet to be released by law enforcement, but a friend of the family set up a GoFundMe page over the weekend identifying the driver as Kalvin Reed. As of Monday afternoon, the campaign had already reached and exceeded its $10,000 goal, which is intended to “help ease the burden of the cost of memorial services,” the post says.

According to Parker, Reed was driving northbound on Hwy. 101, and evidence on the scene suggests that his vehicle hit the center dividing wall, causing it to rebound to the right and off the roadway, where it struck a tree “head-on.”

The California Highway Patrol is still investigating the incident, Parker said.

Bounced Paychecks, Bumpy Care and Bankruptcy: Examining the Track Record of Mad River Hospital’s Potential New Owners

Carrie Peyton Dahlberg / Monday, Aug. 14, 2023 @ 2:22 p.m. / Business , Health Care

Mad River Community Hospital. | Submitted file photo.

PREVIOUSLY:

- Mad River Hospital Announces That It’s Looking to Sell to SoCal-Based Hospital Company

- Who is Precious Velvet Mayes? TV Producer, Soap Star and Likely Next CEO of Mad River Community Hospital.

###

The people trying to buy Mad River Community Hospital have some messy baggage.

Their old website is long gone, vanished along with their descriptions of 11 hospitals they once owned. (Although the Internet Archive kept a copy.)

Many of those hospitals have closed, lost to bankruptcies or economic pressures.

What might be the only hospital they still own gets a dismal one-star rating, on a scale of one to five, from federal health officials who monitor quality of care. By comparison, coastal Humboldt hospitals look glowing: Providence St. Joseph Hospital gets four stars, and Mad River Community Hospital gets three.

Yet, these are the people who might one day control the nearest emergency room for more than 35,000 residents of Arcata, McKinleyville and beyond. These are people who could be in line for millions in state grant money for a sorely needed behavioral health triage center planned in Arcata.

People get nervous when a hospital is up for sale. Will the new owners sell off the juicy bits and leave a skeleton limping on? Will they wreck quality, close the place down, go bankrupt? Or will they pump in money, improve patient care, raise pay?

At first, no one knows.

Southwest Healthcare Services LLC of Scottsdale, Ariz., the would-be buyer of Mad River hospital, indicated in May it is committed to keeping the hospital open, according to a media release issued by Mad River Community Hospital. Southwest, the release said, would invest “heavily” in upgrades while preserving hospital services, pay, benefits and doctors’ contracts.

Beyond that, Southwest executives aren’t talking. The only two people listed in Arizona Corporation Commission records as managers of the LLC, Precious Velvet Mayes and Paul R. Tuft, have declined, ignored or scheduled then postponed multiple interview requests. What’s left is their track record.

Bouncing paychecks, ‘massive’ losses

At Pacifica Hospital of the Valley, the LA-area hospital where Mayes is president and CEO, the website sings her praises. “Precious has led a transformation that reversed years of massive losses,” all while improving quality, it says. Mayes arrived as Pacifica’s chief strategy officer in January 2014, and became its top executive in 2018, according to her LinkedIn page, where she included among her specialties crisis management, bankruptcy and litigation management.

Among the litigation episodes early in her tenure were Pacifica’s two settlements with the city of Los Angeles for allegedly dumping mentally ill patients on Skid Row. The hospital admitted no wrongdoing but paid a combined $1.5 million in 2014 and 2016.

More recently, on the quality of the care provided by Pacifica Hospital of the Valley, state and federal regulators are not reassuring.

The Pacifica acute care hospital has been written up for violations of state or federal regulations, called survey deficiencies, at roughly double the rate of similar hospitals for the last four years, a state government database shows. In that same database, Mad River and Providence St. Joseph both do better, although St Joseph came close to doubling the deficiency rate in 2021.

The one-star federal rating comes from the Centers for Medicare and Medicaid Services, which on its website offers details behind the ranking, including things like a higher-than-average percentage of patients leaving Pacifica’s emergency room without being seen.

