Screenshots from Tuesday’s meeting (clockwise from top left): First District Supervisor Rex Bohn, Second District Supervisor Michelle Bushnell, Third District Supervisor Mike Wilson, Fourth District Supervisor Virginia Bass, Auditor-Controller Karen Paz Dominguez and Fifth District Supervisor Steve Madrone.

###

The Humboldt County Board of Supervisors on Tuesday listened to nearly two and a half hours of testimony from financially desperate cannabis growers beseeching them to lift the burden of Measure S cultivation taxes. But as the all-day meeting stretched past the dinner hour, the board struggled to agree on a level and formula for tax relief and postponed its decision to a special meeting to be held sometime next week.

The highly anticipated hearing got off to a surprising start when Supervisor Michelle Bushnell, whose Second District contains a majority of licensed cannabis operations in the county, announced that she would be recusing herself from the matter entirely.

She didn’t fully explain her reasoning until hours later, following the board’s decision to table the matter for a later date. At that point, Bushnell explained that she recently obtained a state license for her own cannabis company, Boot Leg Farm, LLC, and after consulting with her legal counsel and reaching out to the Fair Political Practices Commission, she decided it would be best to recuse herself so that she didn’t jeopardize the proceedings with her potential conflict of interest.

Many of the more than 60 public speakers had voiced frustration with Bushnell’s absence. She said she was disappointed, too, and acknowledged that she could have handled the situation better. “I really love my community and I’m very supportive of it — especially the cannabis community,” she said.

The decision at hand was whether to establish a program that would reduce, suspend or waive the 2021 and 2022 tax bills from Measure S, the county’s voter-approved cultivation tax, which charges growers between $1.08 and $3.26 per square foot of licensed cultivation area.

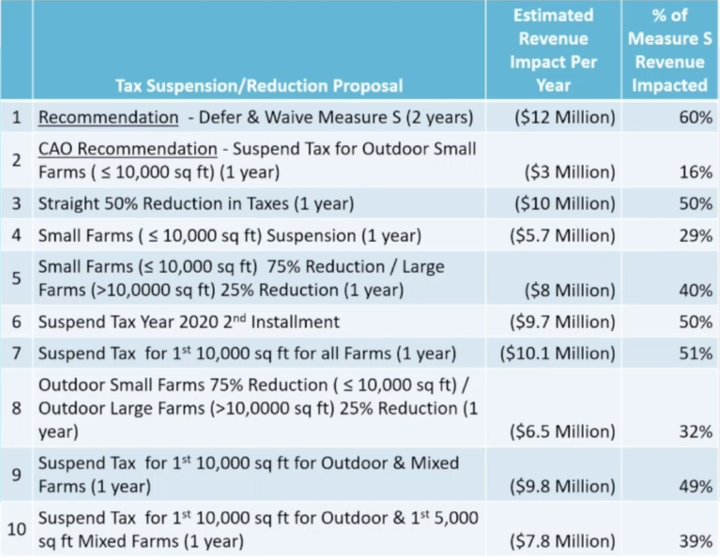

In the staff report, recently appointed Assistant County Administrative Officer/Chief Financial Officer Tabatha Miller said the local cannabis industry is struggling amid “unsustainably low market pricing.” She presented a list of 10 possible approaches to reducing the county tax burden with a range of revenue impacts:

The recommendation from County Administrative Officer Elishia Hayes was to suspend one year’s worth of taxes for growers whose farms are 10,000 square feet or smaller, a proposal that would cost — or at least postpone — an estimated $3 million in revenues to the county’s general fund.

Miller noted that the financial issues buffeting local growers extend well beyond the county borders. Consumers tend to prefer indoor-grown flower, while the majority of Humboldt’s crop is outdoor. State taxes are much higher than Measure S taxes. And counties to our south are permitting industrial-scale operations that add to the state’s oversupply of cannabis.

Regardless, public commenters repeatedly identified the county’s tax bills as the make-or-break for them personally if not the renowned local industry altogether.

“The industry is facing a complete market crash [and] our local community is facing a mass extinction event,” said Sara Bullock, owner of a 22,000-square-foot farm near Kneeland. She has cut expenses drastically in an effort to stay afloat, she added. “I mortgaged my house to continue to live here. I have no more expenses to cut. We are an industry in crisis. We would love to pay Measure S taxes but, simply stated, the money is not there. We cannot pay.”

Samantha Phillips said her company, Mojo Mountain, employed nearly 50 people but has been forced to lay off most of its workforce. “As a mother it is heartbreaking to tell people with families that we can no longer afford to keep them,” she said. “The current tax structure at the state and county level is crippling our ability to survive and navigate this new market we are now in.”

Others made more grandiose proclamations. One man, for example, characterized the tax as “extortion” and accused the board of committing “cultural and economic genocide.”

One of the speakers to take issue with Bushnell’s absence was Craig Johnson, owner of Alpenglow Farms, who said her recusal on this agenda item effectively subjected 80 percent of the county’s farms to “taxation without representation.” (Planning and Building Director John Ford later told the Outpost that the 80 percent figure sounds a bit high, though he didn’t have an exact figure at hand.)

“I’m really rattled by Supervisor Bushnell not being able to be part of this conversation,” Johnson said. “We’re gonna have to get to the bottom of this and find out why our supervisor can’t represent us.”

Ross Gordon, policy director with the Humboldt County Growers Alliance (HCGA), said taxes such as Measure S are predicated on the assumption that cannabis is “wildly profitable” when the reality is that growers are burdened by costs and challenges faced by no other type of agricultural producers.

“And I think the message that we want to bring you today is that that paradigm is over,” he said. “It’s not there anymore. It simply can’t work to continue levying these fees.”

HCGA Executive Director Natalynne DeLapp said already deferred tax bills from October and March need to be forgiven and waived entirely “lest the county deliver a deathblow to an untold number of our cannabis operators.”

The calls stretched into the evening, even though Board Chair and Fourth District Supervisor Virginia Bass had limited each speaker to two minutes apiece. Caller after caller relayed details of their financial woes and called on the county to suspend or waive their tax bills and develop a new taxation model.

Licensed cannabis farmer Thomas Mulder, who is Bushnell’s appointee to the Humboldt County Planning Commission, said the current market collapse was an unforeseeable catastrophe, albeit one he expects to be short-term.

Mulder’s young son called later in the meeting and said, “Please don’t make families have to work so hard that they cannot spend time with their kids.”

###

After a brief break, the supervisors reconvened, and in their initial comments they threw some cold water on the onslaught of lamentations they’d just listened to.

First District Supervisor Rex Bohn, for example, urged the speakers to track down this story from CalMatters, which quotes Nicole Elliott, director of the California Department of Cannabis Control: “It is an oversimplification to say that tax reduction will solve all of the industry’s problems. It’s just a vast oversimplification of the number of variables that impact the health of the legal market and that support or foster illegal activity. It is not tax alone.”

“That scares the hell out of me,” Bohn said, adding that the county’s tax is a minor factor in the grand scheme of things.

Third District Supervisor Mike Wilson agreed. “I don’t think that [the] Measure S tax created the situation that we’re in,” he said. The main factor in the local market collapse is out-of-county competitors who are “growing a plant in a more efficient and less costly way and delivering it to the market at a much lower price than the methodology that was created in Humboldt to grow cannabis under prohibition.”

And yet both Bohn and Wilson went on to say they’re open to offering tax relief, as did fellow supervisors Bass and Steve Madrone.

Bohn said he was looking at a variety of options, including a 50 percent reduction across the board — meaning for indoor, outdoor and mixed-light growers of all sizes — or maybe full suspension of taxes for grows under 10,000 square feet.

“I’ve also got another [idea] float to the top now — it’s suspend everything for a year and come back and look at it, because this problem came on us in six months,” he said. As recently as July, he said, cannabis growers were telling him how good things were, “and by August 15 it had proverbially hit the fan.”

Wilson said he thinks some “significant reductions [in tax liability] are warranted based on the market.” There’s been little in the way of hard data, he said, but he surmised that over the past two years the market price for a pound of outdoor has gone from around $1,200 to around $400. He suggested that the county might respond by offering a corresponding two-thirds reduction of taxes across the board.

A number of speakers had lamented the perceived injustice of a tax lien encumbering their property should they become delinquent in their tax bills, but Ford explained that while each permit is connected to a specified property, chronic nonpayment would simply result in revocation of the permit, not a lien against sale of the property.