Meanwhile, Medicare has repeatedly penalized Pacifica hospital for having too high a rate of hospital-acquired conditions (penalized in five out of seven recent fiscal years) and readmitting too many patients too soon after their discharge (penalized in six out of the seven years). Details on penalties, in the form of lowered annual payments, can be found in a database kept by KFF Health News, a widely respected source of sometimes wonky health care reporting. Again, in that database, Providence St. Joseph does somewhat better and Mad River does a lot better.

On the brighter side, the size of penalties that Medicare has slapped on Pacifica hospital for readmission problems has been declining.

Fiscal details are scantier, but nurse Ronald Derayunan said that during the seven years he has worked for Pacifica, the worst times were wretched. “It was horrible,” he said. “Paychecks were bouncing.” It was a running battle to get overtime hours reflected in checks. Even now, this is the only hospital he’s worked for that won’t let him have direct deposit. Employees have to pick up paper checks, he said, and hope for the best. “As recently as last year I had a paycheck bounce.”

Air conditioning in the psychiatric part of the hospital where Derayunan works has been malfunctioning for months and patients have filed grievances, he said. One portion of the acute care hospital is closed because a leaky roof and the damage that it caused months ago are still being repaired.

Derayunan has met Mayes perhaps eight or 10 times since working at the hospital. Most recently, he said, she stopped by a nursing station where temperatures hit 84 degrees and gave sweltering employees $5 Starbucks gift cards.

“When she’s right in front of you, she seems likable. Giggly, smiley,” he said.

“Based on how she does things, I don’t like her.” It takes too long to get things fixed or get complaints addressed, he added.

The union that represents nurses at more than two dozen southern California hospitals, including Pacifica, is shocked that Pacifica’s owners are trying to buy anything else.

‘Given the history of mismanagement and apparent financial problems faced by Pacifica Hospital, it is alarming that the hospital’s owners would consider purchasing another facility.’

—Roseanna Mendez

“Given the history of mismanagement and apparent financial problems faced by Pacifica Hospital, it is alarming that the hospital’s owners would consider purchasing another facility,” said Rosanna Mendez, executive director of SEIU 121RN. Instead, she said, owners should improve Pacifica’s upkeep, patient safety and nurses’ working conditions.

Why Pacifica?

What could Mad River Community Hospital stand to gain by joining forces with a hospital where the quality of care rates weaker than its own?

For one thing, new ownership would strengthen Mad River’s buying power, potentially lowering the price of supplies and the costs of borrowing, said Arthur S. Shorr, a member of the Mad River Community Hospital’s board of directors.

No looming crises forced the board’s hand, he said. “On an operational basis we were doing OK. Nothing great, but OK.”

Shorr, a longtime southern California healthcare consultant and former hospital executive, said consolidation is making it near-impossible for freestanding hospitals to compete. “You just can’t do it. You have to be affiliated. You have to be part of a system.”

For Mad River, he said, joining forces even with one more hospital should help.

Shorr has met with the two leaders of Southwest Healthcare Services, Mayes and Tuft, but he doesn’t know how many hospitals Southwest currently owns.

At a minimum, Southwest owns Pacifica Hospital of the Valley — where a general hospital, a psychiatric hospital and a skilled nursing facility all share the same address. It also manages a behavioral health care center nearby, according to Mad River’s media release. Beyond that, its current holdings have been undisclosed.

‘Only good things are going to come from this.’

—Arthur S. Shorr

At first in any hospital sale, Shorr said, it’s normal for people to be concerned. With time, in his experience, the concerns dissipate.

“Only good things are going to come from this,” he said.

“I know they’re committed to keep the hospital as a general hospital for the community. That is a strong commitment they have made. Had they not made that, we would have moved on,” he added.

How exactly that commitment might be enforced, especially as years go by, is something Shorr said he could not comment on.

Southwest Healthcare Services is also an appealing buyer because of its values and ”track record with other hospitals in difficult circumstances,” top Mad River executive Douglas Shaw said in the May media release.

That track record includes the survival of Pacifica Hospital of the Valley, but also multiple times that Southwest’s leadership has found itself unloading other hospitals, sometimes leaving a community with no nearby access to an emergency room.

Not intending to look ‘stupid and greedy’

In the early 2000s, one of Paul Tuft’s earlier companies, Doctors Community HealthCare Corporation of Scottsdale, Ariz., was paying its executives millions, hiring their relatives, and using a time-share private jet, the Washington Post reported in 2003. The Post was covering Doctors Community HealthCare Corp.’s bankruptcy proceedings, which unveiled spending that left local health care leaders appalled.