There was some discussion about setting up payment plans for tax bills, but Treasurer-Tax Collector John Bartholomew said county code dictates that cannabis taxes must be collected in the same, or similar, method as all other taxes.

“And so I am opposed to creating installment plans structures specific for cannabis tax collections,” he said. Bartholomew also reminded the board that the county taxes growers in arrears, meaning the tax bills sent out in 2021 covered taxes due for the 2020 calendar year, and so on.

Several speakers called on the board to forgive tax bills sent out last year. Bartholomew objected to that idea.

“I think it’s unfair to all the cannabis cultivators that did pay their 2020 taxes in the 2021 year for the board to be considering waiving any excise taxes from that period,” he said, noting that 80 percent of small growers have already paid those bills. “We have to treat everybody the same with regard to taxation. I am adamant about that.”

When Madrone was offered a chance to speak, he did so at length, discussing the unique challenges facing the cannabis industry, the precedents for government assistance to industries, the folly of the county’s Measure S flat-tax structure, the influx of illegal product from Oregon and more.

Eventually he said would support a tax break because he believes Measure S revenues for last year and this will drop dramatically either way — whether through a cut from the county side or attrition due to business failures.

Madrone said he absolutely would support working with the industry and going back to the voters with an all-new taxation measure to replace Measure S. He also proposed the possibility of tax credits for solar energy or water storage installation.

It was getting late in the evening, and Bass said she didn’t think the board would reach a decision that night. The four participating supervisors each offered proposals for types of tax breaks.

Wilson proposed offering growers in tier one (meaning outdoor sun-grown weed) a 50 percent reduction on 2021 taxes with growers in tier 2 (mixed light) getting a 25 percent break and zero break for the small fraction of legal indoor growers.

Bohn’s idea was to forgive next year’s Measure S tax bills entirely and then reassess the following year, a proposal that Wilson was “not all that excited about.”

Madrone had a variety of his own ideas but said he’d be supportive of Wilson’s tier-based proposal.

It was after 6:30 p.m. when the board agreed to table the discussion and continue it at a special meeting next week. (Probably Monday, Hayes said.)

###

One observation about the day’s long proceedings: It looks like Bushnell’s decision to recuse herself may have lasting repercussions with her core constituency of cannabis professionals.

In the middle of the meeting, the Humboldt County Growers Alliance posted a statement to its Facebook page reiterating the argument that “80% of Humboldt’s Cannabis Farmers Just Lost Their Representative.”

On Wednesday morning, Bushnell fired back, calling it “absolutely ridiculous” to assume “that four other Humboldt county supervisors don’t represent the entirety of the Humboldt County cannabis culture.”

###

Though it was a long, long deliberation, the Measure S matter wasn’t the only item on yesterday’s agenda. We’ll rewind a bit, here, to the beginning.

After the routine passing of the consent calendar, the day’s first agenda item was the latest “required monthly report” from embattled Auditor-Controller Karen Paz Dominguez. She was again asked to provide an update regarding the ongoing mess of county payroll services, a task that was transferred back to her department last August despite employee concerns.

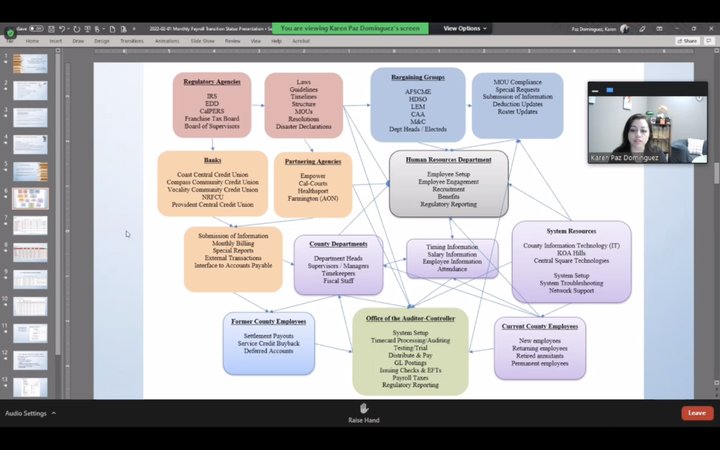

It’s hard to escape the impression, in these updates, that the two sides are talking past each other. Paz Dominguez once again delivered a lengthy and scrupulously detailed PowerPoint presentation replete with lists, spreadsheets, a flowchart and painstaking explanations of the county’s byzantine fiscal procedures.

And yet, despite the sheer volume of information relayed in these reports, supervisors and department heads inevitably return to a handful of questions that have come up again and again over the past year or so: What’s the status of outstanding journals from previous years? Why haven’t the books for those years been closed yet? What’s the holdup on calculating interest apportionment for the last fiscal year?

Auditor-Controller Karen Paz Dominguez presents a flowchart outlining the county’s payroll function. “I tried my best to make it very orderly and not have so many things crossing each other, but this is the reality of the payroll function for this county,” she said. | Screenshot.

###

Paz Dominguez began by outlining some areas in which progress has been made on the payroll function, including the development of written policies for a variety of computational tasks, improved compliance through “innovative reporting mechanisms” and the accumulation of staff expertise in the county’s payroll software.

She went on to list some ongoing challenges with payroll, including continued short-staffing due to vacancies, network reliability issues, miscommunication about timelines and processes and “board actions that require immediate or quick implementation.”

Regarding the latter, Paz Dominguez said, “This is a challenge to payroll, but it is not an accusation that you’re doing anything wrong. Please don’t take it that way.” Still, a seemingly simple request from the board can require a bevy of retroactive adjustments. “[I]t is one of the challenges that we’re facing right now,” she said. “Can we get better? Absolutely.”

Addressing opportunities for growth, Paz Dominguez said she often hears that people want faster responses to questions about payroll. “They want to be able to talk to someone on the phone right away, and we have very limited staff who have access to the payroll module,” she said. Her idea, which she said she’ll likely bring before the board soon, is to reclassify staff in her office to “management and confidential” status, meaning they’d be elevated above the rank-and-file union members that comprise the vast majority of the county’s workforce.

She also said there are inefficiencies and duplication of work across county departments, so she suggested that these monthly payroll reports be broadened to include others, not just her.

The presentation was occasionally interrupted to address board questions, and while the exchanges never got overtly hostile, the underlying frustration was clear. Bohn, for example, peppered Paz Dominguez with questions about why the help being offered by outside accounting agency MGO hasn’t been sufficient. Second District Supervisor Michelle Bushnell had questions about bank reconciliations, the process of matching the county books to bank statements.

Paz Dominguez repeated an allegation she had made previously, that until recently bank reconciliations were not being done. It’s a claim that Bartholomew has disputed, but she was adamant.

“I would swear that under oath,” she said. “Come over the the office and I can show you what documentation is here.”

Bartholomew again took issue.

“I personally know that our controller staff used to go over every bank statement that we received monthly, compare that to the treasurer daily [report], and then make sure everything was accurately reflected in the general ledger,” he said.

“We don’t have to agree,” Paz Dominguez said. “I already know that we don’t have any bank reconciliations. The formula for bank reconciliation is a simple formula and none of the documentation we have even resembles it.”

The board and staff had a variety of other questions for her. Bohn questioned her proposal to make staffers in her department “management/confidential,” Wilson questioned the timeliness of invoice payments and Bartholomew asked about a recurring glitch in calculating employee retirement savings accounts.

Paz Dominguez said many of the ongoing issues are systemic, with responsibility lying across multiple departments.

During the public comment period, an employee in the county’s social services branch, Neil Bost, called in to say that payroll errors caused him to get paid “next to nothing” for two consecutive pay periods, leaving him unable to pay his bills.

“The process of receiving my corrected payments required numerous phone calls and emails to various departments within the county, in which I was given incorrect timeframes for when I would be paid on multiple occasions,” Bost said. “This experience has made me seriously consider ending my employment with Humboldt County, and it has certainly prevented me from recommending working for Humboldt County to anyone that I know.”

Paz Dominguez said she couldn’t discuss specific employee information but added that employee confusion and frustration is often created because there is no central point of contact for resolving such issues.

Toward the end of this hearing, Wilson remarked on the volume of information Paz Dominguez had presented, saying, “I think there are some real ways that we can summarize that” and distill it down to something more digestible, “because there’s no way we can consume this much information every month. … We’re gonna have to figure out a better way.”

CLICK TO MANAGE