Tuft told the Post at the time: “In retrospect, things that I have done which are now under the microscope … I might do differently. I’m sure I look stupid and greedy, but that wasn’t my intent.”

The previous year, the Post reported, Tuft had drawn a $2 million wage and benefit package, plus borrowed another $3 million from Doctors Community HealthCare Corp., which owned five hospitals.

Over the years, using various company names, Tuft has jettisoned some hospitals, then purchased others.

By 2011, his reputation worried one county official in Ohio enough to vote against Tuft’s purchase of the troubled Brown County General Hospital, taking it from public to private. The sale went through anyway. Tuft renamed it the Southwest Regional Medical Center, then quickly sold it in 2012. In 2014 it folded. Now “we have no hospital close in the area. Every serious medical need has to be by air,” said Wayne Gates, a Brown County resident and former journalist who covered some of the hospital’s woes.

The Gulf Coast Medical Center in Wharton, Texas, which Tuft bought in 2012, lasted a little longer. It was still in Tuft’s hands when it abruptly stopped accepting ambulances in October 2016, then closed the following month.

Through it all, Tuft has been drawn to what he calls “distressed or difficult” hospitals.

That was his description in a company overview posted on what was once the website for southwesthealthcareservices.com. The Internet Archive’s Wayback machine in 2015 captured images of the overview, which highlights Tuft’s law degree and his expertise in healthcare finance. It lists 11 hospitals currently or previously owned by Southwest Healthcare Services LLC or its “predecessor” entities, as of either 2012 or 2015. (The overview file name suggests it may have been created in 2012.) Several of them overlap with hospitals described elsewhere as being owned by Doctors Community HealthCare Corp.

In community after community, news coverage makes it clear that of those 11 hospitals, at least seven are now closed.

Another three now have new owners.

The only one remaining from the 2015 list is Pacifica Hospital of the Valley.

Southwest Healthcare Services might have gone on a buying spree since that 2015 overview was online, or it might own nothing more, which could make Mad River its first hospital acquisition since the Texas and Ohio hospitals closed.

Dede Tsuruoka, Pacifica’s communications officer, declined to say how many hospitals Southwest owns or to provide their names, saying that only Mayes could answer that question. The Outpost has tried to ask Mayes that and other things for the last 11 days; once she was on a zoom call, once too busy with her grandchildren, sometimes there was no response at all to calls and emails. Monday morning, minutes before a scheduled phone interview was to begin, Tsuruoka canceled it, saying Mayes was in the emergency room with one of her grandchildren. Tsuruoka said she would get back in touch with an alternate time.

Meanwhile, the 90-day, non-binding get-acquainted phase of the proposed sale, which began on May 20, is nearly over.

Mad River hospital board member Shorr said talks are moving along on schedule but declined to comment on details. Because the sale would be from one private business to another, there may be few opportunities for public input. If things move forward, the deal could be done as early as this fall.

If Southwest buys Mad River, it will be a “small but stable hospital network,” Mad River CEO Shaw had said in his hospital’s May media release. The release hints there might be more, saying Southwest is trying to reopen hospitals closed by other owners.

Southwest has been on the hunt for more hospitals for years. In March 2021, an investment group called JR Dallas Wealth Management announced it had reached a joint venture agreement with Southwest to acquire more “safety net hospitals” in California and the southwestern United States.

That release quoted Mayes extolling the value of safety net hospitals, which often serve “vulnerable and neglected patients.”

Under the joint venture, JR Dallas’ Wealth Management was to provide equity and debt financing to grow this business. Its media release also praised Southwest for developing a “behavioral health service line” that could become a model for California. Which may cast a new light on the taxpayer-funded behavioral health triage center that could one day rise beside Mad River hospital.

Two to five distressed people every day

Around Humboldt County, hundreds of people with mental health issues show up every year in hospital emergency rooms, nearly 800 in 2022, close to 900 in 2021, said Emi Botzler-Rodgers, Humboldt County Behavioral Health Director.

Some have substance-use disorders. Some have diagnoses like bipolar or schizophrenia. They arrive unceasingly, two to five people a day.

Many need help that just isn’t available here, she said, and too often they must be sent for treatment out of county.

“We need a place for people who are struggling with mental health issues,” said Botzler-Rodgers.

One of those places could be a still unnamed triage and treatment center that will be built on the grounds of Mad River Hospital, paid for with $12.9 million in government funds, so far, plus a bit more that still needs to be raised.

The county will run it, likely using contractors to hire the staffers who provide services, and Mad River will be in charge of building it, paying for that with state and local grant money, said Botzler-Rodgers.

If new owners take over Mad River Community Hospital, Botzler-Rodgers anticipates working with them to get the triage center up and running. “I am hopeful that it will not affect it in any negative way,” she said.

After the behavioral health center is built, the hospital will still own it, but center operators will have a 30-year lease, said Connie Stewart, Cal Poly Humboldt’s executive director of initiatives, who has been deeply involved in planning and fundraising.

“Mad River has to agree to keep the facility open for 30 years,” Stewart said. “We have assurances from Precious (Mayes) that she is excited about this project.”

The county has estimated the behavioral health triage center will cost around $15 million to build, and Stewart is working to raise more funds. When it opens, tentatively in 2026, it will have 31 beds for short-term and longer-term care, plus an additional 12 sobering cots, along with a layout that will make it easier to provide care safely for people younger than 18.

Mad River board member Shorr described the behavioral health center as one of the synergies that make this proposed acquisition attractive for Southwest Healthcare Services, although not the only one.

“They have the potential to do extraordinarily well,” he said.

Man Arrested on Mad River Beach for Possession of Stolen Vehicle and Meth After Trying to Flee into the Dunes, Sheriff’s Office Says

LoCO Staff / Monday, Aug. 14, 2023 @ 2:09 p.m. / Crime

Press release from the Humboldt County Sheriff’s Office:

On Aug. 10, 2023, at about 11:19 a.m., Humboldt County Sheriff’s deputies were dispatched to Mad River Beach for the report of a vehicle stuck in the sand.

Deputies arrived in the area and recognized the stuck vehicle, which had been reported stolen out of Eureka one week prior. Upon seeing deputies, a male attempting to dig the vehicle out of the sand fled into the dunes.

Deputies searched for the man, later identified as 45-year-old Dale Dodge Baldridge, and located him hiding underneath a bush. During a search of Baldridge incident to arrest deputies located the keys to the stolen vehicle and over two grams of methamphetamine.

Baldridge was booked into the Humboldt County Correctional Facility on charges of possession of a stolen vehicle (PC 496d(a)), resisting a peace officer (PC 148(a)(1)) and possession of a controlled substance (PC 11377(a)), in addition to warrant charges of false identification to a peace officer (PC 148.9(a)), possession of a narcotic controlled substance (HS 11350(a)), transportation/sale of a controlled substance (HS 11352(a)), person prohibited in possession of ammunition (PC 30305(a))¸ possession of a controlled substance for sales (HS 11351), felon in possession of tear gas (PC 22810(a)), possession of cannabis for sales (HS 11359(b))¸ possession of greater than 28.5 grams of cannabis (HS 11357(B)(2)), possession of a controlled substance paraphernalia (HS 11364(a)) and Post Release Community Supervision (PRCS) revocation (PC 3455(a)).

Anyone with information about this case or related criminal activity is encouraged to call the Humboldt County Sheriff’s Office at (707) 445-7251 or the Sheriff’s Office Crime Tip line at (707) 268-2539.

Redway Neighbor Dispute Leads to Arrest for Elder Abuse, Assault and Burglary

LoCO Staff / Monday, Aug. 14, 2023 @ 1:36 p.m. / Crime

Press release from the Humboldt County Sheriff’s Office:

On Aug. 11, 2023, at about 9:47 a.m., Humboldt County Sheriff’s deputies were dispatched to a residence on West Coast Road in Redway for the report of an assault.

Deputies contacted a female victim who exhibited minor injuries. The victim told deputies that her neighbor, 36-year-old Cory Steven McCauley, had entered into her residence without permission and began arguing with her regarding [a] property issue. During this argument, McCauley reportedly physically assaulted the victim, causing injury, then fled the residence.

Deputies located McCauley at a nearby business and he was taken into custody without incident. McCauley was booked into the Humboldt County Correctional Facility on charges of elder abuse (PC 368(b)(1)), assault (PC 240), battery (PC 242) and burglary (PC 459/461(A)).

Anyone with information about this case or related criminal activity is encouraged to call the Humboldt County Sheriff’s Office at (707) 445-7251 or the Sheriff’s Office Crime Tip line at (707) 268-2539.

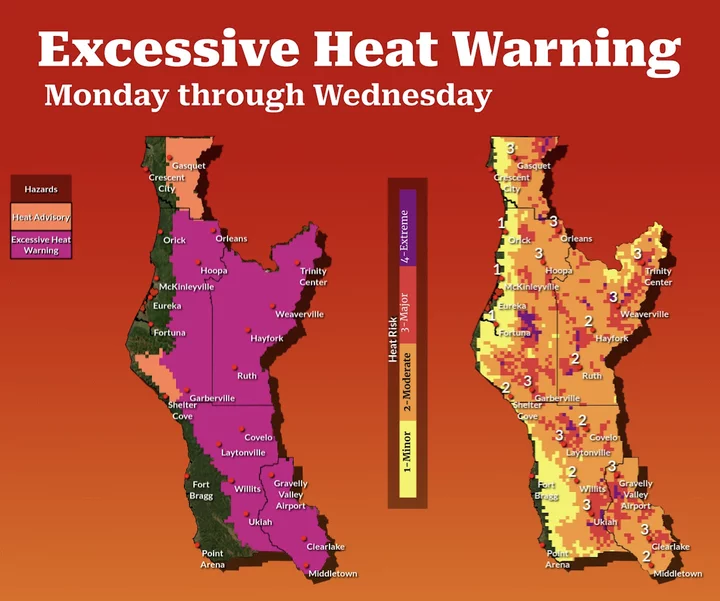

‘Excessive Heat Warning’ Issued for Interior Regions This Week

Andrew Goff / Monday, Aug. 14, 2023 @ 12:03 p.m. / How ‘Bout That Weather

Yuck. Inland Humboldt is going to roast this week, we’re told.

The sky watchers at the Eureka arm of the national weather service have issued an “excessive heat warning” for the eastern halves of Humboldt and Mendocino counties and all of Trinity and Lake counties through Wednesday evening. Temperatures are expected to soar during that period reaching into the 110s.

The following are NWS-recommended actions to take in extreme heat:

Much Fentanyl Discovered During Search of Sleepy Suspect’s Vehicle in Trinidad

LoCO Staff / Monday, Aug. 14, 2023 @ 11:46 a.m. / Crime

Press release from the Humboldt County Sheriff’s Office:

On Aug. 9, 2023, at about 7:14 a.m., Humboldt County Sheriff’s deputies on patrol in Trinidad conducted a vehicle investigation on an occupied vehicle parked in the area of Scenic Drive and Cher-Ae Lane. The occupant of the vehicle, 42-year-old Kathlene Crystal Mellon, was found to be asleep in the driver’s seat with drug paraphernalia in plain view.

Deputies woke Mellon and conducted a search of her person and vehicle. During their search, deputies located approximately 7.3 ounces of suspected fentanyl, over 3 grams of methamphetamine, drug paraphernalia and pepper spray.

Mellon was arrested and booked into the Humboldt County Correctional Facility on charges of possession of a controlled substance for sales (HS 11351), possession of a controlled substance (HS 11377(a)), possession of drug paraphernalia (HS 11364(a)), felon in possession of tear gas (PC 22810(a)) and committing a crime while released from custody on a felony (PC 12022.1(b)).

On August 13, while in custody at the Humboldt County Correctional Facility, Mellon was involved in a physical altercation with another inmate. Due to this incident, Mellon received additional charges of assault (PC 240) and battery (PC 242).

Anyone with information about this case or related criminal activity is encouraged to call the Humboldt County Sheriff’s Office at (707) 445-7251 or the Sheriff’s Office Crime Tip line at (707) 268-2539.